Crypto whales are a key supporting element, offering retail crypto audiences much-needed intel on price action.

Cryptocurrency Financial News

Crypto whales are a key supporting element, offering retail crypto audiences much-needed intel on price action.

Arbitrum (ARB), the Ethereum Layer 2 (L2) scaling solution, recently went through an unlocking event as part of its 2024 roadmap. However, the event raised concerns about how the token’s price would react amid the market slowdown.

It’s been a week since Bitcoin’s price started to dip. Despite BTC’s recovery, the market still exhibits red numbers. Crypto analysts remain optimistic about ARB and the market’s bullish run.

The event on March 16 unlocked 1.1 billion ARB tokens. These tokens were distributed among the team, advisors, and investors, who received 438.25 million ARB, approximately 40% of the total tokens unlocked.

Since then, Arbitrum whales have dumped millions of ARB on exchanges. As reported by NewsBTC, eleven whales recently sent over $58 million worth of the token to different trading venues.

Yesterday, the trend continued as two ARB whales sent around $12.72 million worth of ARB to the Binance exchange. These whales are seemingly investors who received around 28.43 million ARB tokens during the unlock.

::on-chain insights::$ARB investors are selling their tokens:

two wallets which potentially belong to $ARB investors several hours ago sent their tokens to @binance

wallet 0x1dc firstly sent 3 $ARB to be sure that they will arrive to his binance account and then sent… pic.twitter.com/L8yfKnOnvK

— Catakor

(@Catakor) March 21, 2024

As reported by an X user, the first wallet received 19.845 million ARB on March 16. This whale sent 3 ARB to Binance as a test before offloading 3.9 million tokens worth $6.9 million.

The second whale sent 3.424 million ARB tokens to Binance yesterday in two transactions, accounting for $5.79 million. Out of the 28 million tokens these investors received during Arbitrum’s unlock, the wallets now only hold 804,000 ARB, worth around $1.42 million.

Arbitrum’s most recent downward trajectory started right before the unlocking event. After ARB’s price failed to maintain the $2 support level, the token dropped over 30% to trade around $1.48 on March 19.

Since then, ARB has started to rise and retest its resistance levels again. According to crypto analyst World Of Charts, ARB broke a bullish flag on March 20.

Successfully retesting the $1.64 price range could potentially bring a “40-45% Bullish Wave,” per the analyst.

Finally #Arb Has Already Started As Expected Send It Now https://t.co/6RouflzapC pic.twitter.com/zGE6KFtIpk

— World Of Charts (@WorldOfCharts1) March 20, 2024

ARB’s retest above the suggested price range succeeded in the following hours. The token rose to the $1.8 mark in the early hours of today before returning to the $1.75 price range.

Crypto analyst Bluntz projected a leg up for Arbitrum after the price neared the $1.8 resistance level. As the analyst highlighted, ARB’s price performance shows an a,b, and c zigzag pattern that could suggest an upward trajectory for the token. Additionally, he expressed optimism about the market’s health based on the token’s performance.

you know the market is healthy when even eth and eth beta is looking good again$arb pic.twitter.com/gjn4zduLW7

— Bluntz (@Bluntz_Capital) March 21, 2024

ARB is trading at $1.76 at writing time, representing a 5.2% increase in the last 24 hours. Although it shows a 14% and 12% decrease in the weekly and monthly timeframes, its current price still represents a 29.4% surge since the year began.

In recent on-chain data from Spot On Chain, an Ethereum whale appears to have engaged in significant accumulation activity, sparking interest and speculation within the ETH community.

According to the platform, the whale address in question has purchased a total of 64,501 ETH in the past three days, amounting to roughly $187 million at current market prices,

Spot On Chain reported that earlier today, the whale acquired approximately 13,526 ETH at an average price of $2,947 per ETH. This accumulation, valued at over $39 million, adds to the already substantial holdings of the whale, suggesting a bullish outlook on Ethereum’s future trajectory.

The platform’s data further reveals that the whale withdrew 10,136 ETH from Binance while purchasing 3,390 ETH from 1inch. These purchases have compounded the whale’s accumulation of ETH in the past three days to a total of 64,501 ETH.

Additionally, Spot On Chain highlights the withdrawal of an additional 40 million USDT from Binance, prompting speculation regarding its potential use for further Ethereum purchases.

According to the portfolio image above that Spot On Chain shared, the whale’s wallet holds a total of 91,321 ETH, in addition to approximately $49.8 million worth of USDT and 5,485 STETH. These assets, in total, are estimated to be $334 million.

Giant whale 0x7a9 allegedly bought 13,526 $ETH ($39.85M) at ~$2,947 again!

• withdrew 10,136 $ETH ($29.85M) from #Binance

• bought 3,390 $ETH with 10M $USDT #1inchOverall, the whale has bought 64,501 $ETH ($185.5M) in the past 3 days!

It also withdrew another 40M $USDT from… https://t.co/UHIVXfx6Wq pic.twitter.com/ySbvIv2mux

— Spot On Chain (@spotonchain) February 21, 2024

Ethereum has continued to showcase bullish momentum, trading up by nearly 6% over the past week. However, despite briefly surpassing the $3,000 mark, Ethereum has retraced slightly in the past 24 hours, trading around $2,900 at the time of writing.

This pullback has not dampened optimism within the crypto community, with many anticipating further upward movement. Industry experts have weighed in on Ethereum’s performance, with Stefan von Haenisch of OSL SG Pte in Singapore noting the cryptocurrency’s potential to outperform Bitcoin in the coming months.

Haenisch attributes this optimism partly to speculation surrounding the potential approval of spot Ethereum exchange-traded funds in the US. Michaël van de Poppe, CEO of MN Trading, echoes this sentiment, forecasting a potential surge for Ethereum to $3,800 to $4,500 shortly.

#Ethereum is on its way towards $3,800-4,500. pic.twitter.com/TfoBGloBsH

— Michaël van de Poppe (@CryptoMichNL) February 19, 2024

Featured image from Unsplash, Chart from TradingView

Cardano (ADA) staged a remarkable performance today, defying prevailing expectations and orchestrating a meteoric rise that propelled it from a relatively unassuming position to a prominent spot within the top 10 cryptocurrencies by market capitalization, courtesy of an impressive 3.6% rally.

While stalwarts like Bitcoin and Ethereum made incremental movements, Cardano distinguished itself with an unparalleled surge, surpassing its heavyweight counterparts and setting ablaze a bullish sentiment that swept across the crypto community.

The unforeseen ascent of Cardano has left analysts scrambling for explanations, and a prevailing theory points to an upswing in whale activity. Insights gleaned from IntoTheBlock’s data reveal a staggering 11% surge in cumulative whale volume over the preceding 24 hours.

This surge translates to an astronomical $14.34 billion worth of Cardano changing hands among the titans of the crypto realm, dwarfing the transactional activity witnessed in other leading digital assets. In comparison, Ethereum recorded a comparatively modest $4.21 billion in whale transactions, and Dogecoin struggled to breach the $1 billion mark, further underscoring the dominance of Cardano’s surge in whale participation.

The surge in Cardano’s whale activity not only fueled its impressive rally but also underscored the growing influence of large-scale investors within the cryptocurrency market. This unexpected turn of events has prompted speculation and discussions within the crypto community regarding the potential catalysts behind such substantial whale engagement.

These numbers tell a clear story: big bucks are betting big on Cardano. The number of whale transactions went from a respectable 5,080 on January 17th to a jaw-dropping 7,910 by the 19th. This sudden influx of institutional interest from deep-pocketed investors suggests a surge of confidence in Cardano’s future, propelling its price upwards and leaving other altcoins in its wake.

However, amidst the celebratory champagne showers, whispers of caution linger. Cardano’s price remains deeply tethered to Bitcoin, meaning a sudden BTC dip could drag ADA down with it. Additionally, with short-term profit-taking a constant threat, especially near the psychologically important $0.67 resistance level, a temporary pullback isn’t off the table.

But beyond the immediate price action, a bedrock of optimism underpins Cardano’s ascent. The development team continues to churn out impressive updates, with major advancements promised for the Proof-of-Stake network this year. From upcoming hard forks to innovative dApp implementations, these technological leaps could solidify Cardano’s long-term value proposition and attract even more whales to its welcoming shores.

Featured image from Pexels

Recently, cryptocurrency analytics platform Lookonchain reported activities of Bitcoin (BTC) and Ethereum (ETH) whales amid the ongoing market downturn. These whales appear to have been capitalizing on the recent decline in the crypto prices to bolster their holdings.

According to Lookonchain, amid the market dip, a newly established wallet withdrew 700 BTC, valued at roughly $29.36 million, from the Binance exchange.

These BTCs were purchased at an average price of $41,948 each.It is worth noting that, according to the analyst, such a move during a market downturn demonstrates a bullish sentiment on the future of BTC.

It seems that a whale is buying $BTC!

In the recent market drop, a new wallet withdrew 700 $BTC($29.36M) from #Binance at an average price of $41,948.https://t.co/5kE1l0mJlo pic.twitter.com/Fj1thu4C6x

— Lookonchain (@lookonchain) January 19, 2024

The narrative of strategic accumulation isn’t limited to Bitcoin. Lookonchain’s subsequent tweet highlighted similar activities in the Ethereum market.

A whale took advantage of the decreased Ethereum prices, buying 3,600 ETH, worth around $8.9 million. Lookonchain highlighted that this investor’s history of buying ETH at lower prices and selling at higher valuations has resulted in substantial profits, estimated at around $25.8 million.

After the price of $ETH dropped today, this smart whale bought 3,600 $ETH($8.9M) back at a lower price 5 hours ago.

This whale is very good at buying $ETH at low prices and selling $ETH at highs.

