While the current correction remains in line with historical price corrections, Bitcoin could briefly fall to the $50,000 mark after losing the average ETF inflow mark of $59,000.

Cryptocurrency Financial News

While the current correction remains in line with historical price corrections, Bitcoin could briefly fall to the $50,000 mark after losing the average ETF inflow mark of $59,000.

The approval of Bitcoin ETFs in January was a catalyzing event for crypto, says Gregory Mall, head of investment solutions at AMINA bank. How will the upcoming halving affect markets going forward and which projects are likely to win out over the long-term?

What’s different this time? ETFs, Wall Street and a lack of celebrity influencers — for now.

Surveying the small, telltale signs that the market is back. But what’s different this time?

Key indicators tracking Bitcoin’s blockchain activity, miner flows and the 200-day moving average suggest bitcoin is far from being overvalued and could continue to rally in 2024.

With a major rally expected sometime in 2024, industry watchers have shared the top signals they look for to indicate when crypto has reached peak euphoria.

History shows there’s likely a bright year ahead for BTC’s price.

Bitcoin should logically be headed for a “sell-the-news” correction in January, but some analysts argue this may not necessarily happen as some expect.

The heads of Australia’s largest crypto exchanges say a bull run is coming early next year — others say it’s already arrived.

Consumer debt is at a record high, a fact that will weigh on the market in 2024. Yet, it’s safe to say central banks will keep rewriting the rules to keep the economy at full steam.

Ava Labs CEO Emin Gün Sirer however stressed the firm is well-positioned with significant runway and resources at its disposal.

Bitcoin’s surge past $35,000 on the 24th and 25th of October took the crypto world by surprise, as it indicated what might be the beginning of a new bullish sentiment. Trading volumes for the world’s largest cryptocurrency hit their highest levels since March, showing that interest in Bitcoin is booming once more.

The entire crypto market saw an inflow of funds during the week, leading to a surge in market cap. Data from CoinGecko shows that the entire market cap increased from $1.184 trillion on Sunday, October 22, to $1.312 trillion on Wednesday, October 25. Most of this inflow went into Bitcoin, which saw its share of the cryptocurrency market increase from 49.58% to 51.47 % during this same time period.

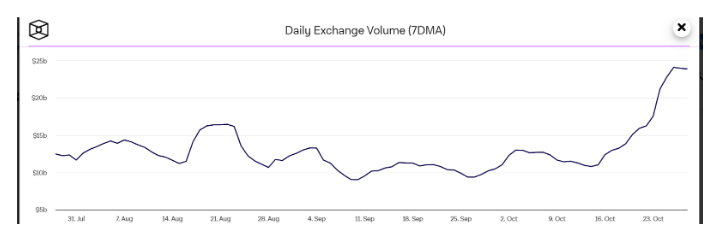

Chart From CoinGecko

The recent boom in Bitcoin and cryptocurrency prices pushed Bitcoin daily trading volumes on crypto exchanges to their highest level since March. According to The Block’s data dashboard, the seven-day moving average for spot exchange volumes across multiple exchanges hit $24.12 billion on Thursday and $23.98 billion on Friday, respectively. In comparison, Bitcoin trading volume on exchanges was at $11.02 billion on the first day of the month.

A similar metric from IntoTheBlock shows Bitcoin transactions reaching 1.4 million BTC as bulls looked to push Bitcoin to $35,000.

Trading volumes are an important metric because higher volumes suggest greater interest and activity in a market. It means more people are actively buying and selling, leading to more liquidity and volatility.

Whale activity also increased during this time period, as indicated by on-chain trackers. Whale transaction tracker Whale Alerts has shown various BTC transactions amounting to millions of dollars to and from crypto exchanges.

