Lower Bitcoin market volatility often precedes significant bull runs, suggesting that the current trend could propel prices toward the $100,000 to $150,000 range.

Cryptocurrency Financial News

Lower Bitcoin market volatility often precedes significant bull runs, suggesting that the current trend could propel prices toward the $100,000 to $150,000 range.

Founder and Chief Executive Officer (CEO) of Morgan Creek Capital Management, Mark Yusko has predicted a massive price increase for Bitcoin during the 2024 bull cycle. Emphasizing Bitcoin’s immense potential, the hedge fund manager has crowned it as the unrivaled “King” among digital assets.

Appearing in a recent interview with CNBC Television on March 27, Yusko shared a bold forecast of Bitcoin, predicting that the cryptocurrency will see a significant rise to $150,000 in 2024.

When asked why he believes the cryptocurrency would have such an astronomical price increase, Yusko cited the impacts of the upcoming Bitcoin halving and Spot Bitcoin Exchange Traded Fund (ETF), on the price of BTC. The hedge fund manager has revealed that historically after a BTC halving cycle is completed, the fair value of the cryptocurrency rises.

He explained that when the upcoming 2024 Bitcoin halving occurs in April, BTC miners will face challenges, with transaction fees poised to soar, consequently driving a price increase to $75,000.

After the Bitcoin halving event, the cryptocurrency is expected to surge two times its fair value to $150,000. The hedge fund manager cited factors like increased interest from investors and Fear of Missing Out (FOMO) as triggers for this price spike.

Yusko also revealed that after the Bitcoin halving, there would be a surge in demand for Spot Bitcoin ETFs, while the supply of new coins would decrease from 900 BTC to 450 BTC a day. “If there’s more demand than supply, price has to rise,” the hedge fund manager stated.

The investment management CEO has expressed a strong belief in BTC’S value as one of the world’s leading digital assets. He envisions the cryptocurrency “easily” skyrocketing by 10x over the next decade.

“Bitcoin is the king, it is the dominant token. It is a better form of gold or digital property. And I do think it will be the best,” Yusko said.

During his interview, Yusko predicted that Bitcoin could reach its peak price value by the end of 2024. The hedge fund manager disclosed that historically, nine months after a Bitcoin halving event, sometime in December, BTC undergoes a surge to its peak value before entering the next bear market.

During this time, the investment management CEO has stated that smaller crypto projects could potentially experience substantial increases, surpassing the gains witnessed by BTC. He disclosed several altcoins and investment assets that his company, Morgan Creek Capital Management, typically buys and HODLs, including Solana, Avalanche and Coinbase.

The flagship crypto token, Bitcoin, finally hit a new all-time high (ATH) on March 5 but quickly dipped by over 10% after this price surge. As explained by this market analyst, this sharp correction was to be expected and could become a norm heading into the bull market.

Alex Thorn, Head of Research at Galaxy Digital, noted in an X (formerly Twitter) post that the market doesn’t move to the upside unfettered, even in a bull market, and corrections are to be expected. He alluded to the 2021 bull run, where Bitcoin experienced around 13 corrections of 10% or more between 2020 and the peak when the crypto token hit its previous ATH.

Thorn also referenced the 2017 bull run, noting that the same thing occurred then as Bitcoin experienced 13 drawdowns of 12% or more. Therefore, what happened with Bitcoin recently isn’t unusual, and more corrections are likely to occur as the crypto token hits new highs on its way to the peak of this market cycle.

Meanwhile, as revealed by Thorn, something similar happened in December 2020 when BTC touched its prior ATH of $20,000, then traded 11.3% lower for the next 15 days before going on to “definitively” break its ATH. If the same thing happens now, the analyst believes that could be good for Bitcoin, stating that “some consolidation would be healthy” after its year-to-date gains.

Moreover, it is worth mentioning that Bitcoin has been on a run since the end of last year (just before the Spot Bitcoin ETFs were approved) and hasn’t slowed since then. Therefore, a significant pullback for the flagship crypto token seems long overdue.

Crypto analyst Guy Turner suggested in an X post that profit-taking could have been the cause of the pullback and that more profit-taking is likely to take place. Investors aggressively taking profit was to be expected considering that Bitcoin hitting a new ATH ultimately put all wallets holding the crypto token in profits.

Turner also noted that these corrections are healthy for a sustainable long-term market. It also allows investors to position themselves and accumulate more BTC during the dip. On the bright side, the bull market is all but confirmed, with Bitcoin hitting a new ATH. According to crypto analyst Ali Martinez, this cycle is expected to continue until sometime in October 2025.

At the time of writing, Bitcoin is trading at around $65,900, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Bitcoin saw an incredible month in February, adding over $18,000 to its value in a single month. This outperformance has now carried on into the month of March, which has seen the Bitcoin price cross the $65,000 mark for the first time since 2021. As BTC trades in the green, expectations remain that the performance will continue.

In a new report shared with NewsBTC via email, the head of research at Matrixport, Markus Thielen, put forward that the Bitcoin price was headed for another all-time high this week. This report highlighted the BTC price performance over the last year, as well as in February, in which the price rose a total of $18,615 in a single month. Additionally, the analyst pointed out that despite the slowdown in Bitcoin Spot ETFs that were seen toward the end of February, it hasn’t affected BTC’s bullishness by much.

The crypto analyst explains that institutional buying is not just happening in the United States either. There has also been a large uptick in buying volume across other countries, including the likes of Korea where volumes have reached near $8 billion for five consecutive days. Interestingly, the buying is not just limited to Bitcoin either as there are also inflows into altcoins and meme coins.

Furthermore, the anticipation of Hong Kong launching its own Spot Bitcoin ETF, as well as BlackRock taking the plunge and launching a Bitcoin ETF in Brazil, also proves that there is a lot of demand. So despite the decreased inflows that were seen last week, Thielen explains that if Grayscale’s outflows keep dropping, reaching between $0-$100 million, then he expects further rally for the Bitcoin price.

Thielen also pointed out that the Untied States debt is growing exponentially and Bitcoin now offers better macro upside compared to gold. This plays into the bullish potential of BTC going forth.

“ Previously we have shown that 30-40% of the Bitcoin ETF inflows appear to come out of Gold ETFs and with $80bn of assets-under-management, those re-allocation flows can continue. We have also shown numerous times that Bitcoin has become a better macro asset than Gold as Bitcoin’s reaction function towards changes in interest rate expectations, announcement of wars/conflicts, etc., has become superior (we backtested this).”

Among the factors driving the Bitcoin price identified by the analyst was a significant decrease in the amount of over-the-counter (OTC) BTC available for large institutions. Spot Bitcoin issuers such as BlackRock tend to utilize these OTC desks for purchases in order to reduce the impact of their buying on the price. However, these OTC sellers have reported that their balances have dropped 80% in the last year from around 10,000 BTC to less than 2,000 BTC.

Thielen also points out that the same trend is seen in exchanges where balances have declined across trading platforms such as Binance and Coinbase. Both of these, which are currently the Bitcoin trading powerhouses of the world, saw a total of 48,000 BTC leave their balances in a month.

Given these developments, the crypto analyst explains that investors are not price-sensitive at this time. So, the expectation for this week is that Bitcoin makes a new all-time high. If this happens, then the market could see BTC tap $70,000 this week.

February was undoubtedly an amazing month for Bitcoin, with the cryptocurrency going on a 39% surge to cross over $60,000. Notably, price history has shown this is the second most profitable February in the history of Bitcoin and the most profitable February in 11 years.

Indeed, many market players have anticipated this price surge to continue throughout 2024 as the next Bitcoin halving approaches. According to an analysis from trading expert Peter Brandt, the price of BTC is set to skyrocket to $400,000 after the next halving.

Bitcoin halvings, which slashes the mining reward for miners into two, are known to trigger massive bull runs before and after they are completed. Indeed, the pre-halving bull run seems to have repeated itself, as Bitcoin has jumped over multiple resistance levels since the beginning of January and is now nearing its all-time high of $69,000, which it reached in November 2021.

Brandt’s analysis is majorly based on gains after past halvings as a percentage of gains before halvings. Consequently, the analyst projected past price behavior into the future after April’s halving is completed.

Per his analysis, BTC’S current cycle reached its low in November 2022 and is now at 75 bars (weekly bars). If the bull trend extends 75 bars after the next halving, a price high of $150,000 is estimated to occur in early October 2025.

Brandt’s analysis also pointed out three different scenarios that occurred after the last three halvings. After the first halving in 2012, Bitcoin went on a 5x gain as a percentage of its pre-halving gains. If the same were to happen after 2024’s halving, Bitcoin could reach $275,000.

Similarly, 2016’s halving saw Bitcoin going on an 8x gain of its pre-halving gains. If Bitcoin were to go on a similar 8x route, it could reach as high as $400,000 before the next market phase. Lastly, 2020’s halving produced a modest 2x return of its pre-halving gains. A 2x repeat applied to a BTC price of $50,000 would see the crypto reaching $100,000 at the end of the current market phase.