The profit is ~$25.8M currently!https://t.co/UzXbheftr1 pic.twitter.com/DannZzsQVk

— Lookonchain (@lookonchain) January 19, 2024

These whale movements are worth noting, especially considering the increasing bearish sentiment in the cryptocurrency markets. Ethereum, for instance, has seen a 1.9% decline in the past 24 hours and a 7.8% drop over the past week.

The asset is currently trading at around $2,475. Bitcoin is experiencing a similar trend, with a nearly 3% decrease in the past 24 hours and a 10% fall over the past week, bringing its price to $40,819 at the time of writing.

This market downturn is also reflected in the asset’s trading volume. Bitcoin’s daily trading volume fell from over $40 billion last Friday to about $26 billion.

In light of these developments, renowned crypto analyst Jacob Canfield has cautioned that Bitcoin might face further corrections in the short term.

Canfield notes that the upcoming Bitcoin halving could play a crucial role in rebalancing the market dynamics, potentially tipping the scale towards demand over supply. However, his analysis of Bitcoin’s 4-hour chart indicates the formation of a trend that has historically been an indicator of negative short to mid-term price movements.

For Bitcoin, critical levels include $48,700, marked by the 61.8% Fibonacci retracement, weekly resistance, and a significant support level to watch at $38,700. Earlier this month, Bitcoin traded at the $48,700 zone before retracing.

Canfield warns that following a tap of the 61.8% level, Bitcoin often experiences an 18-22% sell-off, potentially bringing it back to the $38,700 support level.

#Bitcoin update – If you’ve been following me for a while, you’ll know my local top on $BTC was $48.7k (as per my playbook posts)

The question that everyone is asking now is ‘where do we go from here?’

The current narrative is that the ETF approval unlocked the GBTC investors… pic.twitter.com/MayIZp5vEY

— Jacob Canfield (@JacobCanfield) January 18, 2024

Featured image from Unsplash, Chart from TradingView

The XRP price saw an impressive run over the last day after news broke that the US Securities and Exchange Commission (SEC) was dropping its lawsuit against Ripple’s executives. This surge carried on into Friday as the altcoin’s price was able to clear the $0.53. Naturally, there has been a pullback from this price level, but whale transactions suggest that the rally may not be over.

In the last day, crypto whales have been showing their buying power as the price of cryptocurrencies such as XRP saw a recovery. The first indication of this was a number of large USDT transactions that were making their way toward centralized exchanges.

The first of these reported by whale tracker Whale Alert was $100 million in USDT transferred to Binance. Then two other transactions carrying the same amount of tokens followed suit, all headed for the Binance exchange as well. Another 50 million USDT would make their way to the exchange just a couple of hours later.

Then the minting of $1 billion USDT at the Tether Treasury took place as Thursday drew to a close. What followed was a number of transactions carrying USDT in 50 million tranches headed for Binance. The transactions continued into Friday, with the most recent being two hours old, at the time of this writing.

The continuous transfer of stablecoins to centralized exchanges can often signal a willingness to purchase cryptocurrencies. Mostly, these purchases are in Bitcoin but the buying power tends to have a trickle-down effect. Meaning, that as the price of Bitcoin goes up, so will the XRP price.

In this case, if whales continue to buy and push the Bitcoin price past $30,000, then the XRP price is likely to follow suit and break the $0.55 resistance while at it. However, the XRP price also faces strong resistance as whales have taken to selling.

As Whale Alert shows, there were a number of large XRP transactions headed toward centralized exchanges. The most notable of these are the 32.3 million XRP worth $15.79 million at the time sent to the Bitso exchange, as well as the 31.1 million XRP worth $15.2 headed to the Bitstamp exchange.

These whale movements suggest a battle between bulls and bears as they struggle for dominance. But XRP price continues to show strength with 7.44% gains in the last 24 hours, and up 6.94% in the last seven days.

Bitcoin’s price performance last week may have disappointed investors, but there are indications of a growing momentum as the new week started. Bitcoin spiked up in the early hours of Monday to almost $28,000 before facing resistance that sent it back down.

It would seem whales have been making moves to push BTC up, as indicated by the increasing number of whale wallets. New Bitcoin mid-whale addresses, meaning addresses holding between 100-1,000 BTC, saw a huge single-day increase recently, according to data from analytics firm Santiment.

On-chain data have shown, as was previously reported, that Bitcoin whales are increasing their holdings, with long-term holders adding more than 50,000 BTC to their wallets each month. A similar occurrence took place over the weekend when the number of Bitcoin wallets holding between 100 and 1,000 BTC experienced its largest jump this year.

An X post by crypto on-chain analytic platform Santiment revealed that this metric grew by 16 more wallets, its largest since February 2022. During the same period, wallets between 10-100 BTC fell, indicating smaller wallets adding to their holdings to proceed to the next tier.

Whale addresses have increased by 117 BTC in the past 48 hours, worth roughly $3.2 million, as whales look to push price gains. Although on-chain signals currently point to bearish, the continued influx of investors accumulating Bitcoin could signal higher demand and price appreciation for the leading cryptocurrency.

