Bitcoin price is only striking distance away from potentially setting a new all-time high, or only about a 15% move higher for the new record to be set. As the top-ranked cryptocurrency surprisingly weathers the macro turmoil as of late, altcoins have suffered dramatically and for the most part bled while BTC has been rising.

Alt investors are capitulating, and moving their capital into BTC as to not miss the coming last leg up. But what exactly does this mean for the ongoing altcoin season? Is it over? Or will there be another leg up like there could be in Bitcoin – a move that is becoming increasingly clear by the day?

Alt Season, Bitcoin Dominance, And The Theory Of Five Waves Down

Bitcoin and altcoins have a very unusual relationship, despite being assets of the same class. Top traders such as Nik Patel have spent years working to understand the strange, cyclical behavior between BTC and alts, and have found some success.

After such an explosive altcoin season, the market is convinced that the music has already stopped, asset prices have topped out, and have started to reallocate heavily into the strength of BTC.

Related Reading | How 90-Year Old Market Wizardry Predicted The Bitcoin Breakout

But much like Bitcoin’s recent pullback is close to proving to be little more than a massive bull market shakeout, due to the relationship between alts and BTC, this divergence between the two types of crypto assets could be a similar shakeout.

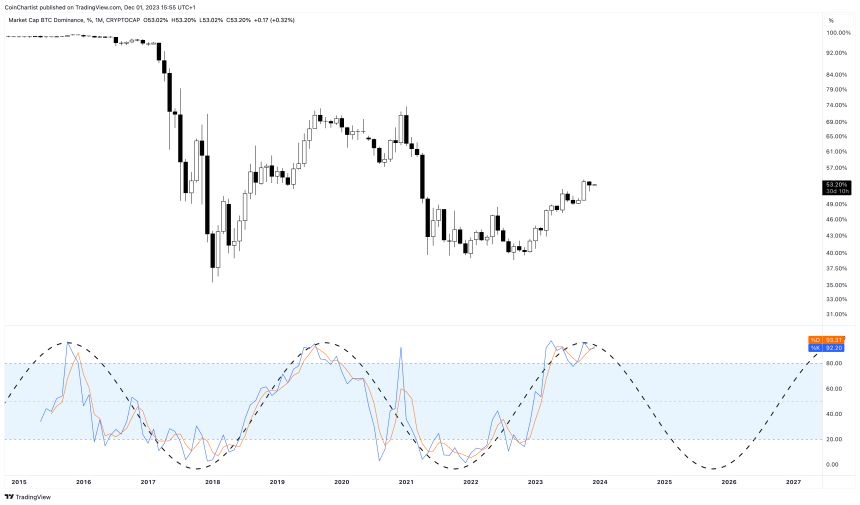

BTC dominance suggests another wave down. | Source: CRYPTOCAP-BTC.D on TradingView.com

Many analysts, such as Elliott Wave International’s Tony Carrion, subscribe to the idea that BTC is about to enter a wave five impulse against the dollar. That would suggest that BTC just completed a wave four, which in the end was a big bear trap. But what if alts are close to finishing a wave four against BTC, with another wave to follow? That’s exactly the picture BTC dominance tells.

Comparing the total altcoin market cap sans BTC against the king itself, shows that alts might shockingly be undervalued by comparison. A similar shakeout in momentum can be seen during the last cycle using the LMACD, pictured below.

Alts are lagging behind BTC in valuation comparatively. | Source: CRYPTOCAP-TOTAL2 on TradingView.com

Which Altcoin Will Survive Best Against BTC When Retail Returns?

Looking at the total crypto market cap and comparing it against Bitcoin price, there are some similarities between the two potential points highlighted by an ascending triangle. The bullish chart pattern if valid would result in a similar up move – taking the cycle to its climax in both Bitcoin and altcoins.

An ascending triangle fractal could launch alts to new highs. | Source: CRYPTOCAP-TOTAL on TradingView.com

With so many altcoins having already performed so well, capital very well could flow into other lagging coins, leading to underperformance in alts that have previously done well.

Related Reading | Astro Crypto: Summer Bitcoin Slump Could Bring Bountiful Fall Harvest

For example, during the last cycle, although both BTC and ETH went on to new highs, it was Litecoin and XRP that performed the best during the last leg up.

Both assets were well below the triangle consolidation during the last cycle, and once again have found themselves lagging severely behind. Is this time different? Not much has changed from cycle to cycle.

Underperforming altcoins could perform the best in the next wave | Source: CRYPTOCAP-TOTAL on TradingView.com

The direction of BTC dominance can be deceiving, as the direction of the chart is down when altcoins are doing well. The rest of the charts, which use the same assets in unique juxtapositions, make for a more compelling argument as to why altcoin season has barely even started yet. And the current divergence between BTC and alts is possible the same type of a shakeout that most of the market just fell for in the BTCUSD trading pair.

The psychology behind this expectation, is that the market has realized it was wrong about BTC, and is selling USD, alts, anything to get back into position. When Bitcoin gets back to new all-time highs and attracts more attention to the market, newcomers will go to alts and not BTC.

The higher the top-ranked cryptocurrency gets toward $100,000 and more, the less likely anyone but institutions or the extremely wealthy can afford it. Altcoins will be the next best bet – especially ones that have no sellers remaining such as those that have underperformed thus far.

This is the best alpha I can offer regarding the future of #Bitcoin price. I do not think we see a lower low, regardless of if we continue to correct. Bears will not get their win before bulls get $100K. All info pulled directly from the source: https://t.co/BhmNxjeE4I pic.twitter.com/WU6snm9aCu

— Tony "The Bull" Spilotro (@tonyspilotroBTC) September 23, 2021

Follow @TonySpilotroBTC on Twitter or via the TonyTradesBTC Telegram. Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

The recent peak has more similarities with 2018 and 2019 than 2017 | Source:

The recent peak has more similarities with 2018 and 2019 than 2017 | Source: