Data from the Debit exchange reveal that the put-to-call ratio for Bitcoin options contracts is currently at 0.50 with a maximum pain point at $61,000.

Cryptocurrency Financial News

Data from the Debit exchange reveal that the put-to-call ratio for Bitcoin options contracts is currently at 0.50 with a maximum pain point at $61,000.

This crypto cycle achieved some remarkable feats during Q1 2024, including the highest monthly and quarterly close in Bitcoin (BTC) history. However, BTC suffered a retrace that dragged Ethereum (ETH) and the rest of the crypto market down as the year’s second quarter started.

Now that we are one month into Q2, the market faces another correction. The most recent retrace became the deepest of the cycle, with Bitcoin nosediving into the $57,000 support zone and Ethereum falling below $3,000. Despite the market’s stumble, analysts remain optimistic for what’s to come.

Traders and analysts have urged investors not to panic about the retraces yet. A broader look shows that the market is above levels not seen since the last bull run. As many have discussed, there’s a significant resemblance between this cycle’s performance and previous ones.

However, analysts have also pointed out the singularities of this bull run. Compared to the 2020 cycle, altcoins “didn’t even run that hard over the last few months,” as renowned analyst Altcoin Sherpa highlighted.

After Wednesday’s correction, trader and economist Alex Krüger weighed in on this cycle’s performance. Krüger concurs with some of Sherpa’s points, considering that the market’s “too many” options have made the playfield more convoluted.

Some thoughts on the current crypto cycle

#1 The crypto cycle has been almost entirely driven by the bitcoin ETF.

#2 ETH has been a major disappointment, but it has performed well overall for stakers and airdrop farmers.

#3 Solana established itself as the chain of choice for…

— Alex Krüger (@krugermacro) May 1, 2024

Similarly, he also has noticed the desire “to focus on making a quick buck” and investing in “short-term hype rather than on longevity.”

The trader highlighted that the Bitcoin exchange-traded funds (ETFs) have “almost entirely” driven this cycle. Besides BTC, memecoins have been the dominating narrative of the bull run, ranking among the top gainers of Q1 2024.

Moreover, Krüger asserted that most market participants who missed the Bitcoin ETF run “went all in on altcoins to compensate.” As a result:

They deployed late and poorly, going in larger at higher levels, and are now seething and at a loss, as too many altcoins have given up their entire 2024 gains in the last month.

One of the crucial points of Krüger’s analysis is Ethereum’s overall unsatisfactory performance. To the crypto veteran, the second-largest cryptocurrency by market capitalization “has been a major disappointment” even though it has performed well for stakers and farmers.

Despite seeing massive gains alongside Bitcoin’s run, Ethereum has not been able to challenge its all-time high (ATH) price set over two years ago. Furthermore, Solana overtook Ethereum after “establishing itself as the chain of choice for retail traders.”

It’s worth noting that the turmoil surrounding Ether and the Ethereum Network has seemingly affected the token’s recent performance. The “king of altcoins” is currently facing severe regulatory scrutiny.

The suspicion of a spot Ether ETF rejection from the US Securities and Exchange Commission (SEC), alongside the news of the agency’s investigation on the asset’s classification as an “unregistered security,” seems to have created uncertainty around ETH.

Ethereum’s current landscape has reignited deeming conversations against its founders and the asset, possibly fueling the doubtful sentiment surrounding a sector of the crypto community.

Despite the challenging landscape, many analysts consider that investors should not be bearish on Ethereum. After falling 4.5% and 14.39% in the weekly and monthly timeframes, ETH has recovered 3.3% of its price in the past 24 hours.

Ultimately, Krüger’s consideration concludes that “the cycle is not over.” However, he points out that investors “need to move out of the panic area and reignite the majors” before finding a new narrative for this run.

MoonPay users in the U.S. can now buy and sell 110 different cryptocurrencies using PayPal transfers via wallet, bank transfers or debit cards.

May 2023 is poised to become a landmark month for the crypto market, with major token releases slated to inject substantial liquidity and potentially catalyze shifts in market dynamics.

Key developments from AEVO and PYTH and significant contributions from other projects are set to channel over $3 billion into the sector.

Token Unlock, a platform dedicated to tracking the release schedules of digital assets, indicates that May will witness one of the most substantial influxes of tokens into the cryptocurrency market this year.

At least 20 crypto projects are preparing to unleash tokens worth more than $10 million each, cumulatively amounting to $3.661 billion. These releases underscore the activity and continuous growth within the crypto sector, even amid fluctuating market conditions.

Among the tokens set to be released, AEVO and PYTH stand out with their billion-dollar injections, underscoring their strong market presence and investor confidence.

AEVO, a decentralized exchange, is scheduled to release 827.6 million AEVO tokens on May 15, which surpasses $1.25 billion at current valuations. This release will dramatically increase AEVO’s circulating supply by 757.95%

PYTH Network, known for providing decentralized market data, plans to follow suit with its considerable token release. On May 20, PYTH will distribute 2.13 billion tokens, valued at around $1.21 billion, representing 141.67% of its existing circulating supply.

Such movements are pivotal for the projects and the broader market, influencing liquidity and potentially price stability.

In addition to AEVO and PYTH, Wu Blockchain reports that Token Unlock has identified several other cryptocurrencies set for significant releases in May.

These include DYDX, ENA, SUI, MEME, GAL, MAVIA, APT, STRK, ARB, APE, IMX, ROSE, PIXEL, and AVAX. ID, YGG, OP, and PRIME are poised to release tokens valued at over $10 million each, rounding out a comprehensive list for the month.

According to TokenUnlocks, the large-amount unlocks in May (unlocked amount greater than $10m) include DYDX ENA SUI MEME GAL MAVIA APT STRK AEVO ARB APE IMX ROSE PIXEL PYTH AVAX ID YGG OP PRIME, etc., with an unlock value of over 3.661 billion US dollars. Among them, the unlocked… pic.twitter.com/tZmihAom3c

— Wu Blockchain (@WuBlockchain) April 30, 2024

Meanwhile, El Crypto Prof, a prominent crypto analyst on X, recently projected a significant rally for the altcoin market based on historical market cycles. He notes that post-Bitcoin halving periods, like those in 2016 and 2020, typically lead to a phase of accumulation in altcoins, followed by a market rally.

Anyone who is bearish here obviously hasn’t done their homework.

Altcoins about to enter the parabolic curve, if we repeat 2016 and 2020.

History doesn’t repeat itself, but It often rhymes.

-Accumulation1⃣

-Backtest2⃣

-Send it3⃣Months of glory ahead imo. pic.twitter.com/uUrKj8qau1

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) April 28, 2024

The analyst suggests the current market mirrors these past cycles, indicating a potential upcoming surge. He believes this could result in the altcoin market cap potentially doubling from its current estimate of around $1 trillion to $2 trillion.

Additionally, Daan Crypto Trades, another analyst, supports the view that the ETH/BTC ratio is a more accurate measure of altcoin market sentiment than the SOL/BTC ratio, signaling positive prospects for altcoins.

Featured image from Unsplash, Chart from TradingView.

Crypto investment products are now going through rough times, as shown by inflow and outflow data. The crypto market is known for its volatile market cycles of ups and downs. Investment products are now struggling, and confidence in the space seems shaken. Crypto funds have now seen outflows for three straight weeks, with investors pulling $435 million from digital asset funds last week, according to CoinShares data. The recent stretch of outflows highlights the souring investor sentiment around some digital assets after a bull run earlier this year.

CoinShares’ recent weekly report on digital asset fund flows has revealed the current sentiment among institutional investors. According to the report, investment funds witnessed $435 million in outflows last week to mark the biggest outflow since March. This comes on top of the $206 million and $126 million pulled out in the previous two weeks. Unsurprisingly, the majority of outflows came from Bitcoin funds. Of the total $435 million outflows, $423 million came from Bitcoin funds. Notably, a bulk of Bitcoin’s outflows ($328 million) came from Spot Bitcoin exchange-traded funds (ETFs) in the US.

A look into previous crypto fund flow data since the beginning of the year shows that the majority of the inflows recorded in January, February, and March can be attributed to the Spot Bitcoin ETFs. These ETFs recorded so much inflow of funds that investment products were able to record their best year on record in less than three months.

However, inflows into these ETFs have declined in the past few weeks, and the largest digital asset is now failing to attract inflows amidst interest rate stagnation in the US market. Grayscale’s GBTC, in particular, continued its run of withdrawals, recording $440 million in outflows. At the same time, the other ETFs failed to attract inflows during the week in order to offset these withdrawals. BlackRock’s IBIT, for instance, failed to register inflows for three days straight last week, bringing its 71-day run of inflows to an end.

Ethereum, the altcoin king, also witnessed $38.4 million in outflows last week to offset inflows into other altcoins. Inflow data shows investors pouring $6.9 million worth of inflows into multi-coin investment products. Solana, Litecoin, XRP, Cardano, and Polkadot witnessed $4.1 million, $3.1 million, $0.4 million, $0.4 million, and $0.5 million in inflows, respectively. Short Bitcoin products also witnessed $1.3 million in inflows, showcasing a glimpse into investors’ sentiment.

Investor sentiment can shift quickly in the fast-moving crypto space and the coming weeks may provide more clarity on the direction of crypto fund flows. Six Spot Bitcoin and Ether exchange-traded funds (ETFs) are set to launch in Hong Kong today April 30. Their entry into the Asian market has been long anticipated and is expected to surpass the first-day inflow record set by their counterparts in the US.

Expectations for the crypto industry are still high, and altcoins, in particular, are expected to do well. One crypto analyst known as El Crypto Prof on X (formerly Twitter), shares this sentiment, expecting the altcoin market to go on a parabolic rally.

In a post on X (formerly Twitter), the crypto analyst highlighted why the altcoins market was said to explode. The chart attached to the post showed previous bull cycles for the crypto market and why the current muted performance from the market was normal.

For example, back in 2016, the crypto market went into accumulation mode after the Bitcoin halving, where altcoins stalled for a while before picking up. The same was the case in 2020 as well following the Bitcoin halving, with accumulation dominating the market for a few months before bouncing.

The same trend is repeating itself in 2024 after the Bitcoin halving was completed a week ago. Looking at the chart, the crypto analyst highlights this accumulation trend is happening once again. But this is not the only thing that is repeating itself.

Following each period of accumulation has been the backtest, and a successful confirmation above this point has always begun the altcoin rally. The analyst points out that this backtest is already happening, and from here, altcoins could see a significant explosion.

Anyone who is bearish here obviously hasn’t done their homework.

Altcoins about to enter the parabolic curve, if we repeat 2016 and 2020.

History doesn’t repeat itself, but It often rhymes.

-Accumulation1⃣

-Backtest2⃣

-Send it3⃣Months of glory ahead imo. pic.twitter.com/uUrKj8qau1

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) April 28, 2024

They further explain that if the trend continues like it did in 2016 and 2020, then the altcoins market could see “months of glory ahead.” This could easily see the total altcoin market cap double like it did in 2016 and 2020, and given the current market cap of around $1 trillion, the market cap is expected to cross $2 trillion. “Anyone who is bearish here obviously hasn’t done their homework,” the analyst warned.

Despite the price declines that have rocked Bitcoin and altcoins over the month of April, the market remains bullish. One indicator of this is that the Crypto Fear & Greed Index continues to trend in the greed territory, meaning investors are still willing to put money in the market.

Rekt Capital, another crypto analyst, also backs up Crypto Prof’s analysis. The analyst also took to X (formerly Twitter) to reveal that the Bitcoin price is also in an accumulation phase, which he refers to as the “Re-Accumulation period.” However, the analyst believes that many will miss the subsequent breakout, saying, “Months from now, nobody will remember this Re-Accumulation period. But everybody will remember the Parabolic Phase that comes afterwards.”

We are here (green circle)

Months from now, nobody will remember this Re-Accumulation period

But everybody will remember the Parabolic Phase that comes afterwards

And they will remember and talk about it for years to come$BTC #Crypto #Bitcoin pic.twitter.com/gO52E7ZnKX

— Rekt Capital (@rektcapital) April 28, 2024

As the crypto industry navigates the waves of this bull run, projects like NEAR Protocol (NEAR) are edging forward with new partnerships and developments. NEAR’s remarkable performance has crypto analysts considering that the toke is getting underway for a massive surge.

At the beginning of the week, crypto analyst World of Charts recognized a bullish flag pattern formed on NEAR’s monthly chart. According to the analyst, a successful breakout could be followed by a 60-65% bullish wave in the coming days.

On Thursday, NEAR tested the $7.00 resistance level, reaching above the $7.50 mark before retracing as the day ended.

Affirming his previous forecast, the analyst stated that if the token successfully holds above the breakout level, investors could expect the price to move towards $14-$15. Since then, the token has remained above the $7.00 mark, hovering between $7.3-$7.1.

Another crypto analyst has been following NEAR’s performance this week similarly. According to Bluntz, the token “has been one of the strongest movers from the lows and will probably be one of the first to make fresh highs.”

Moreover, he considers NEAR “one of the better performers” in the top 20 cryptocurrencies. Previously, the trader displayed a chart identifying an ABC zigzag pattern followed by a still-forming impulse wave pattern.