At the time of writing, Bitcoin is trading at $62,600, up by 21.25% in the past seven days. From a technical perspective, Bitcoin looks prime to continue on its bull run in the current market cycle with virtually no resistance

On-chain fundamentals point to increased accumulation from traders. Data shows that even short-term holding whales are now sitting on over $7.3 billion in unrealized profit, but they still continue to hold. If this bullish sentiment continues, we could see Bitcoin reaching a new all-time high in March.

Crypto financial services platform Matrixport has made another bullish prediction for the Bitcoin price. This time, they predicted that Bitcoin would rise to $63,000, including when the flagship crypto token hits this target. Matrixport had previously predicted that BTC would rise to $50,000 by the end of January, although that didn’t happen.

Matrixport mentioned in their latest report that BTC will rise to $63,000 by March this year. Although this price level seems ambitious, the crypto platform noted that it is achievable with certain factors in mind. One includes the Spot Bitcoin ETFs, which were approved over a month ago.

These Bitcoin ETFs have so far contributed largely to BTC’s resurgence (even before they were approved). They have continued to record an impressive demand, which has led to a significant accumulation of BTC by the fund issuers. Interestingly, Bitcoin maximalist Samson Mow recently argued that BTC would have been down as much as 20% if not for these ETFs.

Meanwhile, Trading firm QCP Capital shares similar sentiments with Matrixport as they noted in a previous report how Bitcoin could rise to as high as $69,000 thanks to these Spot Bitcoin ETFs. Then, they stated that BTC revisiting its all-time high (ATH) will depend on the “genuine flow the actual ETF will bring in the first few weeks of trading.”

The Spot Bitcoin ETFs have not disappointed, recording $2.8 billion in net inflows during the first 21 trading days. Bitcoinist also reported how these funds saw $2.2 billion in inflows last week.

Matrixport also mentioned the Bitcoin Halving, interest rate decisions, and the US presidential election as factors that could make BTC rise to $63,000. The Bitcoin Halving, expected to take place in April, continues to be projected as an event that could cause Bitcoin’s price to increase exponentially.

In Matrixport’s case, they expect that the hopium around the event will cause BTC to rise to $63,000 even before it occurs. It is not uncommon for the flagship crypto token to get priced in ahead of a much-anticipated event like the Bitcoin Halving. Moreover, Bitcoin historically makes significant gains pre-halving.

Furthermore, the Federal Reserve is expected to cut interest rates as inflation cools. However, it is uncertain how much this could impact Bitcoin’s rise to $63,000, considering that the Fed’s minutes showed they are still cautious about cutting rates too quickly (at least not as soon as March).

Matrixport also stated that the US presidential election could influence Bitcoin’s price. Just like the interest rate decision, it is unlikely that the election, slated for November 2024, will impact Bitcoin’s trajectory in the short term.

Bitcoin looks to be stuck in a consolidation zone between $50,000 and $52,000, with neither the bulls nor the bears succeeding in completely taking control of the trend. This performance has sparked a number of speculations on whether the BTC price has finally found a local top. One of those who have speculated on the price direction is crypto analyst Alan Santana, who has used the Elliot Wave Theory to predict where the price of the cryptocurrency might be headed next.

In the analysis shared by Alan Santana on TradingView, the Elliot Wave theory could point out the direction that the Bitcoin price could be headed next. The theory, which consists of five waves, has so far completed three waves, with the fourth wave expected to happen soon.

Given that the third wave is very bullish and the price has risen so fast, the fourth wave is expected to be more bearish. As Santana explains, this fourth wave points toward an upcoming correction. They also reveal that their analysis included Elliot’s Law of Alternation, and applying it to this scenario, the fourth wave is bearish, but would not go as low as the second wave.

Once this fourth wave moves into action, the Bitcoin price is expected to see a sharp correction. At the low end of this correction, though, is the $31,800 level, the analyst believes. So, in this scenario, there will be a return to the $20,000s before Bitcoin resumes its next leg up.

“This wave four of a higher degree cannot enter the territory of wave two, which puts the lowest price possible for the upcoming correction at $31,805 based on Elliot Wave Theory,” Santana said. He further added that: “Just as wave three would lead to a correction (wave four), wave four invariable leads to another impulse; the final and fifth wave of the higher degree.”

Not only does the Elliot Wave theory points toward a possible bottom, it also gives an idea for where the Bitcoin top might lie in the fifth wave. The crypto analyst uses one of the two Wave Principle methods to forecast this price, which takes into account the peak of the third wave and then uses that to give the peak of the fifth wave.

So far, the local top of this third wave looks to be $52,985, where Bitcoin peaked earlier this week. Since the Wave Principle says that the peak of Wave 5 would be three times higher than that of Wave 3, the analyst multiples $59,985 by 3, which gives a cycle top of $138,714.

