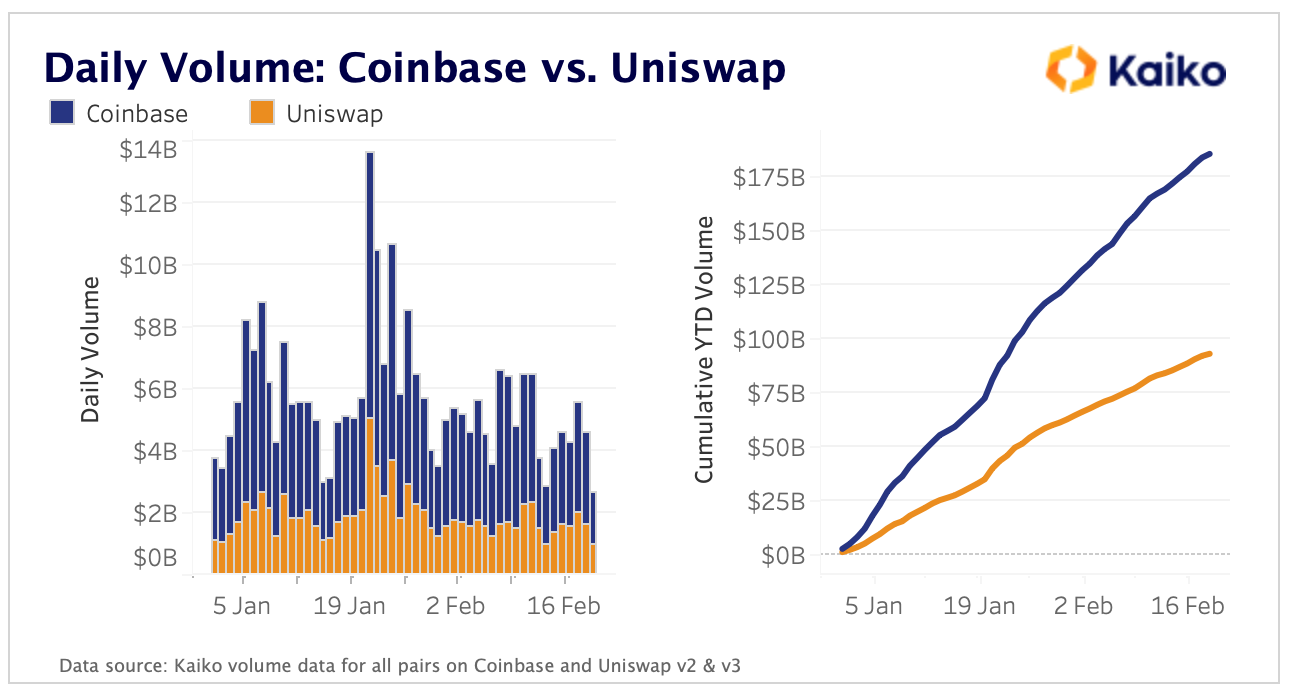

January saw higher spot trading volume on centralized exchanges amid the approval of spot bitcoin ETFs in the U.S.

XRP Whale Makes Massive Transfer Amidst Price Volatility

In light of recent developments in the crypto market, XRP has once again garnered the attention of investors and the community as the crypto asset has witnessed yet another massive whale activity.

XRP Whales Moves Over 50 Million Token To CEXs

A recent report revealed that an XRP whale recently moved over 50 million tokens to cryptocurrency exchanges. On-chain data shows that the whale has been making this kind of transaction over the past few weeks.

Interestingly, these whale transactions have created a whirlwind of speculation among worldwide crypto market enthusiasts after they surfaced during the token’s price decline. According to data from the on-chain tracker Whale Alert, the whale transferred 50.7 million tokens to centralized exchanges (CEX).

Whale Alert has revealed that the aforementioned funds were transferred to CEXs in two separate transactions. The whale transactions occurred amidst the token’s downward movement raising speculation on its effect on XRP’s price.

The on-chain tracker reported that the first transaction saw a whopping 26 million XRP tokens valued at approximately $15.22 million. Data shows that the unknown address identified as r4wf7enWPx…5XgwHh4Rzn moved the tokens to the Mexican-based crypto exchange Bitso.

Meanwhile, the second transaction moved 24.7 million XRP tokens valued at about $14.68 as of the time the transfer was made. The same wallet address mentioned above had transferred the funds to another crypto exchange Bitstamp.

It is noteworthy that the aforestated wallet address has been orchestrating this kind of transaction to the CEXs for a while now. Last week, Whale Alert detected the wallet address transferring over 48 million XRP tokens to Bitstamp and Bitso.

In less than two weeks, the wallet address has moved over 138 million tokens to the cryptocurrency platforms. With the current price of the digital asset, this is valued at over $79 million.

The Crypto Asset Poised For A Significant Upswing

On Wednesday, the entire crypto market experienced a notable disruption which saw XRP falling close to its October lows of $0.50. Despite the significant price drop, cryptocurrency analyst Egrag Crypto has expressed bullish sentiments about the crypto asset.

Egrag has recently shared bold predictions for the asset on the X (formerly Twitter) platform. The crypto analyst pointed out that the token’s price is currently getting ready for an upswing.

He noted an August scenario where XRP reached the lower boundary of its channel during the 1 billion liquidation across crypto. “Now, after five months, it is going back to that zone with another aggressive 1 billion liquidation,” he stated.

He highlighted that the asset’s bulls have been steadfast in “defending this channel,” not allowing anything to stop them from “buying into the dip.” He asserted that the bulls have maintained the price above the “Val Hell Line,” preventing a “daily candle” close below it.

So far, Egrag has pointed out “a slight retest” around the $0.55 appears to be “pretty standard” market behavior.

