Ethereum’s recent Dencun upgrade, which was designed to reduce fees and help scale the network, has caused ether {{ETH}} to revert back to an inflationary asset — potentially reversing one of the key benefits of last year’s Merge.

Ethereum Hit by ‘Blobscriptions’ in First Stress Test of Blockchain’s New Data System

Ethereum fees for “blobs” – the blockchain’s new dedicated class of cheaper data storage – spiked Wednesday after a project called Ethscriptions created a new way of inscribing data, known as “blobscriptions.”

First Mover Americas: Robinhood Shares Jump, Layer 2s Become Cheaper

The latest price moves in bitcoin (BTC) and crypto markets in context for March 14, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Euphoria Or False Dawn? Why The Ethereum $4,000 Party Might End Soon

Ethereum (ETH) experienced a euphoric surge in interest as bullish sentiment enveloped the crypto sector. The recent approval of the Bitcoin ETF served as a catalyst, propelling Ethereum’s price to new heights. However, as the thrilling ride continues, concerns are emerging regarding the sustainability of this upward trajectory.

Increased Demand For Put Options Fuels Market Correction Jitters

Investors are flexing their risk management muscles as they flock towards put options, seeking to protect their gains from potential losses. The mounting demand for these safeguards indicates a shift in sentiment towards a more cautious and bearish outlook for Ethereum. With significant leverage in the market, speculators are wary of a potential correction that could dampen the party atmosphere.

Dencun Upgrade Looms: Anxiety Surrounds Ethereum’s Future

All eyes are on the upcoming Dencun upgrade, set to revolutionize the Ethereum ecosystem. However, the anxiety surrounding this crucial development is palpable. Past upgrades, such as the ill-fated Merge update, which aimed to transition Ethereum to a Proof of Stake network, resulted in a massive correction. As anticipation builds, the market braces itself for the impact this upgrade could have on Ethereum’s price and sentiment.

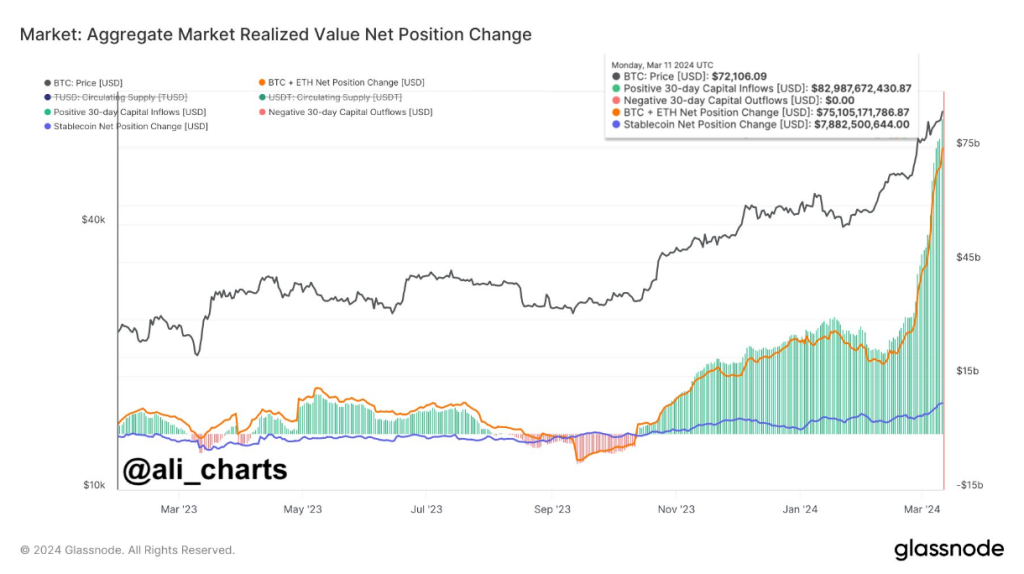

Influx Of Funds Bolsters Market, Ethereum ETF Remains A Wild Card

Amidst the uncertainties, the crypto market experiences an awe-inspiring influx of approximately $83 billion, with Bitcoin and Ethereum accounting for a staggering $75 billion of that total.

This considerable investment, as revealed by popular crypto analyst Ali Martinez, signifies growing interest and confidence in digital assets. The influx of funds further bolsters the market, while the uncertain approval of an Ethereum ETF continues to be a wild card that could reshape Ethereum’s future.

Ethereum’s Price Soars, Traders Eyeing New Milestones

As the rollercoaster ride continues, Ethereum’s price skyrockets, surpassing $4,000 and igniting the imagination of traders. The sentiment surrounding the Dencun hard fork upgrade is a driving force behind this surge.

With expectations set high, traders are eagerly eyeing a monumental milestone of $5,000 post-upgrade. The reduction in transaction fees promised by the upgrade further fuels optimism among ETH enthusiasts.

Navigating Uncertainty: A Balancing Act For Ethereum’s Future

In the midst of this thrilling ride, Ethereum finds itself caught in a delicate balancing act. The uncertainty surrounding the approval of Ethereum ETF applications adds an additional layer of complexity to the market dynamics.

While the odds may have dropped, the impact of an ETF approval, as highlighted by Ali Martinez, cannot be underestimated. It could potentially propel Ethereum’s adoption and trigger a surge in price.

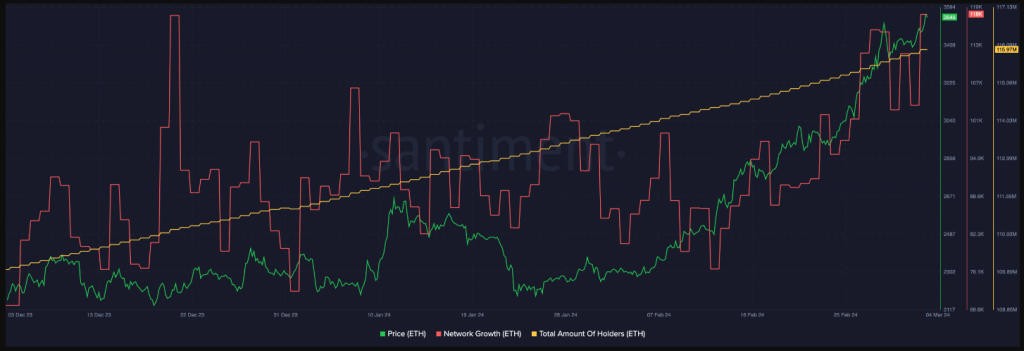

Meanwhile, new addresses were still becoming interested in Ether. Alongside that, the overall count of holders who were amassing ETH had also increased.

Amidst Ethereum’s exhilarating climb past $4,000, the question lingers: Is this euphoria sustainable or a false dawn? With concerns of a potential market correction and uncertainty surrounding Ethereum ETF approval, the party’s fate hangs in the balance.

Featured image from Pinterest/Pexels, chart from TradingView

Layer 2 Blockchains Become Cheaper After Ethereum’s Dencun Upgrade

The upgrade allows layer 2 solutions to store data in “blobs” instead of the expensive call data.

‘Dencun’ Upgrade Officially Deployed On Ethereum Mainnet, ETH Price Holds Steady Below $4,000

Ethereum (ETH) has completed a major software upgrade, Dencun, that promises to make utilizing the network ecosystem more cost-effective. This update specifically targets Layer 2 (L2) networks, such as Arbitrum (ARB), Polygon (MATIC), and Coinbase’s Base, which are interconnected with Ethereum.

With Dencun, transaction costs on these networks have significantly decreased, with fees dropping from dollars to cents or even fractions of a cent.

Ethereum Dencun Upgrade And Cost Savings

Considered the most significant change in Ethereum’s end-user experience, the Dencun upgrade is expected to foster the development of new applications and services by significantly reducing expenses.

As NewsBTC reported on Tuesday, the update introduces a new data storage system, departing from the traditional approach of storing Layer 2 data on Ethereum itself. Adopting a new “blobs” repository reduces data storage costs since information is warehoused for only about 18 days instead of indefinitely.