As for when this peak will roll around, Santana explains that the whole thing could play out by 2025, which is when the peak would take place. “So the potential for the final impulse or fifth wave based on the Elliot Wave Theory system, amounts to $138,714. This can happen sometime in 2025,” the analyst stated.

Kevin Svenson, a crypto analyst on YouTube, recently provided an analysis of the future price trajectory of Bitcoin, predicting a strong surge to $100,000 this year. According to the analyst, BTC is poised to go parabolic after its halving in April as the crypto is looking very bullish on the weekly chart.

The halving cuts the block reward for Bitcoin miners in half, reducing the supply of new Bitcoins in circulation. With demand remaining steady or increasing, the reduced supply has been historically known to drive up the price of BTC.

Bitcoin is currently leading a crypto market surge after four weeks of lackluster action following the launch of spot Bitcoin ETFs in the US. Bitcoin recently broke above $47,000 for the first time this year, pushing the narrative of the return of a strong crypto market bull run.

Svenson noted in his YouTube video that Bitcoin is yet to close above $44,000 on the weekly timeframe this year. However, recent price action indicates this is about to change, giving the highest weekly close so far in the current cycle. The analyst noted that if Bitcoin were to successfully clear trapped liquidity around the wicks, it could lead to the crypto reaching the first step of the $60,000 price level.

On a larger timeline, Svenson looked at past Bitcoin halvings to note a recurring trend before and after each halving. History shows that the price of BTC has always trended up in the months leading to the halving and then going on a parabolic trend in the months after.

Of course, past performance does not necessarily guarantee future price action, but Svenson believes several factors are lining up that could send Bitcoin surging past its all-time high once again.

“There’s no reason for me to not think that we’re just going to do what we’ve been doing in these past cycles,” he said.

Now, looking forward, the analyst noted past halvings were set up by Satoshi to correlate with election years in the US, which have always led to a spike in the financial markets.

In addition, Svenson mentioned that the profitability of Bitcoin has always increased until 80 weeks following each halving, which marks the beginning of a new bear market. If history repeats itself, an 80-week timeline after the upcoming halving should be around October 2025, which is when a new bear market cycle is expected to begin.

Institutional interest in Bitcoin is surging, contributing to a 9.57% surge in the past seven days. Bitcoin is trading at $47,211 at the time of writing.

JUST IN: #Bitcoin ETFs are the most successful ETFs 1 month after launch EVER!

(out of 5,535 total launches in 30 years)

They hold the #1 ($IBIT), #2 ($FBTC), #20 ($ARKB), and #22 ($BITB) spots.

And there is still 2 days left. pic.twitter.com/NAVoyraPHT

— Swan Media (@Swan) February 9, 2024

Franklin Templeton President and CEO Jenny Johnson joined CNBC’s ‘Squawk Box’ to discuss the firm’s spot Bitcoin Exchange-Traded Fund (ETF) offering in the US. In this interview, Johnson shared the reasons for investing in Bitcoin.

As she states in the interview, the CEO is known for saying that “Bitcoin is the greatest distraction from one of the greatest disruptions in financial services,” which has led many people to believe that she doesn’t support or believe in the crypto asset.

Contrary to this belief, she points out that the Franklin Bitcoin ETF (EZBC) launch shows the asset manager company’s belief in BTC and blockchain technology.

Johnson cites the security that Bitcoin provides as one of the reasons that made her a “believer.” Holding and managing your private keys, which she states doing at one point, gives the asset what she labels an “insurance or safety component.”

This component makes crypto investors trust Bitcoin more since there’s a “fear component” linked to traditional assets, as she explains:

One of the things that made me a believer is: as I went around the world talking to people who would tell you ‘I keep 50% of my savings in Bitcoin because if I save the wrong thing in my country, I could have my assets confiscated.’ I remember talking to somebody in Israel who said, ‘My parents and their parents had all of their assets confiscated’ and they keep a portion in Bitcoin. So, there’s a fear component to it that it’s considered almost an insurance or safety component.

The CEO also listed the importance of Bitcoin in “fueling what is the next real opportunity in this blockchain world,” another reason for her to believe in the asset.

Regarding the reason behind the market’s demand that led to the spot Bitcoin ETF’s approval by the US Securities and Exchange Commission (SEC), the CEO thinks that there are various reasons for it, including Bitcoin’s crucial role, “from a blockchain standpoint,” in the ability to pay.

