The Mixed Reality company has raised nearly $4 billion, as metaverse tokens are solidly in the green.

Decentraland (MANA) Leads Crypto Market Gains, Here’s Why

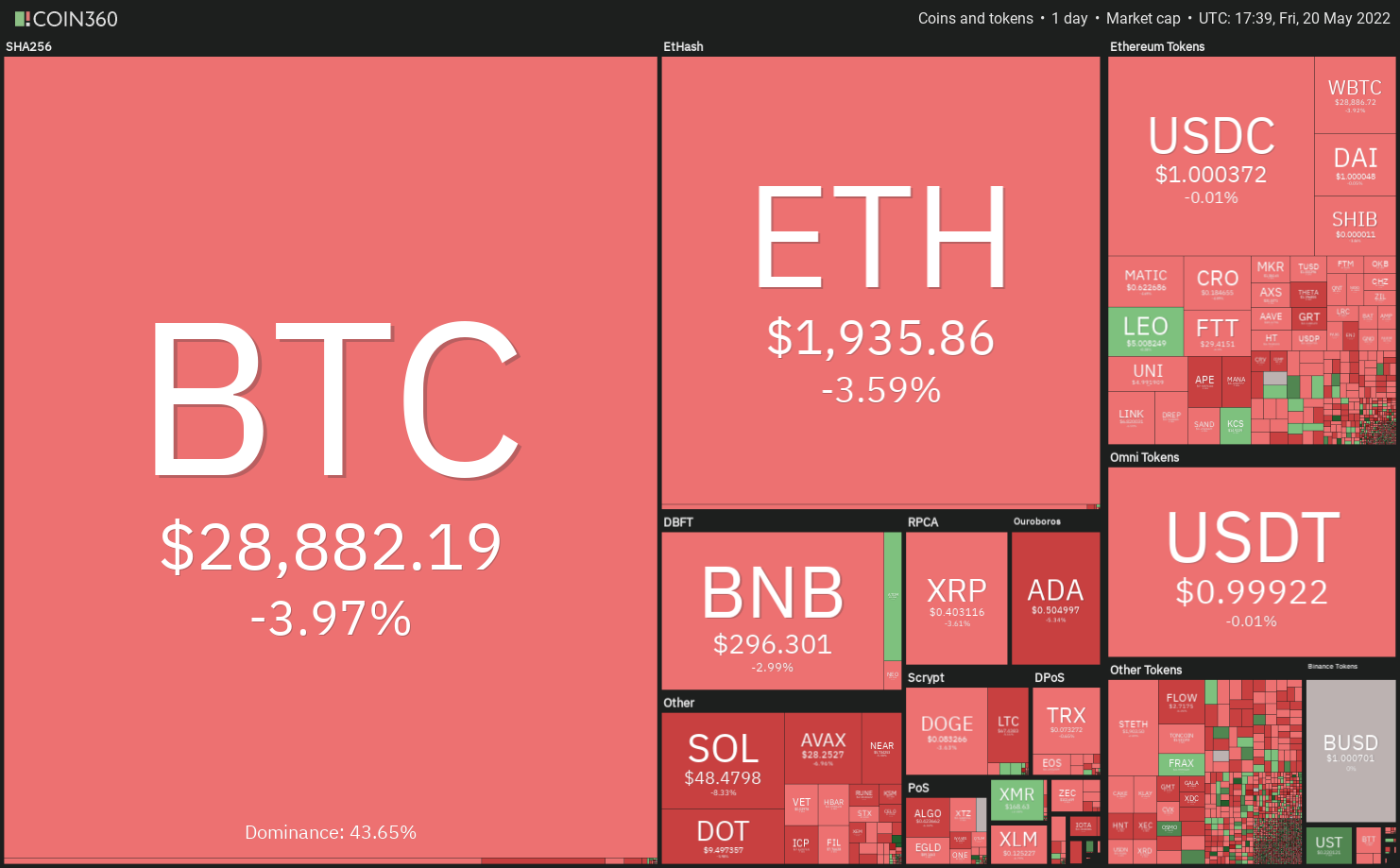

Decentraland (MANA) is currently ahead of the rest of the crypto market after seeing almost double-digit gains in the last day. This incredible recovery comes at a time when the broader crypto market is following in the steps of Bitcoin and shedding most of its first quarter’s gains. So what could be driving the price increase of MANA?