#Bitcoin whales bought around 117 $BTC in the past 48 hours, worth roughly $3.2 million. pic.twitter.com/Aoshmy0r4D

— Ali (@ali_charts) October 15, 2023

With whales stocking up their wallets, the 24-hour trading volume for Bitcoin climbed by 180.15%, and the price of Bitcoin increased by 3.26%. If the current pace is maintained, there is a significant likelihood that it will reach $30,000 by the end of this week.

This push was likely aided by large amounts of older, stagnant coins that were finally moved. According to Santiment’s “Age Consumed” measure, which tracks the average age of cryptocurrencies that are traded, the most dormant BTX has changed wallets since July.

Bitcoin has a history of being used as a hedge against inflation, but its short-term price trajectory is currently hard to predict. There are many market factors that can either send the cryptocurrency up or spiraling downwards.

One example is the SEC’s approval of spot Bitcoin applications, which many have hinted could signal the start of a new bull run to new highs. At the time of writing, BTC is trading at $27,740 and is looking to cross over $28,000.

A report from blockchain data analytics platform Chainalysis has revealed that the majority of crypto transactions in the United Arab Emirates (UAE) from July 2022 to June 2023 have been whale transactions, crossing over $1 million each.

The report from Chainalysis reveals that institutional investments accounted for the majority of cryptocurrency transactions in the UAE with over 67% from July 2022 to June 2023.

The Institutional investments in the country range from $1 million, followed by professional investments ranging from $10,000 to $1 million, and retail investments which accounted for just 4.63% of cryptocurrency transactions in the country up to $10,000.

Kim Grauer, the Director of Research at Chainalysis shed more light on this significant trend noting that the report marks a significant interest among organizations and high-net-worth individuals in the UAE to add cryptocurrency to their investment portfolios.

“The fact that by far the larger portion of crypto investments in the UAE is for institutional and professional-sized transactions, indicates an eagerness from organizations and high-net-worth individuals to add cryptocurrency to their investment portfolios. This market confidence is validation of the efforts being made by the country’s leadership to offer commendable regulatory clarity, and establish the nation as a global crypto hub,” the director said.

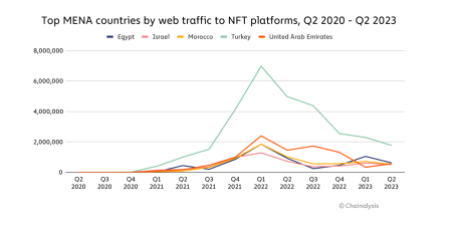

The report shows that UAE was one of the only countries in the MENA (Middle East and North Africa) region to spot a higher share of crypto activity within the decentralized exchanges than centralized exchanges. The country’s decentralized exchanges activity was over 48% with centralized exchanges accounting for 46%.

So far, the country’s crypto market value dropped by 17% over the past year accounting for over $34 billion in crypto market value this year. However, the country still managed to outperform other countries in the MENA region.

The Decentralized Finance (DeFi) sector has also seen tremendous popularity in the country since 2022. This further proves that the country has been successful in passing innovation-friendly regulatory frameworks that allow the development of innovative cryptocurrency platforms in the country, with a direction that keeps consumers safe.

The country also displayed its interest in Non-Fungible Tokens (NFTs) over time. The report revealed that the country had an impressive number of over 4 million web traffic visits across NFT sites from July 2022 to June 2023, despite the fast declination of NFTs since 2022.

On September 12, 2023, Chainalysis released an excerpt based on a variety of parameters to determine the grassroots crypto adoption. The excerpt revealed that most of the countries leading the charge are from the Central & Southern Asia and Oceania (CSAO) region.

According to the excerpt, six countries from the CSAO region are among the top 10 leading countries. These include India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand.

The lower middle-income (LMI) countries were identified to be leading the way in grassroots crypto adoption around the world since last year.

The excerpt was released following the data analysis of 154 countries across five sub-indexes around the world. The rankings were then determined by each country’s geometric mean in all five areas, crypto purchasing power, and population strength.

Bitcoin whales, entities holding a substantial portion of the Bitcoin supply, have ignited speculation within the cryptocurrency realm by amassing more than a billion worth of BTC in mere two weeks.

Data from crypto analytics firm IntoTheBlock reveals a significant uptick in the accumulation of Bitcoin by addresses holding at least 0.1% of the total BTC supply, valued at over $500 million each. These entities collectively added a staggering $1.5 billion to their holdings during the final two weeks of August.

This surge in accumulation coincides with the excitement surrounding the potential introduction of a spot Bitcoin ETF in the United States. This substantial accumulation of Bitcoin by crypto whales serves as a clear testament to their growing confidence and heightened interest in the cryptocurrency, irrespective of recent price oscillations and regulatory ambiguities.

Addresses holding 0.1% of the Bitcoin supply or more have added over $1.5B in BTC holdings in the last two weeks. pic.twitter.com/MrHKLXO9qx

— IntoTheBlock (@intotheblock) September 1, 2023

The chronology of this accumulation is particularly captivating. While Bitcoin’s price experienced a dip, it experienced a transitory resurgence subsequent to a pivotal court ruling linked to Grayscale’s pursuit of a spot Bitcoin ETF. The verdict translated into a price upswing exceeding $2,000, propelling the alpha coin to a two-week zenith, slightly exceeding the $28,000 threshold.

