Data shows “buy the dip” calls for Bitcoin have spiked around social media following the plummet the asset has seen below the $66,000 level.

Bitcoin Social Volume For Terms Related To Buy The Dip Has Shot Up

According to data from the analytics firm Santiment, Bitcoin investors have more heavily reacted with bullish calls than bearish ones despite the sharp decline the asset has observed.

The indicator of relevance here is the “Social Volume,” which tells us about the amount of discussion a given topic or term is receiving on the major social media platforms right now.

This metric works by going through the various posts/threads/messages on these websites to check for mentions of the topic. The indicator, however, doesn’t outright count up these mentions but rather the number of posts that contain at least one mention.

This is naturally due to the fact that a high mention count alone can’t be a reliable indication of whether social media users as a whole are talking about the topic, since talk being limited to just a few threads can also lead to a spike in this count.

In the context of the current discussion, Santiment has filtered the Social Volume for bullish and bearish keywords to find how the two sentiments compare currently.

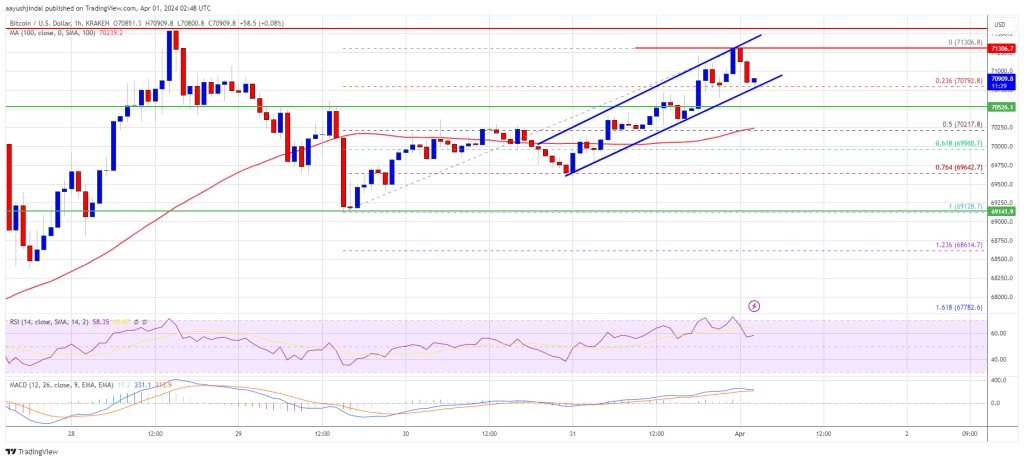

The below chart shows the trend in the metric for these terms since the start of the year 2024:

For pinpointing bullish sentiment, the analytics firm has made use of terms such as “buy” or “bullish.” Similarly, “sell” or “bearish” are among the keywords for the opposite sentiment.

From the graph, it’s visible that the Social Volume for the former type of terms has exploded following the latest plunge in the Bitcoin price, suggesting that social media users are looking at the drawdown as an opportunity to buy more.

The bearish Social Volume has also seen an uplift, but its peak has only been half as high as one of the bullish terms. While the investors being bullish may sound optimistic at first, the fact is that this has actually not been ideal for rebounds to take place in the past.

As Santiment notes:

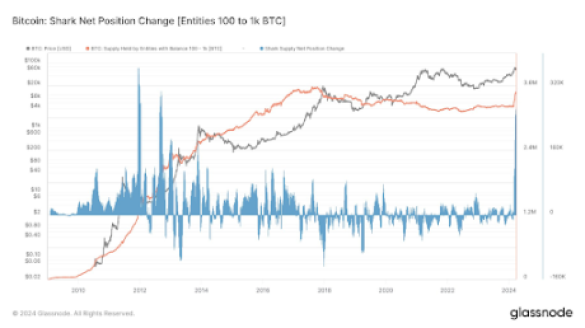

Historically, the best dip buy opportunities occur when the crowd consensus is showing a bit of fear toward a further drop. This usually results in small wallets dropping their bags for whales and sharks to scoop them up.

As such, the current market enthusiasm may actually be counterproductive for the chances of a bottom to form. According to the analytics firm, the real “buy the dip” for Bitcoin opportunity may present itself once the red sentiment has caught up to the blue one.

BTC Price

At the time of writing, Bitcoin is floating around $65,700, down more than 7% in the past week.

4 weeks in a row/broke out of its downtrend so consensus is that a new uptrend is starting yet risk assets are consolidating at ATH

4 weeks in a row/broke out of its downtrend so consensus is that a new uptrend is starting yet risk assets are consolidating at ATH

(@Coredao_Org)

(@Coredao_Org)