Digital bank Revolut is set to release a cryptocurrency exchange targeting “advanced traders,” according to an email sent to customers that was seen by CoinDesk.

Woo Raises $9M to Boost Liquidity of WOO X Exchange

Participants in the raise include Wintermute and Amber, in addition to other notable liquidity providers.

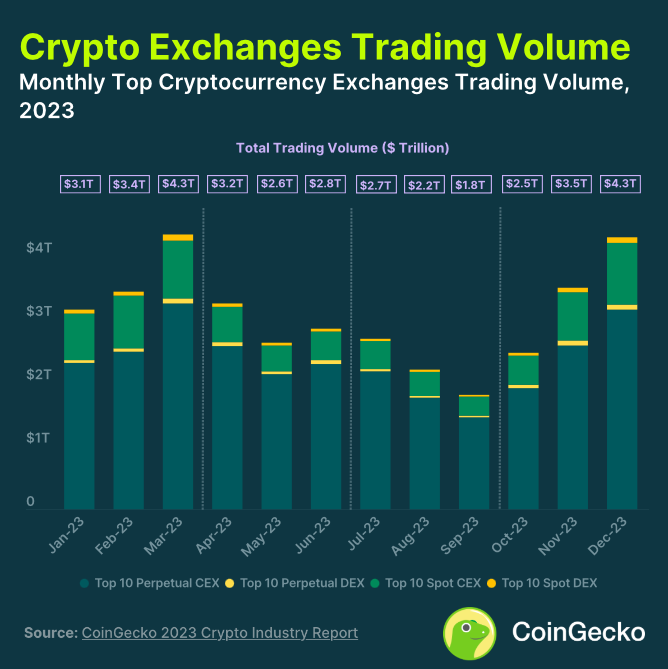

Crypto Exchanges Trading Volume Hit $10.3T in 2023, New Data Shows

CoinGecko’s 2023 Annual Crypto Industry Report has been released. It covers crypto exchanges and their current state, Bitcoin’s +155.2% and Ethereum’s +90.5% growth, analyzing NFT trading volume throughout the year, and more.

Among the report’s highlights is the comprehensive review of the crypto trading volume in 2023 through the performance of centralized crypto exchanges (CEX) and decentralized exchanges (DEX).

Centralized Crypto Exchanges Dominated

Crypto saw a $36.6 trillion trading volume in 2023, with a volume increase of +53.1% from Q3 ($6.7 trillion) to Q4 ($10.3 T). The Q4 increase marked the first quarter-on-quarter (QoQ) growth of 2023 and could be attributed to the “growing bullish sentiment” in the crypto market due to the anticipation of spot Bitcoin ETFs’ approval by the SEC.

Despite the market’s challenges, such as the aftermath of FTX’s collapse, the worldwide banking crisis, or Binance’s regulatory difficulties in 2023, the data presented in the report shows an overall market recovery.

In December 2023, the trading volume increased sharply to $4.3 trillion, a volume not seen since March 2023. Overall 2023, centralized exchanges dominated the year despite the challenges, especially when compared to decentralized exchanges (DEX). The report details:

- CEXto DEX spot trading volume ratio hovered around 91.5% in Q4.

- CEX to DEX derivatives trading volume ratio dropped to 97.3% from 98.5%.

- CEX to DEX spot ratio stood at 91.4% in 2023.

- CEX to DEX derivatives ratio was 98.1% in 2023.

Binance, Upbit, OKX, Bybit, and Coinbase are among the Top 10 centralized exchanges by trading volume. Binance managed to dominate the list despite dropping to a yearly low market share of 41% in November, following a continued loss throughout 2023.

There was a +98.1% increase QoQ, after the top 10 CEXes recorded $2.20 trillion in spot trading volume in 2023 Q4. Previously, the trading volume had failed to reach above $2 trillion for two consecutive quarters.

Altogether, the top 10 CEXes recorded $7.2 trillion in spot trading volume in 2023 compared to $9.4 trillion in 2022, representing a -23.4% year-on-year (YoY) decline.

Deep Dive Into The Spot Decentralized Exchanges (DEX) Trading Volume In 2023

The Top 10 DEXes recorded $205.3 billion in spot trading volume in 2023 Q4, indicating a +87.1% Total Trading Volume Increase QoQ. Uniswap, Pancakeswap, Orca, Curve, and THORSwap dominate the DEXes in 2023’s Top 10 spot DEX trading volume.