2,000 #BTC (68,255,228 USD) transferred from #Coinbase to unknown wallethttps://t.co/SdIJ87ZxNT

— Whale Alert (@whale_alert) October 26, 2023

2,000 #BTC (68,560,116 USD) transferred from unknown wallet to #Coinbasehttps://t.co/MJNn4HwswP

— Whale Alert (@whale_alert) October 26, 2023

1,499 #BTC (51,276,429 USD) transferred from #Binance to #Coinbenehttps://t.co/lVaDk8pYio

— Whale Alert (@whale_alert) October 27, 2023

Bitcoin has since formed a resistance level around $35,000 and is now trading in a range. At the time of writing, Bitcoin is trading at $34,150, still up by 14.47% in a 7-day timeframe. While price action seems to be moving sideways at the moment, there are still hopes of continued momentum from the bulls to push BTC past $35,000 in the new week.

Matt Hougan, CEO of crypto index fund manager Bitwise, has hinted at a further inflow of money into Bitcoin. Hougan makes this prediction on spot Bitcoin ETFs to project an inflow of around $50 billion within the first five years of its launch. Others like crypto financial services platform Matrixport have made more optimistic claims.

Data from analytics platform mempool.space has shown a sustained increase in activity on the BTC network. If bulls continue to maintain a strong push, we could see Bitcoin reach as high as $45,000 in the early days of November.

Featured image from Shutterstock

Traders could be betting on a development that buoys hopes for a spot bitcoin ETF in the US.

For the crypto market to fully enter another epic bull run, investors must be willing to purchase digital assets in large quantities. After a long stretch of abysmal performance, it looks like crypto investors are finally starting to believe in the market as they begin to pool their buying power to enter back into the market.

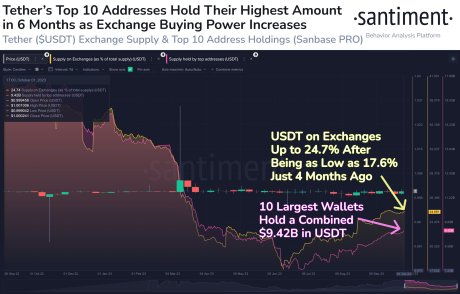

An interesting development reported by the on-chain data tracker Santiment is the accumulation of Tether’s USDT stablecoin by crypto investors. As Santiment points out, the total amount of USDT being held on exchanges saw a notable uptick recently.

The figure which takes into account the total USDT held across the top exchanges went from only 17.6% of the stablecoin’s circulating supply to a whopping 24.7%. This 7.1% jump represents the growing interest of investors to get back into the market which could be bullish for prices.

As always, the large whales led the charge in this accumulation trend. The top 10 largest wallets saw their combined holdings rise from $7.23 billion to more than $9.42 billion in the same timeframe.

Now, when investors start upping their stablecoin holdings, it signals a readiness to begin buying digital assets once more and also shows the current buying power. As the amount of USDT held on exchanges has crossed over to a 6-month high, it could point toward the start of the largest rally seen in the market in 2023.

The accumulation being spread across large and small wallets alike shows that this is not a localized sentiment. Rather, most investors are seeing genuine chances for an upside and are looking to harness some of those gains for themselves.

After accumulating a large tranche of stablecoins as illustrated in the Santiment report, crypto investors would often wait for a good time to deploy it. This is usually when the market experiences a notable crash, plunging the entire space into the red.

At this point, investors would be looking to get back into coins at a time when they look to be on discount. This is often when the market forms support and then prices begin to surge not too long afterward.

Mainly, these stablecoins will be deployed into the largest digital assets first such as Bitcoin (BTC) and Ethereum (ETH). Then once there are enough profits, investors will usually rotate into smaller cap coins, which is why altcoins tend to delay a bit in following Bitcoin’s recovery.

Such a scenario will likely see the price of Bitcoin rally toward $29,000 and then bring the crypto market cap above $1.1 trillion once more.

An inverse correlation between the crypto market and the DXY has often helped to signal when a bull rally is on the horizon. One of the most notable instances of this happened 9 years ago, and since then, the formation has not returned, until now, signaling a massive price surge in October.

In an X (formerly Twitter) post, crypto analyst TheCryptoMann has revealed an important formation in the DXY. The DXY is the United States Dollar Index which measures the value of the dollar to other major (6) currencies around the world.

