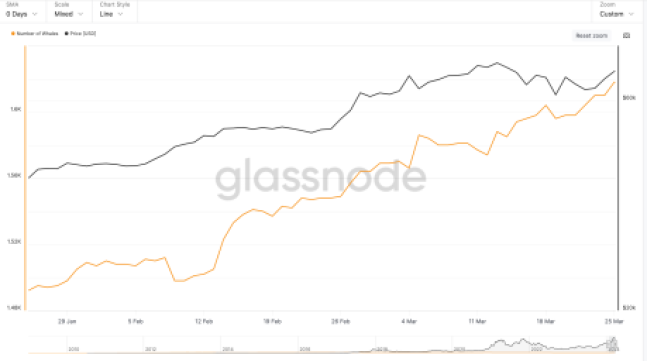

Bitcoin began 2024 with a blast gaining by over 73% in the first quarter of the year to establish a new all-time high price of $73,750. And although BTC soon declined from this value following a turbulent price movement in the last month, its biggest stakeholders have shown a consistent accumulation trend throughout the first three months of 2024, indicating a high confidence in the asset’s profitability ahead of the upcoming halving event.

Bitcoin Whales Acquire $21.6 Billion BTC, Boost Market Dominance By 1.4% As Halving Nears

In an X post on Friday, blockchain analytics platform Santiment shared that Bitcoin whales are still maintaining the “right direction” in regard to their accumulation pattern. Santiment reported that these whales, which represent holders of 100-100,000 BTC, purchased a total of 319,310 BTC (valued at $21.6 billion) in the last three months.

This report also stated that a significant portion of the newly acquired tokens came from retail traders, i.e., holders of 0-100 BTC, who collectively offloaded 105,260 BTC, valued at $7.2 billion and 0.7% of BTC’s circulating supply, within the same time frame.

#Bitcoin‘s key stakeholders with 100-100K $BTC have ACCUMULATED a collective 319,310 $BTC (around 1.4% of the supply) in the past 3 months. Many of these coins came from 0-100 $BTC wallets, which have DUMPED 105,260 $BTC (-0.7% of supply) in 3 months. https://t.co/6KKFgZzrPz… pic.twitter.com/kXyQrOIRGA

— Santiment (@santimentfeed) April 5, 2024

In general, BTC whales increased their market share by 1.4% in the last three months, which is interpreted as a rather positive sign ahead of the highly anticipated Bitcoin halving on April 19. For context, the Bitcoin halving, which occurs every four years, is a network-programmed event during which the amount of miners’ rewards on the Bitcoin blockchain is reduced by half.

Generally, the Bitcoin halving is regarded as a positive event that results in asset scarcity, thus driving up demand and market price in the long term. This notion may just remain true as Santiment describes the increased accumulation by BTC whales heading into the final weeks before the next halving as a bullish signal, indicating high confidence in the asset’s future valuation.

BTC Price Overview

According to data from CoinMarketCap, Bitcoin currently trades at $67,521, reflecting a decline of 0.01% and 3.51% in the last day and seven days, respectively. In tandem, the daily trading volume of the digital coin is also down by 6.80% and valued at $32.35 million.

However, BTC is up by 6.43% on its monthly chart adding to an impressive year-to-date increase of 140.65%. With a market cap of $1.33 trillion, the maiden cryptocurrency remains the largest digital asset in the world.

BTC trading at $67,504 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Mega whales of #Bitcoin have accumulated significantly the past 7 weeks. Addresses with 1,000 $BTC or more have added a combined 220,000 $BTC to their combined wallets since December 23rd, the most rapid accumulation we've seen since September, 2019. https://t.co/RdVAg9FcP7 pic.twitter.com/gL1nJ18hyA

Mega whales of #Bitcoin have accumulated significantly the past 7 weeks. Addresses with 1,000 $BTC or more have added a combined 220,000 $BTC to their combined wallets since December 23rd, the most rapid accumulation we've seen since September, 2019. https://t.co/RdVAg9FcP7 pic.twitter.com/gL1nJ18hyA