Notably, the report names Orca and THORSwap as the biggest gainers amongst the DEXes in 2023 Q4, with Orca increasing 1,079% ($12.2 billion), while THORSwap saw a surge of 422.4% ($10.1 billion)

When breaking down the 2023 spot DEX trading volume breakdown by chain, the report details that Ethereum had $99.3 billion of DEX trading volume in 2023 Q4, displaying an increase of +38.3% from 2023 Q3. However, it ended with a low 41% dominance, dropping below 50% for the first time in 2023 in November and December.

It’s worth noting that Solana was the biggest gainer, with a 985.5% increase in QoQ, while THORChain took second place with a 422.4% trading volume increase in Q4. The data shows that the two chains ranked #3 and #5 in December 2023.

Crypto exchange liquidity, explained

Crypto exchange liquidity hinges on market depth and incentivized trading to ensure robust and stable trading environments.

Whale’s Move: $19.5 Million XRP Shifted To Exchange, Massive Sell Off On The Horizon?

Whale Alert, a renowned blockchain tracker, reported a substantial transfer of XRP tokens to the Bithumb crypto exchange. This transfer, involving over 32 million XRP tokens valued at roughly $19.5 million, originated from an unidentified wallet and was executed today at 05:15:10 UTC.

The substantial nature of this transaction places it firmly in the category of ‘whale transactions,’ which are often scrutinized due to their potential influence on market dynamics.

In the crypto space, such significant transfers are typically indicative of strategic moves by influential players within the market.

While the specific intention behind this transaction remains undisclosed, and the whale’s identity is unknown, its occurrence has not led to any notable immediate price fluctuations in XRP, with only a marginal decrease of 0.1% observed so far.

Massive Sell-Off On The Horizon?

Historically, the transfer of substantial amounts of crypto to exchanges by whales has been linked with either an intent to liquidate or to swap for other digital assets. This makes such movements anticipated to result in a price drop following a significant sell-off.

However, a technical analysis of the current situation suggests a different narrative for XRP. Looking at the asset’s chart on the 4-hour time frame, XRP has recently tapped into an order block on the sell side, which could signal an impending price reversal to the upside in trading parlance.

Mainly, an order block in financial markets is essentially a zone where the initiation or absorption of a large volume of orders occurs. It is considered a crucial area on price charts, as traders often expect a reversal when the price taps into these zones.

In essence, an order block represents a consolidation area where significant trading activities previously took place, and revisiting these zones can often lead to a shift in market momentum.

So far, XRP has shown signs of reversal after tapping this orderblock. Particularly, the asset has moved from the price zone of $0.59, where the order block is located, and surged past $0.61 before showing a current retracement that brings its price to trade at $0.60.

Bullish Forecasts for XRP

Meanwhile, the XRP community has been witnessing a series of optimistic analyses from prominent crypto market analysts. Notably, Egrag, a renowned figure in the crypto analysis sphere, recently shared his insights on XRP, indicating a potential bullish reversal for the digital asset.

#XRP Inverse Head & Shoulder Formation in progress (UPDATE): https://t.co/JRvvFEVhBv pic.twitter.com/wy90z4kCO4

— EGRAG CRYPTO (@egragcrypto) November 29, 2023

His analysis identified an inverse head and shoulders (H&S) pattern on XRP’s chart, a technical indicator often suggesting a trend change from bearish to bullish.

This positive sentiment is echoed by another market analyst, Ali Chart, who has projected a promising future for XRP. Ali’s analysis shows that the altcoin seems to be making a decisive break from a descending parallel channel.

#Ripple | $XRP appears to be breaking out from a descending parallel channel, which may result in an upswing to $0.65 – $0.66 for #XRP. pic.twitter.com/gvfeEMKIDX

— Ali (@ali_charts) November 23, 2023

According to his assessment, such a breakout could propel XRP’s price to the $0.65 to $0.66 range. These analyses collectively paint an encouraging picture for XRP, hinting at a potential shift in momentum and opening the possibility for significant price movements in the near term.

Featured image from Unsplash, Chart from TradingView

Crypto exchange HTX reinstates Bitcoin services after $30M hack

Justin Sun said he expects functionality for other cryptocurrencies to gradually be reinstated with full services returning by next week.