Johnson further explained that blockchain technology will “open a lot of really interesting tech investment opportunities,” as Bitcoin is “one of the suitable opportunities here.” Furthermore, the CEO recalled the asset manager’s previous use and trust in blockchain technology:

We actually launched and tokenized money market fund. We’re the first mutual fund or the first traditional asset manager to actually launch a 40-act fund on a public blockchain, on the stellar blockchain.

Lastly, when asked what can allure a traditional investor to invest in an ETF, she explains there’s a market and use case for both. But while holding your keys can be ideal for many, it may also be complicated to figure out.

ETFs can better fit some investors who want to diversify their portfolio while “being able to open it up, have access through an ETF, and simply through your account.”

The Bitcoin price has been moving steadily at its current but failed to meet general expectations. Following the approval of the spot Bitcoin Exchange Traded Funds (ETFs), market participants were expecting potential scenarios.

In these potential scenarios, Bitcoin pushed through critical resistance at $48,000 and continued making new highs, or the cryptocurrency retraced to $30,000. As usual, the market has avoided pleasing the crowd as BTC trades at $42,000.

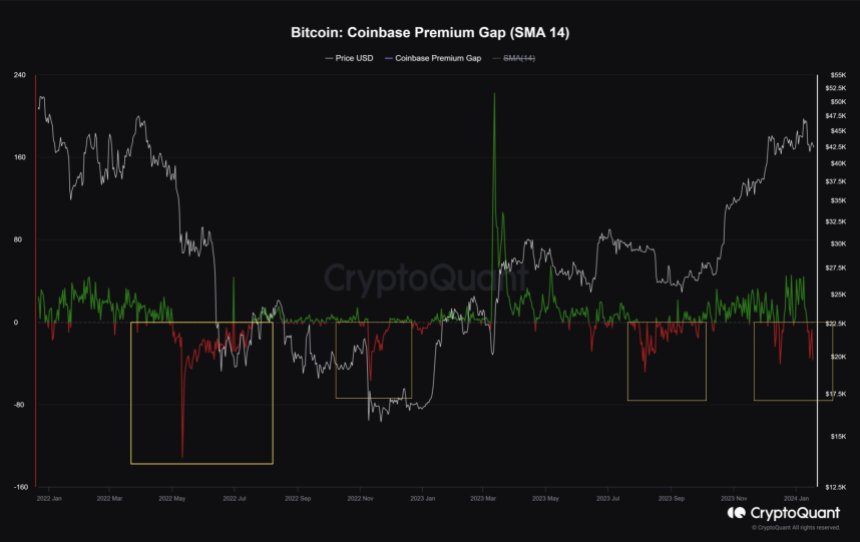

The spot BTC ETFs have been influencing the market; the capital flows from these financial products have been used to suppress the cryptocurrency. A pseudonym analyst has been keeping track of crypto exchange Coinbase to connect the flows with the Bitcoin price action.

Since its initial launch on January 11, the BTC flows into Coinbase have increased. This trading venue is key due to its role as Custodian in most spot Bitcoin ETFs filed with the US SEC.

Thus, asset managers who want to buy or sell BTC go to Coinbase. The exchange sees fluctuations in its Bitcoin price in the spot market compared to other exchanges.

As the trading volume on Coinbase has increased since the spot Bitcoin ETFs launch, the platform records some of its highest activity. In the meantime, the Bitcoin price trends sideways. The pseudonym analyst stated:

(…) supply is coming from somewhere, obviously gbtc and maybe some others, like cme futures, anyways, whats most important is coinbase is still trading discount compared to other spot venues and thats very weak, unless you’re managing billions $, you can probably wait to fomo once coinbase is dragging market up instead of dripping sells.

Another crypto analyst echoed these words; the chart below shows that the Coinbase Premium Gap signals strong selling pressure. If history repeats, the metric hints at a fierce crash for Bitcoin.

In that sense, the analyst recommends “patience” while Bitcoin moves sideways and the Coinbase Premium Gap signals a potential dip into support.

A report from Reuters indicates that the spot Bitcoin ETFs attracted almost $2 billion in their first few days of trading. BlackRock and Fidelity led these capital inflows and will maintain them depending on their fee structure, CEO of CF Benchmarks Sui Chung claims, while adding:

Those that charge the lower management fees will unsurprisingly make themselves more appealing compared to their peers. Brand recognition is another core aspect.

However, several experts have questioned these flows, which disputed the numbers. Three days after the ETFs launched, NewsBTC reported $800 million in new inflows based on a report by Eric Balchunas, ETF expert for Bloomberg Intelligence.

Cover image from Unsplash, chart from Tradingview

There may finally be light at the end of the tunnel for the Bitcoin price as selling has begun to subside for the cryptocurrency. So far, it seems that the large holders have been the main driving force behind the price decline, which could explain why the rally has been suppressed for so long. However, as these large investors start to scale back their selling, the Bitcoin price could be looking at another recovery.