Nevertheless, just as the cryptocurrency community was poised for jubilation and pinned hopes on the ETF’s ratification, the US Securities and Exchange Commission (SEC) introduced an unexpected regulatory twist. A

dopting a circumspect stance, the regulatory authority deferred its verdict on all active Bitcoin ETF applications. Consequently, Bitcoin relinquished all its gains stemming from the brief rally triggered by the Grayscale ruling, regressing below the $26,000 mark.

The current BTC price is $25,808.30 according to CoinGecko, with a 24-hour decline of 0.8% and a seven-day loss of 0.9%.

Despite the recent tumultuous price fluctuations and the ambiguity clouding the cryptocurrency market’s regulatory landscape, the continual accumulation of Bitcoin by crypto whales implies that institutional investors are cultivating an increasingly sanguine outlook regarding Bitcoin’s long-term prospects.

The prospect of a Bitcoin ETF, promising a regulated and accessible entryway for mainstream investors, persists as a game-changing possibility that could significantly reshape the crypto outlook in the United States and beyond.

While the cryptocurrency community anticipates further developments and regulatory determinations, the conduct of these crypto whales functions as a tangible gauge of swelling institutional interest in Bitcoin, fortifying the belief in its enduring value and pertinence.

These crypto whales wield not only the power to sway the market but also reflect the sentiment and perspective of dominant participants within the dynamic domain of cryptocurrencies.

Featured image from VOI

PEPE, the amphibian-themed token that kickstarted the meme coin season in April this year, remains a subject of both fascination and volatility within the cryptocurrency landscape. Its journey, marked by highs and lows, offers insights into the evolving dynamics of this speculative market.

In a surprising turn of events, the meme coin arena witnessed a significant exchange of millions of SHIB and BONE tokens for PEPE, shortly after the successful launch of Shibarium’s mainnet.

A notable whale, identified by Lookonchain as per a PEPE price analysis data cited in a new analysis shifted its holdings from SHIB and sister-token BoneShibaSwap to PEPE, raising eyebrows in the crypto community.

The whale’s move, which included a substantial deposit of 143 billion SHIB into Binance, hints at a potential strategy shift and a “buy the rumor, sell the news” approach that seems to favor PEPE at the expense of SHIB.

However, PEPE’s recent price performance has been on a rollercoaster ride. The current price of $0.00000110, as reported by CoinGecko, reflects an 8% slump in the last 24 hours and a 12% decline over the past seven days.

This stark fluctuation highlights the inherent volatility of meme coins, where sudden shifts in sentiment can lead to rapid price movements.

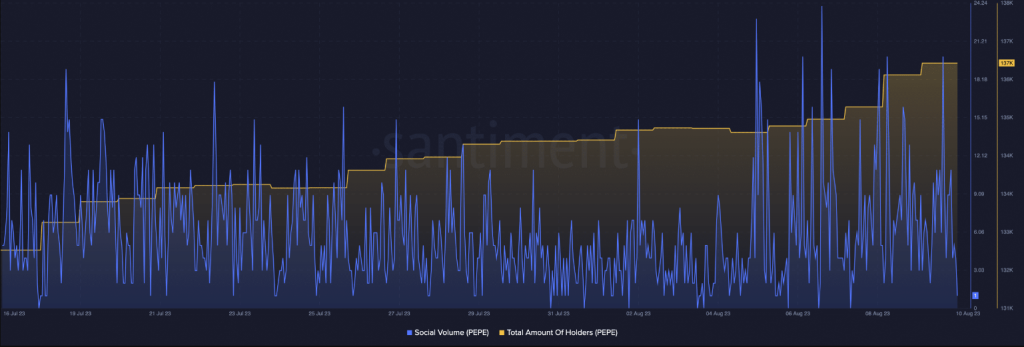

The report’s analysis reveals an intricate pattern in PEPE’s social volume over the past month. The coin’s popularity has swung back and forth, indicating days of heightened interest juxtaposed with relative indifference.

However, in the face of this up-and-down pattern, a notable trend emerged – the rise in the number of PEPE holders.

Currently, the coin boasts a total of 137,000 holders, underscoring a dedicated community that remains engaged despite the market’s unpredictable nature.

In the wake of PEPE’s price correction, traders have turned their attention to emerging meme coins on Decentralized Exchanges.

The allure of new low market cap cryptocurrencies lies in their potential for exponential gains before even making their way to Centralized Exchanges.

These gains are often followed by retracements, as shorting opportunities become available post-listing.

A stand-out example post-PEPE’s correction is HarryPotterObamaSonic10Inu (BITCOIN), a meme coin that has secured a consistent spot among the top 10 trending cryptocurrencies on DEXTools.

Its journey underscores the dynamic nature of meme coin investments, as traders seek the next opportunity to ride the wave of speculative enthusiasm.