Panic At Binance Following CZ’s Departure? Analyzing 24-Hour Inflow and Outflow Trends

A new era for the crypto industry approaches as the world’s largest exchange, Binance, changes leadership. Yesterday, the company’s founder and CEO, Changpeng “CZ” Zhao, stepped down as part of an agreement with the US government.

The deal might have sparked a new era of adoption and legitimacy for the nascent industry at the cost of CZ’s position and a $4 billion fine. Fresh data looked into Binance’s transactions to check if users believe in the company’s future following the historic decision.

Binance Safe From FTX Like Bank Run?

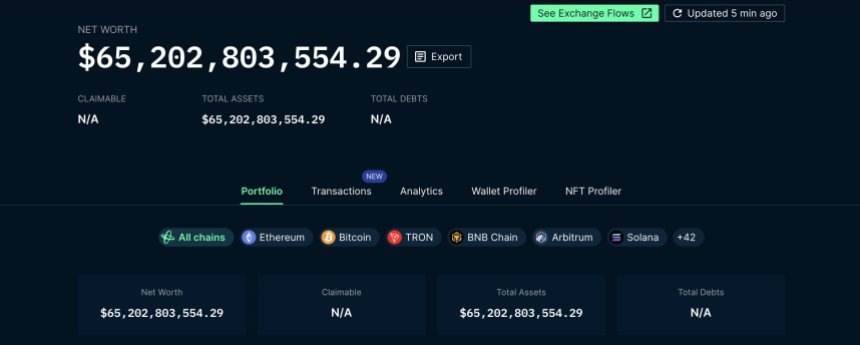

According to crypto analysis firm Nansen data, Binance recorded almost $1 billion in negative netflow following yesterday’s news. The data indicates that the platform’s USDT value decreased by $246 million, followed by Bitcoin’s value, which declined by $76 million.

Users who feel uncertain about the platform’s future withdraw their money, potentially triggering a bank run. However, Nansen’s data shows that this scenario is far from materializing in this trading venue.

While the negative netflows stand at $955 million, there is no “mass exodus” or panic from users trading on Binance. Nansen claims the platform’s holding value increased from $64.6 billion to $65.2 billion.

The analytics firm previously stated that Binance handled bigger net flows. First, when the US Securities and Exchange Commission (SEC) filed a lawsuit against the company, and later, when FTX went bankrupt following a massive bank run.

As mentioned, Binance seems unlikely to follow a similar fate. Nansen stated:

In the past, Binance has processed higher volumes of outflow and negative netflow: Jun 2023 after the SEC sued Binance, December 2022 after insolvency rumors, and the immediate aftermath of FTX. We will provide another update 24 hours after the news originally broke.

CZ’s Departure Forecast Good Times For Crypto

Across the crypto community, the debate around CZ’s departure has been fierce. However, the consensus is optimistic.

A report from The Block cites major banking institution JPMorgan claiming that the Binance deal removes a “systemic risk” for the industry. In 2022, when FTX collapsed, the price of Bitcoin crashed to a low of $15,000 and took months to recover.

With 150 million users on its platform and millions of capital injected into multiple ecosystems. Binance’s collapse would have been equally, if not more, catastrophic than FTX for the nascent industry.

JPMorgan analyst Nikolaos Panigirtziglou told The Block:

We see the prospect of settlement as positive as uncertainty around Binance itself would subside and its trading and Smart Chain business would benefit. For crypto investors the prospect of settlement would see the elimination of a potential systemic risk emanating from a hypothetical Binance collapse.

Cover image from Unsplash, chart from Tradingview

Kraken Said to Seek Partner to Help Build It a Layer 2 Blockchain Network

The crypto exchange is still considering which blockchain developer should build its network, with Polygon, Matter Labs and the Nil Foundation in the mix, according to people familiar with the situation. Rival crypto exchange Coinbase blazed the trail with Base.

Sam Bankman-Fried found guilty on all 7 charges in FTX fraud trial

U.S. Attorney Damian Williams called Bankman-Fried’s crimes “a multibillion-dollar scheme designed to make him the king of crypto” and one of the biggest financial frauds in American history.

Binance founder CZ’s fortune gets slashed $12B, while SBF is still at $0

Binance CEO Changpeng Zhao’s crypto empire has fallen over 80% from its January 2022 peak of almost $97 billion.

