Amidst PancakeSwap’s proposal to burn 300 million CAKE and reduce the total supply from 750 million to 450 million CAKE, on-chain data indicates that a whale has been moving a significant amount of CAKE, the decentralized exchange’s governance token.

Whale Is Moving Tokens As Key PancakeSwap Voting Event Proceeds

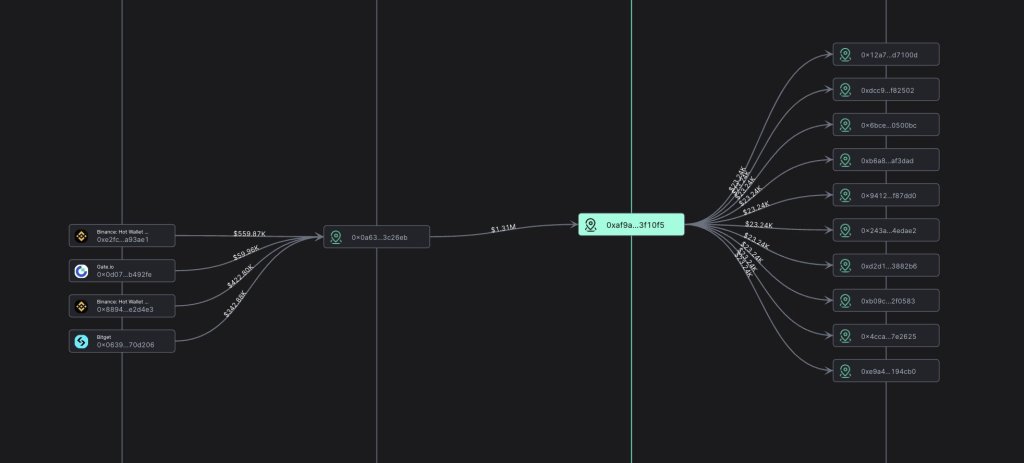

According to a report from Scopescan, a blockchain analytics platform, a whale has moved approximately 1.7 million CAKE worth $1.3 million in the past week from Binance, Gate.io, and Bitget to a series of crypto addresses. The timing of this transfer is noteworthy since it coincides with key voting that would permanently shape PancakeSwap’s tokenomics.

The proposed token burn is gathering significant support, with over 90% of CAKE holders in agreement. According to the proposer, reducing the total supply to 450 million CAKE is reasonable. It would also ensure sufficient supply for future growth while achieving “ultrasound CAKE.”