Rumors Of Apple Metaverse Circulate

The rumors about Apple’s very own metaverse first started circulating on Monday when a Twitter user made a post about it. In the tweet, Idi Wertheimer pointed to the fact that tech giant Apple was allegedly launching its own mixed-reality headset. As a result, Wertheimer believes that metaverse coins are going to start pumping based on this news.

CT is completely oblivious to the fact that Apple is about to launch a mixed reality headset in 3 weeks

Metaverse shitcoins are going to pump so hard it’s not even funny

But you morons keep buying influencer coins

Ok

— Udi Wertheimer

(@udiWertheimer) May 15, 2023

Rumors about Apple working on its own metaverse didn’t just start now as it has since been speculated that the company would build one to compete with Meta’s (formerly Facebook) Oculus series. However, Apple has never confirmed nor denied if it was working on its own metaverse.

Research on our end turned up an article from a website called Tom’s Guide which points toward the tech giant’s plans to enter the virtual and augmented reality space. But instead of the anticipated Apple Glasses, the article refers to an entirely new device which is rumored to be called ‘Reality Pro’.

While Apple fans have waited long for a launch of VR/AR devices, venturing into the sector hasn’t been backed internally from all indications. Previously, executives reportedly vetoed the design team which believed that the device is not yet ready for launch. But it remains to be seen if the company will follow through and launch the device

Decentraland (MANA) Picks Up Steam

With the rumors of Apple launching its own metaverse picking, the price of MANA, one of the largest metaverse projects in the crypto space, has been seeing positive reversals. Despite the low momentum in the market, MANA has been able to rise over 9% in the past day. This recovery has brought the MANA price back above $0.5 and its trading volume surged to $161.4 million during this time as well.

MANA is not the only token to have benefited from the Apple rumors. Another metaverse token The Sandbox (SAND) has been on the rise as well. SAND is up 3.98% in the last 24 hours, enabling it to beat the resistance at the $5.2 level.

It is rumored that Apple’s device will drop at the WWDC 2023 event held later this year. If this happened, then the price of metaverse coins could explode leading up to the event, as well as after it.

The Metaverse Is Facing a ‘Cooldown Moment’ Amid Crypto Winter

That isn’t necessarily a bad thing, Cathy Hackl, chief metaverse officer at Journey, said. There are still people building in the ecosystem.

Metaverse NFT Trading Volume Hit New All-Time High, DappRadar Says

Virtual land trading spiked this past quarter with 147,000 trades generating $311 million in trading volume, according to a new report.

Meta’s NFTease and AI’s Impact on Web3

Meta Platforms announced it was ending its support for NFTs after less than a year from its initial test program. The move is a setback for Web3 creators who use social media to promote their art and interact with their community – and signals that Meta maybe hasn’t yet figured out how to dive into Web3.

Avatars, Get Ready to Strut: Decentraland to Host Second Metaverse Fashion Week

The event will see Dolce & Gabbana and Tommy Hilfiger return with new virtual activations, while Coach and Adidas are set to debut their digital wearables on the popular metaverse platform.

5 altcoins that produced double-digit gains as Bitcoin price rallied in January

Bitcoin’s strong monthly performance translated to outsized gains in APT, GALA, T, MANA and SOL, making them the top performing altcoins in January.

3 reasons why the MANA and SAND metaverse token rally could end soon

Apple’s rumored VR headset launch appeared to fuel a sharp rally in metaverse tokens, but data suggests that the momentum is unsustainable.

Bitcoin price consolidation opens the door for APE, MANA, AAVE and FIL to move higher

BTC could take a break from its sharp rally and if BTC price bounces off underlying support, APE, MANA, AAVE and FIL could breakout.

Decentraland (MANA) Swells 55% – Are Metaverse Tokens Back?

MANA is the native token of the Decentraland ecosystem which, as the time of writing, has seen growth enough to recoup losses post-FTX collapse. According to CoinGecko, the token is up 55% in the weekly timeframe with the biggest gains made during the monthly time frame at 105%.

With 2023 showing a renewed interest in crypto, Decentraland has a lot to unpack this month for users, traders, and investors as they released their manifesto detailing plans to improve user experience and making it easier for creators to enter the world of the metaverse with ease.

The Decentraland Manifesto

The Decentraland team recently posted on their blog about how this year would be the “Year of Creators.” According to Decentraland, it will continue its mission it set itself from the start of 2017: to establish a decentralized platform where users can help build and grow.

