From April 26, police can transfer seized illicit crypto to wallets controlled by the authorities, with victims able to reclaim funds from the accounts.

Cryptocurrency Financial News

From April 26, police can transfer seized illicit crypto to wallets controlled by the authorities, with victims able to reclaim funds from the accounts.

Stripe customers will be able to pay with USDC beginning this summer, president Jack Collison said, after the company canned BTC payments in 2018.

The top memecoins are far from previous highs, yet retail investors may view them as fairer opportunities than VC-backed coins with high fully diluted valuations.

“Unsustainable budget deficits” and “persistent inflation” have HashKey Capital analysts predicting a $100,000 to $200,000 Bitcoin price by the end of 2024.

The volume of crypto VC funding in Q1 2024 surged for the first time since the start of the crypto winter in 2022.

The chief technology officer of VC firm Andreessen Horowitz said that memecoins are like risky casinos that deter real builders from the crypto ecosystem.

Brian Rose also aims to implement a new London cryptocurrency to promote financial education in the Greater London area.

Nigeria’s president appointed the new SEC Chair to regulate the capital market, bolster investor confidence, and advance economic development.

The new legislation would impact crypto-asset service providers (CASPs), like centralized crypto exchanges under MiCA (Markets in Crypto-Assets Regulation).

The crypto mixer allegedly handled $2 billion in unlawful transactions and facilitated $100 million in money laundering.

The Cross-Chain Interoperability Protocol will make cross-chain smart contracts more interoperable across nine blockchain networks.

Despite the temporary price depeg, a trader made nearly $400,000 in profit due to the unfortunate incident.

The CBN, through the circular, also stated that regulated financial institutions dealing in crypto or facilitating payments for crypto exchanges are prohibited.

In his latest essay, Arthur Hayes, the former CEO of crypto exchange BitMEX, introduced a bold investment philosophy he calls the “Left Curve.” This strategy diverges sharply from traditional investment approaches typically adopted during bull markets in the crypto world. Hayes’ essay serves not only as an investment manifesto but also as a critique of conventional financial wisdom, encouraging investors to maximize their returns by embracing more aggressive tactics.

Hayes begins by criticizing the common investor mentality that prevails during bull markets, particularly the tendency to revert to conservative strategies after initial gains. He argues that many investors, despite having made profitable decisions, fail to capitalize fully on bull markets by selling their holdings too soon—particularly when they convert high-performing cryptocurrencies into fiat currencies.

“Some of you think you are masters of the universe right now because you bought Solana sub $10 and sold it at $200,” he states, challenging the notion that such actions demonstrate market mastery. Instead, Hayes promotes a strategy of sustained investment and accumulation, particularly in Bitcoin, which he refers to as “the hardest money ever created.”

A central thesis of Hayes’ argument is the critique of fiat currency as a safe haven for profits taken from cryptocurrency investments. “If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up,” Hayes bluntly asserts.

He discusses the inherent weaknesses of fiat money, primarily its susceptibility to inflation and devaluation through endless cycles of printing by central banks. “Fiat will continue to be printed ad infinitum until the system resets,” he predicts, suggesting that fiat currencies are inherently unstable storage of value compared to cryptocurrencies.

Hayes extends his analysis to the macroeconomic factors influencing cryptocurrency markets. He describes how major economies like the US, China, the European Union, and Japan are debasing their currencies to manage national debt levels.

This macroeconomic maneuvering, according to Hayes, is inadvertently setting the stage for cryptocurrencies to rise. He points out the increasing adoption of Bitcoin ETFs in the US, UK, and Hong Kong markets as a tool for institutional and retail investors to hedge against fiat depreciation.

This part of his analysis underscores a broader acceptance of cryptocurrency as a legitimate asset class in traditional investment circles, powered by the realization that traditional financial systems are struggling under the weight of unsustainable fiscal policies.

Hayes also delves into the strategic aspects of market timing, particularly around events known to influence market dynamics, such as US tax payment deadlines and Bitcoin halving. He notes:

As we exit the window of weakness that I forecasted would occur due to April 15th US tax payments and the Bitcoin halving, I want to remind readers why the bull market will continue and prices will get sillier on the upside.

This observation suggests that understanding these cyclic events can provide strategic entry and exit points for maximizing investment returns. Emphasizing psychological resilience, Hayes encourages investors to adopt a mindset that resists the conventional impulse to cash out during brief market rallies. “At this moment, I will resist the urge to take chips off the table. I will encourage myself to add more to the winners,” he advises, promoting a long-term view of investment in cryptocurrencies.

