This marks the first period of Ethereum becoming inflationary in the past year and a half since the Merge took place.

Cryptocurrency Financial News

This marks the first period of Ethereum becoming inflationary in the past year and a half since the Merge took place.

Ethereum (ETH) is poised for a notable improvement with the impending Dencun upgrade to enhance the network’s scalability. However, amidst this anticipation, QCP Capital, a seasoned crypto asset trading firm, has shed light on an emerging trend that might influence Ethereum’s price trajectory.

The firm’s analysis reveals a shift in “risk reversals” for Ethereum, turning negative for upcoming expiries. This shift indicates growing concerns among investors about a potential decrease in ETH’s price, as a negative risk reversal often suggests a market leaning towards protective measures against a downturn.

Notably, this trend towards negative risk reversals has been attributed to an increased interest in put options, which serve as a hedge against potential losses for those speculating on price increases.

Moreover, the broader altcoin market participants are similarly hedging their investments in Ethereum, aiming to mitigate risks associated with their altcoin holdings.

QCP Capital’s insights into the market dynamics also highlight an underlying nervousness about Ethereum’s price stability, especially in light of the considerable leverage within the market.

The firm cautions about the potential for a market correction, albeit with an expectation of strong buying interest in the event of any price dips. QCP noted in the report:

Altcoin speculators might also be buying ETH puts as a proxy to hedge altcoin downside. This makes us wary of a possible correction given the amount of leverage in the market. However, we think that the market will buy any dip aggressively.

Additionally, Ethereum’s spot-forward spreads have decreased slightly, contrasting with Bitcoin’s sustained high spreads. Commenting on the implication for investors, QCP Capital stated:

A sharp drop in spot price is likely to drag the forward spreads lower as leverage longs get taken out.

Despite the cautionary signals, Ethereum continues to perform “robustly” in the crypto market, closely trailing Bitcoin regarding price movements. Currently trading above $4,000, Ethereum has witnessed a modest increase of 0.6% over the past 24 hours.

Moreover, data from IntoTheBlock (ITB) reveals an encouraging statistic: over 94% of ETH addresses are presently profitable, suggesting a strong holding pattern among investors and a reduced likelihood of selling pressure. This scenario could potentially set the stage for a price uptick.

However, it’s important to note that Ethereum’s growth trajectory, while positive, has not mirrored the notable surge Bitcoin experienced following the approval of its spot Exchange-Traded Fund, indicating a more measured pace of appreciation for ETH.

Featured image from Unsplash, Chart from TradingView

Ethereum (ETH) has completed a major software upgrade, Dencun, that promises to make utilizing the network ecosystem more cost-effective. This update specifically targets Layer 2 (L2) networks, such as Arbitrum (ARB), Polygon (MATIC), and Coinbase’s Base, which are interconnected with Ethereum.

With Dencun, transaction costs on these networks have significantly decreased, with fees dropping from dollars to cents or even fractions of a cent.

Considered the most significant change in Ethereum’s end-user experience, the Dencun upgrade is expected to foster the development of new applications and services by significantly reducing expenses.

As NewsBTC reported on Tuesday, the update introduces a new data storage system, departing from the traditional approach of storing Layer 2 data on Ethereum itself. Adopting a new “blobs” repository reduces data storage costs since information is warehoused for only about 18 days instead of indefinitely.

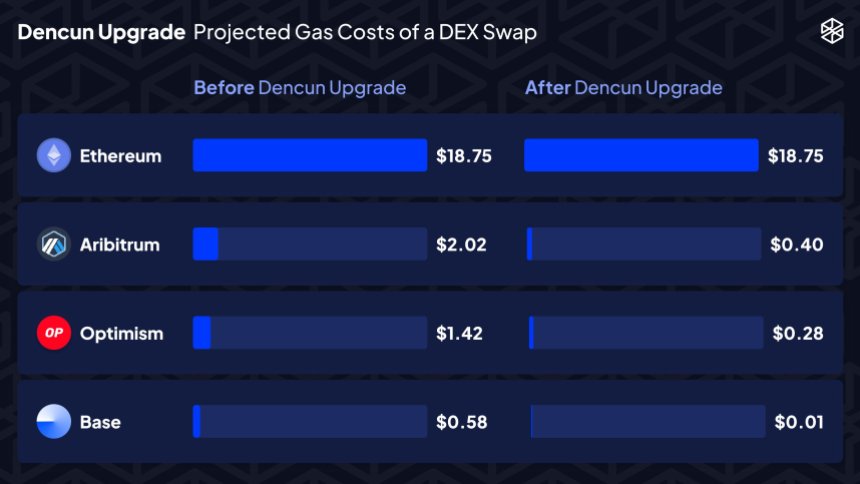

One of the notable benefits of the Dencun upgrade lies in its impact on decentralized exchanges (DEXs) and gas costs. For instance, projected gas costs for popular Layer 2 networks, such as Arbitrum, Optimism, and Coinbase’s Base, are set to be significantly reduced.