The blog post said:

“Decentraland, anyone can extend the capabilities of the virtual world’s platform, audit it, contribute to it, and build on top of it—all the code is open source. To that end, in 2023 Decentraland will continue to be developed as a public good in the era of the internet.”

The manifesto detailed several goals that the ecosystem wants to achieve this year. Namely, the developers aim to achieve a better environment for creators, to make Decentraland more fun, and to make the performance of the ecosystem better. This would drive the platform to become a dominant player in the metaverse space.

In the 18 months since its birth, Decentraland’s DAO has developed into a basic decision-making system for high-level deliberations concerning the Decentraland ecosystem and the metaverse in general.

In order to address the growing demand for governance and stewardship of progressive decentralization, the DAO’s procedures and processes have continued to expand with the community’s increasing self-governance experience and strength, according to the manifesto.

What Does This Mean For MANA?

As the time of writing, MANA is changing hands at $0.6210 with the token being rejected at $0.7567. This led to the token retesting its current support at $0.6352 which, if broken, could lead the bears to test further support ranges in the next few days or weeks.

If the token buckles under the rejection, we might see MANA at $0.5397 support which could easily be breached. However, with the detailed roadmap provided by the devs, MANA will have a strong enough investor sentiment that it will retest $0.7567 once the rejection reaches its bottom.

Investors and traders should brace for short to mid term volatility as the token tries to consolidate above $0.6352. If MANA bulls are successful in entrenching the token above $0.6352, investors and traders will have another chance to target $0.7567 or higher.

As the development of Decentraland continues, expect MANA to reach new highs this year.

Featured image by Coinspeaker

Decentraland (MANA) Sheds 90% In 2022 Despite Solid NFT Volume Performance

Decentraland (MANA), the cryptocurrency launched in 2020 by Ariel Meilich and Esteban Ordano, failed to take advantage of some of the positive developments that happened within its ecosystem this year as it closes 2022 in a “beaten” state.

Over the last 12 months, the digital coin has shed 91% of its value, failing to recover from the massive price dumps it experienced triggered by the a series of unfortunate events that plagued the crypto space and the growing uncertainty in the market.

According to latest tracking from Coingecko, at the time of writing, the digital token is changing hands at $0.2941 and has lost 10.3% of its value during the past seven days.

The last 30 days have been rocky for Decentraland as well, as the altcoin ended up depreciating in value by 27.3%.

This really is unfortunate, considering the crypto’s ecosystem has been making impressive progress in the NFT realm.

Decentraland: 440% Growth In Minted NFTs

The metaverse-based gaming platform seemed to have focused most of its attention to the non-fungible token (NFT) space this year, as evidenced by its incredible performance pertaining to the industry.

In its yearend performance report, Decentraland disclosed that for the year 2022, there were 2.7 million unique NFTs that have been released on its platform.

With such a figure, on a year-over-year (YoY) basis, the project enjoyed a 440% increase in the volume of NFT assets minted on its network.

Decentraland was also proud to announce that it will end 2022 with a unique active user count of 1 million after it tallied a 13% jump in that particular department over the last 12 months.

Moreover, the project also managed to grow its sales volume by 510% during the same time period after it sold 143,900 wearable NFTs.

However, even with this superlative showing, Decentraland’s MANA failed to catch a break from its bearish streak.

What MANA Holders Can Expect In 2023

There’s a bit of good news for holders of the Decentraland altcoin as Coincodex predicts a possible increase in value in the coming days.

According to the online cryptocurrency information provider, over the next five days, the digital asset’s trading price is expected to rise by more than 2% and will change hands at a value of $0.2977.

Meanwhile, 30 days from now, the crypto is expected to hit and surpass the $0.30 mark once again as it is expected to trade at $0.3305.

If these forecasts translate into reality, MANA holders and investors could finally find a little breathing room to take a break from the challenging landscape of crypto industry today.

–

Featured Image: Lumiere Children’s Therapy

Decentraland launches virtual property renting for LAND owners

The metaverse platform announced that users who own LAND within Decentraland can officially rent out the rights to the space through the digital marketplace.

MANA Bloats 3.5% In Last 24 Hours, And Traders Now Smell Profit

MANA, the cryptocurrency used as payment for goods and services in the metaverse project Decentraland, has already lost 33% of its value over the last 30 days.