This approach, according to Hayes, is essential for realizing the full potential of crypto investments, particularly in a market characterized by high volatility and rapid gains. In conclusion, Hayes’ “Left Curve” philosophy is more than just an investment strategy; it is a comprehensive approach that encompasses understanding macroeconomic trends, psychological resilience, and strategic market timing.

His essay serves as a guide for investors looking to navigate the complexities of crypto markets with a bold, assertive strategy that challenges traditional financial doctrines.

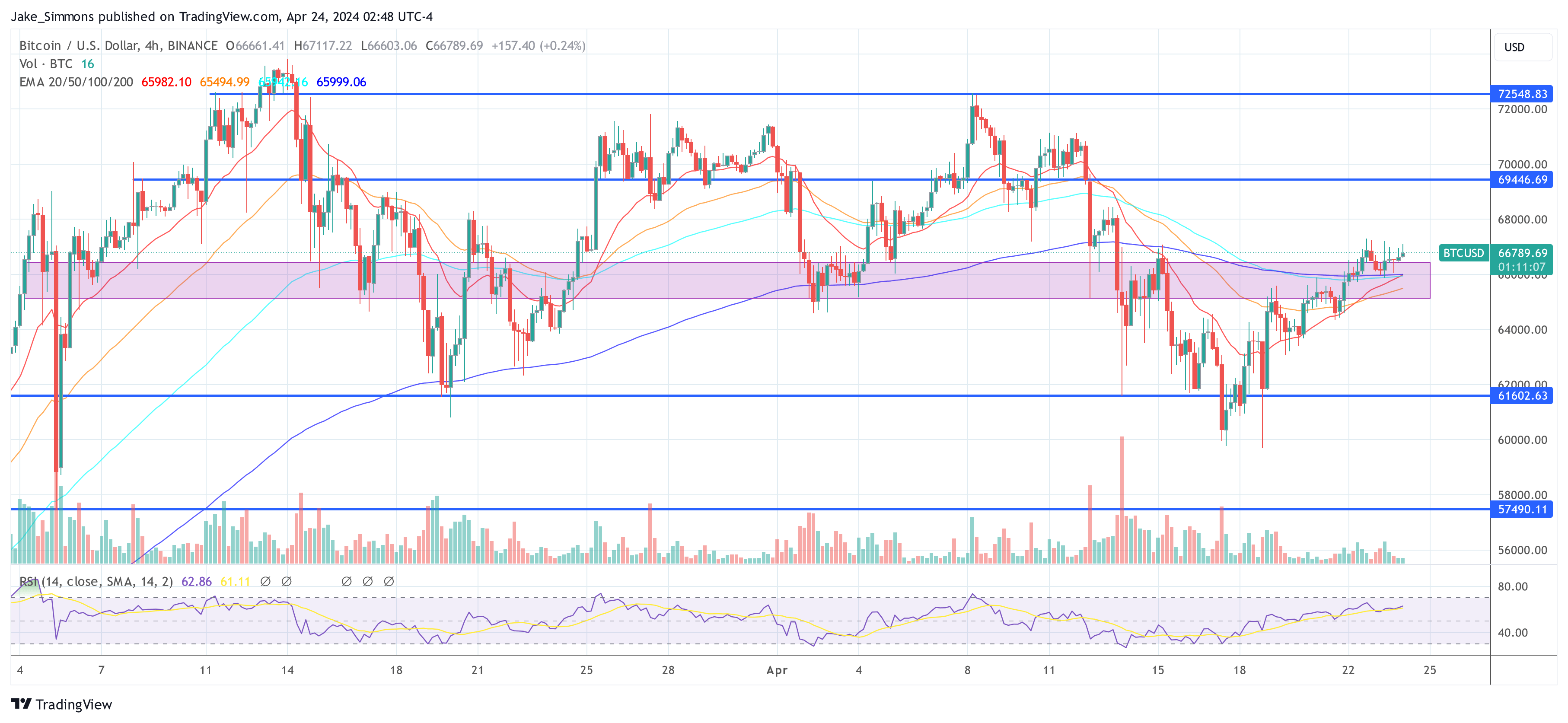

At press time, BTC traded at $66,789.

