Bitcoin price holds above $63,000 even as regulatory enforcement ramps up and spot BTC ETF outflows raise concern.

Cryptocurrency Financial News

Bitcoin price holds above $63,000 even as regulatory enforcement ramps up and spot BTC ETF outflows raise concern.

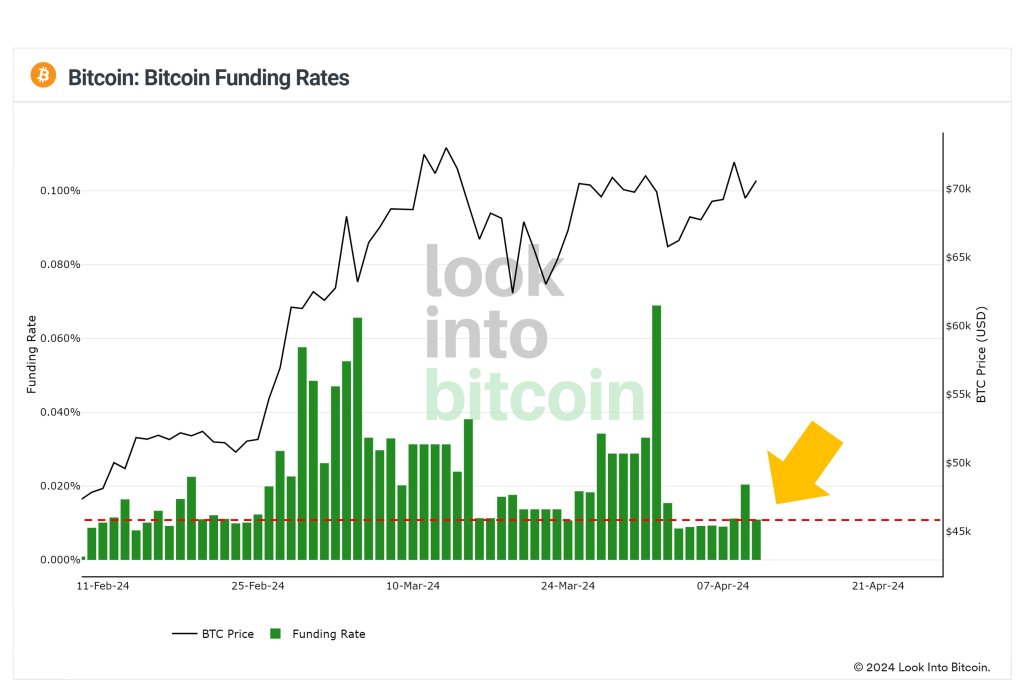

Bitcoin, one analyst notes on X, is looking healthy for the first time since the coin soared to over $70,000, printing all-time highs back in March 2024. The assessment is due to funding rates dropping to within ordinary levels, an indicator that volatility is also falling and moments of fear of missing out (FOMO) are fading.

In crypto perpetual trading, the funding rate is the fee exchanged between market participants. These fees are market-determined and are adjusted every eight hours or so.

Depending on market conditions, they can be positive or negative. However, they play a critical role in determining momentum. Of note, bulls pay a fee to bears When perpetual prices are higher than the spot price. This, in turn, discourages buying in the perpetual market and incentivizes buying into the spot, bringing prices closer.

Whenever prices rally, as has been the case since the start of the year when Bitcoin has generally been in the green, those who enter long have to pay sellers to keep prices from deviating, as mentioned above.

However, at spot rates, the rate leveraged buyers are paying is slightly lower as FOMO drops. Once prices rapidly expand, ideally above March 2024 highs, this funding rate will likely increase to February and March 2024 levels.

So far, Bitcoin is changing hands above $70,800 at spot rates and within a bullish formation. Of note is that buyers are in charge of reversing losses posted on April 8.

Even so, for the uptrend to remain, prices must break out above $72,500 and the April 8 high on rising volume. BTC will likely float to over $73,800 and enter price discovery in that case.

With FOMO dissipating and “normalcy resuming,” the analyst said the coin is now better positioned to soar higher, backed by organic momentum generated from market participants. After dipping slightly on April 9, the coin rose following positive news about the Consumer Price Index (CPI) in the United States.

While the “hot” CPI pushed other assets lower, Bitcoin prices bounced to spot levels. Experts say the coin might benefit as risk-averse traders shift to safe-haven coins to shield their value from raging inflation.

Beyond this, analysts expect demand for spot Bitcoin exchange-traded funds (ETFs) to rise in the months ahead. As institutions pour in, buying shares of spot BTC ETFs issued by players like Fidelity, the demand for the underlying coin might soar to fresh levels, lifting prices. Moreover, some analysts are bullish, saying prices will benefit once GBTC stops offloading coins.

Major U.S. equity indices closed the day lower as faster CPI reading for March, will BTC was up 1%.

Stubbornly high inflation has shattered Wall Street expectations for a long series of rate cuts in 2024.

Stubbornly high inflation so far in 2024 appears to be standing in the way of the Fed’s willingness to begin cutting rates.

The CPI reading reduced expectations for interest-rate cuts in the next months, weighing on risk assets such as crypto.

Bitcoin traders eye BTC price levels of interest as U.S. PPI preserves declining inflation narrative ahead of Fed rates decision.

This morning’s inflation data

This morning’s inflation data

History shows there’s likely a bright year ahead for BTC’s price.

Bitcoin’s latest price pullback to $35,000 was driven by softer U.S. inflation, China’s economic challenges and regulatory uncertainties.

CPI positively surprises stocks, and Bitcoin catches a bid as inflationary pressures are shown to be declining faster than thought.

In addition to the headline beat, core CPI unexpectedly declined last month.

The U.S. government tomorrow will report on October inflation data.

Bitcoin funding rates are in classic bull market territory, but can BTC price upside sustain as macro volatility triggers line up?

CPI joins macro data coming in higher than predicted — something not conducive to BTC price upside, Bitcoin analysts continue to imply.

The latest read on U.S. inflation

Bitcoin prepares for a testing macro week as geopolitical uncertainty injects volatility into gold, oil and the U.S. dollar, but BTC price action has yet to react.

Network, futures and user data all point toward Ether potentially charting a new course.

Solana (SOL) has recorded a 5% gain in the last 24 hours amidst certain concerning developments in the crypto space. On Wednesday, the United States published its Consumer Price Index (CPI) data for August, which shows that inflation rose from 3.2% to 3.7%, higher than the predicted outcome by analysts.

In addition, the bankrupt FTX exchange obtained court approval to liquidate its crypto holdings worth $3.4 billion as it looks to offset its debt.

Normally, developments such as this are expected to induce a selling pressure on crypto assets. However, the majority of the market is staying afloat with slight gains in the last few hours, while Solana has even embarked on a rally, drawing much attention from investors.

Interestingly, popular crypto analyst Michaël van de Poppe has given possible reasons as to why the crypto market may not be moving as widely expected.

According to an X post on Wednesday, Michaël van de Poppe states that there should not be much reaction from the crypto market despite the latest CPI data and the court approval for FTX’s liquidation.

Related Reading: Solana Potential Rebound: Can Bulls Hit Their $30 Target?

The analyst explains that most of the Solana, which makes up the bulk of the FTX crypto holdings, with a value of $1.2 billion, is currently staked and thus cannot be liquidated.

Van de Poppe states that only 7 million SOL is available to FTX for liquidation, and most of these tokens have been sold in the past week. Given these circumstances, the analyst predicts a “sell the rumor, buy the news” scenario would likely occur.

FTX gets approval to sell $3.4B in #Crypto assets & CPI data comes in worse than expected

Markets aren't falling down that much, and not much should be happening from it.

The Solana, which corresponds to $1.2 billion of the assets of FTX, is mostly staked and can't be sold.

… pic.twitter.com/uKG9XefCzy

— Michaël van de Poppe (@CryptoMichNL) September 13, 2023

In relation to the other crypto holdings of FTX, Michaël van de Poppe states the exchange is only allowed to sell $200 million worth of assets per week.

Furthermore, the current market prices have been factored on during the calculation of this liquidation rate; thus, it will likely not produce a high level of selling pressure.

In addition to Solana, FTX also looks to liquidate other assets such as Bitcoin (BTC), Ethereum (ETH), Aptos (APT), and XRP, among others.

Explaining the crypto market’s response to the latest CPI data, Michaël van de Poppe explains that while inflation rates rose higher than predicted in August, the core CPI value was 4.3% as expected, which is lower than July’s value of 4.7%

Related Reading: SOL Price Prediction: Solana Takes Hit and Could Dive To $15

Therefore, the analyst postulates that the US Federal Reserve would likely not be introducing any interest rate hike. This is because the Fed is known to focus more on core CPI data, which provides a long-term outlook on the nation’s inflation rate.

At the time of writing, Solana trades at $18.69, with a loss of 0.29% in the last hour based on data from CoinMarketCap. Meanwhile, the token’s trading volume is up by 47.89% and is now valued at $446.52 million.