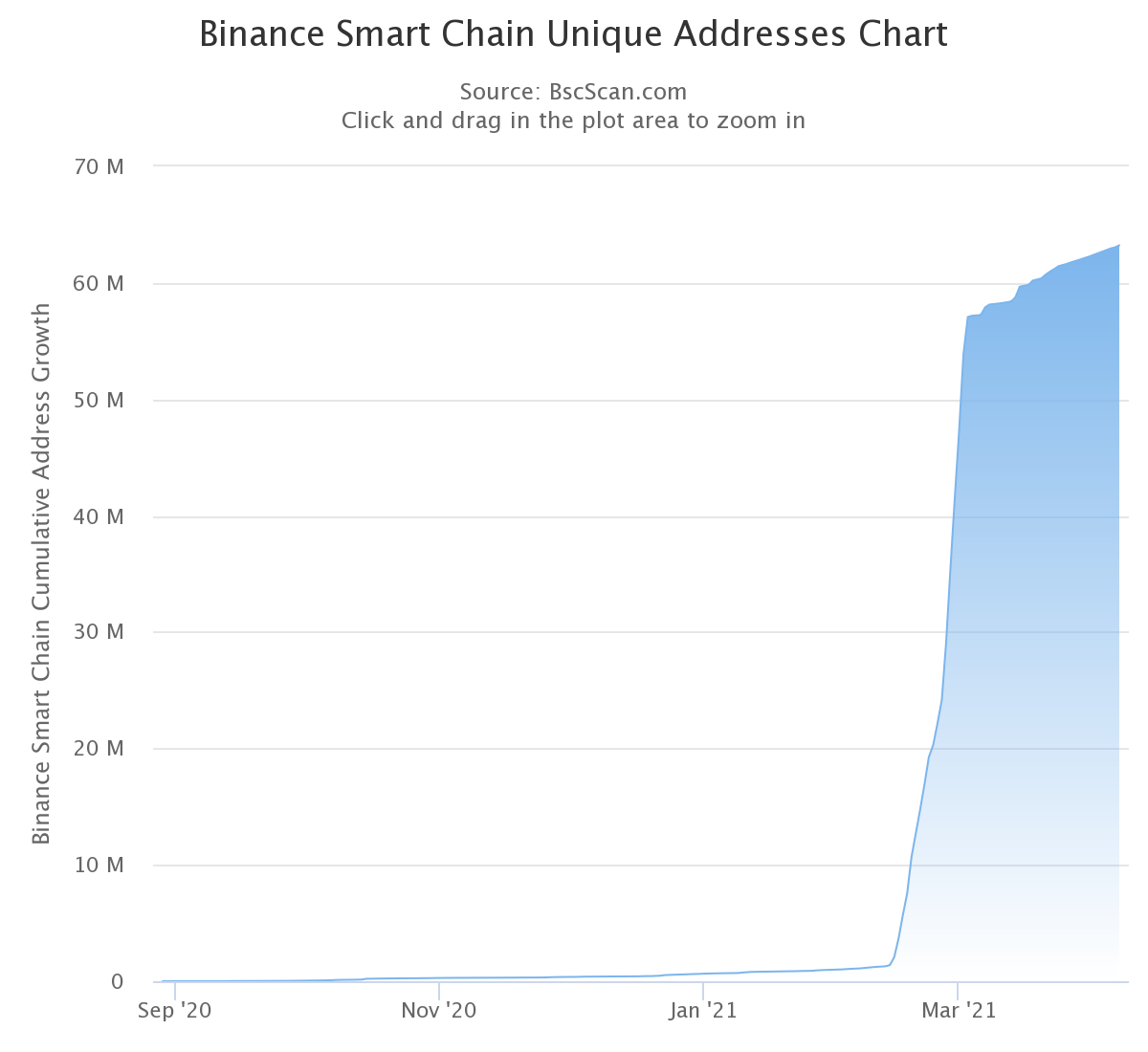

Herein, the idea is to make CAKE deflationary over the long term, and this may support prices as PancakeSwap continues to play a vital role in token swapping in the broader BNB Chain ecosystem.

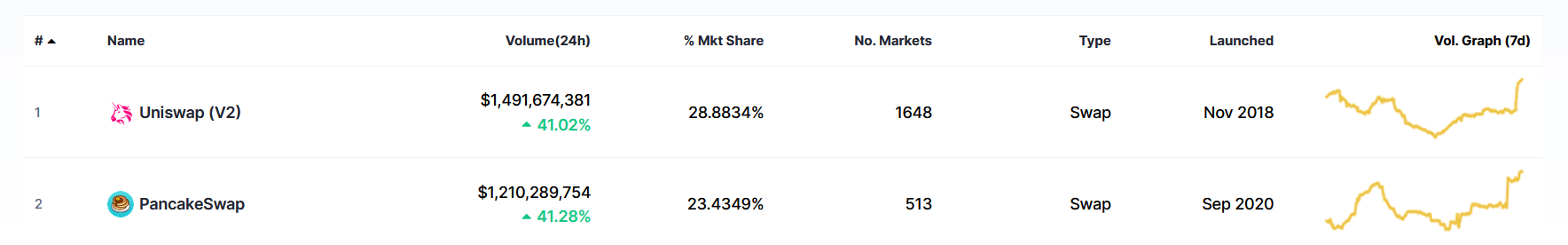

According to DeFiLlama data, PancakeSwap is the largest DEX in the BNB Chain ecosystem, with a total value locked (TVL) of $1.6 billion, commanding roughly half of the network’s TVL of around $3.5 billion. Notably, PancakeSwap has been resilient and continues to evolve, shaking off competition even after the deployment of Uniswap v3 on the BNB Chain.

In the past 24 hours, PancakeSwap has generated over $815,000 in fees, more than 7.5X that of Venus, a lending protocol, the second largest in the BNB Chain ecosystem.

Is CAKE Ready For $10?

Notably, the token burn proposal also comes when PancakeSwap is undergoing significant changes, including the recent introduction of veCAKE and Voting gauges, whose voting concluded on November 22. With this proposal passing with over 99% community support, veCAKE holders can now vote on where future CAKE farm emissions will be directed.

This gives CAKE holders greater governance influence. Supporters maintain that this crucial decision makes the DEX more decentralized and community-facing.

Ahead of PancakeSwap’s plans to burn 300 million CAKE, prices have been rallying. From the weekly chart, CAKE is up by over 260% from 2023 lows, roaring as demand increases. While bullish, bulls are yet to reverse losses of this year. A critical resistance level remains at around $5. A solid, high-volume break above this line could propel CAKE to around $10 in the coming months.