As NEAR broke out of the $7,00 resistance, the analyst reaffirmed his prediction for the token’s movements, considering it “a market leader right now.”

Bluntz added that the token kept “plodding along making fresh highs while everything else has stalled out and continued accumulating.”

The NEAR Protocol is a Layer-1 “user-friendly and carbon-neutral” blockchain focused on performance, security, and scalability. According to its team, the “blockchain for everyone” was built with “usability in mind.”

NEAR’s total value locked (TVL) of $309 million makes it the 16th largest blockchain by this metric. Notably, the network has doubled its TVL since Q4 2023, when it sat in the 25th spot with $128 million.

The protocol collaborates with other projects constantly to continue “expanding financial horizons.” Projects like NodeKit and TrueZK have recently integrated NEAR’s solution designed for Ethereum rollups, NEAR DA.

Similarly, on Thursday, it announced its partnership with Colombian fintech Lulo X and Peersyst Technology “to redefine the parameters of digital finance.” These collaborations have been seemingly well-received by the NEAR community.

Despite being down by 6.25% in the monthly time frame and 65% below its all-time high (ATH) of $20,44 set in January 2022, the blockchain’s token has shown a remarkable performance during this bull run. In the last three months, NEAR has soared over 146%.

Moreover, the token’s daily trading volume has increased by 6.5% in the past day, with over $800 million traded. Likewise, its market capitalization has risen 5% during the same timeframe, making it the 17th biggest cryptocurrency by this metric.

As of this writing, NEAR is trading at $7.2, representing a 7.3% jump in the last 24 hours and a 26% rise in the past week.

Recent trends in the crypto market have indicated a notable shift in trader behavior, particularly among those investing in Bitcoin.

Using data from CryptoQuant, Bloomberg has revealed that the Bitcoin funding rate—the cost for traders to open long positions in Bitcoin’s perpetual futures—has turned negative for the first time since October 2023.

This change suggests a “cooling interest” in leveraging bullish bets on Bitcoin, coinciding with the fading impact of major market drivers.

The decline in Bitcoin’s funding rate correlates with a reduction in net inflows to US spot Bitcoin Exchange-Traded Funds (ETFs), which previously pushed the cryptocurrency to record highs.

Despite the anticipation surrounding the Bitcoin Halving—an event reducing the reward for mining new blocks and theoretically lessening the supply of new coins—the price impact has been surprisingly muted.

According to Bloomberg, this subdued response has compounded the effects of broader economic factors, such as geopolitical tensions and changes in monetary policy expectations, leading to increased risk aversion among investors.

Following the latest Bitcoin halving, the market has not seen the bullish surge many expected. Instead, Bitcoin has only seen a correction of over 10%, from its all-time high (ATH) in March with prices stabilizing in the $63,000 region, at the time of writing.

As CryptoQuant’s Head of Research Julio Moreno pointed out, the recent downturn in Bitcoin’s funding rates to below zero underscores a “decreased eagerness” among traders to take long positions.

According to Bloomberg, this trend is supported by a significant drop in daily inflows to US spot Bitcoin ETFs and a reduction in open interest in Bitcoin futures at the Chicago Mercantile Exchange (CME), which indicates a broader cooling of enthusiasm for crypto investments.

[1/4] Bitcoin ETF Flow – 25 April 2024 – UPDATE pic.twitter.com/ojRayOFlnu

— BitMEX Research (@BitMEXResearch) April 25, 2024

In a Bloomberg report, K33 Research analyst Vetle Lunde noted that the “current streak of neutral-to-below-neutral funding rates is unusual,” suggesting that the market might be entering a price-consolidation phase.

Notably, this period of reduced leverage activity could potentially lead to further price stabilization, but it also raises questions about the near-term prospects for Bitcoin’s recovery.

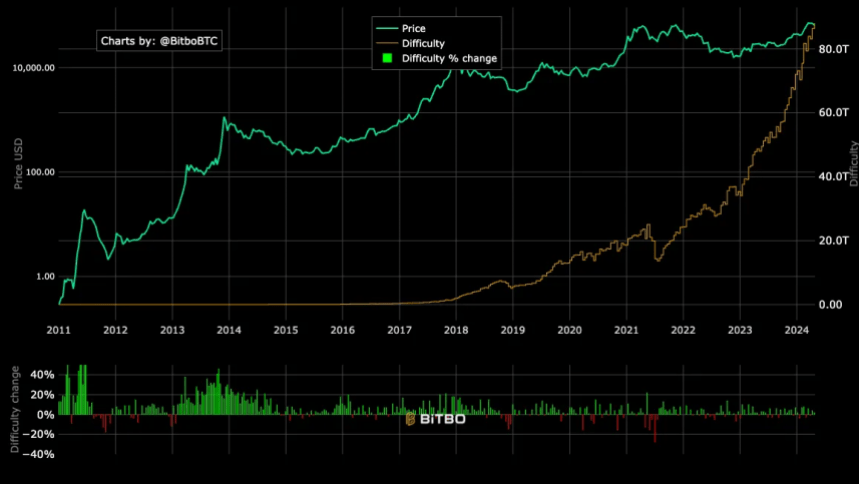

Interestingly, alongside these market adjustments, Bitcoin’s mining difficulty has increased for the first time immediately following the fourth halving.

The difficulty adjustment, which occurs every 2016 block, increased by 2%, reaching a new high of 88.1 trillion, according to Bitbo data.

This adjustment contradicts past trends where the difficulty typically decreased post-halving due to reduced profitability pushing less efficient miners out of the market.

This anomaly in mining difficulty suggests that despite lower rewards post-Halving, miners remain active, possibly buoyed by more efficient mining technologies or strategic shifts within mining operations.

This resilience in mining activity could help sustain the network’s security and processing power. Still, it reflects the complexities of predicting Bitcoin’s market dynamics solely based on historical halving outcomes.

Featured image from Unsplash, Chart from TradingView

Negentropic, the official X (formerly Twitter) account of Glassnode’s cofounders, has offered its own bullish sentiment for the crypto market.

According to their analysis, the market, excluding the top 10 cryptocurrencies, known as “OTHERS,” is showing signs of a strong uptrend with the potential for “more upside” growth.

This observation amidst increased volatility and uncertainty following the recent Bitcoin Halving event on April 20 reduced miners’ block subsidy rewards from 6.25 BTC to 3.125 BTC.

The cofounders pointed out an intriguing pattern in the market’s behavior, comparing the current conditions to the “strong correction” seen in early 2021, which they identified as “wave 4” in the market cycle.

The #Crypto Bull Market Continues.

