The amount stolen through crypto hacks and the number of successful attacks sharply declined in April.

Cryptocurrency Financial News

The amount stolen through crypto hacks and the number of successful attacks sharply declined in April.

Curve Finance awarded cybersecurity researcher Marco Croc with its maximum bug bounty award of $250,000 after thoroughly investigating the security flaw.

Conic Finance was hacked in July draining roughly $3.6 million worth of ether from the protocol.

THORChain $1.32 billion in trading volume over the last week only trails Uniswap and PancakeSwap among non-centralized exchanges.

Mixin Network has offered a $20 million bug bounty to the exploiter behind a $200 million hack to return the remaining funds.

Mixin Network has offered a $20 million bug bounty to the exploiter behind a $200 million hack to return the remaining funds.

Curve Finance’s native token, CRV, has recently experienced a notable uptick in value, driven by a sudden surge in whale accumulation. As the decentralized finance (DeFi) platform’s token rebounds from its November 2022 low of $0.4, crypto enthusiasts are left wondering whether this momentum is sufficient to initiate a sustained bullish trend for CRV.

Over the weekend, cryptocurrency tracker Lookonchain detected an interesting activity involving two significant whales. The first whale orchestrated a substantial withdrawal, amassing a staggering 19.56 million CRV tokens valued at approximately $10.33 million from the popular crypto exchange Binance.

What makes this move even more intriguing is that the whale proceeded to stake the entire sum on Convex Finance (CVX), a DeFi platform intricately designed to empower Curve users in enhancing their rewards.

Not to be outdone, another whale executed a withdrawal of 5.78 million CRV tokens, worth in excess of $3 million, from Binance on a Sunday, further piquing the curiosity of the crypto community.

Whale”0xDf14″ withdrew 5.12M $CRV($2.7M) from #Binance again 6 hours ago.

And the whale has withdrawn a total of 19.56M $CRV($10.33M) from #Binance in the past 3 days.

The whale staked all $CRV on #Convex.https://t.co/eSOmZSlmk8 pic.twitter.com/8fXj2VVk3T

— Lookonchain (@lookonchain) September 25, 2023

The current price of CRV on CoinGecko stands at $0.515, reflecting a 0.1% decline over the past 24 hours but showing a promising seven-day rise of 16%.

Despite the upward surge, CRV is currently confronting a resistance zone in the vicinity of the $0.55 mark, potentially attributable to short-term traders capitalizing on their gains.

In the event that supply pressure mounts, this altcoin could undergo a minor retreat, possibly descending to levels around $0.5 or even $0.45 as it regains its bullish footing.

If the ongoing recovery trend retains its momentum, CRV’s price, according to a price report, may aspire to another notable ascent, targeting a 10% upswing to challenge the upper threshold of a long-standing channel pattern.

Taking a step back to assess the broader picture, the CRV token has endured a prolonged correction phase, ensnared within a descending channel pattern that has persisted since February 2023.

As CRV navigates the currents of the crypto market, the recent surge in whale accumulation adds a layer of anticipation to its journey. Whether this accumulation is indicative of a more sustained bullish run remains to be seen, as the token grapples with resistance levels and supply dynamics.

Nonetheless, the evolving dynamics surrounding CRV underscore the ever-evolving nature of the cryptocurrency space, where market sentiment and investor behavior can rapidly shift the course of a digital asset.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Michael Egorov, founder of Curve Finance, has settled his loan on the Aave Protocol and cut his total debt to $42.7 million. Egorov’s DeFi debt profile was revealed on August 1 following a Curve Finance hack that extracted $73.5 million worth of assets across various liquidity pools.

As expected, the exploit caused a significant decline in the price of CRV, with the Curve governance token losing over 24% of its value in a single day, based on data from CoinMarketCap. This fall in CRV’s market price brought much attention to Egorov’s multiple debt positions.

According to a report by blockchain research firm Delphi Digital, it was revealed that the Curve Finance founder owed around $100 million across several DeFi protocols. Interestingly, these loans were collateralized by 427.5 million CRV tokens, representing 47% of the entire CRV circulating supply.

Therefore, the dwindling price of CRV presented a threat of liquidation, which could have been dangerous to the entire DeFi ecosystem.

According to a report on Wednesday by the on-chain analytics platform Lookonchain, Micheal Egorov has now cleared his debt on the Aave protocol.