After going all the way up to $0.7339 on November 5, the asset was on a consistent decline that pulled it down to a monthly low of $0.3611 on November 22.

Below, a summary of how MANA has been performing in the last few days:

- MANA registered an increase of more than 6% over the last seven days

- The crypto asset succeeded in recapturing the $0.40 marker

- A climb above the $0.50 category remains possible for the token

Since then, the digital token has engaged in multiple attempts to trim its losses, starting with recapturing the crucial $0.4 marker. So far, the crypto has been successful in this endeavor.

At the time of this writing, according to tracking from Coingecko, the altcoin has managed to increase its value by 3% during the last 24 hours to trade at $0.4174.

Over the previous seven days, MANA has tallied an impressive gain of 6.2% and its price action indicates traders are poised to make profit with the asset.

More Bullish Breakout Possible For MANA

When the bulls successfully found a resting zone at $0.2572 after the FTX implosion last month that made the cryptocurrency lose all its gains prior to the unfortunate event, MANA price movement ended up being caught in an ascending triangle pattern.

Source: TradingView

Source: TradingView

In crypto space, this kind of price trajectory denotes a bullish rally and, in the case of the crypto, some of its technical indicators are suggesting it is not yet done recovering its losses and is headed for another upward breakout.

Its Relative Strength Index (RSI) is steadily rising and has moved out of the oversold territory, indicative of diminishing seller influence and increasing buying opportunities.

Moreover, after being flat for about two weeks, the altcoin’s On-Balance Volume (OBV) moved up, indicating a rise in trading volume brought about by healthy buying momentum.

Finally, MANA has established a bullish MACD which is considered to be a buy signal for an early uptrend.

Given all of these considerations, experts predict that if Bitcoin, being the leader of the pack, is able to recapture and hold the $17K turf, the Decentraland digital token will have $0.4740 and $0.5054 as its next destination.

Investors Should Still Be Wary

Holders, prospective buyers and traders must not be complacent due to the idea that they could make sizable profit from MANA right now as there’s still a chance that the bullish thesis could be negated.

Analysts believe that if the crypto fails to close today’s sessions with a price that is higher than the $0.3572 support zone, it will abandon any chance it has of hitting its next targets.

Moreover, Bitcoin is also integral to MANA’s progress as its failure to sustain the $17K region could doom the 57th largest cryptocurrency in terms of market capitalization.

At the time of this writing, BTC is changing hands at $17,025 and is dangerously close of falling back to the $16,000 region once again.

MANA total market cap at $772 million on the weekend chart | Featured image from CoinCentral, Chart: TradingView.com

MANA Loses 80% Of Its Value Over The Last 12 Months – No More Blessings To Come?

The MANA cryptocurrency used in Decentraland has clearly seen better days. From its 2017 high of $5.85, MANA has dropped 80% in value in the last 12 months, as shown by the most recent available data.

Presently, a share of MANA can be purchased for as little as $0.4773. Investor confidence has tanked in light of the current market situation, making a comeback for the crypto a little difficult.

As a result, the question arises as to whether MANA has any chance of survival or whether it is a cryptocurrency that has already passed its expiration date.

Tough Road Ahead For MANA

Investors, traders, and would-be buyers should not expect MANA’s current position to work miracles, as the market has turned hostile due to the panic caused by the ongoing FTX disaster

Technically, the token is not doing very well either. Token prices are hovering above the 50 percent Fibonacci retracement line. Furthermore, it has recently experienced a reversal in price action.

The RSI readings, which are currently in the oversold portion of their range, lend credence to this theory. However, the Chaikin Money Flow index is not promising.

Chart: TradingView

The current reading of -0.25 for this indicator suggests that bears are in complete control of the market. The current trading range for the day sits between $0.4566 and $0.7389.

The connection between the token and the Metaverse may have contributed to a number of price-increasing variables. Recently, a parcel of Metaverse land in Decentraland was purchased for $15,585, or approximately 30,000 MANA coins.

Such advancements bring MANA and Decentraland into the limelight, increasing interest in the coin and the protocol.

However, these may be short-term improvements. Despite the developing retreat, the EMA ribbon continues to suggest shorting the currency as the downtrend persists.

Crypto Winter Freezes The Token

As the crypto winter freezes MANA from its tracks, the token’s price can either breach the present support at $0.4566 and fall to a new low of $0.3522, or it can breach the immediate resistance at $0.5287.

