[toc]

The Cardano Network is a decentralized proof-of-stake blockchain platform with smart contract support and uses its own native token ADA, just like the Ethereum blockchain. Cardano is often described as the Ethereum killer. However, Cardano also considers itself the updated version of Ethereum, which is currently the king of all altcoins, including ADA.

Cardano (ADA) The Supposed Ethereum Killer

It has been said that Cardano has anointed itself as a third-generation crypto platform which it regards to Ethereum as the second generation. Cardano has deemed itself fit to be a threat or competitor to Ethereum as they are both similar in so many ways, including the fact that Cardano (ADA) was created by one of the co-founders of Ethereum, Charles Hoskinson.

As Ethereum is having a hard time with high gas fees issues and slow transaction times, Cardano is all set up to take their share and make a name for themselves in the NFT, DeFI, and Stablecoin market. Cardano aims to be scalable and low-cost for users compared to Ethereum, its major competitor.

It enables owners of their native token ADA to help operate the network and vote on changes to the software roles. A lot of developers now use the Cardano Blockchain for Smart contracts and building decentralized applications (dApps).

Cardano Continues To Evolve: Hard Forked From Byron To Shelley

Cardano has been releasing its blockchain in stages with the aim of releasing better, cleaner, and more secure codes. They continued to evolve as the Cardano blockchain hard forked from Byron, a federated and static model, to Shelley, a more dynamic and decentralized model

A hard fork means or is described as a radical change in the blockchain, but in the case of Cardano, The blockchain hard fork was unique because instead of the blockchain radical change, it ensured a smooth transition from the old protocol to a new protocol while saving the history of the previous blocks. This means the Cardano blockchain contains the Byron blocks and after a certain transaction period, it adds the Shelley blocks.

Shelley was upgraded, and the Shelley protocol upgrade added a new feature that enabled different kinds of Smart contract use cases, which included the creation and transactions with multi-asset tokens. It also established support for the Voltaire voting mechanism. The Shelley protocol hard fork upgrade of March 2021 called “Mary” introduced native token and multi-asset support on the Cardano Blockchain.

Mary allows users to create their own tokens that run on the Cardano network natively, just like Cardano’s native token ADA. Similar to the ERC20 tokens that can be created and transacted on the Ethereum network, Native tokens will open up this same functionality to Cardano.

How Does Cardano (ADA) Work?

The Cardano (ADA) Blockchain is made up of two main components, which are the Cardano Computational Layer (CCL) and the Cardano Settlement Layer (CSL).

The Cardano Computational Layer (CCL):

The Cardano Computational Layer (CCL) consist of the Ouroboros consensus protocol and Proof of stake, which are the backbone of the Cardano blockchain. They help to run smart contracts, it also ensures compliance and security. Lastly, allow other key advanced features and functionalities such as identity recognition and blacklisting.

The Cardano Settlement Layer (CSL):

The Cardano Settlement Layer (CSL) serves as the accounting layer of the Cardano blockchain where its native token holders can send and receive their ADA immediately with minimal transaction fees.

Blockchain Industry Issues Cardano Aims To Solve

- To create a secure voting mechanism for token holders.

- To Separate accounting and computation layers.

- To create an infinitely scalable consensus mechanism.

- To use mathematics to provide a provably secure blockchain that is less susceptible to attacks.

Benefits And Advantages of Cardano (ADA) Blockchain

Decentralization: The Cardano network is designed to promote decentralization, and the founder of ADA Charles Hoskinson, is confident that the network would be 50 to 100 times more decentralized than Bitcoin.

High scalability: The recent Cardano Blockchain Vasil hard fork solves scalability issues as it introduced critical updates that streamline transaction processing, ultimately increasing the transactions per second (tps) Cardano’s blockchain can handle to significantly boost transaction processing speeds, unlike Ethereum.

Multilayer security measures: Cardano has a multilayer architecture that separates the computation layer from the accounting layer and also the Ouroboros proof of stake algorithm reduces the surface attack and ensures good security without falling short on decentralization.

Low gas fees: Unlike Ethereum, Cardano has low transaction or gas fees which makes it more appealing to users and developers.

Environmentally friendly ecosystem: Cardano is designed to be accessible to all persons, no matter their level of skill, from novices to advanced users.

Strong Community: A project is as strong as its community and Cardano has a strong community of active users, developers, researchers, and founders all work together to make the project a very good one.

How To Buy, Sell, And Trade Crypto Tokens On The Cardano (ADA) Network

To see a full picture of the Cardano ecosystem, go to CardanoCube. CardanoCude has information on the applications on the Cardano Blockchain, ranging from DEXes to Liquidity to Wallets, Marketplaces, DeFI, Infrastructure, and Launchpads, in case you want to launch a project on the Cardano Blockchain. There are also Metaverse platforms, Gaming platforms, AI tools, Community & DAO, Developer Tools, Meme Coin, and so many more.