Crypto trading sensation Ansem, known on X (formerly Twitter) as @blknoiz06, has directed the market’s gaze towards the Bitcoin Runes ecosystem, labeling it as the nascent grounds for the next 100x crypto opportunity, as NewsBTC reported yesterday. Ansem, whose prowess is well-documented through his previous astronomical gains of 170x on Solana (SOL), 520x on dogwifhat (WIF), and 80x on Bonk (BONK), stirred the crypto community with his recent Dogecoin comparison.

On the cusp of Bitcoin’s highly anticipated halving today, Ansem doubled down on his initial assessment, particularly highlighting two tokens within the Bitcoin Runes ecosystem: Bitcoin Wizards (WZRD) and PUPS. He equates WZRD with Dogecoin, suggesting it has the potential to mirror Dogecoin’s viral success. In contrast, he compares PUPS to the lesser-known but highly profitable dogwifhat (WIF).

Related Reading: Elon Musk Latest Tweet: How Much Did Dogecoin Gain From It Today?

In a tweet that caught the eye of both investors and enthusiasts, Ansem elaborated on his reasoning behind the picks, stating:

Great thread, been saying, I believe Runes are next asymmetric 100x opp in crypto. The meme that got DOGE founder interested in Bitcoin & the phrase magic internet money is still used today – representative of bitcoin culture. DOGE equivalent = WZRD, WIF equivalent = PUPS.

Ansem references a thread on X by Immutable Edge (@ImmutableSOL), who delved into the historical and cultural significance of the “Magic Internet Money” meme, originally sparked by mavensbot’s viral Reddit ad.

The “Magic Internet Money” meme dates back to February 18, 2013, when mavensbot, a digital artist, submitted a hand-drawn depiction of a blue wizard to promote Bitcoin on Reddit. This ad, created during Bitcoin’s early adoption phase, was crucial in cultivating a cultural ethos around Bitcoin.

It resonated deeply within the community, encapsulating the whimsical yet revolutionary nature of Bitcoin’s rise. The ad’s simplicity and authenticity resonated with the Reddit community, propelling Bitcoin from a niche internet experiment to a major financial phenomenon. Within weeks of the ad’s debut, Bitcoin’s value surged from $27 to a record high of $1,132 by November 2013.

Bitcoin Wizards, one of the highlighted tokens, aims to rekindle this original spirit. The token leverages the iconic imagery and cultural narrative of the “Magic Internet Money” meme to foster a new wave of interest and adoption. The creators of WZRD are not only paying homage to Bitcoin’s roots but are also embedding this storied meme within the mechanics of a modern cryptocurrency, aiming to capture both nostalgia and innovation.

The Bitcoin Wizards project is part of the broader Bitcoin Runes ecosystem, which reached a lot of hype prior to its launch. According to Ansem, WZRD’s history and deep roots in memes give it the perfect ingredients to become the next Dogecoin, just on Bitcoin Runes.

Moreover, the analyst assessment comes at a critical time for the crypto market, which is often influenced by the narratives that capture the community’s imagination. As the Bitcoin halving event unfolds, many eyes will be on the Bitcoin Runes ecosystem to see if it can indeed replicate the meteoric rises seen in BRC-20 tokens and Ordinals.

At press time, WZRD traded at $12.15, up 70% in the last 24 hours.

One of the crypto community’s most notable traders at the moment, Ansem (@blknoiz06), has recently ignited interest with his latest prediction, claiming another potential 100x opportunity. This time, his focus is on a new development on the Bitcoin network, which he believes is currently undervalued by the market.

Ansem stated via X:

Next 100x opp is runes on Bitcoin, 95% of CT is not paying attention to this at all compare volumes on Solana memecoins to current unisat volume & consider the wealth effect if Bitcoiners have their own native altcoins to buy provenance will b v imp here also imo.

Lookonchain, a reputable on-chain analysis firm, provided an exhaustive look at Ansem’s latest trading history and strategy. Their analysis reveals a pattern of early investments in nascent cryptocurrencies that later became highly lucrative.

Ansem(@blknoiz06) – the best crypto trader who:

170x on $SOL 520x on $WIF 80x on $BONK

Yesterday, he tweeted that the next 100x opp is runes on Bitcoin.

1/

Let’s dig into his trading strategy. pic.twitter.com/vN2N2Aekbz

— Lookonchain (@lookonchain) April 17, 2024

On January 1, 2021, Ansem invested in Solana when it was priced at just $1.5. By November of the same year, the value of Solana had skyrocketed to $260, a return that significantly outpaced market expectations, netting a gain of over 170x.