The projected savings translate into a reduction of Arbitrum’s swaps from $2.02 to $0.40, Optimism’s swaps from $1.42 to $0.28, and Coinbase’s Base swaps from $0.58 to $0.01, emphasizing the pivotal role of this upgrade.

As the upgrade was successfully launched on the mainnet, Tim Beiko, Ethereum Foundation core developer, expressed his satisfaction with the work accomplished and claimed:

Dencun is both the most complex fork we’ve shipped since the Merge, and tied for “most total EIPs in a fork” with Byzantium. There were more teams than ever involved in the process, and it somehow all worked out smoothly…! Grateful to work with all of them, onto the next one.

Layer 2 network Arbitrum has provided insights into the upgrade process. It will take around one to two hours for blob transactions to commence posting and for the new pricing changes specified by EIP-4844 to come into effect.

ArbOS Atlas, an upgrade that supports Arbitrum Chains, will introduce further fee reductions for Arbitrum One, set to be activated on March 18th. The updated configurations include a reduction in the Layer 1 (L1) surplus fee from 32 gwei to 0 per compressed byte and a reduction in the L2 base fee from 0.1 gwei to 0.01 gwei.

The Dencun upgrade unlocks cost-saving opportunities for Layer 2 networks and addresses congestion concerns by freeing up more space on the Ethereum network for additional transactions. While the upgrade offers enhanced efficiency, it does come at the cost of no longer retaining a complete record of all data indefinitely.

However, as Layer 2 networks embrace this new update to the Ethereum ecosystem, the stage is set for accelerated adoption, usage, and broader accessibility within the Ethereum community and its underlying protocols.

Dencun Upgrade Fails To Propel ETH Above $4,000

Despite the successful upgrade, ETH’s price remains unaffected, continuing to consolidate below the $4,000 threshold. The token attempted to surpass this crucial resistance level on Monday and Tuesday but failed to sustain its position above it.

For over 24 hours now, ETH has been trading between $3,930 and $3,970. Nevertheless, it’s worth noting that ETH has maintained its upward momentum, with gains exceeding 18% over the past fourteen days and nearly 60% over the past thirty days.

Additionally, introducing the Dencun upgrade is expected to drive increased demand for ETH, potentially sparking a renewed uptrend that could bridge the gap between current trading prices and its previous all-time high (ATH) of $4,878, achieved in November 2021.

Featured image from Shutterstock, chart from TradingView.com

The highly anticipated Dencun upgrade for the Ethereum (ETH) ecosystem is on the horizon, promising to bring significant cost reductions and notable changes to Layer 2 (L2) networks. The update, scheduled for March 13, will introduce a new data storage system known as blobs, reducing congestion on the Ethereum network and driving key new features in various areas.

As highlighted in a recent Bloomberg report, Dencun aims to reduce the cost of Layer 2 networks such as Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base by enabling previously costly transactions to become significantly cheaper.

In particular, transactions that used to cost $1 can now cost as little as one cent, the report notes, while others that used to cost cents can be reduced to a fraction of a cent. This cost reduction is expected to improve the end-user experience greatly and is a significant improvement over previous upgrades such as the September 2022 “Merge.”

One of the most crucial aspects of the Dencun upgrade is the introduction of blobs, a new type of data repository for Layer 2 networks. Currently, Layer 2 blockchains store their data on the Ethereum network, leading to substantial storage costs passed on to applications and users.

However, with blobs, Layer 2s will store their data for a significantly shorter period, about 18 days, resulting in lower costs. While this shift sacrifices storing a complete record of all transactions forever, it frees up more space on the Ethereum network for other transactions, reducing congestion.

According to the report, introducing blobs through the Dencun upgrade also paves the way for using artificial intelligence (AI) in various applications. For example, games can incorporate AI-driven non-player characters, enabling advanced gameplay capabilities and a deeper experience.

In decentralized finance (DeFi), automated market makers can incorporate “complex trading strategies” driven by AI models. This newfound flexibility and complexity are expected to foster innovation and drive the development of advanced applications in the Ethereum ecosystem.

