The bid-ask ratio in bitcoin and ether options markets leans below one, signaling a bias for volatility selling, one observer said.

XRP Options To Debut On Deribit: A Game-Changer For Price

The rapidly evolving crypto market is set to witness yet another milestone as Deribit, the world’s preeminent crypto options exchange, prepares to launch options contracts for XRP, Solana (SOL), and Polygon (MATIC). Given the dominating position of Deribit in the options sphere, this inclusion could have noteworthy ramifications on the pricing dynamics of XRP.

Deribit To Debut XRP Options

Deribit, having established itself as the leading crypto options exchange both in terms of trading volume and open interest, is not letting the recent dip in digital-asset volatility deter its expansion endeavors. As reported by Bloomberg, the exchange is poised to roll out options contracts for the XRP token in January.

This move, announced by Chief Commercial Officer Luuk Strijers, will augment the platform’s offering which until now has been focused mainly on Bitcoin, Ether, and USD Coin options. The choice might be influenced by financial interests and prevailing market conditions. Trading volumes for crypto derivatives declined to roughly $1.5 trillion in September, down from about $2 trillion earlier in the year, affected by reduced prices and volatility relative to the highs of 2021.

Further solidifying its strategic vision, Deribit is not just limiting itself to options expansion. The Panama-based giant has disclosed plans to transition its operations to Dubai, a more crypto-receptive jurisdiction, following the attainment of necessary licensing. Parallel to this, the firm intends to bolster its workforce by approximately a dozen, adding to its current roster of 115.

Strijers expressed the inherent challenges in timing new product launches given the current market sentiment. “Is this the best environment to launch new products or should we defer?” he reflected, but remained optimistic about potential volatility upticks post the January launch.

Impact On The Price

With an overwhelming 85% market share in options trading, the influence of Deribit is unmistakable. The rest of the market is shared by competitors like OKX, Binance, and Bybit. A considerable 85% of the volume flowing through Deribit originates from institutional clientele. Therefore, the addition of XRP options on such a dominant platform is inevitably going to steer substantial attention toward XRP’s pricing dynamics.

Options, by design, provide traders the privilege (without an obligation) to buy or sell the underlying asset at a preset price until a specific date. This can have multifaceted implications for the underlying asset. XRP, as it gets intertwined with the options mechanism, might witness higher short-term volatility in its pricing, particularly around the expiry of these contracts.

“Quarterly expiries are typically the most significant, in terms of volume and value,” highlighted Strijers in a recent discourse. Drawing parallels with Bitcoin, it’s plausible that XRP might undergo amplified volatility as these options contracts approach their expiration, especially at quarter-end, depending on the volume of XRP options being traded.

Conclusively, with Deribit’s unassailable stature in the options space and the inherent nature of options contracts, the induction of XRP options might very well become a pivotal point in XRP’s pricing journey. Traders, especially those engaged in XRP, will need to brace themselves for the nuanced challenges and opportunities this integration brings forth.

At press time, XRP was trading at $0.4994 after briefly falling to $0.4880.

Deribit to List XRP, SOL, MATIC Options; Seeks License in EU

Deribit controls over 85% of the global crypto options market.

Here’s how Bitcoin investors can trade the tension surrounding a U.S. government shutdown

Rumors of a US government shutdown impact asset prices, including Bitcoin. Here’s how BTC options traders can capitalize on the 45 day funding deadline.

Will Bitcoin price hold $26K ahead of monthly $3B BTC options expiry?

Bitcoin trading volumes at a five-year low and the S&P 500 reaching its lowest levels in over three months could spell trouble for BTC bulls.

Binance & Deribit Traders Aggressively Short Bitcoin, Squeeze Incoming?

Data shows Bitcoin shorts have been piling up on cryptocurrency exchanges Binance and Deribit during the past few days.