To buy and sell tokens on the Cardano (ADA) network, you need to get a wallet. The official wallet created by the Cardano developer IOG is called DAEDALUS. DAEDALUS is a desktop or PC secure wallet for the ADA cryptocurrency that downloads a full copy of the Cardano Blockchain, and it independently validates every transaction in its history, ensuring maximum security.

How To Install, Set Up, and Use DAEDALUS Wallet

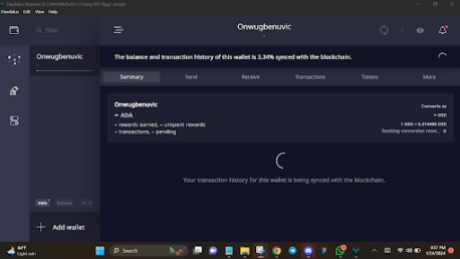

Make sure you download the installation file from the DAEDALUS official website daedaluswallet.io. Once the website is open, click on “Download” and then choose your operating system: either macOS, Linux, or Windows. Start the downloading process by clicking on “Download DAEDALUS.”

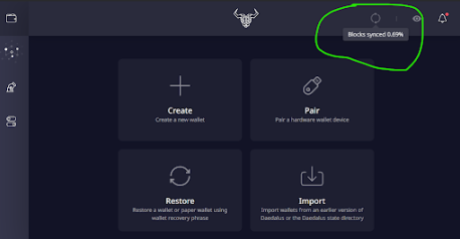

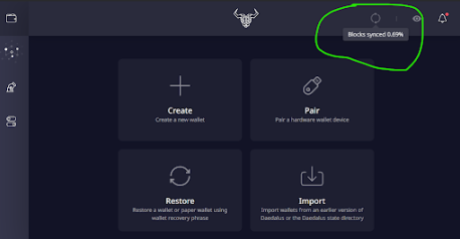

Install it, and once DAEDALUS is launched, you will need to configure the general settings and click on “Continue.” Read, and accept the terms and conditions.

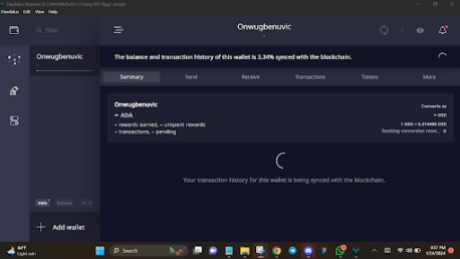

Please note that the blockchain must be completely synced before you can use your wallet.

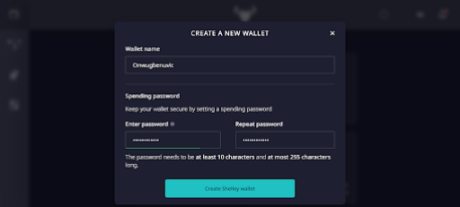

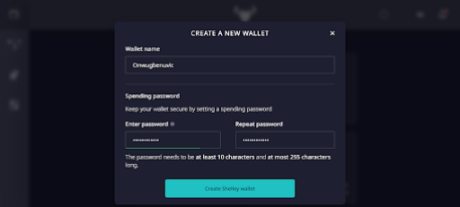

To create a new wallet, click on the “Create” button, give your wallet a “Name,” and Create your “Spending password”. You will need your spending password later to make transactions. It will also Encrypt your wallet file in the dataless directory.

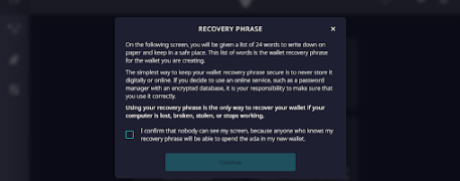

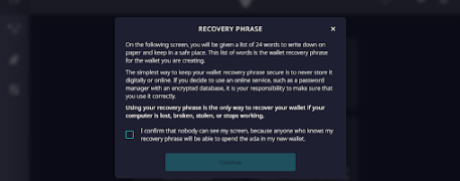

After the setup, the “Recovery phase” page will pop up, and you will be given the 24-word secret phrase that you can use to recover your account in case your laptop is stolen or broken.

Ensure to write down your secret phrase and keep it in a safe place, after verifying your secret phrase your wallet is all set up.