FTX probes $6.5M in payments to AI safety group amid clawback crusade

Bankrupt crypto exchange FTX wants to look into millions it had given to the Center for AI Safety, a nonprofit that has argued AI should be a global priority next to pandemics and nuclear war.

South Korean exchange Upbit gets initial license nod from Singapore

Upbit Singapore scored initial approval from the country’s central bank and financial regulator for a local crypto license.

Time For Self-Custody? Crypto Exchange Reveals Hackers Tried To Gain Access 159,000 Times

Reports from South Korea-based Yonhap News Agency have revealed that Upbit, one of the largest crypto exchanges in South Korea experienced over 159,000 hacking attempts in the first half of 2023 alone.

Upbit’s Hacking Attempts

According to the data from Upbit’s parent company Dunamu shared with the local news agency, the hacking attempts of the first half of 2023 indicate a 117% increase compared to the first half of 2022, and a 1,800% increase in hacking attempts compared to the second half of 2020.

The crypto exchange recorded 8,356 hack attempts in the second half of 2020, 34,687 in the first half of 2021, 63,912 in the second half of 2021, 73,249 in the first half of 2022, and 73,249 in the second half of 2022.

These hack attempts have increased over the years after the crypto exchange suffered a hack of 58 billion won ($50 million) in 2019. The exchange has since successfully fortified its security measures to prevent these hacks, and the exchange has not experienced any exploit since 2019.

“After the hacking incident in 2019, we took various measures to prevent a recurrence, such as distributing hot wallets and operating them, and to date, not a single cyber breach has occurred,” a Dunamu Official stated.

Some of these measures included an increased percentage of money retained in cold wallets by 70%. Hot wallets, which keep keys online and are more susceptible to breaches, are thought to be less secure than cold wallets, which store private keys offline.

This is because the majority of known cryptocurrency exchange hacking instances have occurred in hot wallets, especially the crypto hacks that occurred in September. One such example is Hong Kong-based CoinEx which suffered a $70 million hack in September 2023, and Mixin Network which suffered a $200 million hack, among others.

Due to the significant increase in cryptocurrency hack attempts in South Korea, the country’s Representative Park Seong-jung has called upon the South Korean government to take considerable measures to handle the issue.

“The Ministry of Science and Technology must conduct large-scale whitewashing mock tests and investigate information security conditions in preparation for cyber attacks against virtual asset exchanges where hacking attempts are frequent,” Representative Park said.

Upbit recently experienced an issue in late September 2023, where the crypto exchange was unable to identify a fake token, “ClaimAPTGift.com, present in 400,000 Aptos wallets. This led to the suspension of Aptos token services.

Compilation Of Crypto Funds Stolen In September

September 2023, was a nightmare for certain crypto exchanges as about $332 million in crypto assets were stolen from certain crypto exchanges in September alone.

Blockchain security firm Certik took to their official X handle in late September to share the compilation of the crypto hacks that occurred in the month alone and how much was stolen from these incidents.

The stolen funds accounted for exploits, exit scams, and flash attacks. However, exploits accounted for the most, with over 98% ($329.8 million) of the total amount stolen in that month, while exit scams and flash attacks accounted for the rest.

JPEX crypto exchange launches asset-lock-up plan, as some users cry foul

JPEX has pushed ahead with its DAO Shareholder Dividend Scheme. However, some users claim their assets are being converted without their knowledge.

CoinEx Update: Exchange Set To Resume Deposits And Withdrawals After Exploit

CoinEx, a cryptocurrency exchange, has announced plans to resume its deposit and withdrawal services. The crypto platform was forced to shut down operations after roughly $70 million worth of cryptocurrencies were drained from its hot wallets a week ago.

On Saturday, September 16, the CoinEx team offered an update on their investigation, which showed that 18 different crypto assets, including BTC, ETH, XRP, and BCH, were stolen from the exchange. The exchange, however, asserted that assets in its cold wallets were not affected by the September 12 attack.

Furthermore, CoinEx revealed that it is working with various blockchain security firms to trace the hackers’ addresses and recover the stolen assets. Interestingly, many security organizations and on-chain investigators have linked the attack to the North Korean hacker group Lazarus Group.

CoinEx To Allow Deposit And Withdrawal Of These Cryptocurrencies

In the latest update published on September 20, CoinEx disclosed its plans to resume deposit and withdrawal services for certain crypto assets on Thursday, September 21. Users will be able to interact with about ten cryptocurrencies, including Bitcoin (BTC), Ether (ETH), USDT (on the ERC20 and TRC20 networks), USDC (on the ERC20 network), Tron (TRX), Binance Coin (BNB), etc.

As per the announcement, CoinEx will resume operations after implementing a new wallet system. During this process, the deposit addresses for certain tokens will be upgraded and new ones will be generated for all users.

However, CoinEx warned users not to deposit into any old wallet addresses, as this could result in the permanent loss of transferred assets. The crypto exchange added:

Please be sure to double-check that you are using the new address before depositing.

After addressing that, CoinEx assured users that it will gradually resume deposits and withdrawals for other cryptocurrencies.

The crypto exchange also asked customers to exercise patience, as there may be many pending withdrawals over the next few days. Hence, processing all withdrawal requests for the available assets may take longer than usual.

Will Users Be Able To Withdraw 100% Funds?

CoinEx has maintained that users’ assets were not lost in this exploit. In the September 16 update, the company said that its User Asset Security Foundation would cover the financial losses from the incident.

Moreover, CoinEx CEO Haipo Yang posted on X (formerly Twitter) two days after the attack, assuring “affected users” of 100% compensation. “Your assets with CoinEx remain safe. That’s our commitment to all of you,” Yang added.

CoinEx claims it has always implemented a 100% reserve policy to ensure user asset protection in the face of security threats. And the crypto exchange promised to improve its security infrastructure and invest more in its risk systems.

Crypto CEO Bags Record Breaking Prison Sentence For $2 Billion Theft

Former CEO Faruk Fatih Özer of the bankrupt Turkish crypto exchange Thodex has been given a record-breaking prison sentence for stealing $2 billion in customer funds.

Crypto CEO Sentenced To 11,196 Years Prison Sentence

On Thursday, September 7, 2023, the former CEO of Thodex, which was one of the biggest cryptocurrency exchanges in Turkey, was reportedly sentenced to 11,196 years, 10 months, and 15 days in prison for several criminal charges including fraud, leading a criminal organization, and money laundering by the Anatolian 9th Heavy Penal Court.

The former CEO reportedly defrauded over 400,000 Turkish customers of more than $2 billion in deposits when the exchange went offline in April 2021, and Özer fled the country immediately after the exchange went offline.

The prosecutors had initially requested a 40,562-year prison sentence for the former crypto exchange CEO. However, the final verdict saw the sentence reduced to 11,196 years, the longest sentence so far for a crypto crime. Furthermore, a judicial fine of 135 million Liras was also imposed on the former CEO, according to local media.

Faruk Fatih Özer was not the only one involved in the alleged crime. Following the investigation, 83 people were arrested and detained, and four other senior employees were jailed.

When the case was thoroughly investigated, Özer‘s sister Serap Özer, and brother Guven Özer, were also found guilty of the same charges and were given the same prison sentence respectively.

Although these jail terms may seem outrageous and unfamiliar to many, they are very common in Turkey due to the country’s death sentence eradication since 2004. In 2022, TV cult preacher Adnan Oktar was convicted of fraud and sexual assault and was sentenced to 8,658 years in prison along with 10 of his followers.

Former Thodex Boss Denies Criminal Claims

The 29-year-old former crypto boss was arrested in Albania in August 2022 where he was serving jail terms after fleeing Turkey in April 2021 when his crypto exchange first collapsed.

Before his arrest, Özer denied claims against him fleeing the country intentionally when the Thodex exchange went dark. His response to the allegations was that he was out of the country because of business meetings.

Özer was arrested after Interpol issued a red notice against him, and was extradited back to Turkey in April 2023 to face the charges against him. He was then detained by the police upon arrival and held on seven charges.

Some of the charges included establishing and managing an organization with the purpose of committing a crime, fraud by using information systems as a tool of banks or credit institutions, being a member of an organization, fraud of merchants or company executives and cooperative managers, and laundering the value of assets resulting from crime, among others.

The court believed that Özer had fraudulent intentions right from the beginning and that the crypto exchange Thodex was a criminal organization from the start.

However, Özer denied these claims against him and said Thodex was just a crypto company that went bankrupt in 2021 and had no fraudulent intention. He also told the court that he was very smart and he would not have acted so amateurish if he was looking to be a criminal.

