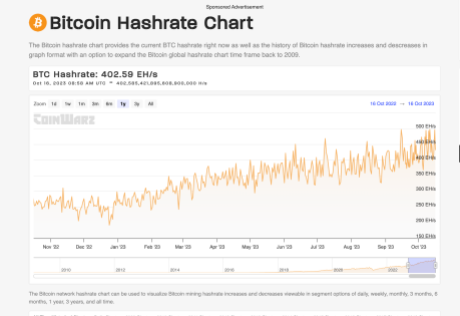

As analysts continue to debate the future of the flagship cryptocurrency, Bitcoin, the network’s hashrate has seen exponential growth, with this key indicator poised to experience an 100% increase (from the beginning of the year) before the year runs out.

How Bitcoin’s Hashrate Has Grown

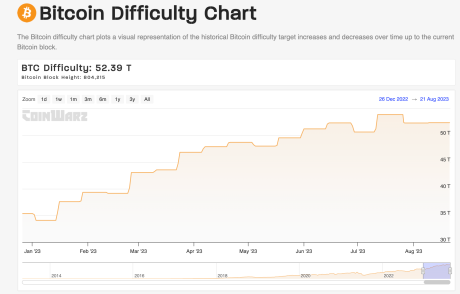

The hashrate, which is used to measure the computational power used to mine and process transactions on the network, currently (at the time of writing) stands at 445 exahashes per second (EH/s). This figure represents a significant increase, considering that the network hashrate stood at 255 EH/s on January 1, 2023.

These figures mean that the network hashrate has grown by 190 EH/s since the year began, and at this rate, it could well hit 510 EH/s by the end of the year, signaling a 100% increase from when the year began. These figures also suggest that more miners have jumped on the Bitcoin blockchain, with it being faster and more secure as a result of this.

At this rate, the hashrate could also well be on the way to fulfilling some of the predictions made by analysts. In March, A research analyst at River Financial, Sam Wouters, noted the impressive growth rate and predicted that Bitcoin’s hashrate could reach a “Zettahash by the end of 2025.” A Zettahash is equivalent to 1,000 EH/s.

Going by this current rate, some have noted that Wouters’ prediction could become a reality by December 23, 2025, or the beginning of 2026.

Despite this significant growth rate, it is worth mentioning that Bitcoin’s hash price has remained rather tepid during this same period. Hash Price refers to the revenue generated by miners on a per tera-hash basis.

The hash price currently stands at close to $60, almost the same figure as at the beginning of the beginning of the year. Notably, Miners’ biggest payday came on May 8, 2023, when the hash price was $125.

Where The Bitcoin Hashrate Is Coming From

In his tweet back in March, Wouters also tried to analyze where the growth in Bitcoin’s hashrate could be coming from. He shared his belief that it was unlikely that the added hashrate was coming from nation-states, as some people may suggest. According to him, the odds of nation-states providing computing power to the network and remaining a secret is low as “there are far too many people involved in running massive operations.”

He concluded by stating that the source of the added hashrate was “nuanced” as it could simply be a result of factors like new models being put on the market, unused inventory going online, more facilities going live, and also entrepreneurs who are finding cheap sources before regulators step in.