Ansem’s acute sense of market potential was again on display with his investments in WIF and BONK. His tweet on December 12, 2023, suggesting that WIF had potential similar to SHIB (Shiba Inu), preceded a massive surge in WIF’s value from $0.09 to $4.85.

Similarly, his endorsement of BONK led to an impressive 80x increase in its price. “On October 30, 2023, Ansem tweeted ‘bonk great coin’, and then BONK skyrocketed! 4 months later, BONK exceeded $0.000047,” the firm stated.

Lookonchain further highlighted, “Ansem combines a strategic allocation of 70% in long-term holdings with 30% dedicated to short-term, speculative trades. This balanced approach helps mitigate risk while capitalizing on high-return opportunities. His success is a testament to his deep market insights, disciplined investment strategy, and timely execution.”

In response, prominent crypto analyst Cyclop (@nobrainflip), who boasts 346,000 followers, analyzed Ansem’s current prediction. He explained that the hype revolves around a newly developed protocol named Runes, created by the inventor of Ordinals, Rodarmor. Runes allows for the issuance of fungible tokens directly on the Bitcoin network, operating as a more integrated alternative to the BRC-20 protocol.

Unlike BRC-20, which follows an account model akin to Ethereum’s, Runes utilizes Bitcoin’s UTXO (Unspent Transaction Output) model, potentially offering a more seamless integration with Bitcoin’s existing infrastructure.

Notably, Runes are not just an alternative; they aim to replace the BRC-20 entirely. The protocol charges fees in BTC for creating tokens and is set to launch on Bitcoin’s halving day, April 19. The development of the Runes ecosystem is gaining traction, with various projects, tools, and platforms beginning to emerge.

With the anticipated launch of Runes scheduled for Bitcoin’s next halving day on April 19, the ecosystem around this new protocol is quickly developing. A variety of projects are already preparing to utilize Runes, with tools, launchpads, and other resources being actively developed.

The most notable, according to cyclop, are:

The crypto analyst also advised that the hype around Runes is just starting. The “Ordinals community has spurred numerous projects to offer Runes airdrops. Thanks to Magic Eden, a new tab now conveniently lists all collections confirmed to distribute Runes to holders in one place.”

At press time, PUPS traded at $48.96, down 68% from its all-time high.

Arkham Intelligence, an industry leader in on-chain data tracking, has released a list of the richest people in crypto according to their wallet balances. This list has been making the rounds in the crypto community due to the top 5 alone being worth billions of dollars. But perhaps, what is more interesting is how much of this money has now been deemed inaccessible.

Arkham took to X (formerly Twitter) to share the top 10 richest individuals in crypto ranked by the net worth of their wallet holdings. But the most interesting bits actually lay in the list of the top 5 richest individuals, which included the likes of Tron’s Justin Sun and Ethereum’s Vitalik Buterin.

According to the data shared by Arkham, Justin Sun emerged at the top of the list with a wallet balance of $1.1 billion, followed by Rain Lohmus, the Chairman of LHV Bank, whose wallet is worth $793 million. Next in line is Ethereum founder Vitalik Buterin, with a wallet balance of $782 million.

In fourth place is Stefan Thomas, a software engineer whose wallet holds a considerable $452 million. And then last but not least is James Fickel, with a total wallet net worth of $446 million. Altogether, these crypto millionaires and billionaire, hold a total of $3.5 billion. However, not all of this money is available to the owners.

As Arkham notes in its report, two out of these five individuals are no longer able to access their wallets anymore. The first of these two is Rain Lohmus who had invested $75,000 during the Ethereum ICO. Lohmus’s allocation came out to 250,000 ETH, which has appreciated greatly over time. However, he can no longer access the coins.

According to Lohmus, he had lost access to his Ethereum wallet and was unable to find the key to the wallet. Given this, the coins are presumed to be lost forever, but Lohmus has offered a 50-50 split to anyone who can access the wallet and recover the funds.

Another individual whose coins are deemed lost is Stefan Thomas. Thomas is infamous in the crypto space for throwing out a flash drive that held the private keys to a wallet containing over 7,000 BTC over 10 years ago. Since then, Thomas has led efforts to excavate the landfill where he believes his trash was sent to, in an effort to recover the flash drive and recover the coins. However, he has run into various issues, such as the city not allowing him to excavate the dump site.

The other three on the list still have access to their wallets and are still involved in the crypto space to varying degrees.

There are a couple of events to watch out for this week, as they could prove pivotal in determining the future trajectory of the crypto market. These events could provide some certainty to the market or cause investors to wait on the sidelines for more favorable market conditions.

