The new “Cronos zkEVM chain” is launching initially as a test network, based on Matter Labs’ software tools, which can be used to spin up new layer 2 and layer 3 “hyperchains” atop Ethereum.

Crypto.com Acquires License In Dubai As Cronos (CRO) Price Slips

Crypto.com achieves yet another milestone with its recently acquired license from Dubai’s regulatory authority to offer services in the country by Dubai’s arm CRO DAX Middle East FZE.

Significance of Crypto.com Recent License

According to the announcement, Crypto.com Dubai’s entity acquired the coveted Virtual Assets Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA). This marks a major step for the firm as it aims to extend its services worldwide.

The recently acquired VASP license will enable the firm to completely satisfy selected conditions and localization requirements outlined by VARA. In addition, it will allow the firm to launch operations, upon receiving operational approval notice from the regulatory body.

Furthermore, it will enable the firm to offer regulated virtual asset service activities in the country. These include exchange services, broker-dealer services, management and investment services, and lending and borrowing services. These services are accessible to retail and institutional users in the market through the Crypto.com Exchange and Crypto.com App.

The announcement also saw the company highlighting Dubai as its regional hub for the Middle East and Africa. According to Crypto.com CEO Kris Marszalek, Dubai is one of the top markets for creating effective regulation for the crypto space.

“Dubai continues to show it is a leading market when designing effective regulation for the crypto space while still supporting adoption and innovation,” the CEO stated.

Since VARA released its specialized regulations for virtual assets in February 2023, Crypto.com has been working to be among the first virtual asset exchanges to operationalize its VASP Licence. Finally, the firm’s aim has been realized.

“It is an incredible honor to be one of the first crypto exchanges to be granted a Virtual Asset Service Provider Licence by VARA,” Kris stated.

The VASP license is one of the notable licenses acquired by the company this year. In March, Crypto.com also acquired an MVP Preparatory Licence from the Dubai regulatory authority.

Latest License Might Propel Cronos (CRO) Price

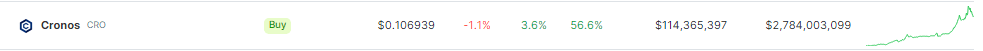

Over the past weeks, Cronos (CRO) has been seen as one of the best-performing coins. CRO experienced an impressive 57% price surge within the seven-day timeframe reaching the $0.1 mark.

The token outclassed some major cryptocurrencies in the top 100 ranking over the weekend. However, the crypto asset seems to have lost its momentum, as it fell from $0.1 to $0.088. According to CoinMarketCap, CRO is currently down by over 5% in the past 24 hours.

Related Reading: Snowfall Protocol (SNW), Shiba Inu (SHIB), and Cronos (CRO) – The Best Cheap Cryptos to Buy Now

So far, Crypto.com’s recent milestones have not had any current impact on CRO. Nonetheless, as the native token of Crypto.com, the license could spark larger adoption for CRO, which might help CRO regain its momentum.

Boom! Cronos Unleashes 57% Weekend Explosion, Beating All In The Top 100 Crypto Ranking

Cronos has experienced a robust and sustained bullish trajectory over the recent weeks. Over the course of the past seven days, it has consistently surged, reaching a solid pinnacle, a level not witnessed in months.

At the time of writing, Cronos (CRO) showcased its impressive strength, outperforming some of the most prominent names in the top 100 cryptocurrency ranking over the weekend.

With a remarkable 7% surge in the last 24 hours and a commanding 57% rally within the seven-day timeframe, as reported by Coingecko, Cronos is not just making waves but also setting itself apart as a standout performer in the current market dynamics.

Cronos’ Outstanding Performance In The Crypto Market

Notably, the CRO token has surpassed the descending trendline, which links the highest points observed since February. This positive momentum underscores the current strength and upward momentum of Cronos, indicating a significant shift in its market dynamics.

The market’s perception of the asset as overvalued at its current levels is suggested by the notably high Relative Strength Index (RSI) at 97.45, firmly placing it within the overbought zone.

This could lead to a potential retracement or consolidation in the near future. However, in the short term, the cryptocurrency exhibits a robust bullish trend, as indicated by the 50-day Exponential Moving Average positioned at $0.0630, with the current trading price of approximately $0.1033 surpassing previous resistance levels.

Targeting the key resistance point at $0.10, buyers are likely to drive the coin’s outlook to continue soaring. The ADX indicator has been consistently rising, and the Stochastic Oscillator has reached the overbought point.

This, coupled with the increased volume, is a positive signal. Additionally, the CRO price has surged above all moving averages, indicating strong momentum in the market.

Market Dynamics And Potential Scenarios

The future course of cryptocurrencies is contingent upon the distribution of power between bulls and bears. In the case of Cronos, if the bulls are able to successfully move the price above $0.08352, we may expect more upward momentum, which would be good.

Furthermore, the coin’s ability to sustain its current level could potentially act as a catalyst for a robust push towards testing the resistance at $0.0900 before the month concludes.

On the contrary, if the bears seize control and initiate a trend reversal, causing the price to lose momentum, a test of the $0.07390 support level becomes probable.

Looking ahead, a continued decline might prompt the coin to challenge the lower support level of $0.06696 in the upcoming days, emphasizing the importance of monitoring market dynamics for potential shifts in sentiment and price action.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Vauld

Australian Man Who Spent $6.7M Erroneous Crypto.com Refund Faces Theft Charges, Guardian Reports

Jatinder Singh and his partner bought four houses, cars, artwork and other luxurious items with money they received due to an accounting error by Crypto.com, according to the Guardian.

Google Cloud adds 11 blockchains to data warehouse ‘BigQuery’

Google’s BigQuery added 11 new public datasets for blockchain networks, allowing users to obtain a variety of data from these networks.

Google Cloud Pushes Deeper Into Blockchain Data, Adding 11 Networks Including Polygon

Google’s cloud-computing business has stored historical data on Bitcoin since 2018, claiming the service provides faster access than can be obtained directly from the blockchain.

Cronos (CRO) Prints Over 9% Gains In A Day While Market Sees Correction

As crypto assets recover from the 2022 crypto winter, Cronos (CRO) has recorded massive gains in 24 hours. Cronos’ trading volume has spiked by 301.28%, showing that the coin has attracted more trading activity.

Generally, the crypto market has seen a slight price increase. Bitcoin, the number one cryptocurrency, has enjoyed a positive rally and has influenced the rise of altcoins such as CRO.

Cronos’ price surged by over 9% in 24 hours, continuing its impressive price action into 2023. The cryptocurrency’s wide range of applications in various spheres has also helped to push this crypto revival.

What Is Behind This Rally?

Cronos is an open-source blockchain that facilitates Crypto.com’s Pay mobile app payments. However, the Cronos blockchain, which is Ethereum compatible, has upgraded and redesigned the project focus to integrate Web 3 and NFTs.

The asset’s price has benefitted from increased adoption, evident in the more than 100% spike in trading activity. Cronos network now supports activities on the Metaverse. NFTs and Games are part of the new projects adopted to keep up with modern trends.

The network has also maintained its core objective of providing decentralized finance (DeFi) solutions. Crypto users can carry out financial transactions on the blockchain fast and anonymously. Cronos has built a strong followership that interacts on social media channels.

The launch of Cronos Chain, compatible with Ethereum, has put the project on the front foot. The Cronos chain allows the migration of DApps built on the Ethereum blockchain and supports the Inter Blockchain Communications (IBC) protocol. The IBC protocol lets Cronos connect to the Cosmos ecosystem and interact with its DApps.

Cronos (CRO) Price Prediction What To Expect

CRO is gaining in the market today, currently trading at $0.0806. The support levels for CRO are $0.070164, $0.071703, and $0.072919, while the resistance levels are $0.075674, $0.077213, and $0.078429.

Cronos is currently trading above its 50-day Simple Moving Average (SMA) but is below its 200-day SMA. It implies that this price action could operate as a short-lived rally. On the price chart, the candles are in an ascending pattern. However, the candle for today has a long upper wick implying that the bears are trying to push the price down.

The Relative Strength Index (RSI) is bullish and in the overbought zone, at 79.27. It represents the massive spike in trading volume in Cronos. However, the RSI might retrace into the channel in the coming days.

The Moving Average Convergence/Divergence (MACD is above its signal line, which is also a buy signal. But, the MACD is showing minimal divergence, implying that there might be a trend reversal in the short term. Cronos will likely continue to trade in the green for a few days before slightly retracing.

A conservative approach to trading the asset might be the best option. More importantly, understand that a digital asset that declines in value by 50% will need to rally to 100% to return to its former value. This feat is difficult for altcoins and meme coins to accomplish.

Cronos (CRO) Up 4% In Last Week Amid Recession Fears

Crypto.com is one of the centralized exchanges that survived the market tribulations of 2022. Recent analysis done by CryptoCompare shows that the CEX had an average market share of 4.6% last year. Its native token Cronos, despite the challenges, was able to withstand the beating.

Although this is incredibly small compared to the big shots of the market, its mere survival could mean big things for its growth.

CRO And Macroeconomic Trends

The crypto market saw its value drop sharply as the bear market gripped the broader financial market. With major crypto institutions collapsing and the crypto market learning the mistakes of the 2008 financial crash, the industry is ready for a new start this year.

The Federal Open Market Committee (FOMC) Meeting Minutes that kicked off yesterday certainly had an effect on Cronos (CRO) as a whole. After dropping in price in the past days, the minutes gave new hope to investors as Cronos traded at $0.0597 and gained 2.4% in the past 24 hours.

Major cryptocurrencies like Bitcoin and Ethereum also rose after news of a seemingly dovish macroeconomic stance by the U.S. Federal Reserve.

This dovish stance can be a sign that the consumer price index (CPI) might be lower than that of November’s. A strong sign that the previous year’s interest hikes have a strong effect on managing the inflation problem. However, it remains to be seen whether it did lower or not.

Investors Should Watch This Level…

Good macros aside, the central bank is still hawkish on the acceptance of crypto on the financial system. But with that said, the crypto market and the traditional financial space are increasingly intertwined with one another and with the International Monetary Fund pushing for regulation.

Although the markets should anticipate the introduction of legislation, CRO investors should still focus on the macro trends that will have an effect on the market right now. Next week, the Fed is expected to release the CPI data that would have an effect on the markets.

Meanwhile, investors and traders should watch a breakthrough on the current CRO resistance at $0.0607 which would be a bullish indicator of things to come.

But with the CPI data incoming, holding off any major decision could be the wisest choice to do.

Monitoring how Bitcoin and Ethereum move will also be crucial. Even though Cronos correlation is low right now, major market movements made by these two top cryptos would determine where the entire cryptocurrency market might go.

However, with the fears of a recession gripping the markets, gains higher than $0.0638 might be impossible for Cronos as investor sentiment is dampened.

As the situation unfolds, investors and traders will have an answer as to what to do with their Cronos holdings.

CRO Price (Cronos) Pumps Over 12%, Why This Could Be The Start of Bigger Rally

CRO price started a fresh increase from the $0.062 support zone. Cronos bulls are now aiming a strong move towards the $0.094 level in the near term.

- CRO price started a decent increase above the $0.065 resistance against the US dollar.

- The price is trading above $0.070 and the 100 simple moving average (4-hours).

- There was a break above a major bearish trend line with resistance at $0.0650 on the 4-hours chart of the CRO/USD pair (data source from Coinbase).

- The pair could continue to rise towards the $0.080 and $0.094 resistance levels.

Cronos CRO Price Eyes Fresh Rally

This past month, cronos’s price found support near the $0.0615 zone against the US Dollar. CRO formed a base above the $0.0615 and $0.0620 levels before it started a fresh increase.

There was a clear move above the $0.0650 resistance zone and the 100 simple moving average (4-hours) to move into a positive zone. Besides, there was a break above a major bearish trend line with resistance at $0.0650 on the 4-hours chart of the CRO/USD pair.

The price is now trading above $0.070 and the 100 simple moving average (4-hours), outperforming bitcoin and ethereum. On the upside, an immediate resistance is near the $0.074 level. It is close to the 23.6% Fib retracement level of the main drop from the $0.131 swing high to $0.0568 low.

The next major resistance is forming near the $0.080 zone. If there is an upside break above the $0.08 resistance level, the price could start another strong increase.

Source: CROUSD on TradingView.com

In the stated case, the price could rise steadily towards the $0.094 level. It is close to the 50% Fib retracement level of the main drop from the $0.131 swing high to $0.0568 low.

Dips Limited in CRO?

If CRO price fails rise above the $0.074 and $0.080 resistance levels, it could start a downside correction. An immediate support on the downside is near the $0.07 level.

The main support is near the $0.0650 level and the 100 simple moving average (4-hours). A downside break below the $0.065 level could open the doors for a fresh decline towards $0.062. The next major support is near the $0.060 level.

Technical Indicators

4-hours MACD – The MACD for CRO/USD is gaining momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for CRO/USD is now in the overbought zone.

Major Support Levels – $0.070 and $0.065.

Major Resistance Levels – $0.074, $0.08 and $0.094.

Crypto.com’s CRO is in trouble, but a 50% price rebound is in play

Short CRO traders were paying as much as 3% premium to long traders on Nov. 14, reflecting extreme bearishness in its futures market.

CRO Coin Falls 19% After Crypto.com Announces Rewards Cut Down To Cardholders

On Monday, Crypto.com’s Cronos (CRO) slide followed suit with a sharp drop after the crypto exchange said it was reducing some staking and rewards tied to its popular pre-paid Visa cards.

According to Tradingview.com, the coin dropped by 19% to $.265. On Sunday before the announcement, CRO was trading above $.33 per coin.

Related Reading | TA: Bitcoin Consolidates Below $39k: What Could Trigger Another Decline

Crypto.com announced the changes in a blog post:

To ensure long-term sustainability, we are introducing a number of changes to the CRO Card rewards programme, effective 1 June 2022 00:00 UTC.

CRO Card Rewards Cut Down

Next month, the company will reduce the usage rewards on four of the exchange’s card tiers. The most premium tier, the Obsidian tier, will see a Cronos card reward reduction from 5% to 2%. In addition, the Icy White / Frosted Rose Gold tier reward will be pulled down from 3% to 1%.

The top tier of the company’s card program, Obsidian carries a $400,000 staking requirement and offers up to 8% cashback at retailers.

CRO price trading at $0.27 after company announcement of rewards cut down | Source: CRO/USD price chart from Tradingview.com

According to company policy, there will be a limit on how much a person can earn CRO card rewards for two tiers. For example, the Ruby Steel Card earns are limited to $25 or equivalent in other fiat currencies like Dollars and Euros. While for the Royal Indigo/Jade Green tier, the cap is set at $50.

In Addition, Crypto.com is phasing out CRO staking rewards for cardholders. Cards include Jade Green, Royal Indigo, Frosted Rose Gold, Icy White, and Obsidian. Staking rewards involves coin owners “locking up” or delegating a portion of their crypto holdings to earn more interest on deposits.

While explaining staking rewards, the exchange said;

Cardholders with an active 6-month stake and who staked before 1 May 2022 13:00 UTC will continue to earn CRO Card rewards on spending at the current rate until their 180-day stake expires. Thereafter, the revised rates will apply. Cardholders who stake CRO after their 180-day lock expires will earn card spending rewards as per the schedule.

Cronos Price Performance

Since the start of January 2022, Cronos has been trading lower. The price of CRO was over $0.50 at the beginning of the year, but it has been retreating since then. At one point, CRO was close to sliding below $0.30. Cronos’ price skyrocketed during the NFL Super Bowl. But after that, there hasn’t been any sign of a recovery as the price of CRONOS crashed continuously.

Related Reading | Analysts Predict ApeCoin To Hit $50 By End Of 2025 – And $100 By 2030

In the last 24 hours, CRO started the day in green, but after the company announcement price crashed below $0.30. Since then, the coin has lost 19% of its value and reached $0.26 lowest level.

Featured image from Flickr, chart from Tradingview

Crypto.com supports Cronos cross-bridge mainnet beta launch

The protocol launched testnet in July 2021, and has since facilitated 1.5 million transactions.