According to a report posted by Santiment, the reason for the suppressed Bitcoin price over the last week could be traced back to large Bitcoin holders. These holders who have a massive stash of old coins, which means coins that have not moved in a long time, had begun to move their coins after the price of BTC found its legs due to anticipation around the Spot ETF approvals.

Once these whales began to move these coins, there was a definite drop in the asset’s price that can be linked back to this move. As these whales moved these coins out of their wallets, the age of their BTC holdings went down, suggesting that they were selling these older coins.

On average, the age of their holdings went from around 640 days to around 624 days in the days following the Spot ETF approvals by the SEC. The on-chain tracker suggests that this was a sign that the market was back in the bull market.

However, after around a week of doing this, these whales seem to have come to a point where they are no longer moving coins. “There are mild signs that this continued movement of older coins is finally done for the time being,” Santiment said.

Now, while Santiment interprets this as a sign that the bull cycle may be over, there is also the possibility that these whales have stopped moving their coins in a bid to wait for the price to recover. In this case, selling pressure will recede, allowing Bitcoin the space to regain its footing once more.

The Bitcoin price is currently struggling with the resistance mounting at $43,000. Since the crash last week, bulls have continued to lag behind as bears have chosen this level to pitch their tents. The sell pressure also seems to be localized at this point, so it has become the next important level to beat.

If Bitcoin is able to surmount the $43,000 resistance, it could signal a return of the rally. At this point, $45,000 becomes the next major resistance as investors flock back in. However, failure to turn $43,000 into support could result in a further decline in the price.

Billionaire Tim Draper has predicted a new all-time high for Bitcoin, foreseeing a staggering $250,000 rise for the cryptocurrency in 2024.

In a recent exclusive interview with Coin Bureau, a crypto informational portal, American venture capital investor, Tim Draper and Co-founder and CEO of Real Vision, Raoul Paul shared compelling insights on the outlook of Bitcoin and other cryptocurrencies in the space.

During the engaging conversation, Draper expressed highly bullish sentiments regarding Bitcoin’s future trajectory. When asked about his thoughts on Bitcoin’s price prediction, Draper confidently stated that BTC is poised to reach $250,000 soon. He hinted at the possibility of that surge happening in 2024, due to the present bullish trend on Bitcoin and several other cryptocurrencies.

Draper, known for his success in Bitcoin investments also revisited a past Bitcoin projection he made. He stated that he had foreseen Bitcoin reaching $10,000 in three years and true to his foresight, the cryptocurrency achieved the milestone.

“I would say that my number $250,000 will probably come pretty soon, so I’ll stick with $250,000. I think that if it hits $250,000, it’ll go way past it,” Draper stated.

While addressing his $250,000 BTC forecast, Draper also mentioned a prior prediction where he anticipated the price of Bitcoin reaching $250,000 when its value was at $4,000. Despite the non-fulfillment of this particular prediction, Draper hinted at the possibility that the United States’ archaic approach towards cryptocurrencies may be stifling innovation and growth.

“When I predicted that, what I didn’t expect was how fearful and just old thinking the US would be. I think with a receptive US, we would be having conversations like the ones I have with the people from El Salvador,” Draper stated.

Presently, El Salvador is one of the few countries that has accepted Bitcoin as a legal tender. The country became the first to make Bitcoin a legal tender in September 2021, allowing its citizens to utilize BTC as a legal form of payment.

During the interview, Draper highlighted the role of stablecoins in the crypto space. The billionaire asserted that stablecoins could serve as a valuable support mechanism for BTC due to its price stability and seamless portability.

“The role of stablecoins, I think, will be a bridge to bitcoin. I think the way stablecoins will operate, they will be viable as long as the dollar is viable, and then when there’s a run on the dollar, people will move to Bitcoin,” Draper stated.

The billionaire also expressed a particular interest in smart contracts, highlighting its diverse use cases. He discussed the transformative impacts Bitcoin could bring into the financial sector through smart contracts.

Draper stated:

I’m a big fan of smart contracts. I can’t wait for the moment when I can raise all my investor money in Bitcoin, invest it all in Bitcoin, have them all pay their employees and suppliers and their taxes and everything else [in Bitcoin], and have it all be completely accounted for, audited, without an accountant, an auditor, a bookkeeper, a transfer agent, or a tax lawyer. This new economy will have far less friction. I think that’s very exciting.”

VanECK’s CEO, Jan van Eck, had so much to say about Bitcoin in a recent interview. One of the highlights was his prediction as to when the flagship cryptocurrency will once again hit its all-time high (ATH) of $69,000.