Some Federal Reserve officials are scheduled to speak at different events this week. One of them is Governor Lisa Cook, who will give a lecture on March 25. Fed Chair Jerome Powell will also participate in a discussion at the Monetary Policy Conference on March 29.

Their speeches are significant as they could provide valuable insights into the current state of the economy and what to expect from the Federal Reserve regarding interest rates in its fight against inflation. Macroeconomic factors like interest rates usually impact the crypto market and partly determine the sentiments among crypto traders.

The crypto market is usually bullish whenever the Federal Reserve adopts a dovish stance on whether or not to hike interest rates. Therefore, these officials sounding positive in their speeches could help boost investors’ confidence in the crypto market since they would be less worried about things on the macro side.

Meanwhile, several economic data will be released this week, including the Consumer Confidence and Consumer Sentiment data and the Personal Consumption Expenditures (PCE) index. These releases offer insights into the economy’s strength and guide the Fed in deciding on future interest rate decisions.

Stakeholders and investors in the industry will no doubt hope that the events lined up for this week will provide a momentum boost for the crypto market. Last week was one to forget as things cooled after weeks of seeing the flagship crypto, Bitcoin, and altcoins make significant runs. This downward trend is believed to have been due to some external factors.

One of them is the net outflows that the Spot Bitcoin ETFs recorded throughout last week, with many investors taking profits from the various funds. These Bitcoin ETFs had previously seen an impressive amount of inflows into them, which positively affected Bitcoin’s price. As such, a trend of outflows was also expected to influence Bitcoin’s price, although negatively.

These Spot Bitcoin ETFs will again be in the spotlight this week, with the crypto community waiting to see if the sentiments among the ETF investors will change. A sustained trend of profit-taking this week could spark another decline in the crypto market.

In a thread on X (formerly Twitter), the popular crypto analyst known as cyclop (@nobrainflip) delivered a bold forecast to his substantial following of 394,000. He proclaimed, “We are close to the biggest altseason in history. Everyone will make x50-x100 on their entire portfolio. $5k portfolio will be around $250k-$500k in 2025. All you need is to buy the right lowcaps.”

This assertion hinges on a strategic selection of low market capitalization cryptocurrencies, which, according to Cyclop, are poised for an exponential surge in value. Cyclop elucidates his strategy by detailing the liquidity flow typically observed during a bull market phase, a sequential process starting with Bitcoin (BTC) and cascading down to meme coins.

He explains, “Here is a typical bull run liquidity flow: 1: BTC pump 2: ETH pump 3: High cap alts pump 4: Low caps pump 5: Memecoin pump.” Importantly, he highlights that high cap memecoins have already experienced their growth phase, suggesting that “lowcap/lowcap memecoins – next” are primed for significant value appreciation.

Within this framework, Cyclop underscores the potential for staggering returns without the necessity for professional day trading expertise. “It’s cause each coin has its maximum, and if its MC is already high, it’s not so far away. But when the market cap is almost at zero, the potential is enormous,” he advises, promoting a hands-off investment strategy focused on the ‘right’ coins.

Cyclop’s watchlist is a selection of ten recently launched projects with low market caps and, in his view, substantial growth potential:

#1 Wolf Wif (BALLZ): A meme coin that took the Solana blockchain by storm, achieving a $75 million market cap within a day of its launch. Despite a subsequent correction, Cyclop views this as an optimal entry point, confidently stating, “I’m holding my BALLZ tight.”

#2 Entangle (NGL): Positioned as a potential leading messaging infrastructure for the Web3 space, Entangle aims to enhance liquidity within the ecosystem. It offers secure, flexible, and interoperable solutions for blockchain data communication, positioning itself as a critical infrastructure for dApps and builders.

#3 StarHeroes (STAR): This esports-centric, multiplayer third-person space shooter game is making waves with its dynamic and competitive gameplay. Cyclop sees this as a revolutionary blend of gaming and blockchain technology, offering intense gaming emotions and a new avenue for esports within the crypto realm.

#4 Heroes of Mavia (MAVIA): A blockchain strategy game that allows players to build bases, engage in battles for cryptocurrency rewards, and form partnerships with landowners. Cyclop highlights its potential in the play-to-earn space, marking it as a standout project.

#5 VoluMint (VMINT): This project introduces a decentralized, AI-driven market-making service, aiming to redefine market-making in the era of blockchain. Cyclop is bullish on its ability to unlock the potential of crypto projects, emphasizing its innovative approach.