In addition, the Dencun upgrade is expected to reduce the operating costs of Layer 2 chains significantly. Previously, launching and operating a Layer 2 project required considerable venture capital backing. However, Bloomberg reports that with the cost reductions brought about by Dencun, small teams may be able to launch and maintain Layer 2 chains.

While the adoption of blobs and the associated cost advantages are expected to drive immediate benefits, it is worth noting that the cost of blobs may increase over time as demand grows.

How Could Dencun Boost ETH Price?

While the price of ETH has corrected by over 3% in the past 24 hours, resulting in a current trading price of $3,916, the Dencun upgrade holds the potential to have a positive impact on its price.

The upgrade aims to significantly reduce costs for Layer 2 networks and enhance the overall user experience, making Ethereum a more appealing platform for decentralized applications (dApps) and other use cases. By lowering transaction fees and improving scalability, Dencun could attract more users and developers to the Ethereum ecosystem, potentially driving up demand for ETH tokens.

Despite the ongoing correction, it is worth noting that the current price of ETH is not far from its two-year high of $4,084. However, it’s important to consider that the price has formed a double top pattern on the daily time frame for two consecutive days, which may present a near-term hurdle for ETH’s price. The market’s reaction and the ability of ETH to surpass its nearest resistance level remain to be seen.

Featured image from Shutterstock, chart from TradingView.com

As the Ethereum ecosystem braces for the much-anticipated Dencun upgrade, renowned crypto analyst Miles Deutscher provides an in-depth look at the altcoins poised for significant growth.

Scheduled for March 13, the Dencun upgrade is a critical hard fork aimed at enhancing Ethereum’s scalability, security, and usability. Deutscher’s insights reveal how specific Layer 2 (L2) solutions are uniquely positioned to benefit from the upgrade’s introduction of Proto-Danksharding and other key enhancements.

Deutscher explains, “The Dencun upgrade, especially with EIP-4844, represents a paradigm shift in how Ethereum will handle transactions. By drastically lowering gas fees and increasing throughput, we’re looking at a more accessible, efficient blockchain.” This upgrade is part of Ethereum’s broader roadmap, known as “The Surge,” focusing on scalability improvements.

#1 Polygon (MATIC/POL): With its impending rebrand and investment in zk-technology, Polygon is at a pivotal juncture. Deutscher notes, “Polygon’s deep dive into zk-rollups could redefine its position in the L2 landscape, making MATIC an attractive asset for forward-looking investors.”

#2 Arbitrum (ARB): As the leading L2 by TVL and transaction volume, Arbitrum’s robustness is undisputed. “Arbitrum has cemented its position as a powerhouse in the L2 space, and the Dencun upgrade will only amplify its strengths,” Deutscher remarks.

#3 Optimism (OP): Positioned as a strong contender in the L2 space, Optimism’s ecosystem is set to expand. “The announcement of Optimism’s fourth airdrop is not just a reward for its community but a strategic move to bolster its ecosystem’s vibrancy,” says Deutscher.

#4 COTI Network (COTI): With the launch of V2 and its innovative ‘Garbled Circuits,’ COTI introduces a groundbreaking privacy solution. Deutscher observes, “COTI’s approach to privacy on the blockchain through ‘Garbled Circuits’ is a game-changer, potentially setting a new standard for private transactions.”

#5 Mantle (MNT): Highlighting Mantle’s rapid growth, Deutscher points out, “With $1.5 billion in ETH now staked as mETH, Mantle is not just growing; it’s thriving, supported by strategic airdrops that reward its community.”

#6 Metis (METIS): Identified as a potentially undervalued project, Metis’s upcoming initiatives are a beacon for investors. “Metis’s decentralized sequencer and the substantial METIS Ecosystem Fund are laying the groundwork for a robust, decentralized future, making it an intriguing prospect post-Dencun,” Deutscher explains.

Deutscher also casts a spotlight on Manta Network, Starknet, zkSync, and Linea as projects to watch, emphasizing the widespread impact of the Dencun upgrade. He advises, “The ETH/L2 trade is increasingly compelling as we approach the Dencun upgrade. Shifting a significant portion of one’s portfolio into the Ethereum ecosystem seems prudent, given the transformative potential of the upcoming changes.”

At press time, ETH still traded just below the $3,000 mark.

Despite concerns over network congestion and high gas fees, Ethereum remains bullish in the long term, according to borovik.eth–a partner at Rollbit, who posted on X on December 26. The key factors driving the positive outlook are pointing to Ethereum’s developer ecosystem, its role in the broader blockchain ecosystem, and the launch of numerous Layer-2 solutions (L2s).

