Another year, another Crypto Holiday special from our team at NewsBTC. In the coming week, we’ll be unpacking 2023, its downs and ups, to reveal what the next months could bring for crypto and DeFi investors.

Like last year, we paid homage to Charles Dicke’s classic “A Christmas Carol” and gathered a group of experts to discuss the crypto market’s past, present, and future. In that way, our readers might discover clues that will allow them to transverse 2024 and its potential trends.

Crypto Holiday With Blofin: A Deep Dive Into 2024

We wrapped up this Holiday Special with crypto educational and investment firm Blofin. In our 2022 interview, Blofin spoke about the fallout created by FTX, Three Arrows Capital (3AC) collapse, and Terra (LUNA). At the same time, the firm predicted a return from the ashes for Bitcoin and the crypto market. The resurrection seems well underway, with Bitcoin surpassing the $40,000 mark. This is what they told us:

Q: In light of the prolonged bearish trends observed in 2022 and 2023, how do these periods compare to previous downturns in severity and impact? With Bitcoin now crossing the $40,000 threshold, does this signify a conclusive end to the bear market, or are there potential market twists investors should brace for?

Blofin:

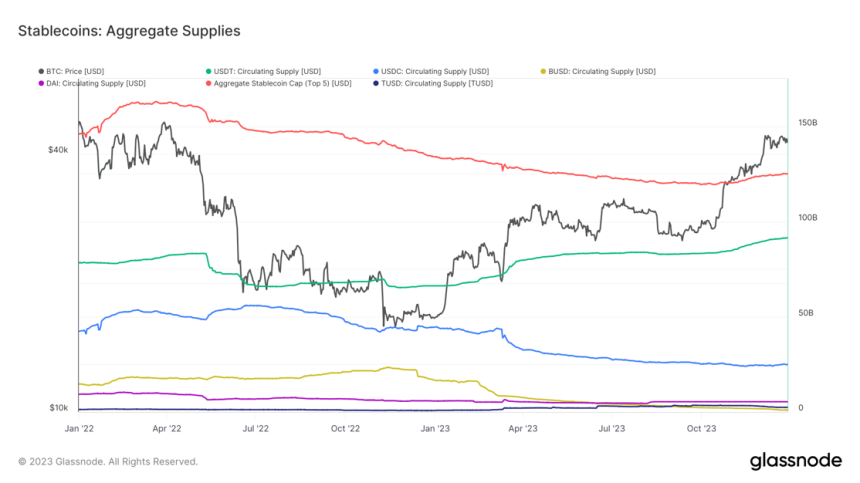

Compared to previous crypto recessions, the 2022-2023 bear market appears milder. Unlike previous cycles, in the last bull market, the widespread use of stablecoins and the entry of massive traditional institutions brought more than $100 billion in cash liquidity to the crypto market, and most of the cash liquidity did not leave the crypto market due to a series of events in 2022.

Even in Mar 2023, when investors’ macro expectations were the most pessimistic, and in 2023Q3, when liquidity bottomed out, the crypto market still had no less than $120 billion in cash liquidity in the form of stablecoins, which provides sufficient support and risk resistance for BTC, ETH and altcoins.

Similarly, due to abundant cash liquidity, in the bear market of 2022-2023, we did not experience a “liquidity dryness” situation similar to March 2020 and May 2021. In 2023, with the gradual recovery of the crypto market, liquidity risks were significantly reduced compared to 2022.

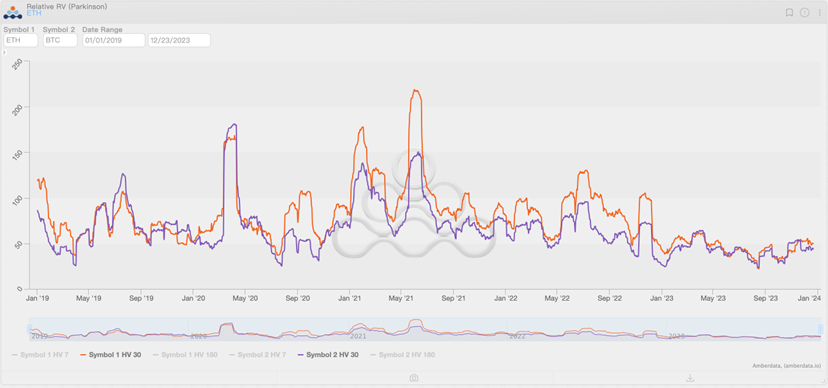

The only troubling thing is that in the summer and autumn of 2023, risk-free returns of more than 5% have caused investors to focus more on the money market and brought about the lowest volatility in the crypto market since 2019.

