The Sei (SEI) Network is a Cosmos-based layer-1 blockchain that aims to change the world of digital asset trading, especially in the decentralized exchange (DEX) ecosystem. It was specifically designed for the world of trading, featuring various sectors of the cryptocurrency space spanning GameFi, NFTs, and, most especially, decentralized finance (DeFi). Sei is positioned as the “Decentralized NASDAQ,” as it offers a seamless blend of centralized finance (CeFi) trading experiences with decentralized finance tools.

Since its inception, it has established itself as a major player in the cryptocurrency space by providing cutting-edge features and advantages over rivals. With its innovative technology stats and passionate community, it has become one of the fastest-growing Layer 1 blockchains for trading and other purposes.

At its core, the SEI token is designed to optimize and streamline business operations and interactions. It is expected to be not just a cryptocurrency but a comprehensive solution that addresses several challenges in the contemporary blockchain ecosystem.

Who Are The Founders Of Sei Network?

Sei (SEI) network founders and brains behind the SEI are Jayendra Jog, Dan Edlebeck, and Jeffrey Feng. Jayendra Jog was the former lead software engineer at Robinhood, a popular centralized crypto exchange.

Dan Edlebeck is the co-founder and CEO of Exidio, a decentralized VPN application in the Cosmos ecosystem. Lastly, Jeffrey Feng brought his investment experience from his role at Goldman Sachs.

Investors And Institutions Backing the SEI Token

The Sei network has a lot of credible investors and institutions backing it, such as Coinbase, which is one of the largest centralized exchanges (CEX) in the world; Jump, Muitcoincapital, Layer Zero, GSR, and many more, as shown in the screenshot from the website below.

What Sei Network Aims To Achieve In The Crypto Space And Beyond

Sei aims to foster smart, efficient, and sustainable enterprises, and it does so by leveraging the power of blockchain technology to automate processes, reduce costs, and eliminate intermediaries. This makes Sei tokens a frontrunner in the race toward a decentralized future.

Sei token is unique in its approach and functionality as it goes beyond the standard features of cryptocurrencies and offers a sophisticated governance model encouraging active community participation. It takes the decentralization aspect a notch higher by ensuring fair and transparent decision-making.

The token is designed for compatibility and scalability, allowing seamless integration with new and existing business systems. This means whether you are a large corporation like Blackrock, which manages $10 trillion in assets, or a small business startup, the Sei token is designed to fit right into your operations, providing you with the benefits of blockchain without the hassle of overhauling your business system.

How Does Sei (SEI) Work?

One of the major problems with decentralized exchange (DEXs) is that orders are either not processed on-chain or are processed on-chain on a fast blockchain at the expense of decentralization and security.

Given this bottleneck, the Sei network has implemented several innovative features to resolve the challenges faced by decentralized exchanges (DEXs) by combining off-chain speed with on-chain security. It aggregates orders at the end of the block and executes them all at once rather than executing them one at a time, and in this way, it prevents the persistent problem of front-running in decentralized trading.

The Sei network also makes use of native price oracles that minimize external dependencies while offering trustworthy data feeds. It handles the placement and execution order of a single transaction as opposed to doing so in two (2).

What Makes The Network Unique?

The Sei network stands out from the rest due to its self-executing smart contracts with the terms of the agreement directly written into code lines. The code and the agreement contained therein then exist across a distributed blockchain network.

This means that the transactions are irreversible and trackable, and they do not require a third-party intermediary. This automation process drastically reduces costs and increases efficiency, making transactions smooth and very easy.

Sei tokens also utilize a decentralized infrastructure, which means any single central entity or authority does not control it. Instead, control is spread out amongst many different nodes or computers that participate in the network to ensure that even if one node goes down, the entire network continues running smoothly.

The decentralized nature of the SEI token fosters a sense of community and mutual trust among its users. It boasts a democratic system that encourages active participation and promotes transparency and fairness.

Notable Features Of The Sei (SEI) Network

Twin-Turbo Consensus Mechanism: The Sei network leverages the Cosmos SDK and Tendermint Core to provide decentralized trading apps with speed, security, capital efficiency, and decentralization.