In the world of meme coins, PEPE’s story mirrors the wider crypto market’s blend of excitement, uncertainty, and the continuous pursuit of the next big opportunity.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Benzinga

Litecoin is the winner in daily crypto gains as whales appear to be behind the ongoing LTC price rally, on-chain data suggests.

Cardano whales are largely behind ADA’s price rally in the last week, helped by Bitcoin’s multi-month highs amid the banking crisis and Fed pivot hopes.

After a strong week for bitcoin (BTC) and many other leading cryptocurrencies, traders are now on the lookout for indicators of what could spark the next bull run.

After being battered by losses for the majority of 2022, bitcoin and other cryptocurrencies are on the rise in 2023, leading to predictions that the so-called crypto winter has thawed.

Bitcoin has begun the new year on a bright note. On Saturday, Bitcoin surpassed $21,000 for the first time in 60 days. At the time of writing, BTC is trading at $21,090, up 25% in the last seven days, data by Coingecko show.

If this week’s US economic data shows that the Federal Reserve may be nearing the end of its interest rate hikes, the prices of major cryptocurrencies could soar.

Ed Moya, a senior market analyst at Oanda, wrote on Friday:

“Wall Street is very confident that the end of the central bank’s tightening cycle is upon us and that is providing some underlying support for crypto.”

The most recent Bitcoin rise is still a far cry from the alpha coin’s November 2021 record high of $68,990. However, this has provided market participants with enthusiasm.

The whole cryptocurrency market lost over $1.4 trillion in value last year because of liquidity troubles, bankruptcies, and the collapse of crypto exchange powerhouse, FTX.

It didn’t take long for the so-called “contagion” to make its presence felt in all corners of the crypto market after the wave of insolvencies.

Bitcoin dropped to a two-year low of $15,480 as the FTX epidemic engulfed the cryptocurrency market.

This spike in Bitcoin’s value is likely fueled by a number of causes. There is a rising expectation among market participants that the Federal Reserve would follow a more benign monetary policy by halting interest rate hikes or decreasing rates in the near future, possibly as early as the end of this year.

Last year, the Federal Reserve raised interest rates seven times, sending risky assets such as equities and tech stocks to slide.

In addition, data released by cryptocurrency company Kaiko indicates rising purchasing optimism among major bitcoin purchasers, commonly known as “whales,” which analysts say helps to support current high levels of demand.

Cryptocurrency whales, or crypto whales, are persons or organizations that possess enormous amounts of a particular cryptocurrency.

Meanwhile, although bitcoin has gained a nice boost at the beginning of 2023, in conjunction with risk assets as mentioned above, market observers say the leading coin is unlikely to retest its all-time high of $69,000, but it may have reached a bottom.

Featured Image from BW Businessworld

As the dog-themed crypto asset gets ready to launch its new metaverse, a crypto whale is suddenly transferring trillions of Shiba Inu (SHIB) tokens.

According to a tweet by Whale Alert, a platform for tracking whales said that a huge number of SHIB tokens (3,323,256,285,484) worth almost $30.48 million were moved from one unknown wallet to another.

3,323,256,285,484 #SHIB (30,458,751 USD) transferred from unknown wallet to unknown wallethttps://t.co/f12FEIOwzC

— Whale Alert (@whale_alert) January 12, 2023

The addresses used in the transactions aren’t associated with cryptocurrency markets, so it’s unlikely that the action has anything to do with buying or selling the trending meme coin.

The Shiba Inu team has recently made several announcements, and this massive transfer of SHIB tokens has occurred in the midst of this. First, Shiba Inu’s developers said they want to unveil their new metaverse at the South by Southwest (SXSW) festival 2023 in Austin, Texas.

A virtual reality (VR) tour of the WAGMI Temple, one of 11 locations in Shiba Inu’s metaverse showcasing the Dogecoin (DOGE) competition, will be featured in the exhibition.

For the Ethereum-based Shiba Token Decentralized Community Project, millions of devoted SHIB supporters have organized themselves into a movement they call the #ShibArmy. As a result, the cryptocurrency is consistently placed in the top 15 by market cap. According To Shiba Inu Ecosystem’s Blog:

The unique possibilities that will be in HUBs like WAGMI Temple make SHIB: The Metaverse stand out. “HUBs are epicenters of activity within the Metaverse, offering distinctive experiences rooted in each HUB’s theme,” explains Sherri Cuono, Metaverse Advisor to Shiba Token.“ Each offers special attractions that may only be experienced in that hub. The common thread is extensive digital or digital-plus-IRL utility including activities, commerce, customization, expression, events, education, exploring and more. Users will be able to earn passive income, collect in-game resources, generate rewards, and even have their own space to build and manage their projects in SHIB: The Metaverse.”

On the other hand, the Shiba Inu team has just announced some latest upgrades to the Shibarium Network. It will soon deploy a layer-2 scaling protocol and promote Bone ShibaSwap (BONE) as the official virtual asset associated with the blockchain.