Borovik.eth remained deviant and optimistic about ETH, even with Solana (OSL) and other layer-1 coins like Cardano (ADA) soaring in 2023. In the analyst’s view, Ethereum’s scaling challenges are manageable, believing that developers will find ways of “resolving this concern permanently over the long term.”

Based on this optimism, the Rollbit partner believes that ETH will likely recover strongly in the coming sessions considering the level of development, especially of layer-2 scaling options meant for the pioneer smart contract platform. According to Borovik.eth, the development of layer-2 off-chain options backed by massive companies, for instance, Coinbase, a crypto exchange, and venture capitalists (VCs), positions Ethereum (ETH) favorably for a bull run.

As of December 26, ETH remains in an uptrend but is cooling off after solid gains in Q4 2023. At spot rates, ETH is underperforming most layer-1 platforms like Injective Protocol (INJ) and Solana (SOL), whose prices rallied, reaching new 2023 highs. ETH prices are still trending below $2,400, a critical resistance level. If bulls overcome this line, ETH may fly towards $3,500 or better in the months ahead.

The spike in SOL’s valuation, especially in H2 2023, has led to a comparison with ETH. Even so, most traders are optimistic. Arthur Hayes recently stated that users should begin rotating funds from SOL to ETH, an endorsement of the second most valuable coin by market cap.

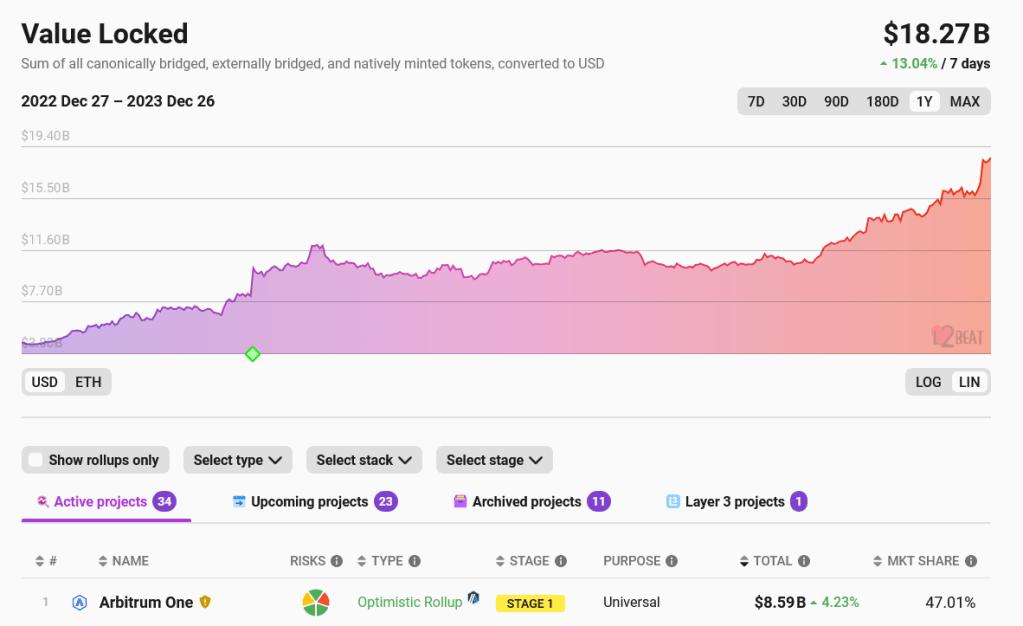

While Ethereum faces challenges around on-chain scaling, developers have been working hard to resolve this issue. The release of layer-2 off-chain options using rollups has been key in this drive. Most of these solutions, including Arbitrum and Optimism, have been critical in alleviating pressure from the mainnet, thus reducing gas fees. According to L2Beat, layer-2 protocols manage over $18 billion as total value locked (TVL). There are also 34 active projects, with 23 more being developed.

Among the big companies hitching the layer-2 ride is Coinbase, where through Base, users can transact cheaply while relying on the Ethereum mainnet for security. According to Borovik.eth, over 60% of Base’s revenue is from rollup fees charged, highlighting the importance of their scaling solution and the role Ethereum plays in all this.

Related Reading: Shiba Inu Whale Moves $45 Million In SHIB, Bullish?

The upcoming Dencun Upgrade set for integration next year will further slash layer-2 fees. Developers plan to release this update in the Goerli test network as early as mid-January 2024.