Now, since Bitcoin is often touted as an alternate and better currency to the likes of the US dollar, there is often some competition between them leading to an inverse correlation over the years. This is why this DXY formation is important.

As TheCryptoMann points out, the DXY is headed toward a 12th consecutive green candle which is bullish for the crypto market. This is because the last time that this happened was in 2014, and the results were very bullish for crypto.

The analyst explains that when this happened in 2014, the DXY had fallen 8%. Crypto had then gone in the opposite direction, mounting a rather impressive rally. A look at the chart shows that in the year 2014, the crypto market went from $5.4 billion to over $8.2 billion, an over 50% surge in price.

TheCryptoMann likens the current movement to what took place in 2014 and actually expects this movement to repeat once more. As he explains, the incoming correction in the DXY will see the crypto market explode as it did 9 years ago.

He also points out that “the DXY is also being rejected from the 0.5 FIB Retracement level from its most recent local highs and lows!”

He further added:

There is a clear inverse correlation between the DXY and the cryptocurrency market. So over the next month, we’re about to see some major price movements, so eyes on the market.

Another analyst Cryptoinsighuk also seems to share the views of TheCryptoMann as he also believes there is correction coming for the DXY. “Also, whilst sentiment is this bad we are having the SBF trial. This is negative towards Crypto, tells me the bottom could be very close in this move,” the analyst added.

Great thoughts.

I also have some further technicals to add to this later. Just waiting for their confirmation.

I think the $DXY will soon turnover.

Also, whilst sentiment is this bad we are having the SBF trial. This is negative towards Crypto, tells me the bottom could be… https://t.co/QK13cnvOka

— Cryptoinsightuk (@Cryptoinsightuk) October 4, 2023

If TheCryptoMann’s forecast is correct, then the crypto market could be getting ready for a massive move to the upside. A similar rally would see the total market cap go from $1.065 trillion currently to over $1.5 trillion, signaling a bullish end to the year 2023.

Bitcoin’s last all-time high was $69,000 in November 2021; as of September 2023, it’s been 22 months since that peak. While estimating what price Bitcoin could reach next can be very useful, it’s also important to estimate when a new peak could occur.

History suggests this may still be some time away, as analysis shows that the next Bitcoin peak could arise around the end of 2025.

A specific pattern seems to occur when looking at previous tops and bottoms. The three previous bottoms, January 2015, December 2018, and November 2022, were all exactly 47 months apart. Similarly, the previous three tops, November 2013, December 2017, and November 2021, are either 49 or 47 months apart.

Market participants could anticipate the next Bitcoin peak around October-December 2025 if this pattern persists. The subsequent bottom could then occur around October 2026.

This phenomenon of tops and bottoms forming cyclically is a widely held belief in investing. Both stock markets and economies are believed to experience periods of expansion, marked by increased economic activity and rising stock market prices, and contraction, during which the stock market prices decline, and economic growth slows.

What’s particularly interesting about Bitcoin is its consistent pattern of forming its tops and bottoms roughly every four years. The ‘halving theory’ is a popular explanation for this observed pattern.

Approximately every four years, Bitcoin undergoes a ‘halving’ event, during which the reward for mining new blocks (i.e. the new supply of Bitcoin) is halved. This mechanism ensures the scarcity of Bitcoin, which is capped at a maximum supply of 21 million coins. A simple economic principle suggests that prices rise when supply drops while demand stays constant or grows.

Historically, Bitcoin has reached a new peak a year after each halving. Given that the next halving is projected to be in April 2024, it aligns with the chart above, showing the next Bitcoin peak to be around the end of 2025.

Next Bitcoin Peak – Will This Time Be Different?

While historical data points provide valuable insights into the potential future performance of an asset, it’s crucial to understand that history does not always exactly repeat itself – it often rhymes. This suggests that while certain patterns from the past might re-emerge, they don’t necessarily play out in the same way.

Various factors, such as technological advances, macroeconomic conditions, and regulatory changes, can introduce differences.

