With the fourth Bitcoin Halving just around the corner, Lady of Crypto, a market analyst and trader, has weighed in on claims concerning this bull cycle.

The crypto analyst shared her insights after analyzing the recent market decline and the impending Bitcoin halving this month. According to the expert, there have been speculations that since BTC broke its all-time high early, the cryptocurrency can continue seeing fresh gains.

Bullish Run Misconception: Bitcoin Can Hit Another ATH?

Lady of Crypto has disregarded the claims that this bull cycle will begin early, saying she believed the community was “lied to and suggesting widespread misinformation” and dismissing the current gains as the signs of a widespread bull run.

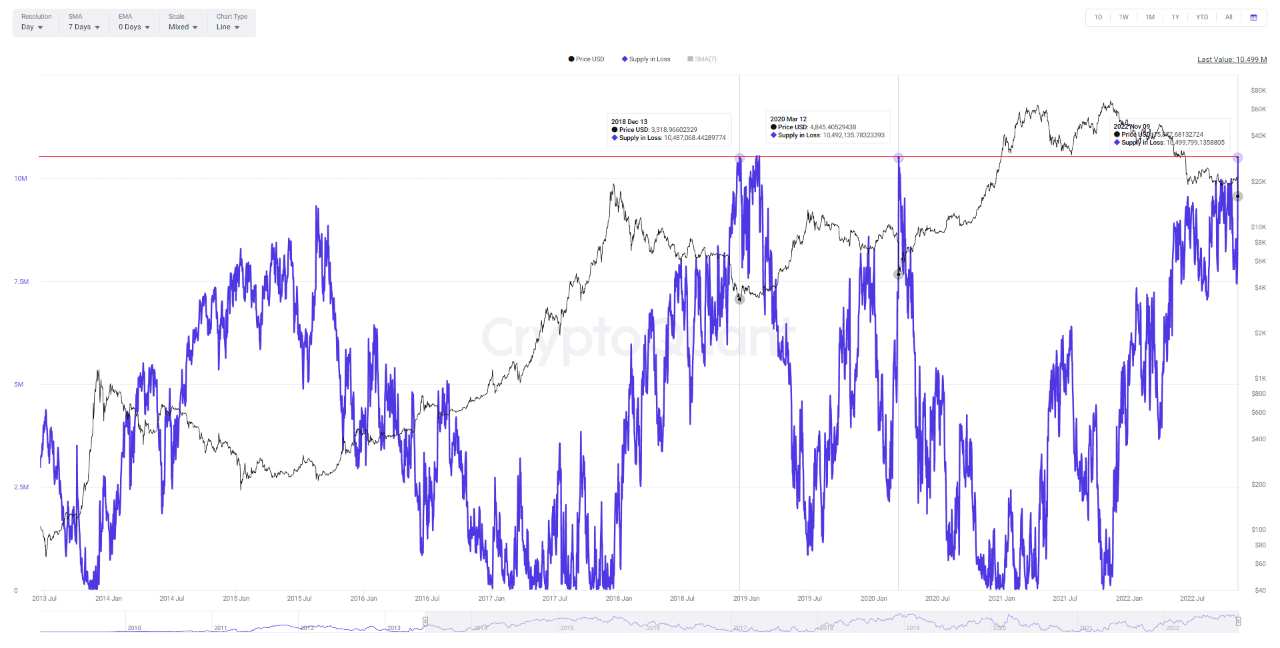

As The Halving approaches, the analyst noted that Bitcoin and Altcoins are severely down, but this is not the time to panic. Drawing attention to the 2016 and 2020 pre-halving dips, she highlights that BTC plummeted by 30% and 20% shortly before the event.

Meanwhile, during this pre-halving period, BTC has dropped by over 17%, with altcoins falling by 29%. Although the current decline was severe, Lady of Crypto notes that it is in the range of a typical pre-halving dip and a black swan event.

She compares the COVID meltdown, in which BTC fell by 58% and altcoins by 68%, suggesting that the current decline pales in significance.

Lady of Crypto clarified that Bitcoin Spot Exchange-Traded Funds (ETFs) have been a major factor in BTC breaking its peak early, highlighting that the masses have not yet arrived.

The expert then points to social media presence, revealing that the masses are returning to the crypto market. “YouTube views and subscribers show interest in returning gradually, in line with this time last cycle, as do new Twitter followers,” she added.

This Bull Cycle Is Mirroring Past Halving

Except for BTC’s early all-time high break, Lady of Crypto believes this bull run is unfolding similarly to the last two, albeit with more volatility. However, the volatility suggests this will be the biggest bull market ever.

She advises underexposed investors that the dips are the best chance to purchase BTC during a bull run. Meanwhile, if an investor is overexposed, holding the crypto asset has historically been the best course of action, drawing attention to 2020 and 2021 dips.

Addressing fear and panic among investors, Lady of Crypto cautioned that multiple situations might trigger a panic sell during every bull run. Even though these events appear terrible, like the bull run coming to an end, they are just sideshows.