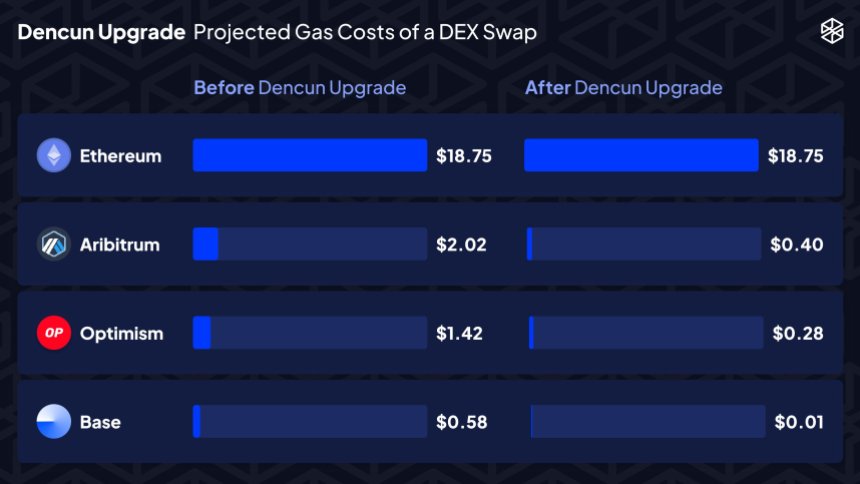

One of the notable benefits of the Dencun upgrade lies in its impact on decentralized exchanges (DEXs) and gas costs. For instance, projected gas costs for popular Layer 2 networks, such as Arbitrum, Optimism, and Coinbase’s Base, are set to be significantly reduced.

The projected savings translate into a reduction of Arbitrum’s swaps from $2.02 to $0.40, Optimism’s swaps from $1.42 to $0.28, and Coinbase’s Base swaps from $0.58 to $0.01, emphasizing the pivotal role of this upgrade.

As the upgrade was successfully launched on the mainnet, Tim Beiko, Ethereum Foundation core developer, expressed his satisfaction with the work accomplished and claimed:

Dencun is both the most complex fork we’ve shipped since the Merge, and tied for “most total EIPs in a fork” with Byzantium. There were more teams than ever involved in the process, and it somehow all worked out smoothly…! Grateful to work with all of them, onto the next one.

Blob Transactions And Pricing Changes

Layer 2 network Arbitrum has provided insights into the upgrade process. It will take around one to two hours for blob transactions to commence posting and for the new pricing changes specified by EIP-4844 to come into effect.

ArbOS Atlas, an upgrade that supports Arbitrum Chains, will introduce further fee reductions for Arbitrum One, set to be activated on March 18th. The updated configurations include a reduction in the Layer 1 (L1) surplus fee from 32 gwei to 0 per compressed byte and a reduction in the L2 base fee from 0.1 gwei to 0.01 gwei.

The Dencun upgrade unlocks cost-saving opportunities for Layer 2 networks and addresses congestion concerns by freeing up more space on the Ethereum network for additional transactions. While the upgrade offers enhanced efficiency, it does come at the cost of no longer retaining a complete record of all data indefinitely.

However, as Layer 2 networks embrace this new update to the Ethereum ecosystem, the stage is set for accelerated adoption, usage, and broader accessibility within the Ethereum community and its underlying protocols.

Dencun Upgrade Fails To Propel ETH Above $4,000

Despite the successful upgrade, ETH’s price remains unaffected, continuing to consolidate below the $4,000 threshold. The token attempted to surpass this crucial resistance level on Monday and Tuesday but failed to sustain its position above it.

For over 24 hours now, ETH has been trading between $3,930 and $3,970. Nevertheless, it’s worth noting that ETH has maintained its upward momentum, with gains exceeding 18% over the past fourteen days and nearly 60% over the past thirty days.

Additionally, introducing the Dencun upgrade is expected to drive increased demand for ETH, potentially sparking a renewed uptrend that could bridge the gap between current trading prices and its previous all-time high (ATH) of $4,878, achieved in November 2021.