In an interview with CNBC, Jan Van Eck stated that he expects Bitcoin to hit a new ATH in the next 12 months. That means that the crypto token could reclaim its current ATH of $69,000 and possibly surpass it based on Van Eck’s prediction. Interestingly, his firm predicts that Bitcoin could witness a new ATH by November 9, 2024.

Throughout the interview, Jan Van Eck sounded so bullish on BTC. He highlighted how he had always been a firm believer in the crypto token. He also noted that his firm was the first ETF player to have filed to offer a Spot Bitcoin ETF back in 2017. The application was, however, rejected at the time.

Asset manager VanEck’s relatively early interest in Bitcoin seemed to have been driven by their CEO as he narrated how his interest in Bitcoin grew. Van Eck mentioned how he began to listen to podcasts and went as far as reading Bitcoin’s whitepaper. Back when the crypto token was trading at $3,000, he said he had predicted that it would still do a 10x from there.

VanEck’s CEO further stated that Bitcoin is “the obvious asset that is growing in front of our eyes.” He likened Bitcoin’s growth to China’s and how the country was underdeveloped years ago but now has one of the largest economies. Therefore, he suggested that BTC is still going to attain unprecedented heights.

At some point in the interview, Van Eck was quizzed about whether or not there could be something else that surpasses Bitcoin, just like it did with Gold. He responded in the negative as he stated that it is almost impossible for him to imagine some other “Internet store of value” leapfrogging Bitcoin.

Van Eck went on to note that the macro behind Bitcoin is very strong. He also alluded to the macrocycle, especially with interest rates expected to keep falling, and how this is bullish for the crypto token. He believes that this, alongside with the upcoming Bitcoin Halving event are the factors that will make BTC outperform in the coming year.

Asset manager VanEck is one of the numerous asset managers who have applied to the SEC to offer a Spot Bitcoin ETF. With approval possibly on the horizon, the firm’s CEO believes that the Commission is likely to approve the pending funds simultaneously. His belief stems from the fact that the SEC did the same thing with the Ethereum futures ETF.

Bitcoin and altcoins are a sure-fire bet ahead of a “great pivot” by the Fed on interest rates in 2024, Hayes believes.

Bitcoin and altcoins are a sure-fire bet ahead of a “great pivot” by the Fed on interest rates in 2024, Hayes believes.

Bitcoin and altcoins are a sure-fire bet ahead of a “great pivot” by the Fed on interest rates in 2024, Hayes believes.

Bitcoin supply shock tactics give way to ETF hype in Standard Chartered’s new $100,000 BTC price prediction.

In a recent analysis, a crypto market expert has discovered key elements that could trigger a massive surge in the Bitcoin price.

Head of Research at CoinShares, James Butterfill has published an in-depth analysis of a revelation that could catalyze a significant increase in Bitcoin’s price. Butterfill’s research delves deep into the present dynamics of the crypto market surrounding the potential approval of Spot Bitcoin ETFs and the inflows that could follow.

Using an analysis by Galaxy, Butterfill deduced that if 10% of the $14.4 trillion addressable assets within the US were to go into Spot Bitcoin ETFs, each with a 1% allocation, then over $14.4 billion inflows would be witnessed. If the predictions prove true, Butterfill has stated that it would signify the largest influx ever seen in the financial markets.

“One could assume that perhaps 10% invest in a spot bitcoin ETF with an average allocation of 1%, which would equate to US$14.4 billion of inflows in the first year. If this were correct then it would be the largest inflows on record, with the largest so far being in 2021, which saw US$7.24 billion of inflows, representing 11.5% of assets under management (AuM),” Butterfill stated.

The crypto expert also highlighted a distinct correlation between asset under management (AuM) inflows and price changes, suggesting that price surges occur around the same time inflows increase.

“There does seem to be a relationship between inflows as a percentage of AuM and change in price. Inflows do appear to be coincident, the week the prices rise so do flows rather than one leading the other,” Butterfill said.

In his research, James Butterfill also predicted that the price of Bitcoin could rise as high as $141,000 if driven by $14.4 billion inflows.

He stated reservations about his deductions, citing that it would be difficult to accurately estimate the amount of inflows that would occur if Spot Bitcoin ETFs were introduced.

“If we take the aforementioned US$14.4 billion of inflows, the model suggests it could push the price up to US$141,000 per Bitcoin. The problem with the estimate of inflows is that it is very difficult to ascertain exactly how much inflows there will be when the spot ETFs are launched,” Butterfill stated.

Butterfill also acknowledged the uncertainties surrounding demand for Spot Bitcoin ETFs following its potential approval. He stated that there were many variables, both regulatory and corporate that could significantly influence the perception of Bitcoin’s role in society.

“Ultimately, it is very difficult to ascertain just how big the potential wall of demand will be once a spot-based ETF is launched. We know that it effectively diversifies a portfolio and enhances Sharpe ratios, but regulatory approval and corporate acceptance are slow-burn issues due to Bitcoin’s perceived complexity,” Butterfill concluded.

The machine learning algorithm at CoinCodex has taken a crack at the Bitcoin price and predicted where the asset’s price could be both over the short term and the very long term. If the predictions are anything to go by, then the price of Bitcoin is at one of the lowest points it’ll ever be in the next seven years.

The predictions from the machine learning algorithm for the Bitcoin price, especially in the short term, are very bullish. These predictions ranging between five days and one month show where the algorithm expects the price to be in these time frames and they are a long way away from the current price levels.

On the 5-day prediction, the machine learning algorithm is showing a rather outrageous price, predicting that the price will rise approximately 50% from here. The 5-day price target is placed at $55,661, and taking into account the current Bitcoin price of just under $31,200 at the time of this writing, it will mean that BTC would have to jump 49.65% in less than a week.

The prediction on the one-month timeframe is, however, much more realistic at $43,760. This translates to a $17.66% rally taking the current price into account, and an almost $7,000 increase in value for the pioneer cryptocurrency.

On the much longer timeframes, the algorithm shows much more bullishness for Bitcoin. For example, in 2024, which is less than two months away, it predicts that the Bitcoin price will run as high as $109,364, with a yearly low of $29,564, which is the lowest it expects the asset’s price to be in the next seven years.

Between the years 2025 and 2026, it expects BTC to peak above $100,000 with a bottom yearly range of $62,757. Interestingly, in 2027, the algorithm does not expect much deviation between the yearly low and high, putting the former at $78,443 and the latter at $78,522.

In 2029, the CoinCodex machine learning algorithm expects the Bitcoin price to finally cross the sought-after $300,000 level. In this year, the yearly low moves up significantly to $126,318 and the yearly high is placed at $305,028.

Fast forward to 2030 and the bullishness is maintained with an expected yearly low of $141,562. The predicted yearly high for 2030 is lower than that of 2029 but still significant at a value of $266,676.

The high figures projected for the Bitcoin price are not without merit as the website identifies that there are more bullish signals flashing now than bearish signals. Out of a total of 30 signals analyzed, 27 were found to be bullish with only 3 bearish signals.

The Bitcoin price has been trading in a tight range around the $37,000 price level through the weekend. This tight trading suggests that there is a lot of fighting going on right now between the bulls and the bears as each camp tries to gain an upper hand over the other. As this tug of war continues, a crypto analyst has presented the most important level that will determine whether the bulls or the bears will claim dominance.

Crypto analyst Ben Vouh took to TradingView to share their analysis of where the price of Bitcoin will be depending on whether the price stays above or below $31,000. According to the analyst, this level is the most important determinant factor for whether the Bitcoin price will continue its uptrend or crash back below $20,000.

The two scenarios presented include whether the Bitcoin price closes the week above or below $31,000. If Bitcoin were to close the week below the $31,000 level, then Vouh expects a massive crash to follow. This crash could see the price fall to $18,400, as illustrated in the analyst’s chart.

For the second scenario, if the Bitcoin price is able to close the week above $31,000, then the crypto analyst expects the uptrend of the last few weeks to continue, putting the top above the $42,000 mark. This would translate to another 20% move for the cryptocurrency’s value.

The crypto analyst highlights the fact that the Bitcoin Fear & Greed Index is sitting very high. At a score of 72, the crypto market is firmly in greed, which is a sentiment score that has often preceded crypto market crashes. Given this, the analyst advises investors to be careful during this time. “I would recommend to just hodl and wait,” Vouh said.

With the new trading week opening up, the Bitcoin price has not exactly started off on the most bullish note. It is trading below $37,000 as of the time of this writing and is seeing 0.46% losses on the daily chat. This could mean that investors are currently watching to see what happens next before making their next move.

The Fear & Greed Index has reached its highest level in 2023 so far, with a score of 74 on November 6. While prices have not begun to tank, there could be a crash on the horizon as the analyst points out.

One example of this was on April 16, 2023, when the Fear & Greed Index reached a peak of 68. In the next few days, the price would fall around $3,000, dropping from above $30,300 to below $27,400. The same was the case on July 12 when the index hit 64. This marked the top of the rally and the BTC price would go from $31,000 to below $26,000.