The report stated that the Curve Founder deposited 68 million CRV, worth $35.5 million, on DeFi lending protocol Silo before proceeding to borrow $10.77 million worth of the stablecoin crvUSD.

After that, Egorov swapped the crvUSD tokens for USDT and finalized the repayment of his debt on the Aave Protocol.

Michael Egorov deposited 68M $CRV ($35.5M) to #Silo and borrowed 10.77M $crvUSD in the past 2 days.

Then swapped $crvUSD for $USDT and repaid the all debt on #Aave.

He currently has 253.67M $CRV($132.52M) in collateral and $42.7M in debt on 4 platforms.https://t.co/stkFvDrlnv pic.twitter.com/oBQ4yiT9Xs

— Lookonchain (@lookonchain) September 27, 2023

Based on more data from Lookonchain, Michael Egorov’s total debt now stands at $42.7 million spread across 4 lending protocols: Fraxlend, Silo, Inverse Finance, and Cream Finance.

In detail, the Curve Finance founder has his largest debt on Silo, where he owes 17.14 million crvUSD backed by 105.8 million CRV, worth $55.3 million. On Fraxlend, Egorov owes 13.08 million FRAX, collateralized by 68.7 million CRV, valued at $35.94 million.

While on Inverse Finance, Michael Egorov has an outstanding debt of 10 million DOLA, backed by 66.18 million CRV, worth $34.5 million. The Curve Finance founder’s lowest debt can be found on Cream Finance, which comprises 2.02 million USDT and 506,000 USDC, secured by 13 million CRV, valued at $6.8 million.

Altogether, Egorov’s $42.7 million debt is backed by 253.67 million CRV, worth $132.53 million, representing 28.87% of the total CRV circulating supply.

CRV trades at $0.516 when writing, with a 2.99% gain on the last day. Meanwhile, the token’s daily trading volume is down by 0.73%, valued at $33.85 million. CRV ranks as the 70th largest cryptocurrency with a market cap value of $452.87 million.

Curve Finance founder Michael Egorov still has a debt of $42.7 million across four protocols, including Silo, Fraxlend, Inverse and Cream.

CRV, the native currency of Curve Finance, the decentralized exchange focused on stablecoins, is shaking off August’s weakness and printing higher highs when writing on September 22. Trackers reveal that CRV is up 22% in the past two weeks, adding 10% in the last week alone.

Coincidentally, there has been increased activity from a whale moving CRV from Binance, the world’s largest crypto exchange by client count.

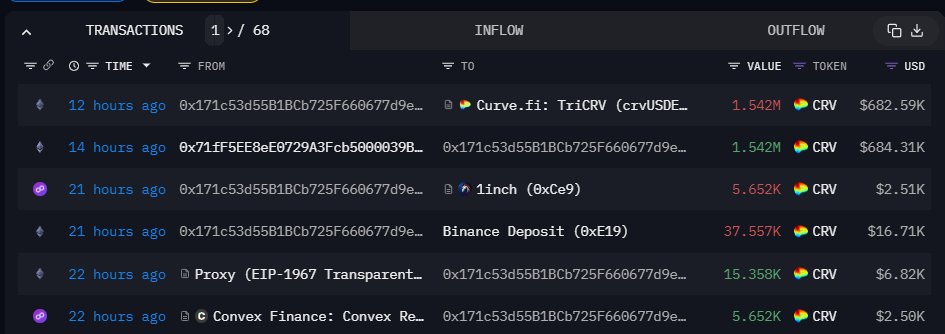

According to The Data Nerd, a tracker, a whale transferred 1.542 million CRV, worth roughly $684,000, from Binance. Afterward, the whale, only identified as “0x171,” added liquidity to Curve Finance.

Over the last week, the whale has been actively supplying liquidity to Curve Finance, providing 5.36 million CRV worth $2.27 million.

CRV is the governance token in CurveDAO, the decentralized autonomous organization (DAO) behind Curve Finance. Since the exchange is decentralized, CRV holders have voting rights. Moreover, they can receive rewards whenever they supply liquidity to any of Curve Finance’s pools.

Curve Finance used an automated market maker (AMM) model for the trustless swapping of stablecoins, including DAI, USDT, USDC, and other tokens like ETH and wrapped Bitcoin (wBTC). However, to function optimally, Curve Finance relies on liquidity pools where users can supply liquidity and get a share of fees distributed in CRV.