#6 SatoshiVM (SAVM): As a decentralized Bitcoin ZK Rollup Layer 2 solution, SatoshiVM bridges the gap between Bitcoin and Ethereum’s EVM, using BTC as gas. This project aims to combine the value and security of Bitcoin with the programmability of Ethereum, creating a powerful ecosystem for decentralized applications. Cyclop notes, “SAVM’s unique positioning as a bridge between BTC and EVM ecosystems presents a groundbreaking opportunity for growth.”

#7 Graphlinq Chain (GLQ): Offering a no-code interface for automating blockchain tasks, Graphlinq Chain simplifies the creation and deployment of blockchain automations. Its suite of tools, including an IDE, App, Engine, and Marketplace, is designed to make blockchain automation accessible to a wider audience. “GraphLinq Protocol demystifies blockchain automation, paving the way for innovative applications and efficiencies,” Cyclop remarks.

#8 zKML (ZKML): This project addresses the pressing need for privacy in digital transactions and communications. By combining zero-knowledge proofs, homomorphic encryption, and multi-party computation (MPC), zKML offers a secure and private framework for blockchain interactions. “ZKML’s focus on privacy-enhancing technologies is timely and critical, offering a secure haven for digital transactions,” observes Cyclop.

#9 Monai (MONAI): Monai stands out for its development of uncensored generative AI tools, integrated with its blockchain, Monad. It features an advanced, unrestricted Large Language Model as its flagship product, aiming to revolutionize the way we interact with AI. “Monai’s pioneering approach to generative AI within the blockchain space is a game-changer, offering unparalleled possibilities,” Cyclop asserts.

#10 EMC Protocol (EMC): Dedicated to AI applications, EMC Protocol is a blockchain network that includes a computing power consensus mechanism. It aims to facilitate the execution of AI tasks within a decentralized framework, including validator, smart router, and computing power nodes. “EMC’s innovative approach to integrating AI and blockchain could redefine the landscape of decentralized applications,” Cyclop concludes.

At press time, cyclop’s top pick – BALLZ – traded at $0.04231, down almost 50% from its alltime-high.

In an analysis shared with his nearly 100,000 followers on X (formerly Twitter), the crypto analyst known by the pseudonym Xremlin (@0x_gremlin) has pinpointed Base as the burgeoning hub for memecoin enthusiasts and investors. This proclamation follows a season of unprecedented gains in the Solana memecoin market, with tokens like BOME, WIF, and SLERF achieving returns ranging from 300x to 1000x.

Xremlin’s insight into the crypto market dynamics suggests a potential replication of these astronomical returns on Base, underlined by a tweet stating, “Meme traders on Solana printed millions this season: BOME: 800x, WIF: 1000x, SLERF: 300x. BASE season is just revving up, and might have a similar rally.”

Meme traders on Solana printed millions this season:$BOME: 800x │ $WIF: 1000x │ $SLERF: 300x$BASE season is just revving up, and might have a similar rally.

List of memes on Base with 10-500x potential⭣ pic.twitter.com/wAs5hde0N9

— Xremlin (@0x_gremlin) March 21, 2024

The transition of focus towards Base is attributed by the analyst to its association with Coinbase and an upcoming product launch aimed at simplifying on-chain trading. Xremlin elaborates, “Why Base? Coinbase has a large user base in the US, but trading on-chain can be too complex for normies. Soon, Coinbase will launch a product that enables its CEX users [100M+] to trade on Base without requiring seed phrases or private keys.”

This move is anticipated to significantly lower the entry barriers for new investors, potentially catalyzing a memecoin rally on the Base platform.

However, amidst the excitement, Xremlin issues a word of caution to their followers: “Remember: Investing in memes is high risk. Only bet what you can afford to lose. Projects might rug, slow rug, or suddenly tank by 50%-70% when the hype fades.” This cautionary advice reflects the inherent volatility and risk associated with memecoin investments, where the line between significant gains and losses can be remarkably thin.

Xremlin’s curated list of Base memecoins is not only varied but also rich with potential, highlighting projects inspired by cultural references, pets of notable figures, and even caricatures of industry leaders. Here’s a closer look at the analyst’s picks:

Xremlin further emphasizes the importance of community and research in navigating the memecoin market: “For those interested in researching Base memes, I recommend joining the /base channel on Warpcaster. Community insight is invaluable, and collective due diligence can help mitigate risks associated with memecoin investments.”

At press time, TOSHI traded at $0.000321653, up 210% in the last three weeks.