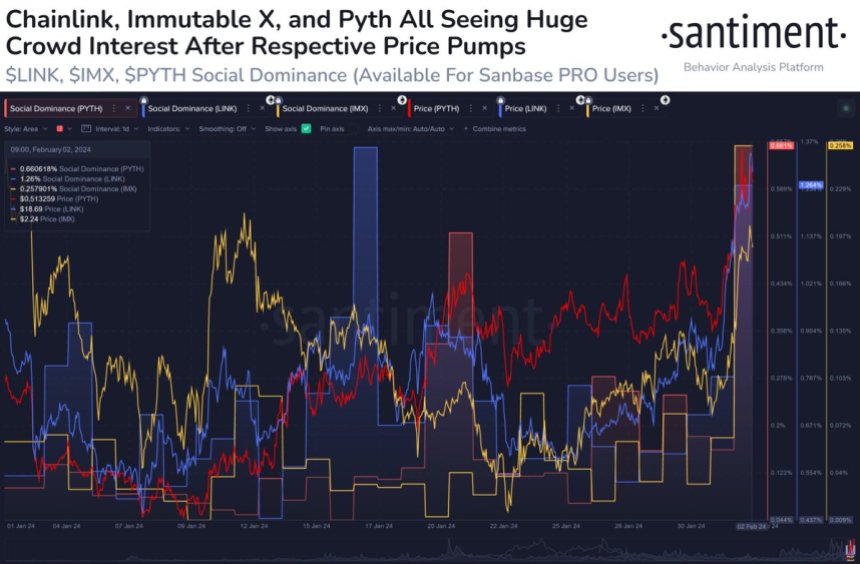

After Chainlink’s impressive run of more than 34% over the past week, LINK has dethroned Dogecoin (DOGE) from the top 10 crypto by market cap list.

Chainlink Has Pulled Away From The Crowd With A Sharp Surge Recently

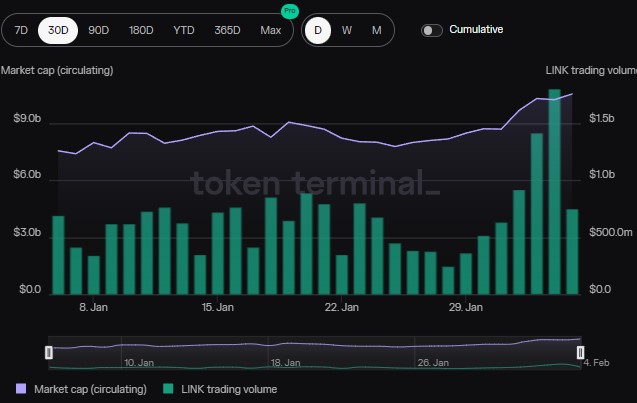

While most cryptocurrency sectors have observed minimal movement recently, Chainlink has emerged as an outlier, enjoying a surge of over 34% in the last week.

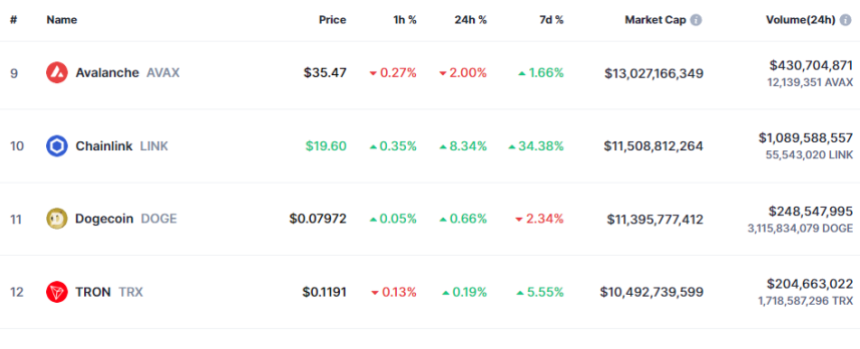

The below chart shows how LINK has performed over the past month.

LINK had achieved a major milestone, breaking above the $18 level earlier during this latest rally, but with a sharp 8% continuation of the run, the coin has now surged beyond the $19.5 mark for the first time since early 2022.