The withdrawal of coins from Binance to a non-custodial wallet is a vote of confidence for CRV. The token has been free-falling in Q3 2023. To illustrate, CRV crashed by 32% in August alone.

The draw-down was worsened by the broader contraction in crypto occasioned by waning momentum around the approval of several complex derivatives for Bitcoin and Ethereum. At the same time, regulatory actions, especially from the Securities and Exchange Commission (SEC), significantly impacted sentiment and token prices.

The free-fall of CRV can be directly pinned to an exploit of multiple Curve Finance liquidity pools in late July 2023. In a re-entrancy attack, a hacker exploited a vulnerability in the older version of a Vyper compiler, draining over $61 million worth of tokens from Curve Finance’s pools.

Through the re-entrancy attack, the hacker could infinitely withdraw deposited tokens from Curve Finance’s pools, resulting in losses.

Curve Finance has since patched the vulnerability, but CRV prices are yet to recover despite the recent pump. Also, its co-founder and CEO, Michael Egorov, had to liquidate a big chunk of CRV that he had used to secure loans on multiple platforms, including Aave.

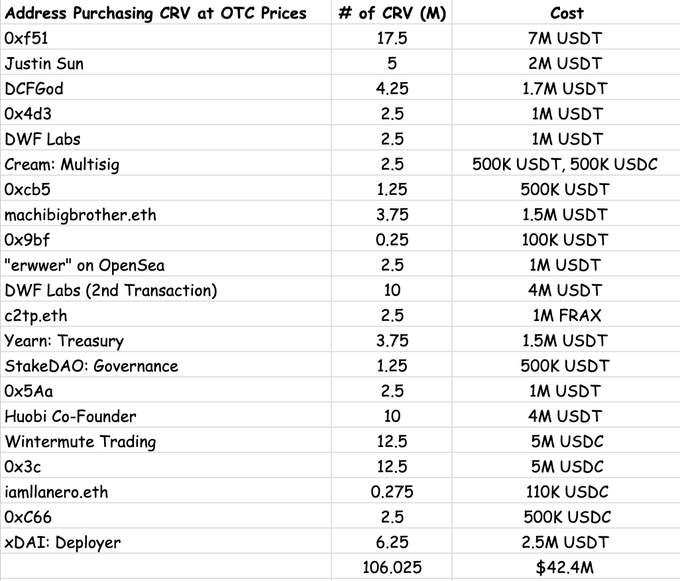

By early August, Egorov had sold 106 million CRV via over-the-counter (OTC) trades at a discount to multiple entities. Top buyers included Justin Sun, the co-founder of Tron, who bought 2 million CRV, and Jeffrey Huang, who acquired 3.75 million CRV.

According to an analysis from investment manager firm VanEck, exchange volume across DeFi protocols declined to $52.8 billion in August, 15.5% lower than in July.

A judge ruled a California courtroom is the wrong venue since Egorov wasn’t living in the state when the alleged misdeeds took place.

The DeFi ecosystem had another exploit of over $2 million on a stablecoin liquidity pool this past week, just weeks after the Curve Finance exploit.

Binance jumped in with a $5 million Curve token investment to help with efforts to minimize the risk of contagion.

Binance jumped in with a $5 million Curve token investment to help with efforts to minimize the risk of contagion.

Curve Finance (CRV), a leading decentralized finance (DeFi) protocol, announced significant progress in its recovery efforts following a recent hack that resulted in losing $73.5 million across several projects within its factory pools.

The attack on July 30 exploited a critical security flaw known as a “reentrancy vulnerability,” allowing malicious actors to drain funds from Curve’s smart contracts.

In a significant effort, Curve Finance has successfully retrieved 70% of the funds affected by the hack. While this achievement marks an important milestone, an active investigation is underway to recover the remaining balance and hold the perpetrators accountable.

Understanding the gravity of the situation, Curve Finance has also taken proactive measures to ensure a fair and transparent distribution of the recovered funds to affected users.

The protocol is diligently working to measure the respective shares of each impacted account, aiming to facilitate an equitable restitution process that prioritizes user protection and trust restoration.

Curve Finance’s recovery efforts are further bolstered by their recent announcement of a $1.85 million bounty. This generous reward will be granted to anyone who can provide accurate information leading to the identification and apprehension of the attackers holding the remaining funds.

