After a strong week for bitcoin (BTC) and many other leading cryptocurrencies, traders are now on the lookout for indicators of what could spark the next bull run.

After being battered by losses for the majority of 2022, bitcoin and other cryptocurrencies are on the rise in 2023, leading to predictions that the so-called crypto winter has thawed.

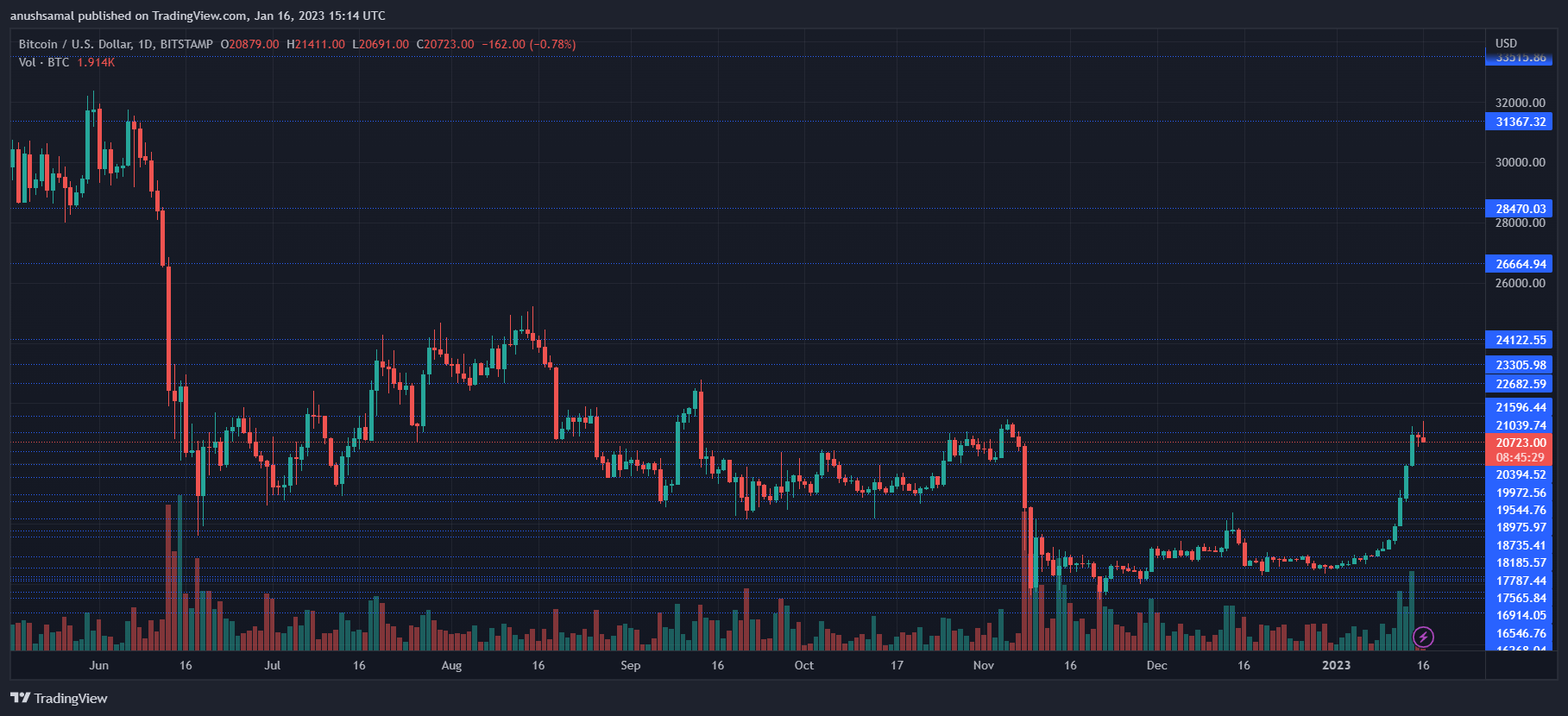

Bitcoin has begun the new year on a bright note. On Saturday, Bitcoin surpassed $21,000 for the first time in 60 days. At the time of writing, BTC is trading at $21,090, up 25% in the last seven days, data by Coingecko show.

Bitcoin Could Still Climb Higher

If this week’s US economic data shows that the Federal Reserve may be nearing the end of its interest rate hikes, the prices of major cryptocurrencies could soar.

Ed Moya, a senior market analyst at Oanda, wrote on Friday:

“Wall Street is very confident that the end of the central bank’s tightening cycle is upon us and that is providing some underlying support for crypto.”

The most recent Bitcoin rise is still a far cry from the alpha coin’s November 2021 record high of $68,990. However, this has provided market participants with enthusiasm.