Bitcoin Funding Rates On Binance & Deribit Are Deep Red Right Now

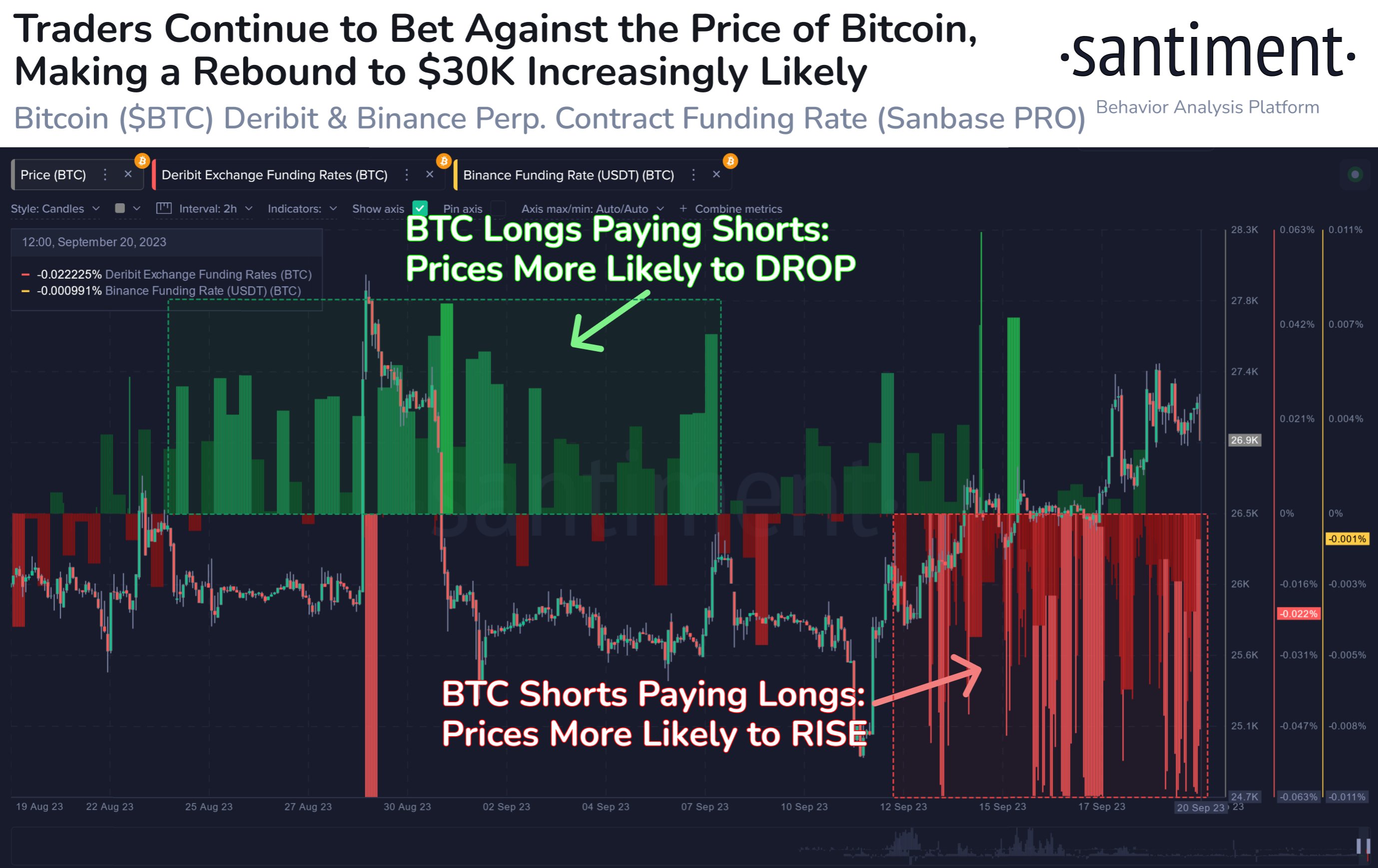

According to data from the analytics firm Santiment, traders on the derivative market have continued to bet against the cryptocurrency recently. The relevant indicator here is the “funding rate,” which keeps track of the periodic fee that derivative contract holders on an exchange are paying each other right now.

When this metric has a positive value, it means that the long traders are paying a premium to the short traders in order to hold onto their positions. Such a trend suggests that the majority sentiment on the given exchange is bullish currently.

On the other hand, the metric being under the zero mark implies the traders on the platform hold a bearish mentality at the moment, as the shorts are the dominant force.

Now, here is a chart that shows the trend in the Bitcoin funding rates for Binance and Deribit over the past month:

As displayed in the above graph, the Bitcoin funding rate for both of these exchanges had been mostly positive during the last third of August and the starting third of this month, implying that the majority of the traders had been longs.

The bets of these holders had failed, however, as the price had seen an overall downtrend in this period. Since the rebound earlier this month, though, the sentiment has flipped in the market as shorts have piled up on both of these platforms.

These short traders haven’t been successful so far, either, as the value of the cryptocurrency has seen net growth since they have appeared. Historically, the market has actually been more likely to go against the expectation of the majority, so this pattern may be in line with that.

The reason why the asset would move against the bets of these contract holders is that mass liquidation events, called squeezes, become more likely to happen the more lopsided the sector is.

A large amount of long liquidations can amplify crashes, while short liquidations can provide the fuel for upward surges. Since Bitcoin is still seeing aggressive shorting, it may be a positive sign for the cryptocurrency’s current price rise, as a potential short squeeze could help it extend further.