By offering this substantial bounty, Curve Finance actively encourages community participation and collaboration to expedite the investigation and bring the perpetrators to justice.

Following a thorough investigation, Curve Finance discovered that the exploit primarily targeted the aleth, peth, mseth, and crveth pools.

The vulnerability stemmed from a bug within the vyper 0.2.15-0.3.0 version, which the protocol promptly identified as the root cause of the breach. By swiftly pinpointing the issue, Curve Finance was able to take immediate action to mitigate any further risk to its users.

It is important to note that all other pools on Curve Finance have been confirmed as safe and unaffected by the exploit, according to Curve’s update. This assurance gives users the confidence to continue utilizing the platform, knowing that their funds remain secure within these pools.

Alongside the technical remediation, Curve Finance collaborates with security experts, auditors, and the broader DeFi community to conduct thorough audits and implement additional security measures.

This collaborative approach aims to reinforce the protocol’s resilience and prevent similar incidents in the future. Overall, Curve Finance’s recovery of 70% of the hacked funds, coupled with its ongoing investigation and bounty initiative, underlines the protocol’s commitment to user protection and the broader DeFi community.

According to Token Terminal data, Curve Finance’s circulating market cap currently stands at $518.76 million, reflecting a decrease of 22.29% over the analyzed period.

The fully diluted market cap, which represents the potential future market value of the project, is estimated at $1.97 billion.

Curve Finance’s total value locked (TVL), a crucial indicator of the protocol’s popularity and user engagement, currently amounts to $2.44 billion. Despite a decline of 35.19% over the analyzed period, Curve Finance maintains a substantial TVL, highlighting its significance within the DeFi landscape.

Featured image from iStock, chart from TradingView.com

Aave token holders are voting on three proposals that could reshape the protocol’s exposure to Curve DAO token.

From PayPal’s entry into the stablecoin market to regulatory challenges faced by Worldcoin in Kenya, the crypto world continues to be a blend of innovation and controversy.

Curve Finance, a popular decentralized (DeFi) protocol, has recently announced that it was rewarding persons capable of identifying the exploiters behind the draining of over $61 million from the platform’s stable pools on July 30.

The huge bounty offer is open to every person who can pinpoint the individual behind the incident in such a way that would lead to definitive legal repercussions.

Curve Finance announced the public offer using an Ethereum transaction’s input data, noting that the allowed time for the voluntary return of the funds connected to the Curve exploit was 08:00 UTC, and that time is now elapsed.

Curve and other protocols that were affected by the attack had previously offered a 10% bug bounty to the hacker on August 3. Upon agreeing to the offer, the hacker returned part of the stolen assets to JPEGd and Alchemix but did not refund other affected pools.

Since the time allowed has elapsed, Curve announced that any person capable of identifying the hacker would receive assets worth $1.85 million. This recent announcement was extended in scope to include members of the general public.

According to Curve, while the deadline for the voluntary return of stolen funds had passed, should the hacker elect to return the stolen funds, the platform “…will not pursue this further.”

While returning the parts of the funds earlier, the hacker left a message that was seemingly targeted at Curve and Alchemix teams, noting their intention to return the funds. However, the hacker stated that the decision to return such funds was not based on fear of being recognized but rather out of a desire not to “ruin” the projects associated with the exploit.

Members of the Curve Finance community were left shocked after a hacker utilized vulnerable versions of the Vyper programming language to implement reentrancy attacks on stable pools within Curve Finance on the 31st of July.

The attack drained Curve Finance of over $61 million, including $13.6 million from Alchemix’s aIETH-ETH, $11.4 million from JPEGd’s pETH-ETH, and $1.6 million from Metronome’s sETH-ETH. The event raised concerns about the likely fallout in the cryptocurrency ecosystem, especially with respect to the risks posed to every pool using Wrapped Ether (WETH).

The DeFi community rallied around to provide support to Curve Finance and on the 31st of July, a white hat hacker was able to successfully recover from the exploiter about 2,879 Ether worth about $5.4 million, which was later returned to Curve Finance. Another ethical hacker also recovered about 3,000 ETH and refunded it to Curve Finance’s deployer address.

Curve Finance is extending a $1.85 million bug bounty offer to anyone who can identify the exploiter of its stable pools.