An analyst has explained how, if the historical pattern followed by the ADA price is to be believed, Cardano seems ready to go on a parabolic bull run.

Cardano May Be Set For A Bull Run Based On Historical Trends

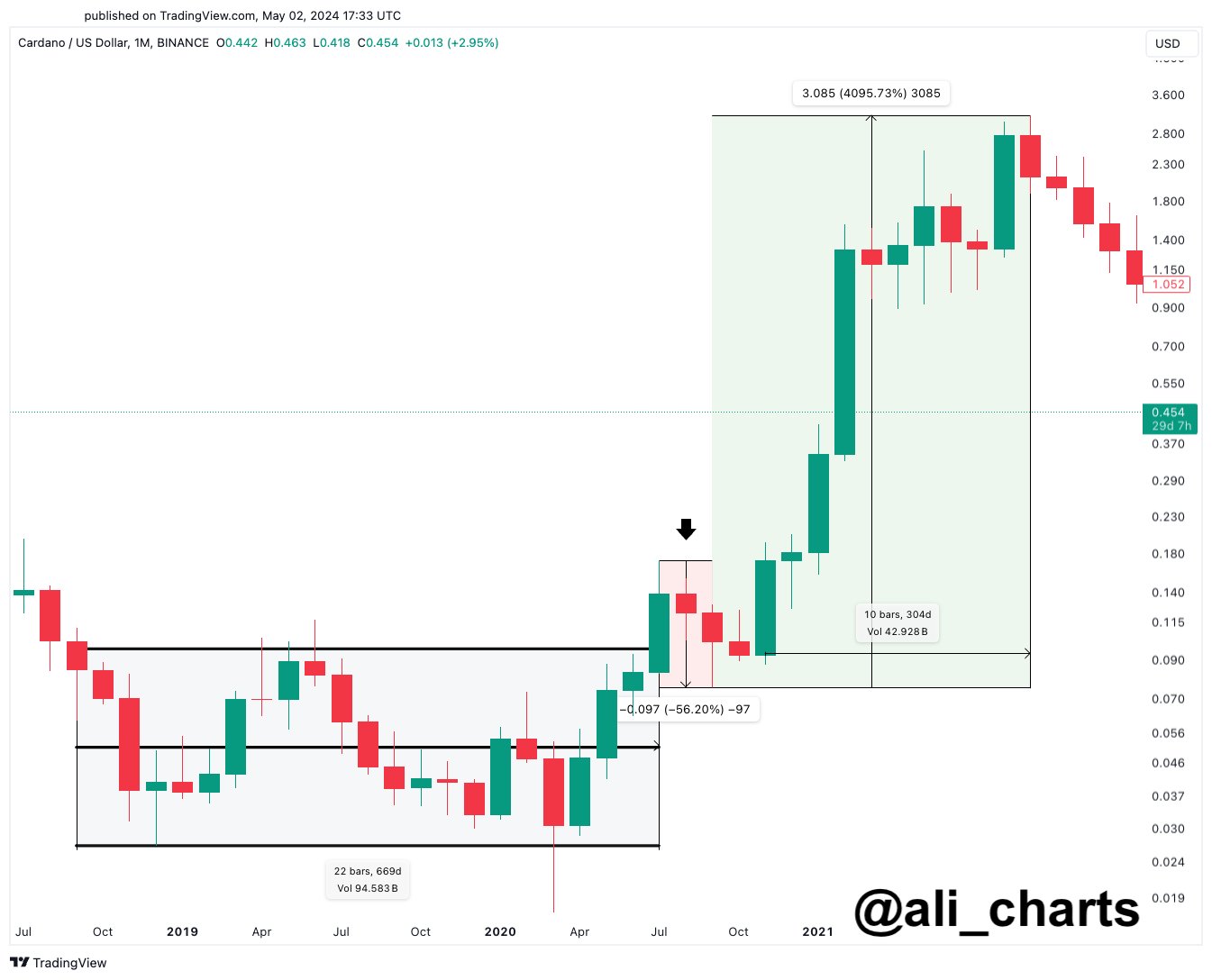

In a new post on X, analyst Ali Martinez has discussed what hints history may contain regarding where ADA’s price would go next from here. First, here is a chart shared by the analyst that shows the trend the cryptocurrency followed back in 2019:

From the graph, it’s visible that the asset had first consolidated inside a parallel channel during this period. A “parallel channel” in technical analysis (TA) refers to the region bounded by two parallel trend lines.

The upper line of the pattern connects the tops in the price, while the lower one joins the bottoms. When consolidating inside the channel, the price is probable to find resistance at the upper end and support at the lower one.

A break out of either of these lines can imply a continuation of the trend in that direction. As is visible in the chart, ADA managed to break out of this past parallel channel with a 75% surge. The asset then followed this rally up with a correction of around 56% before finally lifting off into a massive 4,095% bull run.