In the current market scenario, Bitcoin is navigating through a high-inflation and high-interest-rate environment for the first time. These conditions can lower market liquidity as investors might have reduced capital available for investment.

Additionally, faced with such an environment, many investors could turn to savings or bonds, which may present more attractive and stable returns than other assets.

Predycto is the author of a cryptocurrency newsletter. Sign up for free. Follow @Predycto on Twitter.

Millions of new crypto investors could be experiencing their very first bull run soon, and those who’ve been through it have shared how they plan to tackle it.

Perceptions of token issuance by projects have changed dramatically during the crypto winter.

Delphi Digital co-founder Kevin Kelly believes a recent change in a key U.S. manufacturing business index could be one of the bellwethers for a crypto bull run.

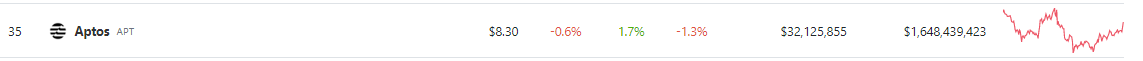

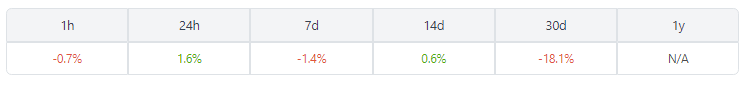

At the time of writing, there are indications of a potential market recovery, at least the major coins like Bitcoin and Ethereum are posting decent gains. Aptos (APT) is one of the tokens that is expected to experience an increase in bullishness and price.

Although APT’s gains are minuscule at 1.7% in the last 24 hours, the project’s partnerships and on-chain developments point to a somewhat rosy picture. APT price rose to $8.30 at the time of writing, contributing highly to this bullish momentum.

Crypto ecosystems use contests to support new projects that need funding. Aptos Hack returns with Hack Holland, an event to find the new wave of Web3 projects that will contribute to the industry’s growth.

The Hack Holland hackathon, which takes place on June 5–7th, is set to engender the next wave of DeFi products and services on Aptos. The event will give away prizes in categories like NFTs, DeFi, public goods, and many more.

Ready to show off your skills and earn some serious rewards?

Aptos Hack Holland is your chance to hack game-changing Web3 ideas and win huge prizes.

Step up to the challenge! Applications close May 29th

https://t.co/K6DGUNRUoi pic.twitter.com/BIpC7HDaP6

— Aptos (@Aptos_Network) May 27, 2023

Along with the recent buzz Hack Holland produced is the upcoming second playtest of Metapixel’s Gran Saga: Unlimited. Metapixel is the Web3 arm of South Korean gaming company NPIXEL which entered the world of Web3 in November last year. If the playtest is successful, we may see more games built on the Aptos blockchain, further providing positivity in the long term.

Another exciting development is Quicknode’s announcement of its strategic partnership with Aptos in the realm of remote node infrastructure. This partnership is crucial for Aptos’ success as a robust blockchain infrastructure will ensure the dominance of the Aptos blockchain.

Aptos joins the @QuickNode network to provide developers easy-to-use remote node infrastructure services – so devs can spend less time on node operations and more time on building and innovating.

Learn more at https://t.co/fYorOhQFak. https://t.co/6gVy4dMaM5

— Aptos (@Aptos_Network) May 24, 2023

To onboard more developers on Aptos, Move launched a Developer Hub featuring tutorials and documents on how to get started building the Aptos blockchain using the Move developer language. This consolidation of resources should also have an effect on the amount of dApps the platform will have in the future.

At $8.30, Investors Have Room For Gains

After reaching its all-time-high price back in January, APT has been in decline since then. However, this may change in the coming days or months. At the moment, the token is trading in a very tight range which contributes to the bullishness.

Meanwhile, investors and traders should defend the $7.5 support level if the market flips from bullish to bearish. Holding this support level will allow the bulls to target the $12 range in the medium to long term. If the momentum permits it, we might even see a return to $16 in the long run.

-Featured image from Asia Crypto Today