Binance Will Halt These 39 Liquidity Mining Pools This Week

On Sunday, Binance announced that it will halt 39 liquidity mining pools this week following the latest assessment. As a result of a supposed failure to pass this assessment, these 39 liquidity pools are expected to stop operating on September 1, 2023.

Liquidity Pools Stopped By Binance

This decision was made due to the platform’s recent liquidity mining performance. The announcement said Binance Liquid Swap will “periodically review listed liquidity pools to concentrate liquidity for our users and ensure optimized trading experience, price and slippage.”

As a result of the most recent review, the 39 liquidity pools listed below are expected to cease operation on Friday:

ADA/BNB, ALICE/BTC, APE/BTC, AVA/USDT, AVAX/BNB, BTC/TUSD, CHZ /BNB, CHZ/BTC, CTSI/BNB, DOT/BUSD, ENJ/USDT, FIL/BNB, FRONT/BUSD, GALA/BNB, ICP/BNB, ID /BTC, KDA/USDT, LIT/USDT, MATIC/BNB, NEO/BNB, PAXG/USDT, PEPE/USDT, SANTOS/USDT, SUSHI/BNB, SUSHI/BTC, SXP/BNB, SXP/BTC, THETA/BNB, THETA/BTC, TKO/USDT, TLM/USDT, TRX /BNB, TRX/ETH, WBTC/ETH, XMR/ETH, XMR/USDT, XVS/BTC, XVS/USDT, ZEN/USDT.

For now, users will not be able to add liquidity to these liquidity pools from today. However, the liquidity of the liquidity pools listed above will still remain accessible to ensure that users are provided with a trading experience.

Users will also still be able to redeem and withdraw their assets from the respective pairs on Binance Spot before the closing date on September 1, 2023. User deposits in the liquidity pool will be calculated following the current composition of the respective pool and then it will be converted to the user’s Spot wallet automatically.

According to the announcement, the removal of the liquidity pools listed above will not hinder other trading respective pairs on Binance Spot and users will still be able to trade on other liquidity pools that are currently available on Binance Liquid Swap.

This marks the second time Binance has eliminated liquidity pools this month. On August 9, 2023, Binance also announced that the exchange would stop about 38 liquidity pools on August 18, 2023.

Multiple Charges Hinder Binance’s Business

Amid these developments, the Binance crypto exchange continues to deal with regulatory pressures that seem to be affecting its business. Firstly, Visa and Mastercard are slowly cutting their ties with Balance due to the multiple regulatory actions from the US Securities and Exchange Commission (SEC) against the exchange.

One of the allegations brought against Binance is that the exchange has been operating under an unregistered business and misled investors about the company’s risk.

Also, the US Commodity Futures Trading Commission (CFTC) in May brought multiple charges against the exchange for what it calls a “willful evasion” of US law.

Among the hurdles the exchange is also facing include allegations that the US Department of Justice is looking into the exchange and is considering charging Binance for fraudulent activities.

On August 23, 2023, Binance announced on X (formerly Twitter), that the exchange’s card known as the Binance Card will no longer be available to users in Latin America and the Middle East.

MasterCard Axes Partnership With Binance Amid Regulatory Pressures

The crypto space is in pandemonium after MasterCard, a global payment service giant, announced the imminent termination of its services and alliance with the Binance crypto exchange.

Mastercard To Sever All Ties To Binance

Binance, the world’s largest cryptocurrency exchange by trading volume, is facing new challenges that could impact its reputation and growth rate. According to reports, Mastercard will discontinue its services on Binance, ending a years-old relationship and crypto cards programs starting Friday, September 22.

The reason for the abrupt termination has not been clarified by Mastercard. Some have attributed the news to the recent regulatory challenges and lawsuits Binance has been up against since this year.

Binance has refrained from making any comments regarding the reason for the suspension or who initiated the decision first. However, the crypto exchange has reassured users around the globe, stating that their Binance accounts are not affected by the news and they can continue their crypto transactions per usual.

“Binance accounts around the world are not affected. Where available, users can also shop with crypto and send crypto using Binance Pay, a contactless, borderless, and secure cryptocurrency payment technology designed by Binance,” Binance stated.

Mastercard and Binance have been working together as partners for about four years. Around August 2022, they both joined hands to initiate debit card programs for four major countries, allowing users in Brazil, Argentina, Colombia, and Bahrain to have access to cryptocurrency assets via their Mastercards linked to a cryptocurrency wallet.

Binance first partnered with Mastercard to launch crypto card payments in Brazil and Latin America at the beginning of 2023. The crypto exchange then made a similar announcement and launched prepaid crypto cards in Argentina in August 2022.

Financial Service Companies Break Away Following SEC Lawsuit

Binance has been in a legal battle with the United States Securities and Exchange Commission (SEC) since June when the SEC sued the crypto exchange for allegedly offering unregistered securities. The regulator further attempted to freeze all Binance assets stating that the crypto exchange was operating a “web of deception” and filing 13 charges against Binance.

Since then, Binance has been facing regulatory hurdles and industry challenges with many companies ending year-long partnerships and the price of BNB declining as a result.

The cryptocurrency exchange has also ended several projects in the course of a month and carried out massive layoffs following the SEC’s Lawsuits.

Recently, Binance shut down all cryptocurrency service operations on its official fiat-to-cryptocurrency payments provider, Binance Connect. The cryptocurrency exchange also discontinued its partnership with Checkout.com, a global payment service, after Checkout’s CEO terminated its contract this month.

Visa, another payment service giant, also cut ties with Binance in July and stopped supplying co-branded cards with Binance in Europe.

At the moment, it is unsure what the outcome of the SEC and Binance case would be. However, the results will undoubtedly impact the crypto industry and financial sector.

Is Binance Really Selling Bitcoin To Prop The Price Of BNB?

Crypto exchange Binance has had a tough few months in terms of market news and pressure from regulatory bodies. Just a few days ago, Binance lost another payment processing partner after Checkout.com terminated its contract with the crypto exchange. And now, another rumor that appears to be spreading is that Binance is selling Bitcoin on the spot market to sustain the price of its native token, BNB.

Is Binance Really Selling Its Bitcoin To Buy BNB?

The rumor originated from a post made by @WhaleChart on X (formerly Twitter), claiming that Binance is allegedly selling Bitcoin on the spot market to support the price of its own token, BNB.

BREAKING:

Binance is allegedly selling Bitcoin to support the price of their own token BNB

— Whale (@WhaleChart) August 22, 2023

This rumor seems to be gaining ground since the tweet first went live, especially as the price of BNB continues to struggle in the market. This is because as one of the biggest holders of both Bitcoin and BNB, Binance is in a unique position to manipulate the market if it wanted.

However, this remains only a rumor as there are currently no signs the crypto exchange is manipulating the price for short-term gains in BNB.

Additionally, data from Coinmarketcap shows that the prices of both cryptocurrencies have been falling together in the past week, with Bitcoin also down by 11.20% in a 7-day timeframe.

This will not be the first time such allegations are being brought against the exchange. Binance has faced similar claims in the past, with crypto analyst JW claiming Binance was selling Bitcoin to prop up the price of BNB in June of this year.

Binance CEO Changpeng Zhao (CZ), however, denied the allegations, dismissing them as an attempt to spread fear, uncertainty, and doubt (FUD).

4. Binance have not sold BTC or BNB. We even still have a bag of FTT.

It is amazing they can know exactly who sold based on just a price chart involving millions of traders. FUD.

pic.twitter.com/M3MUH2bFRE

— CZ

Binance (@cz_binance) June 13, 2023

Whether or not the theories are true, Binance has surely been under intense scrutiny, but it continues to stand strong as the biggest exchange in the world.

BNB and other cryptocurrencies that rely on the BEP20 and BEP2 token standards are very dependent on Binance, as news surrounding the exchange has led to price pumps and dumps in the past. But there has been no solid evidence that the exchange has been manipulating the prices of any of these tokens.

The price of BNB has seen a drastic reduction in the past few days as the entire market goes through corrections signaled by BTC falling by more than 8% in a couple of minutes last week. As a result, BNB has seen its price drop to $209.44, a reduction of 12.33% in the past few days.

To combat a further price drop, the BNB Chain had to manually liquidate a $200 million position on the Venus DEFI protocol, which would have been liquidated after BNB dropped below $220.

At the time of writing, BNB is the fourth biggest crypto with a market cap of $32.2 billion.

Crypto Exchange EDX Markets Taps Anchorage as Custody Provider

Crypto exchange EDX Markets, which is backed by Wall Street giants including Citadel Securities and Charles Schwab, tapped Anchorage Digital to provide custody for its clearinghouse business set to launch later this year.