Chainlink (LINK) has enjoyed a sharp surge of more than 21% over the past 24 hours. Here’s what data suggests could be behind this rally.

Chainlink Has Surprised Crypto Market With Breakout In The Past Day

While most cryptocurrency sectors have seen flat or small green returns over the last 24 hours, Chainlink has shown a decoupling as it has observed some sharp bullish momentum in this window.

Here is a chart that displays how LINK’s recent performance has looked like:

With this sudden burst, Chainlink has touched the $16.7 mark for the first time since the crash during the first half of April. While the asset has now retraced a major part of this plunge, it still hasn’t made a full recovery.

Should LINK’s bullish momentum continue, though, it may not be too long before the cryptocurrency can reclaim the $17.8 level it was trading at just before the crash.

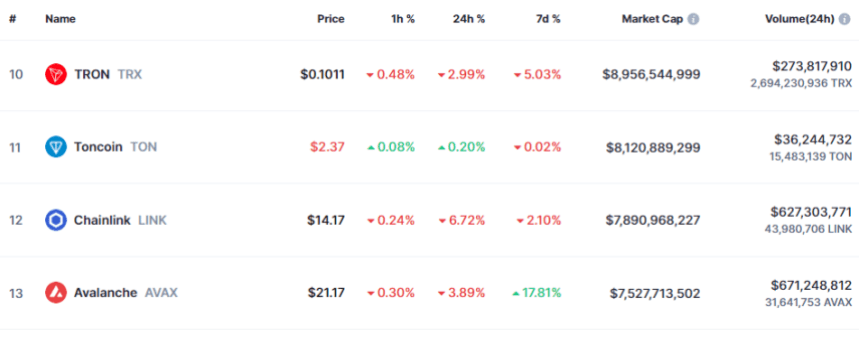

As for where Chainlink stands in the wider market, the table below shows that, based on market cap, it’s currently the 15th largest coin.

LINK isn’t too far off from Polkadot (DOT) now, so it’s possible that if the price rise continues, the coin will dethrone DOT and take over the 14th spot on the list.