However, low volatility does not indicate a recession. The performance of the crypto market in the fourth 2023Q4 proves that more investors are actually holding on to the sidelines. They are not leaving the crypto market but are waiting for the right time to enter.

Currently, the total market cap of the crypto market has recovered to more than 55% of its previous peak. It can be considered that the crypto market has emerged from the bear market cycle, but the current stage should be called a “technical bull market” rather than a “real bull market.”

Again, let’s start our explanation from a cash liquidity perspective. Although the price of BTC has reached $44k once, the size of cash liquidity in the entire crypto market has only rebounded slightly, reaching around $125b. $125b in cash supports over $1.6T in total crypto market cap, implying an overall leverage ratio of over 12x.

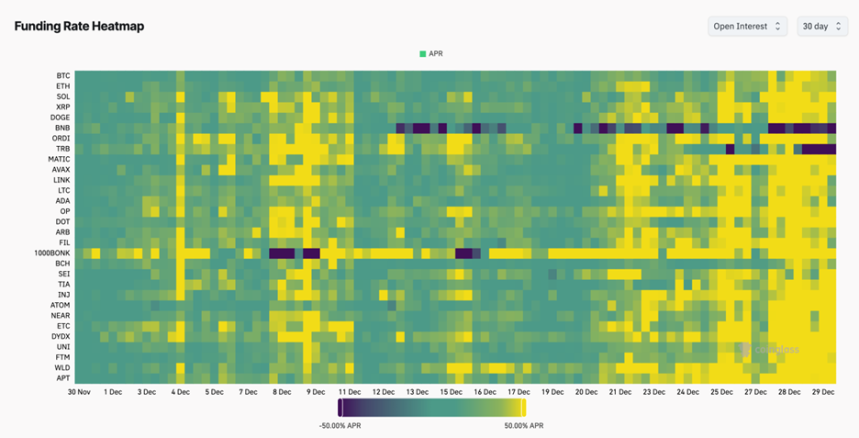

Additionally, many tokens have seen significant increases in their annualized funding rates, even exceeding 70%. High overall leverage and high funding rates mean that speculative sentiment has as much impact on the crypto market as improving fundamentals. However, the higher the leverage ratio, the lower the investors’ risk tolerance, and the high financing costs are difficult to sustain in the long term. Any bad news could trigger deleveraging and cause massive liquidations.

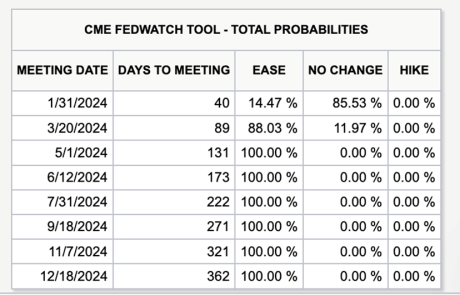

Furthermore, real improvements in liquidity are yet to come. The current federal funds rate remains at 5.5%. In the interest rate market, traders expect the first rate cut by the Federal Reserve to occur no earlier than March and the European Central Bank and Bank of England to cut interest rates for the first time no earlier than May. At the same time, central bank officials from various countries have repeatedly emphasized that interest rate cuts “depend on the data” and “will not happen soon.”

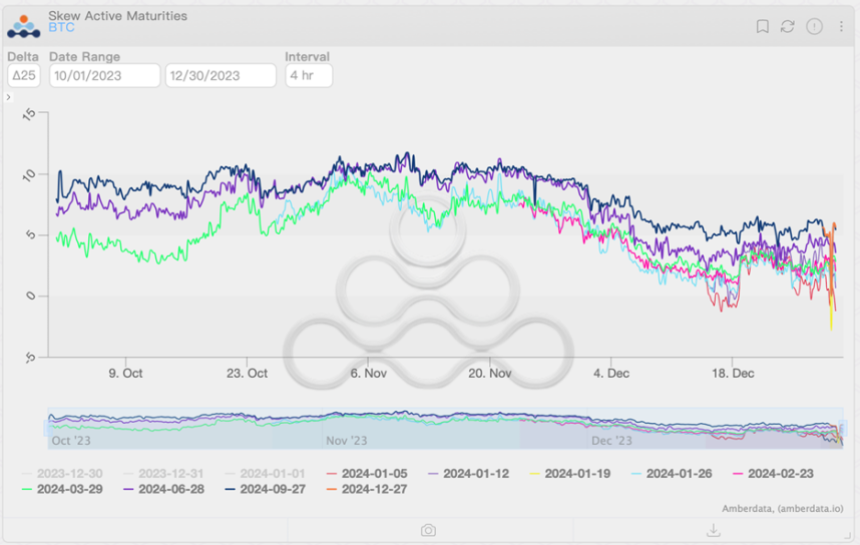

Therefore, when liquidity levels have not really improved, the recovery and rebound of the crypto market are gratifying, but the “leverage-based” recovery is significantly related to investors’ financing costs and risk tolerance, and the potential callback risk is relatively high. In fact, in the options market, investors have begun to accumulate put options after experiencing a rise in December to deal with the risk of any possible pullback after the start of 2024.

Q: Right now, we are seeing Bitcoin reach new highs. Do you think we are in the early days of a full bull run? What has changed in the market that enabled the current price action; is it the Bitcoin spot ETF or the US Fed hinting at a loser policy or the upcoming Halving? What is the big narrative that will go on in 2024?

Blofin:

As stated above, we are still some way away from the early stages of a full-blown bull market. “Technical bull market” better describes the current market status. This round of technical bull market started with improved expectations: the spot Bitcoin ETF narrative triggered investors’ expectations for the return of funds to the crypto market, while the peak of the federal funds rate and expectations for an interest rate cut next year reflected the improvement at the macro environment level.

In addition, some funds from traditional markets have tried to be the “early birds” and make early arrangements in the crypto market. These are all important reasons why BTC’s price is back above $40k.

However, we believe that changes in the macro environment are the most important influencing elements among the above factors. The arrival of expectations of interest rate cuts has allowed investors to see the dawn of a return to the bull market in risk assets. It is not hard to find that in November and December, not only Bitcoin experienced a sharp rise, but Nasdaq, the Dow Jones Index, and gold all hit all-time highs. This pattern typically occurs at or near the end of each economic cycle.

The beginning and end of a cycle can significantly impact asset pricing. At the beginning of a cycle, investors typically convert their risky assets into cash or treasury bonds. When the cycle ends, investors will take cash liquidity back to the market and buy risk-free assets without distinction. Risk assets typically experience a “widespread and significant” rise at this time. The above situation is what we have experienced in 2023Q4.

As for the Bitcoin halving, we prefer that the positive effects it brings result from an improvement in the macro environment rather than the result of the “halving.” Bitcoin had not become a mainstream asset with institutional acceptance when the first and second halvings occurred. However, after 2021, as the market microstructure changes, institutions have gained sufficient influence over Bitcoin, and each halving coincides with the economic cycle to a higher degree.

In 2024, we will witness the end of the tightening cycle and the beginning of a new easing cycle. But compared with every previous cycle change, this cycle change may be relatively stable. Although the period of high inflation is over, inflation is still “one step away” from returning to the target range.

Therefore, all major central banks will avoid releasing liquidity too quickly and be wary of the economy overheating again. For the crypto market, a solid liquidity release will lead to a mild bull run. Perhaps it is difficult for us to have the opportunity to see a bull market similar to that in 2021, but the new bull market will last relatively longer. More new chances will also emerge with the participation of more new investors and the emergence of new narratives.

Q: Last year, we spoke about the most resilient sectors during the Crypto Winter. Which sectors and coins will likely benefit from a new Bull Run? We are seeing the Solana ecosystem bloom along with the NFT market; what trends could benefit in the coming months?

Blofin:

What is certain is that exchanges (whether CEX or DEX) are the first beneficiaries when the bull market returns. As the trading volume and user activities begin to rebound again, it can be expected that their income (including the exchange’s fee income, token listing income, etc.) will increase significantly, and the performance of the exchange tokens may also benefit from this.

At the same time, infrastructure related to transactions and capital circulation will also benefit from the new bull market, such as public chains and Layer-2. When liquidity returns to the crypto market, crypto infrastructure is an indispensable part: liquidity must first enter the public chain before it can be transferred to various projects and underlying tokens.

In the last bull market, the congestion and high gas cost of the Ethereum network were criticized by many users, which became an opportunity for the emergence and development of Layer-2 and also promoted the development and growth of many non-Ethereum public chains, while Solana and Avalanche are some of the biggest beneficiaries.

Therefore, with the arrival of a new bull market, more usage scenarios and possibilities for Layer 2 and non-Ethereum public chains will be discovered. Ethereum will also naturally not be far behind; we may witness a new boom in public chain ecosystems and tokens in 2024.

In addition, as an exploration of the latest applications of BTC, the development of BRC-20 cannot be ignored. As a new token issuance standard based on the BTC network that emerged in 2023, BRC-20 allows users to deploy standardized contracts or mint NFTs based on the BTC network, providing new narratives and use cases for the oldest and most mature public chain.

With the return of liquidity, the exploration and development of BRC-20-related applications may gradually begin, and together with other public chain ecosystems, they will make great progress in the new “moderate but long-term” bull market.

Cover image from Unsplash, chart from Tradingview