Binance, the largest cryptocurrency exchange in the world measured by volume, was prompted to stake an astounding 4 trillion Shiba Inu tokens as a result of this move.

At press time, the trading price of Shiba Inu was $0.00001032 with a 24-hour trading volume of $667.322 Million. Shiba Inu’s price was up by 7.72% in the last 24 hours and up by almost 24% in the last 7 days, with a market cap of $5.655 Billion.

Featured Image from Somagnews, chart from Tradingview.com.

XRP, the 7th largest cryptocurrency with more than $19.74 billion market capitalization, appears to be poised for a healthy surge.

Unfortunately for traders, investors or prospective buyers of the crypto asset, this upward movement will be temporary and the bears are expected to take control shortly after the altcoin registers an uptick in its price.

At the time of this writing, according to tracking from Coingecko, the digital coin is changing hands at $0.3932, down by only 1.4% during the last seven days.

On its month-to-date (MTD) performance, XRP registered a decline of 13.6%. However, the pattern currently being followed by its price action is indicating a minor upward movement.

Over the past few days, the cryptocurrency has already tested its resistance trendline on two different occasions while it revisited its support trendline multiple times.

Source: TradingView

Source: TradingView

In doing so, XRP’s price action has made it caught in an inverted flag pattern which is a bearish model but offers a chance for a minor bullish breakout.

Currently, the $0.39 zone is a crucial support level for the altcoin as failure to hold it would mean a continuation of the ongoing downward trend for the crypto.

However, in the event that XRP manages to hold that particular line, there’s a good chance that the inverted flag pattern will provide a window of opportunity for the asset to surge all the way up to $0.443 to tally an impressive 12.5% jump.

The decline in trading volume of the cryptocurrency will eventually cool it down and pull it back to a bearish state all the way to $0.36.

Just a few days ago, Bithomp, an XRP-focused whale tracker shared some information about an unusual transfer of large sum of the XRP token.

According to the data, around 143 million units of the altcoin worth more than $56.5 million was moved by a crypto whale from Binance to Bittrex, a major U.S. exchange company.

Large investors have been active recently, getting involved in movement of millions worth of XRP from an anonymous wallet to another for purposes of selling or facilitating withdrawal through a cold wallet.

As of posting time, it is believed by the tracker that over 150 million of the altcoin has already been moved by whales.

XRP responded with this development with a minor price increase although its gains remain temporary as it cannot sustain its upward trajectory.

XRP total market cap at $19.5 billion on the weekend chart | Featured image from CryptoCoin Spy, Chart: TradingView.com

Volatility is one of the distinguishing attributes of the crypto market that springs surprises in several observers. It creates a desirable environment for traders and investors in the crypto industry to advance with huge profits.

Over the past week, the crypto market experienced the presence of the bulls in considerable measure. Most of the crypto assets made some impressive reclaims in their value. Most tokens were forced to break their resistance and advance more to the north. This pushed the cumulative market cap to its coveted level of $1 trillion.

But this week has calmed the trends in the crypto market. Hence, many crypto analysts are now observing to uncover the next possible move in the market. They’ve focused on the recent activity of some major stablecoins, such as Tether (USDT) and USD Coin (USDC).

According to on-chain data, the stablecoins USDT and USDC have witnessed massive whale activity. Such high-valued transactions indicate the possibility of significant volatility in the future.

In its report, on-chain data provider Santiment noted that the Whales engaged massively in crypto activity from Monday after the weekend volatility. It reported that the most significant digital assets with $100k+ whale transactions are the stablecoins USDT and USDC.

As more considerable buying power is in play, the outcome will be a significant market movement. Hence, the market will experience volatility in the future.

A more positive outcome is expected in line with the current market situation and its recent rally. The speculation is that the crypto market bull run will continue following the whales’ increased digital asset buying spree.

At the time of writing, the total market cap sits at $970 Billion, indicating a surge over the past 24 hours. The volume of all stablecoins is $81.19 billion representing about 92.76% of the cumulative digital asset market 24-hour volume.

Following the past few months of silence, the US Department of Justice (DoJ) pushes the investigatory plans on Tether USDT. This new move is in line with the allegations against Tether executives in bank fraud.

According to Bloomberg’s report, US Attorney Damian Williams in the Southern District of New York will lead the probe for DoJ.

The issuing firm for USDT disclosed that it had maintained undivided cooperation with the DoJ for a long time. But stated that its executives are yet to speak to DoJ since the year. It reported the agency had deployed an active investigation on Tether.

Further, Tether touted Bloomberg over its report on the firm, stating that it has repeatedly shown its desperation for attention in the industry without proper understanding.

featured Image From Pixabay, Charts From Tradingview

The drop in Ethereum’s daily active addresses comes as ETH price flatlines, raising fears about a potential drop ahead.

QNT whales have started securing profits after the token’s 450%-plus price rally since June 2022.

There has been a massive sell-off in the cryptocurrency market, and during this period, whales have been focusing on Dogecoin (DOGE) and the general negative attitude in the cryptocurrency industry.

There was a 5.34 percent increase in the number of addresses owning between 100 million and 1 billion DOGE, as revealed by @bull bnb.

For Dogecoin, the percentage of wallets with between 100 million and one billion Dogecoin has grown by 5.13 percent in the last week. About six additional whales have joined the network, bringing in an additional 620 million DOGE.

Dogecoin | The number of addresses holding 100M – 1B $DOGE has increased by 5.13% over the past week. Roughly 6 new whales have joined the network, scooping up approximately 620M DOGE.

Considering this I will scoop a fresh brand new bag of #DOGE pic.twitter.com/0TaysaPIog— Bull.BnB (@bull_bnb) September 23, 2022

In light of this, @bull bnb recently tweeted, “I’m about to scoop a fresh brand new bag of #DOGE.”

Recent whale activity has come as a huge surprise to DOGE holders and investors. What, then, compelled the whales to seek out DOGE?

Is This The Time To Purchase The dip?

As you may be aware, the present market climate is extremely negative for cryptocurrencies. Fear sparked by the CPI report’s release and the U.S. Federal Reserve’s interest rate hike triggered a widespread selling off in the stock and cryptocurrency markets.

The USD followed this decline. At the time of publication, the memecoin has fallen 9.94 percent from its September 12 peak. Even if DOGE showed signals of bullishness, it was not enough to prevent a 9.56 percent decline on September 18.

This decline may have prompted whales to seek accumulation rather than selling their DOGE supply. Now that whale activity has increased, what does this signify for DOGE?

Dogecoin Bullish Behavior

DOGE’s bullishness came as a surprise as the cryptocurrency market continues to decline, particularly Bitcoin and Ethereum.

This increase in price can be ascribed to the whales’ recent buying binge in DOGE. A As at the time of writing, DOGE was trading at $0.066041, up 9.4% in the last seven days, data from Coingecko show.

This implies that the memecoin is leading the crypto market, giving the entire crypto market hope that respite is on the horizon. But investors and traders must ask whether this is really a flash in the pan or a persistent bull trend.

As of the time of writing, the token’s resistance level was tested at the 0% Fib level. This was answered with a lengthy wick of rejection, followed by a red candle. This could be the beginning of a short corrective period for DOGE, which will result in a slight price decline.

In the coming days, we can anticipate receiving additional information.

DOGE total market cap at $8.7 billion on the daily chart | Source: TradingView.com

Featured image from Cryptory, Chart: TradingView.com

The number of “whale” addresses in AAVE has recently increased. Whale addresses are digital currency addresses that store 1 million or more of a particular coin. AAVE is currently riding a wave of whale-like popularity.

AAVE is currently riding a wave of whale-like popularity. A 55 percent of the AAVE coins are held by addresses with 1,000 to one million tokens, per Santiment. That’s a big jump from the 48% investors saw in the first half of June.

This increase in whale addresses may be attributable to new AAVE features. AAVE recently tweeted on the company’s recent achievements in the present DeFi industry.

We may expect an increase in the number of services that make use of the AAVE ecosystem over the coming years, as funding has been awarded to more than 26 different beneficiaries.

Staking the token on the ecosystem can now generate instant returns thanks to the company’s cooperation with Flashstake.

AAVE TVL Increasing As Well

Using the governance token, users may lend and borrow cryptocurrencies and real-world assets (RWAs) directly from one another, cutting out the need for a trusted third party. Investors gain interest when lending money and lose it while borrowing money.

The TVL of the system has increased to $1.17 billion, from $1.09 billion on September 14th, since tweets describing current changes in the ecosystem were released.

When the TVL number goes up, trade volume goes up with it. The token’s 24-hour trading volume increased from $74,494,475 on September 18 to $145,288,857 on September 20, according to publicly available data. This represents a massive growth of nearly 49 percent.

As of the time of writing, this figure decreased by 19.5 percent to $116,733,735. Although the long-term outlook for AAVE may be favorable, the short-term outlook is not promising.

Despite the significance of the advancements, the token is still subject to market conditions. The token has already lost 14 percent of its September 17 gains.

Positive Developments Help The Token Recover

The price decline can be attributed to the deteriorating macroeconomic conditions in the first half of September. Due to the market’s climate of dread, the crypto winter will persist until the end of the year before conditions improve.

Recent economic developments will influence the broader financial markets, particularly the cryptocurrency market. But recent developments can assist AAVE in recouping its losses.

Recently, NASDAQ announced its entry into the cryptocurrency market. Their justification was that institutional investors’ interest in digital assets has increased.

Despite the fact that their approach is still cautious because crypto exists in a legal murky area, this is still a big milestone in the crypto industry.

AAVE has been a part of the cryptocurrency market as a lending and borrowing platform. As the crypto winter persists, services such as AAVE will become indispensable for surviving the current market conditions.

AAVE total market cap at $1.02 billion on the daily chart | Source: TradingView.com

Featured image from The Coin Republic, Chart: TradingView.com

(The analysis represents the author’s personal views and should not be construed as investment advice).