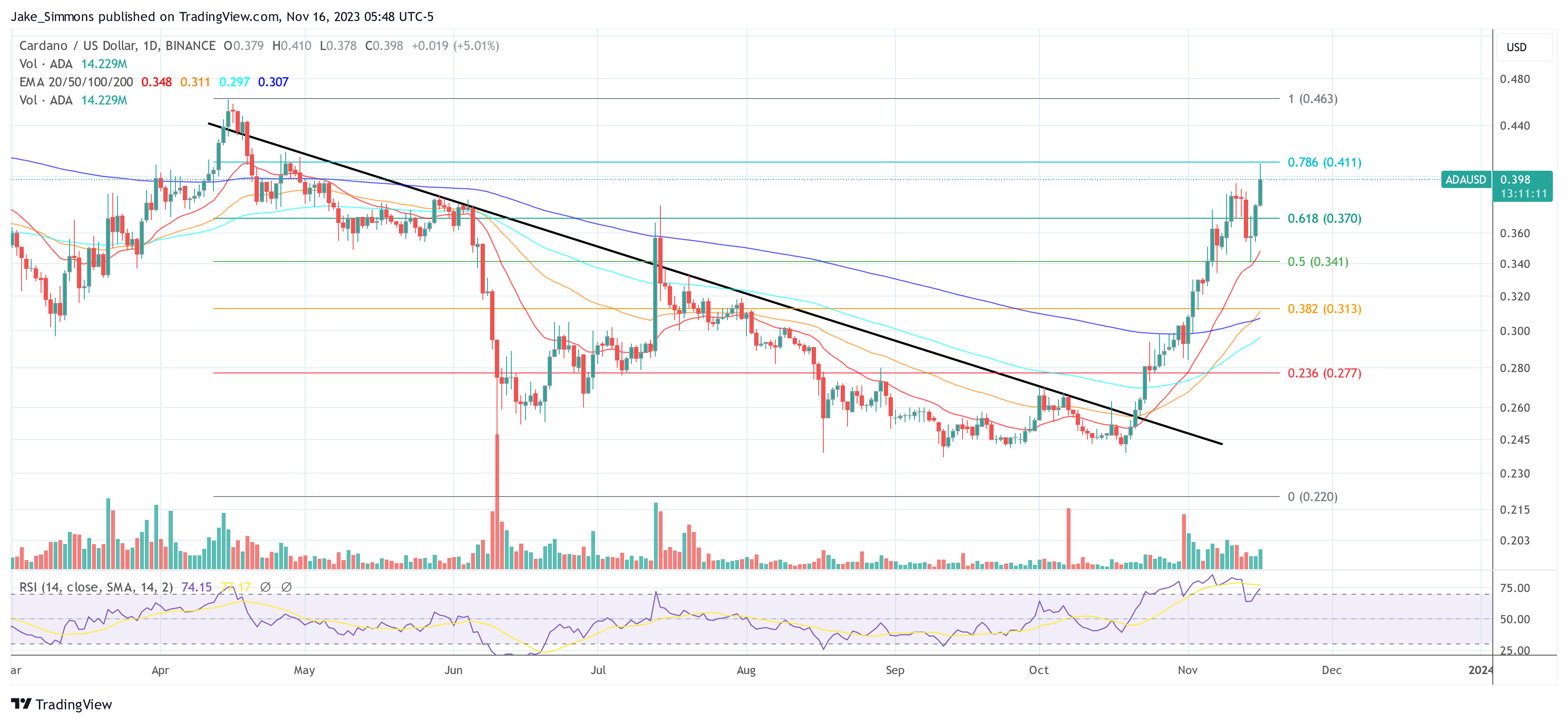

Interestingly, just like in 2019, Cardano was stuck inside a similar parallel channel in 2023. The chart below shows this recent pattern for the cryptocurrency.

As displayed in the graph, Cardano broke out of this latest parallel channel a while ago, this time with a rally of around 72%. Recently, though, the asset has lost this bullish momentum, as it has seen a drawdown of 50%. According to the analyst, however, this can, in fact, set the stage for a new bull run.

History doesn’t repeat itself, but it often rhymes! If that is the case for Cardano, we should be positioning ourselves for what’s coming, understanding that the recent price correction might just be one of the last buy-the-dip opportunities ADA will give you.

It now remains to be seen whether ADA will repeat the pattern from the last bull run or not. This is more about the long-term view, though, so where might the asset go in the short term? This may be answered by a signal that the analyst has shared in another X post.

As Martinez explains:

The TD Sequential, which timed the Cardano top, now presents a buy signal on the ADA daily chart. It anticipates a one to four daily candlesticks rebound that could put an end to the ADA corrective phase.

ADA Price

At the time of writing, Cardano is trading around $0.464, down 3% over the past week.