Reports from South Korea-based Yonhap News Agency have revealed that Upbit, one of the largest crypto exchanges in South Korea experienced over 159,000 hacking attempts in the first half of 2023 alone.

Upbit’s Hacking Attempts

According to the data from Upbit’s parent company Dunamu shared with the local news agency, the hacking attempts of the first half of 2023 indicate a 117% increase compared to the first half of 2022, and a 1,800% increase in hacking attempts compared to the second half of 2020.

The crypto exchange recorded 8,356 hack attempts in the second half of 2020, 34,687 in the first half of 2021, 63,912 in the second half of 2021, 73,249 in the first half of 2022, and 73,249 in the second half of 2022.

These hack attempts have increased over the years after the crypto exchange suffered a hack of 58 billion won ($50 million) in 2019. The exchange has since successfully fortified its security measures to prevent these hacks, and the exchange has not experienced any exploit since 2019.

“After the hacking incident in 2019, we took various measures to prevent a recurrence, such as distributing hot wallets and operating them, and to date, not a single cyber breach has occurred,” a Dunamu Official stated.

Some of these measures included an increased percentage of money retained in cold wallets by 70%. Hot wallets, which keep keys online and are more susceptible to breaches, are thought to be less secure than cold wallets, which store private keys offline.

This is because the majority of known cryptocurrency exchange hacking instances have occurred in hot wallets, especially the crypto hacks that occurred in September. One such example is Hong Kong-based CoinEx which suffered a $70 million hack in September 2023, and Mixin Network which suffered a $200 million hack, among others.

Due to the significant increase in cryptocurrency hack attempts in South Korea, the country’s Representative Park Seong-jung has called upon the South Korean government to take considerable measures to handle the issue.

“The Ministry of Science and Technology must conduct large-scale whitewashing mock tests and investigate information security conditions in preparation for cyber attacks against virtual asset exchanges where hacking attempts are frequent,” Representative Park said.

Upbit recently experienced an issue in late September 2023, where the crypto exchange was unable to identify a fake token, “ClaimAPTGift.com, present in 400,000 Aptos wallets. This led to the suspension of Aptos token services.

Compilation Of Crypto Funds Stolen In September

September 2023, was a nightmare for certain crypto exchanges as about $332 million in crypto assets were stolen from certain crypto exchanges in September alone.

Blockchain security firm Certik took to their official X handle in late September to share the compilation of the crypto hacks that occurred in the month alone and how much was stolen from these incidents.

The stolen funds accounted for exploits, exit scams, and flash attacks. However, exploits accounted for the most, with over 98% ($329.8 million) of the total amount stolen in that month, while exit scams and flash attacks accounted for the rest.

Binance (@cz_binance)

Binance (@cz_binance)

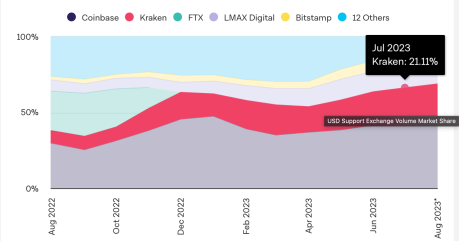

In July, Kraken emerged as the most liquid platform for alts in the US.

In July, Kraken emerged as the most liquid platform for alts in the US. Its claiming almost half of the market depth for the top 10 alts.

Its claiming almost half of the market depth for the top 10 alts.