“OTHERS” follows Crypto excl. the largest 10 Cryptos.

Observe that we in early 2021 had a strong correction. We believe that was a wave 4.

We now have a similar strong decline.More upside is coming. This index and our Fibonacci levels… pic.twitter.com/qKtIOSXneP

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 22, 2024

Using their index and Fibonacci levels, Glassnode’s cofounders anticipate approximately a 350% increase from the current market levels, noting:

More upside is coming. This index and our Fibonacci levels gives us, that we may see ~350% upside from current levels.

Notably, this bullish projection underscores their confidence in the potential for further market expansion despite recent downturns.

While the Glassnode Co-founders have predicted significant growth for the crypto market, it’s important to note that the overall market sentiment remains bullish. After a notable decline last week, the global crypto market is showing signs of recovery, with nearly a 3% increase in the past 24 hours.

This upward movement can be attributed to major cryptocurrencies like Bitcoin and Ethereum, which have seen gains of 2.7% and 1.7% over the same period.

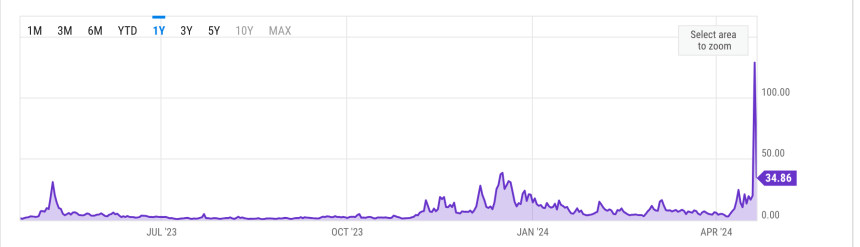

Bitcoin, the flagship cryptocurrency, has recently faced criticism from prominent figures like Peter Schiff, who criticized its high transaction fees and longer processing times.

The cost to complete a #Bitcoin transaction is now $128 and it takes a half hour to process. This is another reason why Bitcoin can’t function as a digital currency. The cost to actually use Bitcoin as a currency is prohibitively high for almost all transactions. It’s a failure.

— Peter Schiff (@PeterSchiff) April 22, 2024

Due to these challenges, Schiff labeled Bitcoin as a “failure” in terms of digital currency. However, it’s worth noting that Bitcoin’s average transaction fee has significantly decreased to $34.86 on April 21, following a record high of $128.45 the day before.

Meanwhile, analyst and founder of the Capriole Investment fund Charles Edwards has shared three possible scenarios for Bitcoin after the Halving.

Edwards highlighted the increase in Bitcoin’s electrical cost to $77,400 per new BTC coin produced, while the overall miner price, including block rewards and fees, surged to $244,000.

He predicts that Bitcoin’s price may skyrocket, approximately 15% of miners may shut down their operations, or transaction fees will remain elevated. Edwards expects a combination of these scenarios to unfold, ultimately leading to Bitcoin’s price surpassing $100,000.

Featured image from Unsplash, Chart from TradingView

In a recent tweet, well-known crypto analyst Rekt Capital delved into the potential timeline for the next Bitcoin market peak, emphasizing the Halving cycle’s significant impact on building BTC’s market path.

As the Bitcoin Halving is set to occur between today and tomorrow, April 20, Bitcoin has shown less significant market movement. At the time of writing, the asset has a market price of $64,578.

According to Rekt Capital’s analysis, Bitcoin typically reaches its bull market peak between 518 and 546 days following a Halving event. Applying this historical timeline, the next anticipated bull market peak could fall between mid-September and mid-October 2025.

However, as disclosed by Rekt Capital, recent market trends suggest a possible acceleration in Bitcoin’s ongoing cycle compared to historical patterns, demonstrated by the cryptocurrency achieving new record levels approximately 260 days ahead of the typical schedule.

Despite this apparent acceleration, Rekt Capital noted:

Bitcoin has been experiencing a Pre-Halving Retrace for the past month or so As a result, Bitcoin has been slowing down and decelerating the cycle by 30 days thus far and counting So while Bitcoin may have been accelerating by ~260 days last month… Today this acceleration is now more close to ~230 days due to the current Pre-Halving Retrace.

Additionally, Rekt Capital introduced an alternative viewpoint termed the “Accelerated Perspective,” which factors in the duration from when Bitcoin exceeds its previous peak to the projected culmination of the bull market.

Given Bitcoin’s recent attainment of new all-time highs in March, this perspective implies that the subsequent bull market peak could happen between December 2024 and February 2025.

When Could Bitcoin Peak In This Bull Market?

Historically, Bitcoin has peaked in its Bull Market 518-546 days after the Halving (Chart 1)

This is how typical Bitcoin Halving Cycles have progressed

So if history repeats…

Next Bull Market peak may occur 518-546 days… pic.twitter.com/QXZUS7ZyjU

— Rekt Capital (@rektcapital) April 19, 2024

Meanwhile, amidst recent market fluctuations, BTC is undergoing a slight recovery. At the time of writing, it had increased marginally by 1.4%, bringing its market price to above $64,000. This recovery follows a week-long decline during which Bitcoin experienced nearly a 10% downturn.

In light of these developments, crypto expert Michaël van de Poppe has shared insights into the potential implications of the impending BTC Halving event. Van de Poppe suggests a shift in focus away from Bitcoin once the halving occurs, speculating on potential changes in market narratives.

While he did not specify the exact narrative shift, Van de Poppe previously outlined expectations for the crypto market, including an anticipated emphasis on Ethereum (ETH) and projects focused on Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA) post-Halving.

Expectance:

– #Bitcoin to consolidate.

– #Altcoins bouncing in their Bitcoin pairs.

– Narrative to shift to ETH and DePIN/RWA.

– Altcoin strength from in Q2/Summer.

– Corrections in Q3.It’s going to be great, just buy the dip.

— Michaël van de Poppe (@CryptoMichNL) April 17, 2024

Featured image from Unsplash, Chart from TradingView

Legendary trader Peter Brandt has recently shared notable insights into the potential future trajectory of Bitcoin price, suggesting the possibility of a significant market move for the crypto asset.

This insight comes as Bitcoin appears to be recovering slightly from its week-long decline. The asset is up nearly 5% over the past 24 hours, with a current trading price of $64,968 at the time of writing.

Brandt’s analysis, presented through a series of charts, outlines a distinctive pattern in Bitcoin’s historical price behavior, characterized by three distinct phases.: the Hump-Slump, Bump-Rump, and Pump-Dump cycles.

As per Brandt’s observation, while Bitcoin has completed the initial two phases of the cycle, the third phase, marked by the “pump” component, remains unfulfilled, hinting at potential bullish momentum ahead.