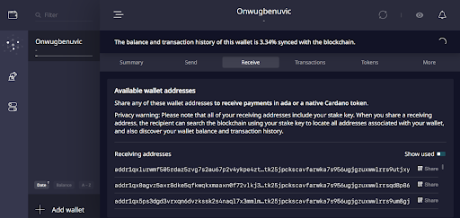

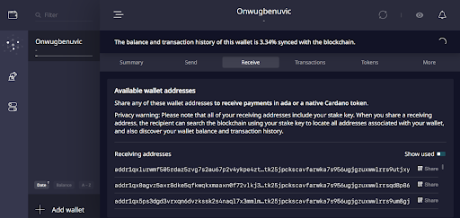

Click on “Send” to send coins and Click on “Receive” to receive coins, select one of the automatic recipient addresses to receive your coins for other exchanges.

How To Use The Wallet Function On Minswap Instead Of Daedalus

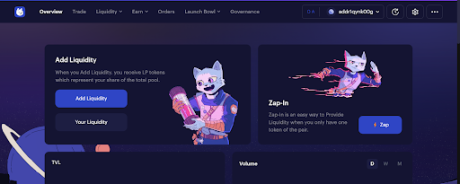

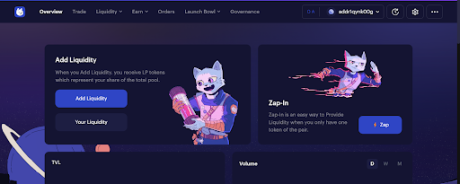

Minswap is a multi-pool decentralized exchange (DEX) on Cardano (ADA) where you can swap tokens with minimal time, cost, and maximum ease.

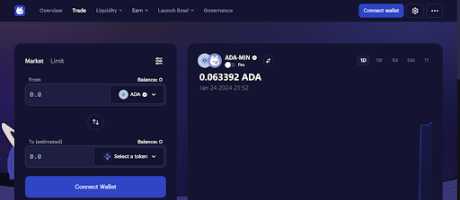

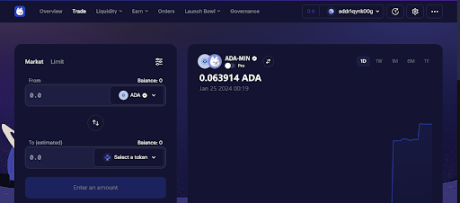

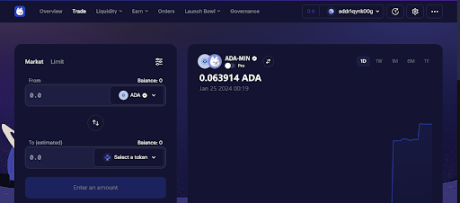

The Minswap website is user-friendly and easy to trade on. Go to the website, click on “Trade,” then click on “Connect wallet.”

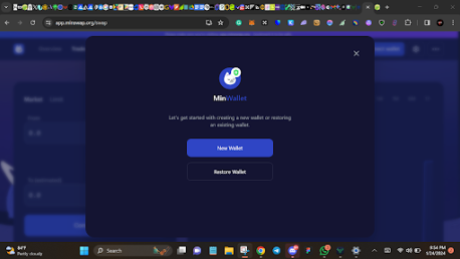

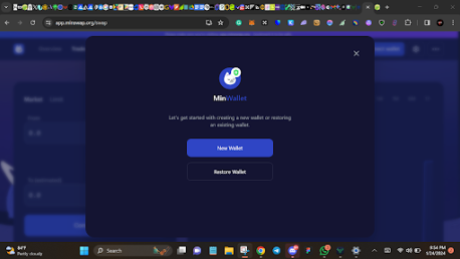

You might not see the DAEDALUS wallet there, so just create a “MinWallet” by clicking on it, then click on “New Wallet.” Copy your 24-word secret phrase down, write it down in a safe place, verify your secret phrase, create your MinWallet password, Now your MinWallet is ready to be used.

How To Buy ADA On Centralized Exchanges And Send To Your MinWallet

You need some ADA tokens in your wallet to make your transactions. You can buy your ADA from centralized exchanges (CEX) like ByBit, Binance, OKX, and MEXC, etc. In this case, we will use Binance.

Once the ADA is purchased, copy your MinWallet address, go to Binance, buy your ADA, and then go to “Withdraw.” Paste the MinWallet address you copied in the box to input your address, and Cardano will be automatically filled as your transfer network. Input the amount of ADA you want to transfer, then click on the “Withdraw” button.

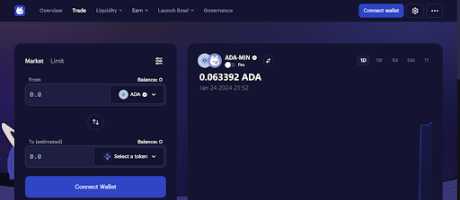

How To Trade Crypto Tokens On MinSwap

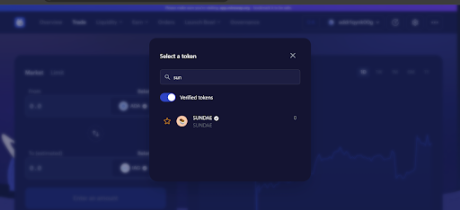

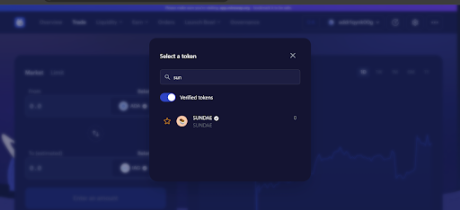

To buy tokens, go to Coingecko and search for the token on the Cardano Blockchain Network you want to buy. Alternatively, you can go to the social media pages of the token you want to make sure you have the correct coin. Go back to MinSwap, click on the denominator token button, input the name of the token you want to buy, and select it.

Input the amount of ADA you want to swap for that token and swap it. If you want to sell, just switch their positions and swap.

Checking Prices Of Cardano-Based Tokens

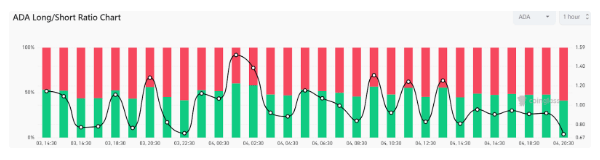

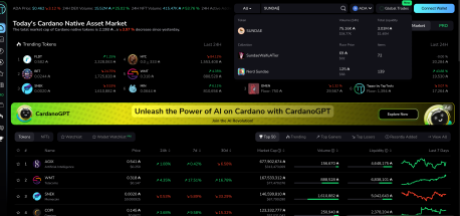

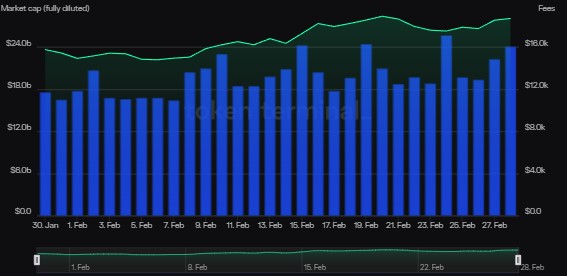

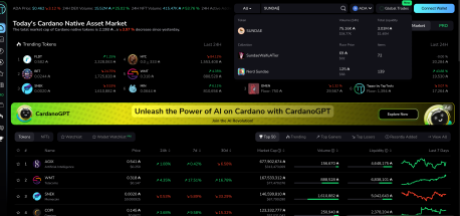

Knowing how to check the price action of tokens when trading on blockchains such as Cardano is important for investors to make the best decisions. For the Cardano network, data trackers such as TapTools is the one-stop-shop for all things Cardano charts.

Just go to TapTools, click the Search bar, and input the name of the token you want to check. In this case, we’re using SUNDAE.

Choose the correct token and click on it, and TapTools will show you the price chart for that token. By using TapTools, you will be able to keep track of the price and follow how your token is doing, as shown below:

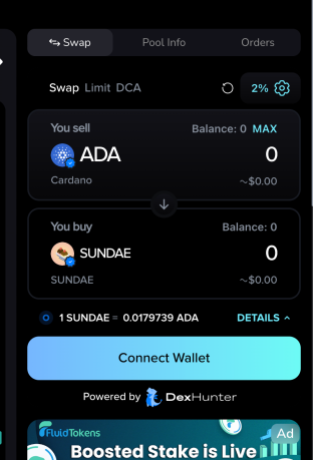

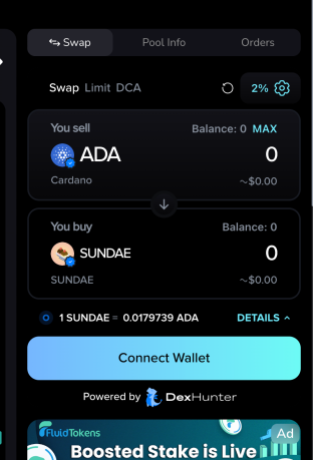

Interestingly, TapTools also has its own inbuilt decentralized exchange (DEX) for those who want to do everything in the same place. All you have to do is connect your wallet similarly to connecting to MinSwap as illustrated above, pick the token you want to swap to, enter the amount of ADA you want to swap, and click “Swap”. The DEX is visible on the right-hand side when you open the chart of a token.

Conclusion

Trading on the Cardano (ADA) network is quick and seamless due to its fast transaction speeds and low fees. However, like with any crypto trading, it does carry its own risk, which could be a partial or total loss of capital.

Sell signals have emerged on both the 3-day and 1-day

Sell signals have emerged on both the 3-day and 1-day  The notable

The notable