However, bulls should defend the $0.4566 support line, as a breach of this line could spark further selling.

Investors and traders in MANA should also monitor the prices of Bitcoin and Ethereum, as MANA has a correlation of 0.98 and 0.94 with the two leading cryptocurrencies, respectively.

When the market rebounds, MANA will follow the performance of the other two cryptocurrencies. But for the time being, bulls should concentrate on consolidation and possibly target the 61.80 Fib level.

MANA total market cap at $946 million on the daily chart | Featured image from Medium, Chart: TradingView.com

Norwegian gov’t agency opens metaverse office in collaboration with EY

The Brønnøysund Register Center collaborated with EY to open a virtual office in the Decentraland metaverse to reach its next generation of users.

Decentraland (MANA) Seen Getting Pulled Downstream In Next 7 Days – Here’s Why

Decentraland (MANA) managed to tally a 3.4% increase over the last 24 hours as the crypto space is looking at a possible bullish recovery.

In doing so, the crypto managed to trim its losses on its biweekly and monthly charts to 2.7% and 9.4%, respectively.

- Decentraland rallies over the last 24 hours to trade at $0.633

- MANA at the mercy of selling pressure that might soon put it to another downward trend

- Decentraland might soon test the $0.544 and $0.584 range

This, however, might not be enough to revise the bearish thesis that threatens Decentraland should it fail to strongly and convincingly break free from its downtrend momentum that started since August of this year. In fact, MANA could be looking at a possible heavy pull downstream in the next coming week.

MANA’s overall valuation of $1.152 billion, which ranks it as the 51st largest cryptocurrency in terms of market capitalization, is in danger of declining sharply if the asset continues to spiral down.

At press time, tracking from Coingecko shows the altcoin is trading at $0.633 and is about to enter next month with a price level that is almost 90% lower than its $5.85 all-time high (ATH) that it attained, incidentally, on November 25, 2021.

Bearish Momentum Likely For Decentraland

Technical indicators and analysis points bring bad news for MANA which is experiencing difficulty to sustain the $0.75 marker.

The asset’s failure paved the way for more selling on the market and that’s one of the reasons why Decentraland is in danger of another major decline.

Source: TradingView

Source: TradingView

The asset’s daily chart showed it settled to 38.2% Fibonacci retracement level which might pull it back to $0.65, losing the gains it had over the last 24 hours.

Traders are also in a good position right now to orchestrate a price decline all the way to $0.584, with the possibility of a fall to an even lower trading price of $0.544. There is also strong selling pressure that will not help the asset’s hopes of turning the tables around for another price pump to happen.

Additionally, for almost two months now, MANA’s Relative Strength Index (RSI) stayed below the 50-neutral zone.

Positive Developments In The Metaverse

Meanwhile, dubbed as “the virtual destination for virtual assets,” Decentraland continues to look for different ways to improve its metaverse capabilities.

Through a summer training camp organized by Cominted Labs and Web3 developer Dogman, a team of eager 15-year old metaverse builders will try to gain more experience and refine their craft inside MANA protocol’s digital universe.

This team will be responsible for designing and coding unique experience for users and Decentraland expressed their happiness and excitement to help in the development of these young, enthusiastic and talented individuals.

MANA total market cap at $1.18 billion on the daily chart | Featured image from Coin Central, Chart: TradingView.com

Disclaimer: The analysis is based on the author’s personal knowledge and should not be construed as investment advice.

Ecosystem is bullish on the Metaverse, no matter what the numbers imply

Despite the reports surfacing of low numbers of unique active wallets on Decentraland, the metaverse hype, investment and development go on.

Metaverse trading volume plummeted 80% but hype hasn’t decreased

A DappRadar report found that while trading volumes have taken a sharp hit during Q3, the average number of NFT sales for these 10 projects only decreased by 11.55%.

DappRadar explains why it counted less than 40 active users on Decentraland

DappRadar only tracks users directly interacting with blockchain, a new blog post explains. For example, Axie Infinity’s daily user count is over 100,000, but DappRadar measures it only at 20,000.

Metaverse platforms refute ‘misinformation’ about daily active users

User data from DappRadar consists of metaverse users who have also made an in-game purchase with the project’s native token, but the Decentraland and Sandbox projects disagree with that criteria.