What say you?? $btc pic.twitter.com/IDvIpkZeER

— Peter Brandt (@PeterLBrandt) April 18, 2024

Meanwhile, amid heightened market volatility and uncertainty, Bitcoin has faced notable price fluctuations, experiencing a nearly 10% decline over the past week.

However, recent bullish momentum has seen the cryptocurrency surging by 3.7% in the past 24 hours, with its price briefly climbing above $65,000 after hitting a 24-hour low of $60,000.

This upward movement aligns with Brandt’s suggestion of a pending bullish phase in Bitcoin’s price cycle, adding weight to the anticipation of a potential market “pump.”

In addition to Brandt’s analysis, industry leaders and analysts have offered their perspectives on Bitcoin’s future trajectory.

Anthony Scaramucci, founder and managing partner of Skybridge Capital, has recently projected a bullish outlook for Bitcoin, forecasting a potential price surge to $200,000 following the upcoming halving event.

Scaramucci cited various factors, including the influence of new financial products like spot ETFs and increasing institutional interest, as key drivers behind Bitcoin’s anticipated price appreciation.

However, amidst optimistic forecasts, CryptoQuant, a prominent crypto analytics platform, has cautioned that Bitcoin could face a significant downturn to $52,000 if its price breaches the critical $60,000 support level.

Derivative Uncertainty

“If the price breaks below $60,000, we might witness a decline to $52,000 before a subsequent rise.” – By @ShivenMoodley

Full post

https://t.co/XSBnfexbzZ

— CryptoQuant.com (@cryptoquant_com) April 18, 2024

A CryptoQuant analyst particularly noted:

If the price breaks below $60,000, we might witness a decline to $52,000 before a subsequent rise. However, given the significant dominance of institutional ETFs, I wouldn’t be surprised if they accumulate excess supply from liquidations near the short-term support level of $60,000.

Featured image from Unsplash, Chart from TradingView

The Chief Executive Officer (CEO) of Ripple, Brad Garlinghouse, has revised his earlier ambitious prediction on the crypto industry’s future market capitalization, acknowledging that he had underestimated the market’s potential surge.

Appearing in a recent interview with Fox Business, Garlinghouse shed light on the growth potential of the cryptocurrency market as well as its performance since the beginning of the year.

The Ripple CEO was questioned about his previous optimistic forecast for the crypto industry’s market capitalization, in which he projected that the market cap would double to approximately $5 trillion by the end of the year. According to CoinMarketCap, the current global cryptocurrency market capitalization stands at roughly around $2.25 trillion.

In response to the inquiry, Garlinghouse expressed his belief that his previous predictions were not overly ambitious, emphasizing the market’s potential for further growth. He admitted to underpredicting the industry’s potential market capitalization by the end of 2024, citing factors such as the current supply and demand dynamics driving additional increases.

Garlinghouse noted that the current market conditions are characterized by increased demand and reduced supply, with these dynamics playing a significant role in the performance of cryptocurrencies.

He disclosed that the Spot Bitcoin ETF market and the overall sentiment regarding Bitcoin’s value have significantly boosted demand for the cryptocurrency. Meanwhile, Bitcoin’s supply is diminishing due to the increasing number of large-scale investors purchasing the cryptocurrency rapidly. Additionally, the impending Bitcoin halving event is expected to further decrease the cryptocurrency’s supply.

Assessing the current state of the crypto market, Garlinghouse stated that since the last six months, Bitcoin has been up by more than 250%, with further increases anticipated. He also asserted that this overperformance was largely driven by the approval and launch of Spot Bitcoin ETFs as well as the upcoming Bitcoin halving.

Garlinghouse has disclosed that establishing proper regulatory frameworks for the cryptocurrency market would yield positive outcomes for the market in the future.

He explained that one of the primary factors hindering the growth of this evolving market was the United State’s prevailing anti-crypto stance, suggesting that the country’s enforcement actions on the developing industry were “problematic.”

The Ripple CEO highlighted several countries, including Dubai, Singapore and the United Kingdom, which have been proactively embracing cryptocurrencies and implementing proper regulatory systems to foster further growth in the market.

Garlinghouse has asserted that the US has significantly lagged in recognizing the transformative and innovative impact of the cryptocurrency market, attributing this setback to the United States Securities and Exchange Commission (SEC) and its current Chair, Gary Gensler.

Recently, reports from IntoTheBlock revealed that the Litecoin (LTC) network has exceeded five million long-term holders. This achievement represents approximately 62.5% of all LTC addresses with a balance, underscoring Litecoin’s widespread adoption and long-term viability within the crypto community.

The surge in long-term holders has been particularly noticeable in recent months, underscoring a growing inclination towards holding LTC for quite a long time. In February’s closing days alone, the number of long-term holders soared by 170,000, signaling robust investor confidence in Litecoin’s long-term prospects.

In tandem with this surge in long-term holders, the number of individuals holding LTC for more than a year has steadily risen, now totaling 2.54 million addresses. Apart from the numerical growth, the profitability of holding LTC over the long term adds another dimension of interest.

Amazing milestone for Litecoin!

The network now counts over 5 million long-term holders of $LTC.

This figure represents 62.5% of all Litecoin addresses with a balance. pic.twitter.com/K5FHz3Ivjs

— IntoTheBlock (@intotheblock) April 12, 2024

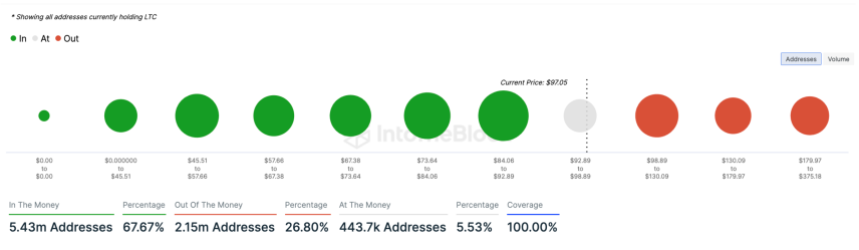

According to on-chain data, roughly 67.67% of all LTC addresses currently stand in profit, collectively holding 49.76 million LTC. In contrast, approximately 26.8% of LTC holders, totaling 2.15 million addresses, are currently at a loss.

Meanwhile, a smaller segment, constituting 5.53% of holders, is situated at breakeven, which means they are neither in a loss nor a profit.

So far, Litecoin has seen relatively stable movement, experiencing a minor increase of 0.3% over the past week, followed by a slight downturn of 0.1% in the last 24 hours. As of the current writing, LTC is trading at $96.72.

Despite the altcoin’s current stability in price, analysts such as World of Charts anticipate a potential surge in the coming months, with projections suggesting a climb to $400. This bullish momentum is fuelled by growing institutional interest, particularly surrounding rumors of a potential LTC Exchange-Traded Fund (ETF).

Fox Business journalist Eleanor Terrett has hinted at institutional intrigue towards a Litecoin ETF, citing LTC’s functional similarities to Bitcoin as a potential factor in its approval by the US Securities and Exchange Commission (SEC).

SCOOP (with fixed ticker)

: Hearing rumblings on the institutional level about possible interest in a Litecoin ETF. The logic is that because of $LTC functional similarities to $BTC, the @SECGov may be more inclined to approve it, possibly even more so than $ETH.

Last week,… https://t.co/nsrhE87OLm

— Eleanor Terrett (@EleanorTerrett) March 26, 2024

Additionally, Coinbase Derivatives’ recent launch of futures contracts for Litecoin further contributes to the buzz surrounding the cryptocurrency.

Renowned crypto analyst Luke Martin echoes this sentiment, suggesting that the approval of an Ethereum ETF could pave the way for other “old altcoins” like Litecoin to gain regulatory approval. Martin emphasizes that LTC and Dogecoin may have a stronger case for not being classified as securities, particularly in comparison to Ethereum.

Featured image from Unsplash, Chart from TradingView

The cryptocurrency market has witnessed a significant surge after a prolonged bear market and the intensified crypto winter caused by the collapse of crypto exchanges and firms during 2022 and part of 2023.

Notably, Bitcoin and other major cryptocurrencies have experienced substantial price surges, accompanied by renewed interest from institutional investors entering the market through recently approved spot Bitcoin exchange-traded funds (ETFs).

Adding to the industry’s positive outlook, asset manager and Bitcoin ETF issuer, Grayscale, believes that the current state of the market indicates that the industry is in the “middle” stages of a crypto bull run.

Grayscale recently released a comprehensive report detailing their key findings and insights into what lies ahead. A closer analysis of the report by market expert Miles Deutscher sheds light on the factors contributing to this assessment.

Grayscale’s report starts by highlighting several key signals indicating that the market is currently in the middle of a bull run. These include Bitcoin’s price surpassing its all-time high before the Halving event, the total crypto market cap reaching its previous peak, and the growing attention from traditional finance (TradFi) towards meme coins.

To understand how long this rally might sustain, Grayscale emphasizes two specific price drivers: spot Bitcoin ETF inflows and strong on-chain fundamentals.

Grayscale notes that nearly $12 billion has flowed into Bitcoin ETFs in just three months, indicating significant “pent-up” retail demand. Moreover, ETF inflows have consistently exceeded BTC issuance, creating upward price pressure due to the demand-supply imbalance.

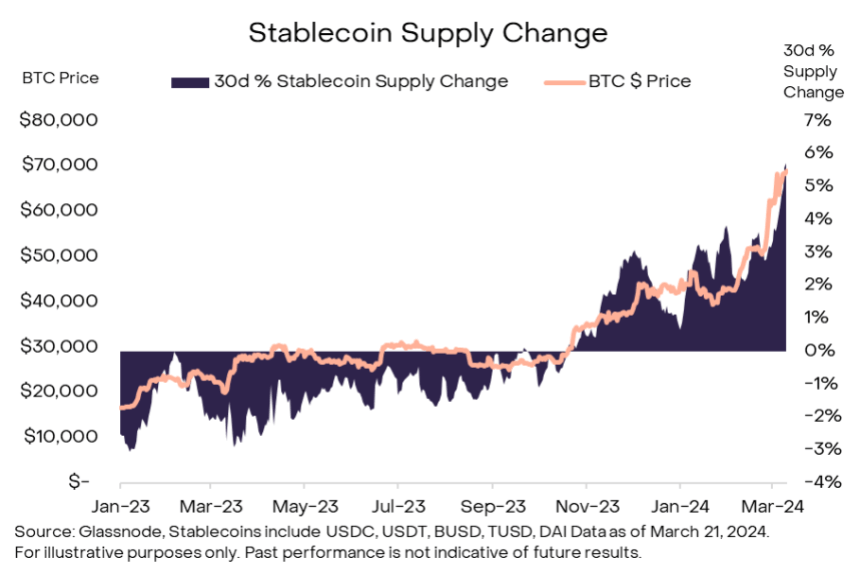

Grayscale’s research focuses on three critical on-chain metrics: stablecoin inflows, decentralized finance (DeFi) total value locked (TVL), and BTC outflows from exchanges.

According to Deutscher, the increase in stablecoin supply on centralized exchanges (CEXs) and decentralized exchanges (DEXs) by approximately 6% between February and March suggests enhanced liquidity, making more capital readily available for trading.

Furthermore, for the analyst, the doubling of the total value locked into DeFi since 2023 represents growing user engagement, increased liquidity, and improved user experience within the DeFi ecosystem.

The outflows from exchanges, which currently account for about 12% of BTC’s circulating supply (the lowest in five years), indicate rising investor confidence in BTC’s value and a preference for holding rather than selling.

Based on these catalysts, Grayscale asserts that the market is in the “mid-phase” of the bull run, likening it to the “5th inning” in baseball.

Several key metrics support Grayscale’s analysis, including the Net Unrealized Profit/Loss (NUPL) ratio, which indicates that investors who bought BTC at lower prices continue to hold despite rising prices.

According to Deutscher, the Market Value Realized Value (MVRV) Z-Score, currently at 3, implies that there is still room for growth in this cycle. Additionally, the ColinTalksCrypto Bitcoin Bull Run Index (CBBI), which integrates multiple ratios, currently stands at 79/100, suggesting that the market is approaching historical cycle peaks with some upward momentum remaining.

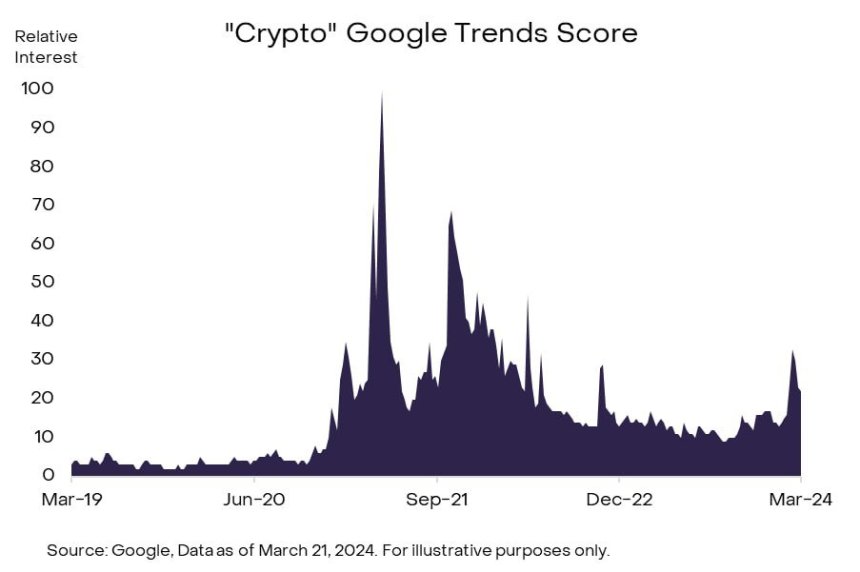

Furthermore, retail interest has yet to fully return this cycle, as evidenced by lower cryptocurrency YouTube subscription rates and reduced Google Trends interest for “crypto” compared to the previous cycle.