Featured image from Shutterstock, chart from TradingView.com

The Protocol: Is Ethereum’s Dencun Update All It’s Cracked Up To Be?

Some developers think that shifting the Ethereum ecosystem further towards layer 2 networks could risk setting it down the wrong path.

Debating Dencun: Will Ethereum’s Big Update Help or Harm the Network?

While Ethereum’s rollup-centric roadmap could help the ecosystem reach new levels of scale, some developers think relying on third parties to improve access to Ethereum could backfire.

Arbitrum’s ARB, Polygon’s MATIC Lead Gains as Ethereum’s Dencun Upgrade Goes Live

Ethereum’s Dencun upgrade enabled a new way of storing data that was forecast to dramatically cut costs for interacting with layer-2 networks.

Blast Blockchain Locks Up Amid Ethereum’s Dencun Upgrade

Ethereum Activates ‘Dencun’ Upgrade, in Landmark Move to Reduce Data Fees

A key element of the upgrade is to enable a new place for storing data on the blockchain – referred to as “proto-danksharding,” which gives room for a dedicated space that is separate from regular transactions, and at a lower cost.

Ether Could See Price Correction After Dencun Upgrade, QCP Capital Says

QCP’s sentiment towards ETH is cautiously optimistic, with concerns about potential corrections and the impact of leverage in the market.

Getting Cheaper, Getting Higher? Ethereum Dencun Upgrade And The Potential For ETH To Rise Back Above $4,000

The highly anticipated Dencun upgrade for the Ethereum (ETH) ecosystem is on the horizon, promising to bring significant cost reductions and notable changes to Layer 2 (L2) networks. The update, scheduled for March 13, will introduce a new data storage system known as blobs, reducing congestion on the Ethereum network and driving key new features in various areas.

Ethereum Dencun Upgrade

As highlighted in a recent Bloomberg report, Dencun aims to reduce the cost of Layer 2 networks such as Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base by enabling previously costly transactions to become significantly cheaper.

In particular, transactions that used to cost $1 can now cost as little as one cent, the report notes, while others that used to cost cents can be reduced to a fraction of a cent. This cost reduction is expected to improve the end-user experience greatly and is a significant improvement over previous upgrades such as the September 2022 “Merge.”

One of the most crucial aspects of the Dencun upgrade is the introduction of blobs, a new type of data repository for Layer 2 networks. Currently, Layer 2 blockchains store their data on the Ethereum network, leading to substantial storage costs passed on to applications and users.

However, with blobs, Layer 2s will store their data for a significantly shorter period, about 18 days, resulting in lower costs. While this shift sacrifices storing a complete record of all transactions forever, it frees up more space on the Ethereum network for other transactions, reducing congestion.

AI-Driven Trading Strategies

According to the report, introducing blobs through the Dencun upgrade also paves the way for using artificial intelligence (AI) in various applications. For example, games can incorporate AI-driven non-player characters, enabling advanced gameplay capabilities and a deeper experience.

In decentralized finance (DeFi), automated market makers can incorporate “complex trading strategies” driven by AI models. This newfound flexibility and complexity are expected to foster innovation and drive the development of advanced applications in the Ethereum ecosystem.

In addition, the Dencun upgrade is expected to reduce the operating costs of Layer 2 chains significantly. Previously, launching and operating a Layer 2 project required considerable venture capital backing. However, Bloomberg reports that with the cost reductions brought about by Dencun, small teams may be able to launch and maintain Layer 2 chains.

While the adoption of blobs and the associated cost advantages are expected to drive immediate benefits, it is worth noting that the cost of blobs may increase over time as demand grows.

How Could Dencun Boost ETH Price?

While the price of ETH has corrected by over 3% in the past 24 hours, resulting in a current trading price of $3,916, the Dencun upgrade holds the potential to have a positive impact on its price.