Don’t be mean to CEXs — Crypto relies on them

Centralized crypto exchanges have a crucial role left to play in bridging traditional finance with decentralized cryptocurrencies.

Centralized Exchanges Are Here to Stay

Crypto’s Quirky Automated Market Makers and How They Differ From TradFi Exchanges

Crypto exchanges have order books just like the NYSE, but the digital asset realm also offers something very different known as automated market makers (AMMs).

Uniswap Topped Coinbase’s Trading Volume in March During USDC Depeg, U.S. Crackdown

The DEX, however, has been unable to maintain elevated periods of trading volumes in the past, CCData noted.

Uniswap Topped Coinbase’s Trading Volume in March During USDC Depeg, U.S. Crackdown

The DEX, however, has been unable to maintain elevated periods of trading volumes in the past, CCData noted.

Crypto’s Decentralized Exchanges Had Most Volume in 10 Months Amid U.S. Crackdown in March

Trading volume on DEXs rose to $133.1 billion in March, the third straight monthly increase, according to DeFiLlama.

Coinbase Trade Volume Surpasses Uniswap’s, Countering Expectations for a DEX Surge

Market observers expected a surge in the use of decentralized exchanges following the collapse of FTX, but analysts said many DEXs offer a less user-friendly experience than centralized ones.

Bitcoin Short Squeeze May Reach $30,000, Top Crypto Trader Predicts

As Bitcoin breaks out of the $21k level, many crypto analysts have begun projecting further rallies for the asset. One of the famous crypto strategists, Crypto Kaleo, recently gave a high price prediction for the world’s largest cryptocurrency.

Addressing his over 550,000 followers on Twitter, Kaleo says BTC is preparing for a rally to $30,000. Bitcoin last saw $30,000 during the bear market in June 2022. However, the crypto strategist believes there would be fluctuations as Bitcoin targets $30,000, albeit his bullish stance.

In his words, the market should expect more falls before Bitcoin reaches $30,000. According to Kaleo, there would be some lows beneath $20k, which would trigger lower positions before Bitcoin can be ready for the short squeeze.

A short squeeze occurs when crypto traders borrow assets at a particular price, hoping to sell them lower and keep the difference. These traders often use overleverage short positions in the futures market. However, the traders would have no choice but to buy the borrowed assets as price propulsion pushes against them, sparking more rallies as market makers take out their liquidity to keep the momentum.

Kaleo is confident that the short squeeze is approaching since the BTC price has already jumped above 23% within seven days.

Bitcoin Rally Could Signal Increased Volatility

BTC has witnessed several bullish indicators since the beginning of 2023, bringing it to a year-high of over $21,000. Bitcoin’s bullish rallies have boosted crypto traders’ hopes that the long-running bear market could end soon.

There has been a reduction in the Bitcoin Fear and Greed Index to neutral, which might cause an increase in trading volume.

A massive increase in Bitcoin trading volume followed the recent price surge. Throughout the past week, Bitcoin trading volume has climbed above double the initial value, reaching $10.8 billion, a 114% increase.

An increase in trading volume often leads to a spike in volatility. Bitcoin’s current seven-day volatility level of 2.4% is below the 2022 value of 3.1% but remained stable during the recent rally. There is a likelihood that the constantly increasing trading volume during the rally may cause a spike in volatility.

Centralized exchanges (CEXs) had to battle with low trading volume, which means lower transaction fees and revenue, including staff layoffs. Therefore, the rising trading volume is a welcomed development for the exchanges and BTC traders.

Bitcoin Recovery Underway As Realized Profit And Trading Volume Increase

According to Glassnode’s data, on-chain realized profits for BTC return to the adjusted spent output profit ratio (aSOPR) value of 1.0. Some analysts believe it is the critical resistance level. The aSOPR historically indicates a shift in the total market cycle when increasing demands (trading volumes) absorb profits.

BTC’s on-chain realized profit and loss ratio has jumped over the 1.0 mark, recording 1.56 profits against the January 16 losses. This marked a reversal of the downtrend that started in May 2022. An increase in realized gain without a price drop indicates market strength.

On-chain analytics by Glassnode also suggest that a BTC price recovery is underway. As the market absorbs more selling pressure without a fall in price, the overall fear and macro shift will reduce.

Technically, volatility, trading volume, and realized profits are pushing BTC decoupling from equities. Bitcoin’s previous price action correlates to US equities.

The correlation to equities might have been due to asset accumulation by institutional investors. The correlation has reduced now that institutional investors hold fewer BTC and might exit the market in the future.

Binance CEO urges crypto buyers to ‘hold’ amid ‘unpredictableness’

Binance CEO Changpeng Zhao (CZ) said people should invest in crypto if they’re using “cash that you don’t need for a long time” as the market sees high volatility amid FTX’s fallout.

Solana wallets ‘compromised and abandoned’ as users warned of scam solutions

Solana users have been urged to move their funds to cold storage and be alert to possible scams after a major exploit of thousands of wallets sees more than $8 million stolen.

Automated order books eliminate DeFi costs and match CEX capability

DeFi may eliminate the middleman, but this was often at the expense of costly transactions and reduced functionality.

$1.2B in Ether withdrawn from centralized exchanges in record daily outflow

More than $1 billion worth of Ether has been withdrawn from centralized exchanges within a 24-hour period. It’s the second time this year and the price went vertical last time.

Exchange Tokens Hit New All-time Highs as Stock Traders Rush to Crypto

GameStop caught the stock-buying public’s imagination. That excitement has spilled over to crypto.

CEX, Lies and Videotape: Binance Accuses Rivals of Fighting Dirty

A bogus video on Chinese social media has intensified a long-standing feud involving Binance, Huobi and OKEx.