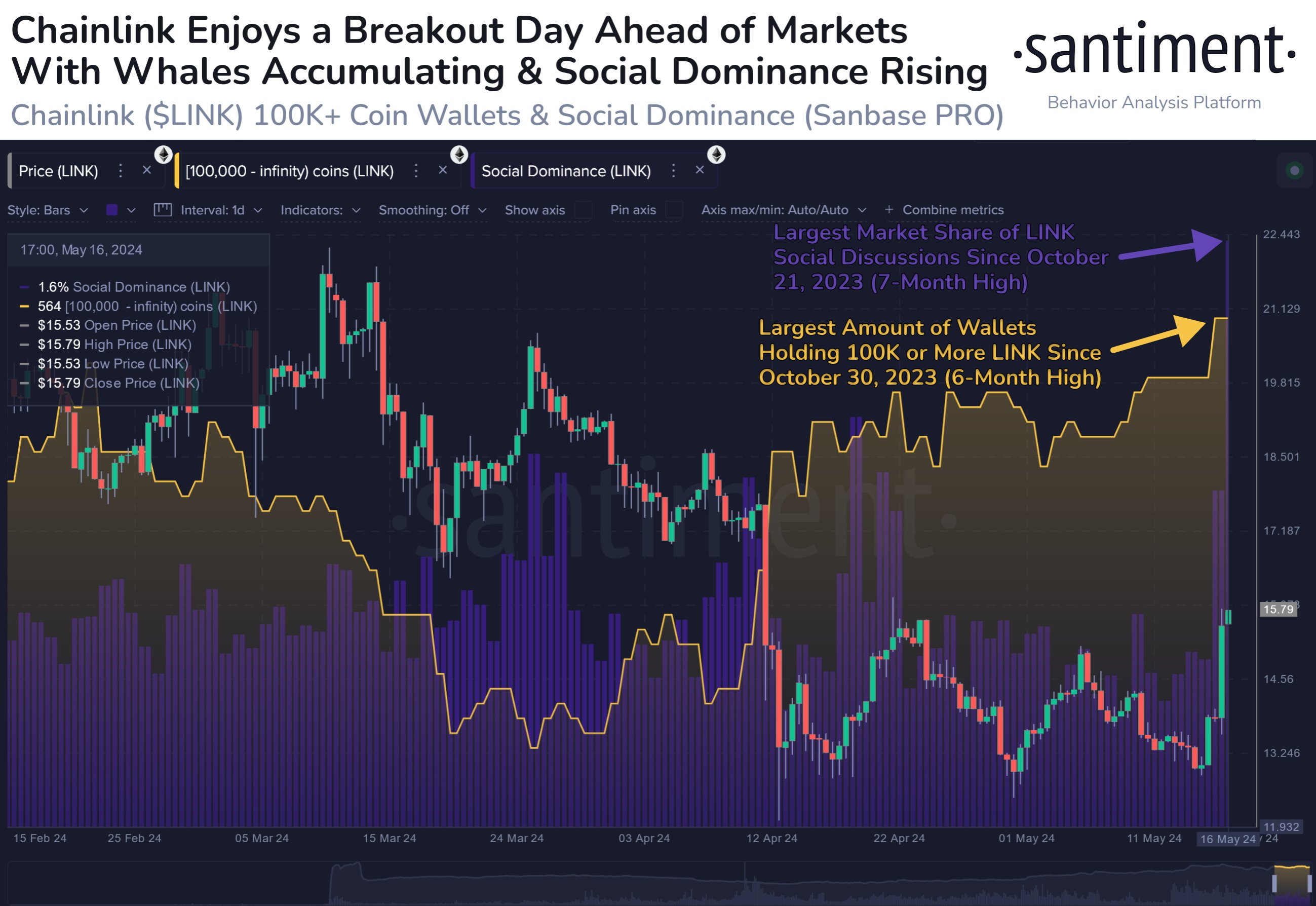

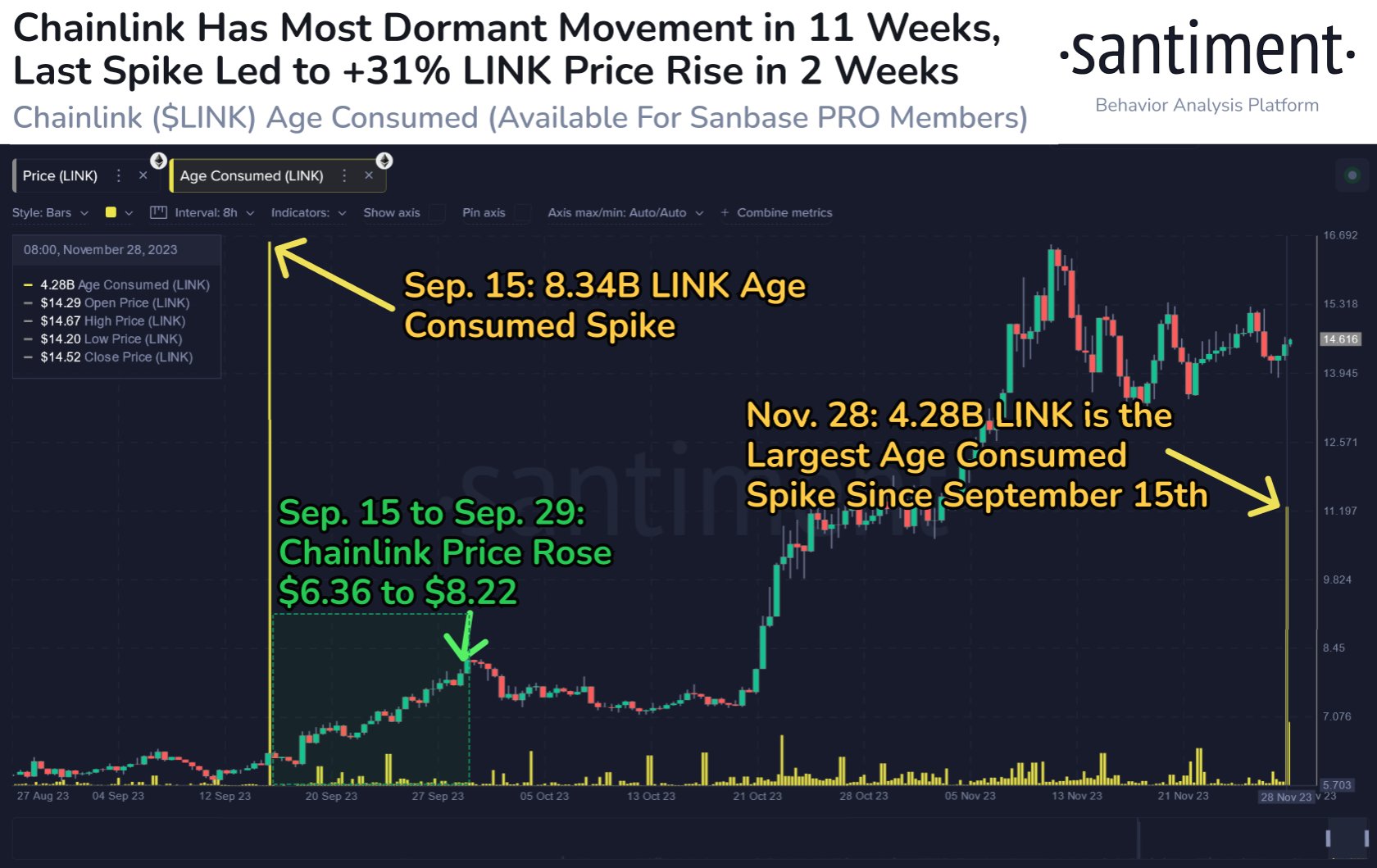

Now, what could be the reason for Chainlink’s sudden decoupling from the rest of the market? Data from the on-chain analytics firm Santiment may perhaps provide some hints.

The Total Number Of LINK Whales Is At A 6-Month High Now

As pointed out by Santiment in a post on X, Chainlink investors holding 100,000 tokens or more of the asset in their balance have recently seen their address count increase.

This cutoff is equivalent to around $1.67 million at the current LINK exchange rate. Investors with holdings this large are popularly referred to as whales.

Whales can be influential entities in the market because they can move a large amount of volume in a short span of time. As such, their behavior may be worth monitoring.

From the graph, it’s visible that Chainlink’s total number of whale addresses has hit 564 after the latest rise, which is the highest the metric has been since October of last year. This increase in the number of whales on the network may be partially behind the surge that LINK has just seen.

In the same chart, the analytics firm has also attached the data for another indicator: social dominance. This metric tells us about the share of cryptocurrency-related social media discussions that LINK occupies right now.

This indicator has shot up alongside this rally, implying the interest around the coin has spiked. Historically, such a rise in attention has been a bearish sign for the asset, so it remains to be seen if these high values will be maintained. “If social dominance calms and FOMO doesn’t take over, bullish conditions are ahead,” notes Santiment.