Parallelization: The Sei blockchain divides work into smaller chunks, processing and executing them simultaneously to prevent front-running.

Native Order Matching: The Native Order Matching feature ensures that decentralized exchanges (DEXes) are able to have their own central limit order book (CLOB).

Order Bundling: Sei offers order bundling at the client and chain level to enhance user experience and efficiency.

Price Oracles: It’s integrated into a native system for trustworthy assets with real-time oracles provided by validators, meaning that Sei provides users with an Oracle module that functions as a token price reference.

Lightning Speed Transactions: Sei claims to offer 600 milliseconds in transaction finality, making it highly scalable compared to other crypto projects like Bitcoin, Ethereum, and even Solana.

Fee Structure: At launch, SEI tokens have no chain-level trading fees; however, decentralized exchanges (DEX) may introduce their transaction fees through smart contracts.

Potential Applications Across Various Industries

Banking and Financial Industry: The Sei blockchain technology is designed to streamline operations, eliminating the need for intermediaries and reducing transaction costs. This will bring a new level of transparency to the banking and financial industry, with every transaction recorded and traceable on the blockchain.

Medical and Healthcare Industry: The Sei network offers an efficient way to manage and share patient data securely. This can help eradicate fraudulent activities, improve patient care, and enhance data interoperability.

Supply Chain (Import and Export) Industry: The Sei blockchain network token can ensure the authenticity and traceability of products, from the raw materials to the end consumers. Every step can be recorded on the blockchain, providing full visibility and reducing the emergence of counterfeit goods and products.

Impact on the Environment: Sei’s eco-friendly consensus mechanism significantly reduces energy consumption compared to traditional cryptocurrency. Its smart contracts can automate carbon credit trading, supporting businesses in their sustainability efforts.

Digital Identities: The Sei network can be employed to develop a secure decentralized solution for managing digital identities and protecting individuals’ privacy and digital data.

The Tokenomics Of SEI Coin

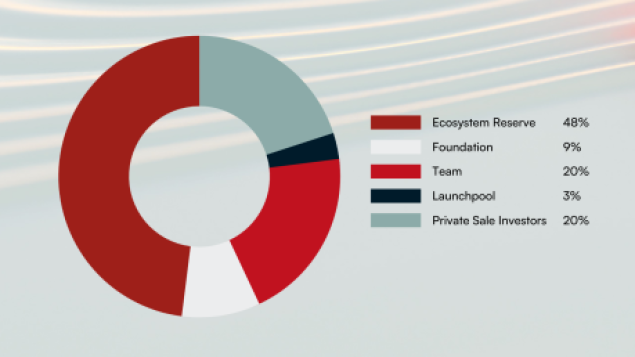

Sei’s native cryptocurrency, SEI, does not have a maximum supply of tokens to be mined. However, it has a total supply of 10 billion coins. This means all of the tokens in circulation have been free-mined on the blockchain, including those that are locked or reserved. The token has a circulating supply of 2.4 billion at the time of publication.

According to its website, 48% of the supply is in an Ecosystem Reserve, with Private Sale Investors and the Team receiving 20% of the supply, respectively. 9% of the supply went to the Sei Foundation and the Launchpool received 3% of the supply.

Sei token is up 619% since its all-time low of $0.09536 on October 19, 2023, and its latest all-time high of $0.8778 was recorded on January 3, 2024. With a market cap of $1.5 billion, it is currently the 48th-largest cryptocurrency in the industry.

Conclusion

The Sei network aims to solve issues not only in the crypto industry but also in other industries. This includes the likes of the banking and financial industry, where it aims to reduce the costs of transactions by eliminating the use of intermediaries and providing top-notch security measures to protect user privacy and identities.

The blockchain is energy-efficient compared to the likes of Bitcoin as it doesn’t consume as much energy. Its super-fast 600-millisecond transaction finality makes it highly scalable on a scale comparable to Kaspa, whose full confirmation transactions are at an average of 10 seconds.