Ultimately, Grayscale retains a “cautiously optimistic” stance regarding the future of this bull cycle, given the promising signals and analysis outlined in their report.

Featured image from Shutterstock, chart from TradingView.com

Crypto analyst Cyril-DeFi has projected a forthcoming altcoin season (alt season) that could deliver massive returns for investors. Cyril-DeFi forecasted returns ranging from 50x to 100x for those willing to venture into the altcoin market during this period.

The premise of such an optimistic outlook is rooted in the historical performance of altcoins during these seasons, where the broader market sees a significant upswing in value outside the dominion of Bitcoin.

Cyril’s analysis suggests that an investment of $10,000 could become a million dollars by 2025, assuming the investor navigates the altcoin market with the right narratives.

Notably, Cyril-DeFi’s projections are not without basis. He earmarks several key narratives that he believes will dominate the next alt season, pinpointing areas within the cryptocurrency sector that are ripe for growth. Among these, Artificial Intelligence (AI) stands out, spurred by the widespread adoption of AI applications like ChatGPT.

Cyril posits that blockchains offering solutions to AI-related challenges, including storage, data accessibility, and computational power, will likely grow substantially.

Furthermore, Decentralized Physical Infrastructure Networks (DePin) are highlighted as another potential area, with incentives for users contributing to GPS maps, space weather tracking, and environmental monitoring poised to offer lucrative rewards.

The upcoming alt season promises 50x-100x returns.

By 2025, $10k of assets could soar to $500k-$1M.

To seize this opportunity, you need to follow the right narratives

Here are 5 key narratives and altcoin picks to watch

pic.twitter.com/y7jpqGe4Qn

— Cyril – DeFi (@cyrilXBT) March 31, 2024

Beyond the technical and infrastructural narratives, Cyril spotlighted memecoins, Real World Assets (RWA), and Game Finance (GameFi) as pivotal to the altcoin surge.

According to Cyril, while memecoins present a high-risk, high-reward scenario, often driven by viral trends rather than foundational technology, their allure lies in the potential for notable gains.

Conversely, Cyril highlighted that RWAs introduce a tangible aspect to the digital currency realm, with tokenization efforts to bridge real estate and business investments with the blockchain world.

Lastly, GameFi’s integration of gaming with blockchain technology, rewarding players in cryptocurrency, is expected to continue attracting interest and investment, signaling strong performance during the alt season, according to the analyst.

It is worth noting that this optimistic outlook towards altcoins is not singular to Cyril-DeFi. Other analysts, like Xremlinalso, concur that the upcoming alt season could surpass the substantial gains observed in 2021.

Supporting this perspective, analytics firm Santiment reveals several altcoins currently residing in what they term the “Opportunity Zone.”

This classification is based on the Market Value to Realized Value (MVRV) metric, indicating that despite recent market downturns, certain altcoins present promising mid-term investment opportunities.

Santiment’s analysis provides a nuanced view of the market. It suggests that altcoins with subdued performance relative to their counterparts may offer a fertile ground for investors aiming to capitalize on the impending alt season.

Following #Bitcoin‘s drop to a 2-week low of $61.7K Tuesday, the @santimentfeed MVRV Opportunity & Danger Zone Model indicates that several #altcoins have finally dropped enough for mid-term trading returns to be in an #opportunity zone. This zone gets breached when an asset’s… pic.twitter.com/LAJxDtc1kp

— Santiment (@santimentfeed) March 20, 2024

Featured image from Shutterstock, Chart from TradingView

There are a couple of events to watch out for this week, as they could prove pivotal in determining the future trajectory of the crypto market. These events could provide some certainty to the market or cause investors to wait on the sidelines for more favorable market conditions.

Some Federal Reserve officials are scheduled to speak at different events this week. One of them is Governor Lisa Cook, who will give a lecture on March 25. Fed Chair Jerome Powell will also participate in a discussion at the Monetary Policy Conference on March 29.

Their speeches are significant as they could provide valuable insights into the current state of the economy and what to expect from the Federal Reserve regarding interest rates in its fight against inflation. Macroeconomic factors like interest rates usually impact the crypto market and partly determine the sentiments among crypto traders.

The crypto market is usually bullish whenever the Federal Reserve adopts a dovish stance on whether or not to hike interest rates. Therefore, these officials sounding positive in their speeches could help boost investors’ confidence in the crypto market since they would be less worried about things on the macro side.

Meanwhile, several economic data will be released this week, including the Consumer Confidence and Consumer Sentiment data and the Personal Consumption Expenditures (PCE) index. These releases offer insights into the economy’s strength and guide the Fed in deciding on future interest rate decisions.

Stakeholders and investors in the industry will no doubt hope that the events lined up for this week will provide a momentum boost for the crypto market. Last week was one to forget as things cooled after weeks of seeing the flagship crypto, Bitcoin, and altcoins make significant runs. This downward trend is believed to have been due to some external factors.

One of them is the net outflows that the Spot Bitcoin ETFs recorded throughout last week, with many investors taking profits from the various funds. These Bitcoin ETFs had previously seen an impressive amount of inflows into them, which positively affected Bitcoin’s price. As such, a trend of outflows was also expected to influence Bitcoin’s price, although negatively.

These Spot Bitcoin ETFs will again be in the spotlight this week, with the crypto community waiting to see if the sentiments among the ETF investors will change. A sustained trend of profit-taking this week could spark another decline in the crypto market.