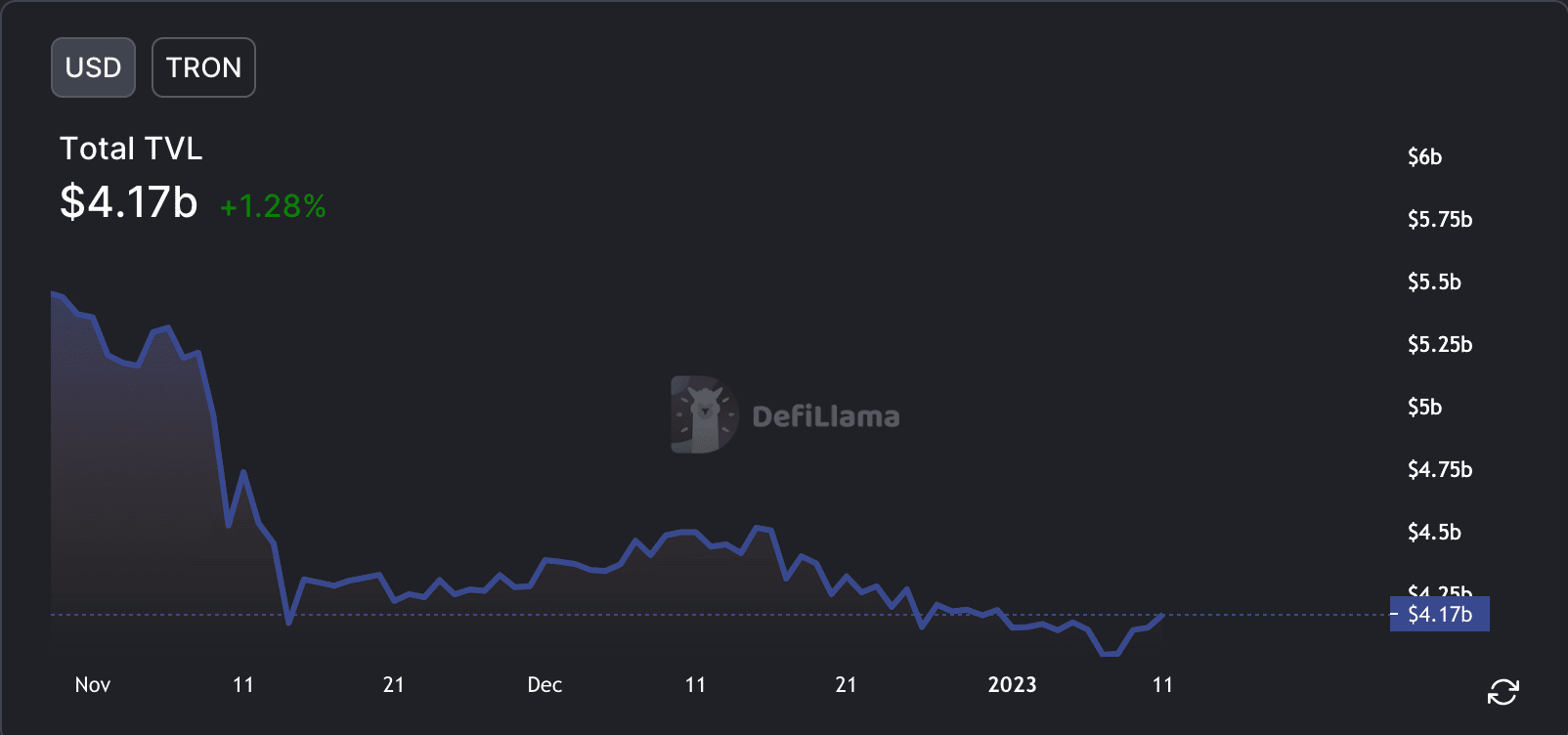

The whole cryptocurrency market lost over $1.4 trillion in value last year because of liquidity troubles, bankruptcies, and the collapse of crypto exchange powerhouse, FTX.

It didn’t take long for the so-called “contagion” to make its presence felt in all corners of the crypto market after the wave of insolvencies.

Bitcoin dropped to a two-year low of $15,480 as the FTX epidemic engulfed the cryptocurrency market.

Whale Accumulation Boosts BTC Price

This spike in Bitcoin’s value is likely fueled by a number of causes. There is a rising expectation among market participants that the Federal Reserve would follow a more benign monetary policy by halting interest rate hikes or decreasing rates in the near future, possibly as early as the end of this year.

Last year, the Federal Reserve raised interest rates seven times, sending risky assets such as equities and tech stocks to slide.

In addition, data released by cryptocurrency company Kaiko indicates rising purchasing optimism among major bitcoin purchasers, commonly known as “whales,” which analysts say helps to support current high levels of demand.

Cryptocurrency whales, or crypto whales, are persons or organizations that possess enormous amounts of a particular cryptocurrency.

Meanwhile, although bitcoin has gained a nice boost at the beginning of 2023, in conjunction with risk assets as mentioned above, market observers say the leading coin is unlikely to retest its all-time high of $69,000, but it may have reached a bottom.

Featured Image from BW Businessworld

to learn more about Polkadot nomination pools and how to stake natively on Polkadot.

to learn more about Polkadot nomination pools and how to stake natively on Polkadot.

(@ryder_ripps)

(@ryder_ripps)

JUST IN:

JUST IN: