In a recent blog post, ETC Group’s Head of Research, Andre Dragosh, provided a comprehensive analysis of the current state of the crypto market. Dragosh’s findings shed light on the market’s performance dynamics, profit-taking activity, and derivative trends.

High-Risk Appetite In Crypto Market

According to Dragosh’s analysis, crypto assets showcased their resilience as they outperformed traditional assets like equities, supported by a significant repricing in monetary policy expectations and short futures liquidations at the beginning of last week.

However, this outperformance encountered some limitations in the short term due to stronger-than-expected US jobs data, which began to dampen the recent rally. The US non-farm payroll growth and unemployment rate surpassed consensus estimates, leading to a reversal in US Treasury yields and a decrease in overall risk appetite across traditional financial markets.

Notably, altcoin outperformance gained momentum during the period, with Avalanche (AVAX) and Cardano (ADA) returning over 50% each. Among the top 10 crypto assets, Avalanche, Cardano, and Polkadot (DOT) stood out as the relative outperformers.

According to Dragosh, this surge in altcoin outperformance compared to Bitcoin (BTC) indicates a “high-risk appetite” within the crypto market. On the other hand, on-chain data for Bitcoin suggests that investors are increasingly taking profits, evidenced by the rising number of coins in profit being sent to exchanges.

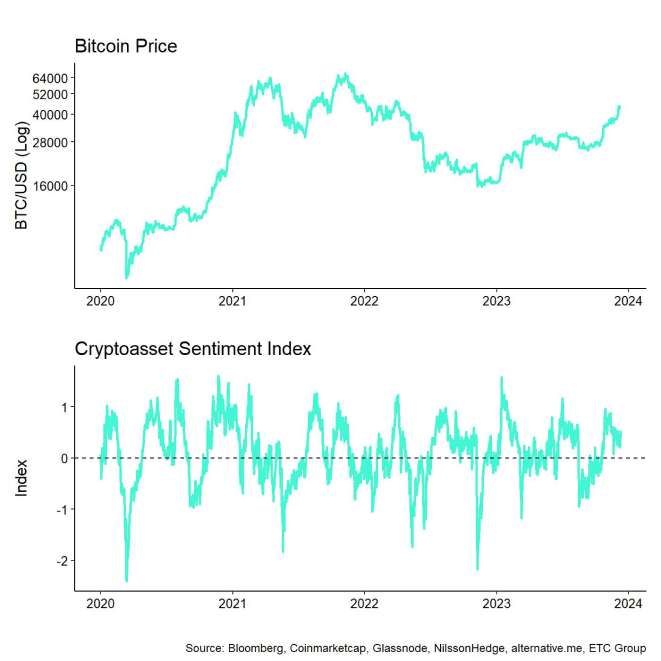

ETC Group’s in-house Crypto Asset Sentiment Index remained relatively elevated compared to the previous week, indicating positive market sentiment. However, major reversals to the downside were observed in the Crypto Dispersion Index and the BTC 25-delta 1-month option skew.

The Crypto Fear & Greed Index continued to reside in “Greed” territory, reflecting ongoing market optimism. Although ETC Group’s Cross Asset Risk Appetite (CARA) measure declined slightly, it remained in positive territory, signaling a decrease in risk appetite in traditional financial markets.

Performance dispersion among digital assets decreased compared to the previous week but remained relatively high. This implies that correlations among crypto assets have decreased, and investments are driven by coin-specific factors, highlighting the importance of diversification among digital assets.

Short-Term Holders Cash In

The market remains in a strong profit environment, with a significant percentage of BTC and ETH addresses in profit. According to Dragosh, profit-taking activity, particularly among short-term holders, has increased as Bitcoin approaches recent highs, leading to higher selling pressure.

Long-term holders have also increased their transfers of profitable coins to exchanges, potentially hindering short-term price increases. However, it is worth noting that there is no evidence of older coins being spent, which would indicate a larger price correction.

On the other hand, aggregate open interest in BTC futures and perpetual remained stable, with notable futures short liquidations recorded. BTC option open interest saw a significant increase, accompanied by relative put-buying and an increase in the put-call open interest ratio.

The 25-delta BTC option skews also increased, indicating higher demand for puts compared to calls. However, overall at-the-money (ATM) implied volatilities did not change significantly.

At the time of writing, BTC has lost its $42,000 support line, trading at $41,600, down 5% in the last 24 hours.

Featured image from Shutterstock, chart from TradingView.com