The upgrade aims to significantly reduce costs for Layer 2 networks and enhance the overall user experience, making Ethereum a more appealing platform for decentralized applications (dApps) and other use cases. By lowering transaction fees and improving scalability, Dencun could attract more users and developers to the Ethereum ecosystem, potentially driving up demand for ETH tokens.

Despite the ongoing correction, it is worth noting that the current price of ETH is not far from its two-year high of $4,084. However, it’s important to consider that the price has formed a double top pattern on the daily time frame for two consecutive days, which may present a near-term hurdle for ETH’s price. The market’s reaction and the ability of ETH to surpass its nearest resistance level remain to be seen.

Featured image from Shutterstock, chart from TradingView.com

What to Expect From Ethereum’s Latest Massive Upgrade: Dencun

Cheaper L2 transactions. Data blobs. Proto-Danksharding. Everything you need to know about tomorrow’s changes.

Ethereum Blockchain Counts Down to ‘Dencun’ Upgrade, Set to Reduce Fees

The upgrade is designed to usher in a new era of cheaper fees for the growing array of layer-2 networks that operate on top of Ethereum.

Rocket Pool Stands To Reap Big From Ethereum’s Dencun Upgrade, RPL Flying

The Ethereum liquidity staking protocol Rocket Pool is on the brink of a massive transformation with the incoming Dencun upgrade. As one community advocate points out, this change is primarily due to the enhancements the Houston upgrade will tag.

Eyes On Dencun Upgrade

In a recent post on X, the advocate explained that the Dencun upgrade, scheduled to go live in mid-March 2024, will pave the way for the implementation of the Houston upgrade. The Houston upgrade, in turn, aims to improve Rocket Pool’s scalability and efficiency.

The Dencun upgrade must first be successfully implemented so that the Houston enhancements can take effect and improve Rocket Pool’s performance.

This hard fork update requires all Ethereum node operators to upgrade their software. Once the network is updated, developers predict that transaction costs, particularly in layer-2 networks, will decrease significantly.

EIP-4788 And Why It Is Crucial For Rocket Pool

However, the Dencun upgrade will also execute a crucial enhancement, Ethereum Improvement Proposal (EIP) 4788. This proposal is designed to optimize communication between the execution layer, where all smart contracts and transactions occur, and the consensus layer, which includes validators like Rocket Pool.

A crucial aspect of this proposal is enabling the execution layer to access consensus layer information without needing third-party oracles, thereby enhancing the mainnet’s security and efficiency.

With the activation of the Houston upgrade, Rocket Pool users can anticipate a series of enhancements designed to improve their experience.

Once Houston goes live, the protocol will automatically lower the minimum ETH staking amount, allowing more users to stake. Additionally, introducing a delegated mini-pool contract will streamline the distribution of fees and rewards. In Rocket Pool, a mini pool is a virtual pool combining all the ETH from stakers.

However, over time, the activation of EIP-4788 allows Rocket Pool to innovate on ETH staking. Looking at the price chart, this expectation has been well received.

So far, RPL, the native token of the liquidity staking platform, has been ripping higher. On March 6, the token broke above February highs above $33. Traders expect bulls to build on recent gains, pushing the token towards January 2024 highs of around $40.

When written on March 7, the token was up nearly 110% from its October 2023 lows. Even so, RPL has yet to recover from the bear run of 2022. In April 2023, the token rose to as high as $65.

Ether Could Run to $10,000 or Higher This Year on Numerous Catalysts: Bitwise

Bitcoin has already climbed to new all-time high while ether is lagging, but previous market cycles suggest change is coming.

Ethereum’s Dencun Upgrade Could Mean Near-Zero Fees for Layer-2 Blockchains: Fidelity Digital Assets

The upgrade is the first step toward enabling the network’s rollup-centric roadmap, the report said.

Ethereum Plans For Dencun Upgrade: Is This The End Of Roll-Ups?

Ye Zhang, the co-founder of Scroll, a layer-2 project using zero-knowledge proof, is cautiously optimistic about the upcoming Dencun upgrade. In a post on X, Zhang pointed out Dencun’s potential benefits, particularly the low transaction fees.

However, in the same post, the co-founder highlighted the likely challenges it could present for existing layer-2 scaling solutions using roll-ups.

Dencun Introduces EIP-4844 In Ethereum: What It Means

Ethereum developers plan to implement Dencun in mid-March. Implementing the Ethereum Improvement Proposal (EIP)-4844 is a big part of this hard fork. With this execution, the proposal will introduce a new “blob-carrying transaction” feature.

What’s unique about these transactions is that they allow users to cheaply attach blobs, which are large amounts of data, compared to traditional Ethereum transactions.

Based on observations from the Goerli testnet, Zhang anticipates blobs to be 3-5 times cheaper than traditional call data on Ethereum. Accordingly, the vast difference means innovative developers can come up with blob-inscriptions. These inscriptions will effectively compete with layer-2 solutions like Arbitrum or Optimism leveraging roll-ups.

This possibility cannot be discounted because, in essence, EIP-4844 aims to reduce layer-2 transactions through blob transactions. Effectively, the proposal means the foundation of Blob inscriptions.

This solution takes a different approach but could take on roll-up platforms if widely adopted. It will be the case if users transacting large chunks of data realize the advantage of going the blob inscription route.

Even so, roll-ups will carry distinct advantages over blob inscriptions. A notable one is the superior scalability of roll-ups. These solutions can inherently process more transactions every second. Additionally, they are secure since they inherit security from the Ethereum mainnet.

ETH Prices Steady Above $3,800

Still, until after Dencun is implemented, the impact of EIP-4844 will be thoroughly measured. Overall, the Ethereum and layer-2 communities are ecstatic for the upgrade, expecting it to thrust ETH even higher in the current bull run.

Ethereum is trading above $3,800. It has been up by double digits in the past week, and experts are predicting even more gains in the days ahead.

Related Reading: Analyst Cites Key Indicators That Signal Bitcoin Correction

In the medium term, bulls target $5,000, around the all-time high.

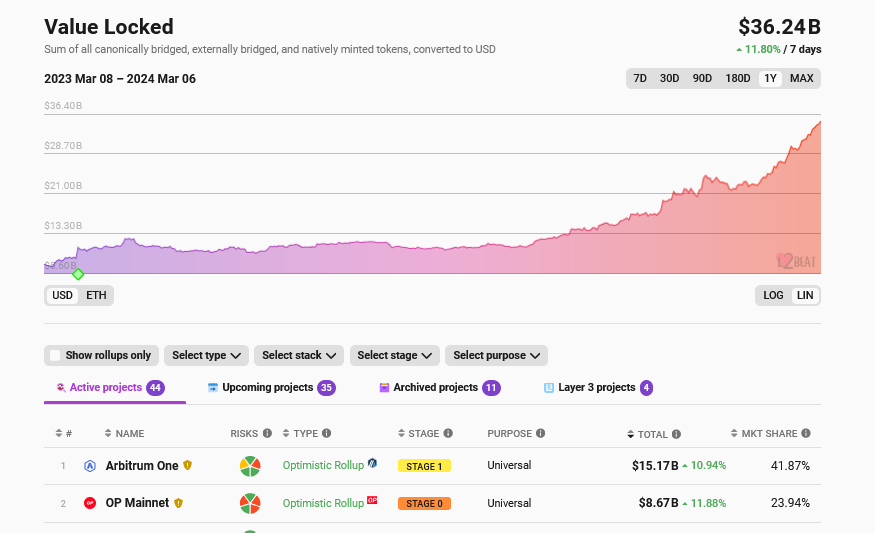

Amid the boom in ETH and crypto prices, interest in Ethereum layer-2 solutions continues to expand. The latest L2Beat data shows that Arbitrum, Optimism, and other alternatives manage over $36 billion. Arbitrum, enjoying its first-move advantage, manages nearly $16 billion.

Ethereum Fees Set to Drop for Arbitrum, Polygon, Starknet, Base. But How Much?

Leading figures behind layer-2 teams told CoinDesk how Ethereum’s upcoming Dencun upgrade will affect their networks.