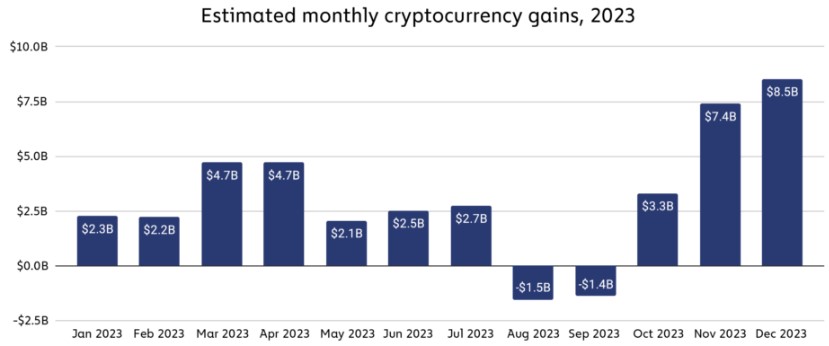

In a recent report by market intelligence firm Chainalysis, it has been revealed that global crypto gains in 2023 amounted to a staggering $37.6 billion. This profit surge reflects improved asset prices and market sentiment compared to 2022.

Although this figure falls short of the $159.7 billion gains witnessed during the 2021 bull market, it signifies a significant recovery from the estimated losses of $127.1 billion experienced in 2022.

The report suggests that despite similar growth rates in crypto asset prices in 2021 and 2023, the total gains for the latter year were lower. According to Chainalysis, this discrepancy could potentially be attributed to investors’ decreased inclination to convert their crypto assets into cash.

The analysis further suggests that investors in 2023 seem to have anticipated further price increases, as crypto asset prices did not exceed previous all-time highs (ATHs) during the year, unlike in 2021.

Cryptocurrency gains remained relatively consistent throughout 2023, except for two consecutive months of losses in August and September, as seen in the image above. However, gains surged sharply thereafter, with November and December eclipsing all previous months.

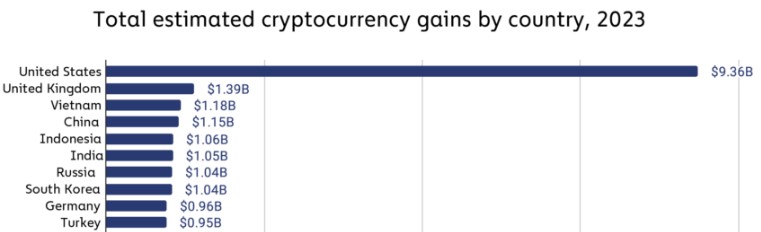

Leading the pack in cryptocurrency gains was the United States, with an estimated $9.36 billion in profits in 2023. The United Kingdom secured the second position with an estimated $1.39 billion in crypto gains.

Notably, several upper and lower-middle-income countries, particularly in Asia, such as Vietnam, China, Indonesia, and India, achieved significant gains, each surpassing $1 billion and ranking within the top six countries worldwide.

Chainalysis had previously observed strong cryptocurrency adoption in these income categories, particularly in “lower-middle-income” countries, which demonstrated resilience even during the recent bear market. The gains estimates indicate that investors in these countries have reaped substantial benefits from embracing the asset class.

Ultimately, the Chainalysis report suggests that the positive trends observed in 2023 have carried over into 2024, with prominent cryptocurrencies such as Bitcoin (BTC) hitting all-time highs of $73,700 following the approval of Bitcoin exchange-traded funds (ETFs) and increased institutional adoption.

If these trends persist, the firm believes that it is conceivable that gains in 2024 will align more closely with those witnessed in 2021.

As of this writing, the total crypto market cap valuation stands at $2.5 trillion, a sharp drop of over 4% in the last 24 hours alone, and down from Thursday’s two-year high of $2.7 trillion. Bitcoin, on the other hand, is trading at $68,400 after dropping as low as $65,500 but has quickly regained its current trading price, limiting losses to 4% over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Positive drivers such as spot ETF inflows are likely to meet some important macro and technical headwinds in the coming weeks, the report said.

Prominent digital asset financial services platform Matrixport has recently issued a bullish projection indicating a potential surge in Bitcoin’s (BTC) value. According to their analysis, Bitcoin may surpass its previously established two-year peak and climb to $63,000 by next month.

This bold prediction stems from a confluence of factors poised to exert significant influence on the trajectory of Bitcoin’s price in the coming weeks and months.

The primary driver behind Matrixport’s optimistic outlook is the live trading of Bitcoin spot Exchange-Traded Funds (ETFs). According to the report, these spot ETFs have opened the doors for more investors to engage in crypto trading through conventional financial channels.

Additionally, with the increasing demand for these spot ETFs and the daily trading volumes reaching noteworthy levels, signaling growing investor interest in Bitcoin as an asset class, this could help propel the flagship crypto to trade above $60,000 by next month, according to the report.

[1/3] Bitcoin ETF Flow – Up to 22 Feb 2024

All data in. +$251.4m net flow on 22nd Feb. A strong day. pic.twitter.com/IdrCmgq5u8

— BitMEX Research (@BitMEXResearch) February 23, 2024

Furthermore, the impending Bitcoin halving event, scheduled for April 2024, is anticipated to catalyze further upward momentum in BTC prices. Bitcoin halvings result in a reduction in the rate of new BTC generation, and historically, this leads to a decrease in supply, typically driving up Bitcoin’s value.

Matrixport’s report also mentions the influence of macroeconomic factors on BTC’s price. The expectations of interest rate adjustments following the Federal Reserve’s Federal Open Market Committee (FOMC) gatherings are anticipated to have a significant impact.

Furthermore, the forthcoming uncertainty surrounding the US presidential elections may instigate market fluctuations, leading investors to turn to alternative assets such as Bitcoin to safeguard against potential shifts in economic policies.

Meanwhile, despite Bitcoin experiencing a nearly 10% surge over the past 14 days, the asset has witnessed quite a retracement in the previous week, declining by 2.2%. It’s worth noting that despite this setback, the cryptocurrency’s market capitalization remains above the $1 trillion mark.

An analyst known as Mags has expressed an overwhelmingly bullish sentiment toward Bitcoin, noting that the asset has “never been this bullish.” Mags city’s historical patterns and bullish technical signals reveal that BTC has recently closed a weekly candle above the 0.618 Fibonacci level, a rare occurrence in the cryptocurrency’s four-year cycle.

#Bitcoin has never been this bullish

For the first time ever, BTC is deviating from the 4 year cycle by closing a weekly candle above the 0.618 level before the halving event.

The best part about this deviation is it’s a bullish one, with the rise in demand among institutional… pic.twitter.com/F9xpTbEZ1d

— Mags (@thescalpingpro) February 22, 2024

However, Mike Novogratz, CEO of Galaxy Digital, has cautioned against potential downside risks, speculating on the possibility of a regulatory setback or market sentiment shift that could lower BTC prices to the $45,000-$42,000 range.

Featured image from Unsplash, Chart from TradingView

Total crypto market cap climbed to $2 trillion for the first time since April 2022.