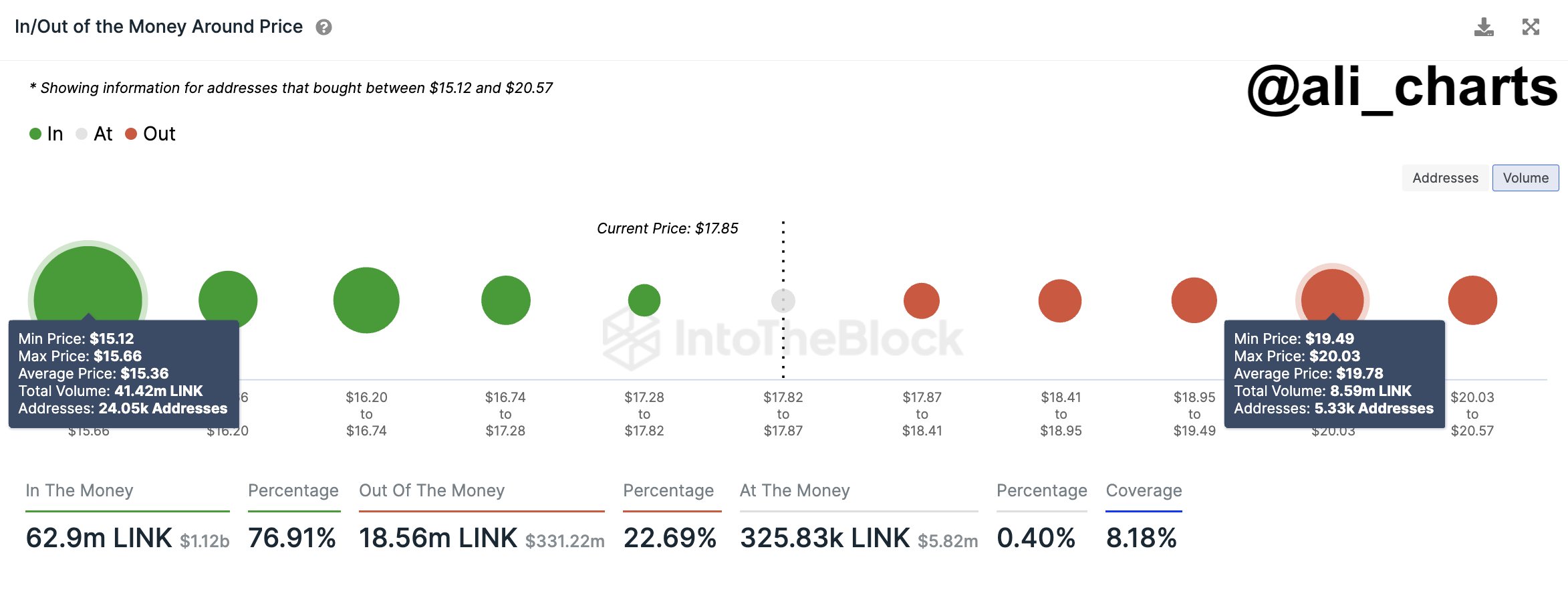

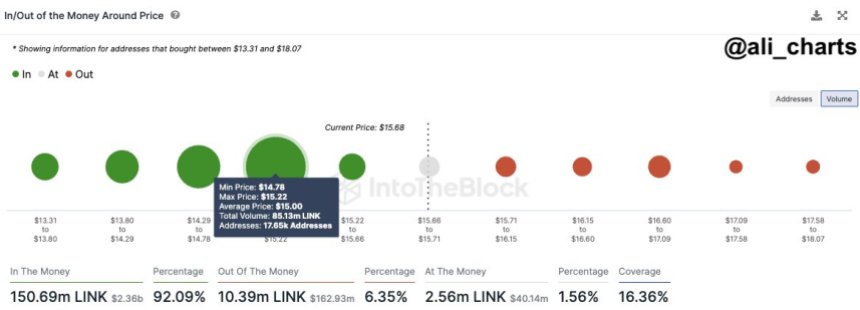

Should Chainlink’s surge continue, the cryptocurrency would be retesting the $20 level, which could prove to be a source of major resistance, according to on-chain data.

LINK has surged more than 38% over the past thirty days, which means it has significantly outperformed the wider sector. Bitcoin, for instance, hasn’t even been able to put together positive returns in this period, as the original cryptocurrency’s price has declined by almost 2%.

Thanks to this strong rally, Chainlink has changed its standing among the wider sector. Specifically, the token has shaken things up in the market cap list.

Dogecoin Has Lost Its Position In The Top 10 List To LINK

Following the rally, LINK has improved its market cap rank and is now the 10th largest cryptocurrency in the sector based on this metric. Dogecoin, holding this spot earlier, has now fallen to 11th.

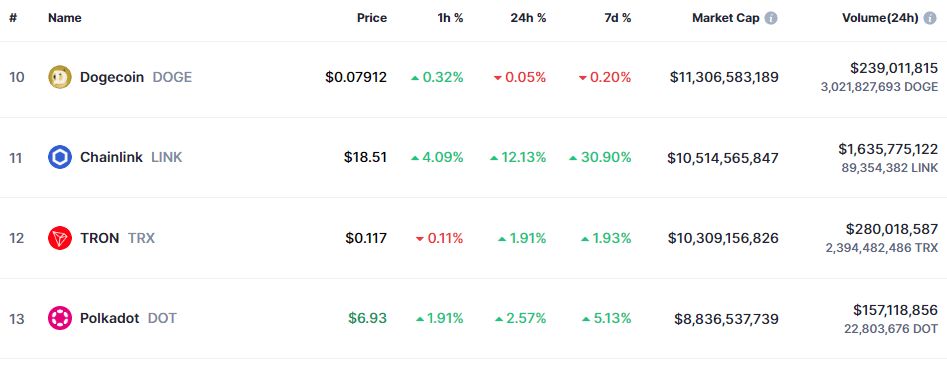

The table below shows how the two assets fit in the broader sector.

Although Chainlink has now surpassed Dogecoin in this metric, the gap between the two assets is still not much. This means the two coins may continue to flip each other in the coming days unless one shows diverging performance.

As LINK has arrived at this spot with a sharp surge, things may be looking favorably for the asset, especially considering that DOGE has rather put up negative returns in the past week.

The overall picture has also been a bit dire for the memecoin recently, as the chart below displays that its price has followed a sideways trajectory during the past month.

Unless things change fast for Dogecoin, its exit from the top 10 list may be here to stay. Of course, this only assumes that Chainlink itself doesn’t fall off shortly.

INDEXED:

INDEXED: