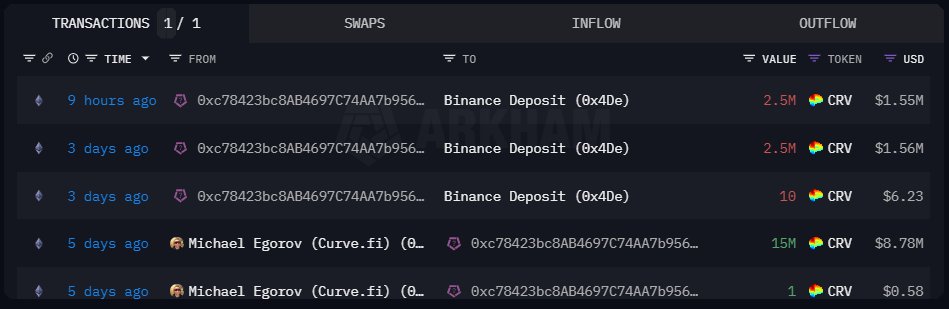

Curve Finance founder Michael Erogov has moved over 23 million CRV, the native governance token of the Curve DAO, to Binance, the world’s leading cryptocurrency exchange, over the last five days, The Data Nerd, on December 27, shows. The founder moved 2.5 million CRV on December 27. This transfer may ruffle investors, raising concerns because it could indicate that Erogov is likely liquidating.

CRV Is Firm, Up 60% In The Last 3 Months

While the founder’s sale of CRV could put downward pressure, the token remains firm and is up roughly 60% from September 2023 lows. The token trades above $0.60 at spot rates, rejecting selling pressure as the daily chart shows.

If bulls press on, it could break above $0.72 to record new 2023 highs. The token is trending higher, rejecting bear attempts amid improving sentiment across the crypto scene. Although Erogov is selling CRV, the market seems to interpret the move as bullish.

The spectacular revival of CRV is net bullish for the protocol, suggesting that investors are still confident despite headwinds in early H2 2023 when several Curve pools were exploited due to a Vyper compiler issue.

Curve Founder Sold CRV To Prevent Liquidation Of DeFi Loans

Following the hack in late July 2023, Erogov was forced to liquidate a large chunk to prevent liquidation. On its part, the hack led to over $52 million in crypto assets, including 7.19 million worth of CRV, lost. In the aftermath of the hack, prices crashed.

At the time of this hack, Erogov had over $100 million in DeFi loans backed by 427.5 million CRV as collateral. As CRV prices fell, the health of Egorov’s loans fell in tandem.

If the value of Egorov’s CRV collateral were to fall further, it could face liquidation. This meant that all protocols from where the founder had borrowed using CRV as collateral would have been forced to sell the token at spot rates to repay the loan. As an automated intervention, the event would have likely caused a cascade, even impacting ordinary holders using CRV as collateral.

To avoid this and as a form of intervention, Tron founder Justin Sun and multiple other parties, including Jeffrey Huang, made deals to buy CRV from the Curve founder, preventing this liquidation from happening.

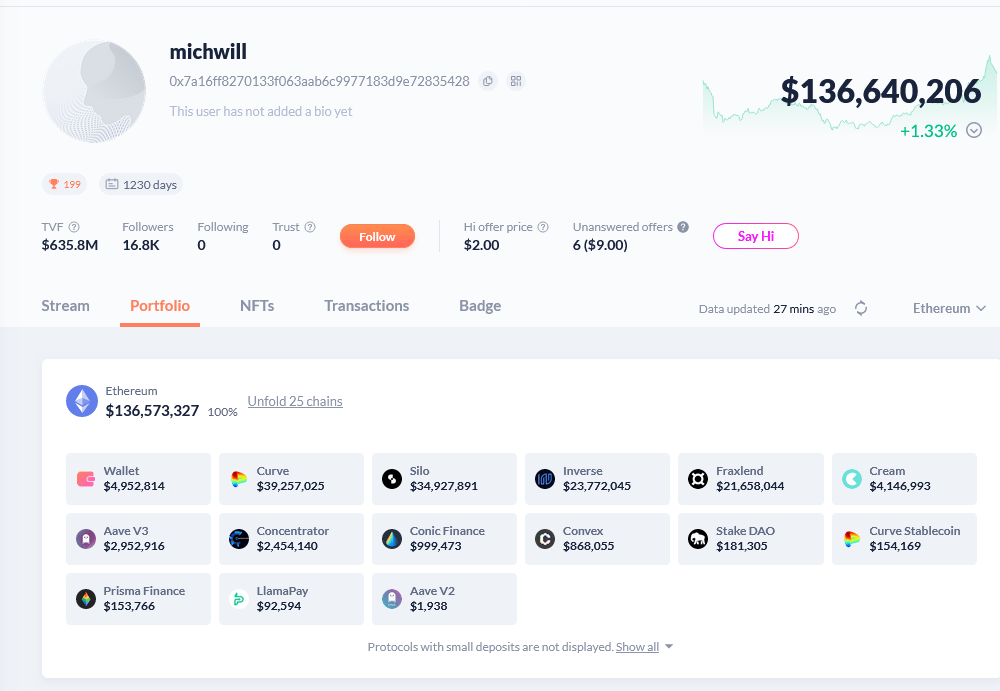

According to DeBank on December 27, Erogov’s crypto portfolio was north of $136 million. Out of this, the founder owns over $38.9 million of CRV.