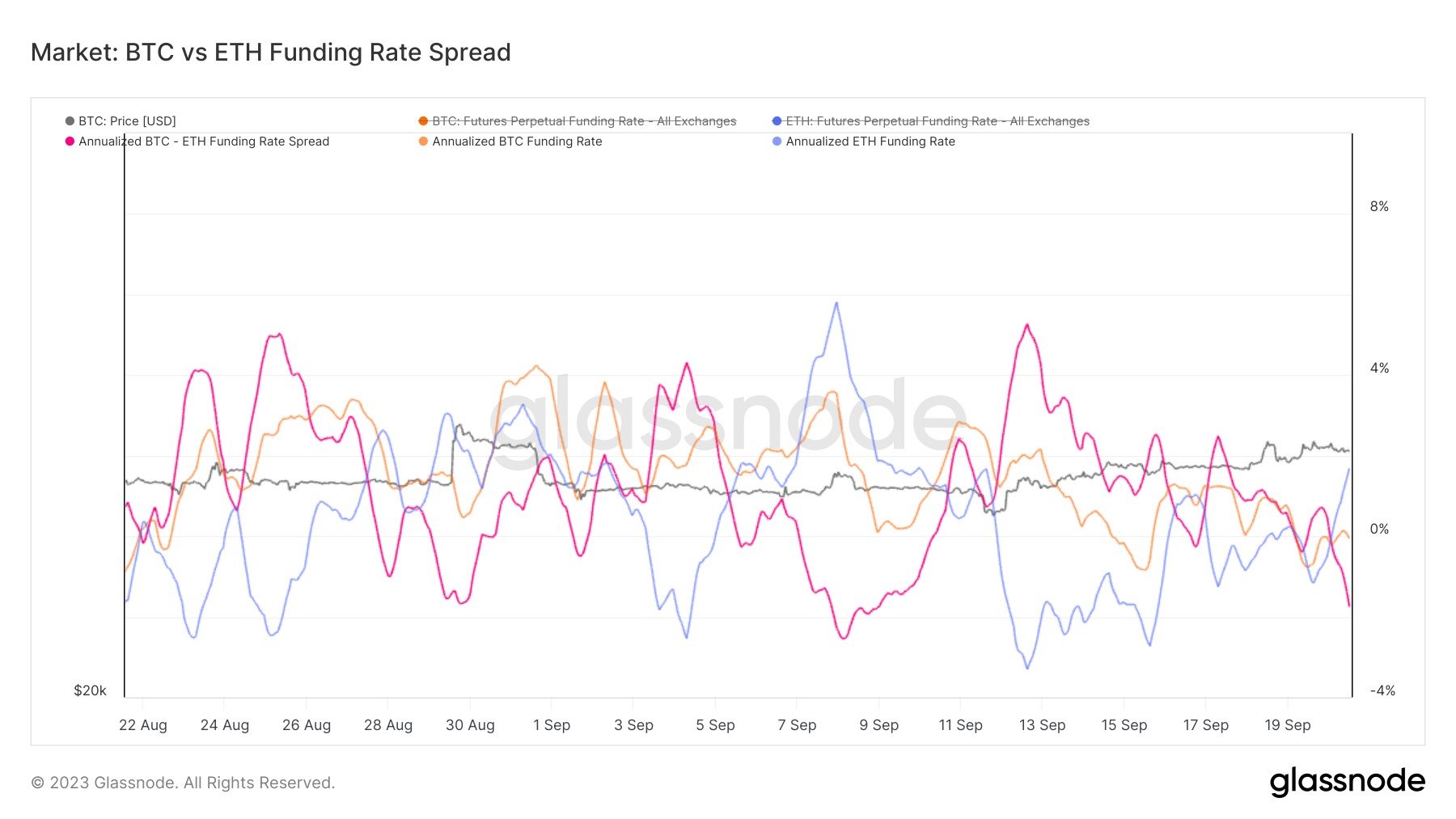

Interestingly, while Bitcoin is being bet against right now, Ethereum’s funding rates are positive, as pointed out by analyst James V. Straten in a post on X.

From the graph, it’s visible that the funding rates of the top two assets in the sector have gone opposite ways recently. This means that while BTC may be able to build an uptrend off the shorts, ETH could face the opposite effect if the longs end up being liquidated.

BTC Price

Bitcoin has seen a drawdown of about 1.5% today as the asset’s price has now dropped towards the $26,700 level.

Deribit Sees 17% Growth in Crypto Derivatives Trading Volume in August, Led by Options

Options tied to ether recorded their highest volumes since March of this year, Deribit’s Luuk Strijers told CoinDesk.

Bitcoin options data points to an interesting outcome after this week’s $1.9B expiry

A flurry of macro and crypto-specific factors is expected to impact this week’s $1.9 billion Bitcoin options expiry.

Bitcoin price breaks from range with drop below $28K, and options tilt toward BTC bears

$570 million in weekly BTC options expire on Friday, and the recent macro and crypto news events have further tilted the advantage to bearish traders.

Bitcoin traders put eyes on $31K even as $2B in BTC options expire on Friday

BTC traders fix their eyes on $31,000 even as $2 billion in Bitcoin options are set to expire this Friday.

Bitcoin options tantalizing bears to push price below $30K before Friday’s expiry

Bitcoin bears are closing in on a rare win, as they have the advantage in this week’s $600 million BTC options expiry.

Bitcoin price rallies to $31.8K, but derivatives data highlights BTC bears’ advantage

Bitcoin’s price is following in XRP’s footsteps by rallying close to $32,000, but the price could pull back in the face of this week’s $720 million options expiry.

Bitcoin price data suggests bulls will succeed in holding $30K as support this time

Two key Bitcoin price metrics suggest that bulls will be able to hold the $30,000 level as support.

Bitcoin holds $30K as bulls flaunt their advantage in Friday’s $715M BTC options expiry

News of regulatory enforcement against the crypto sector fell by the wayside as the Bitcoin price rallied above $30,000, and options data suggests the trend will continue.

Bitcoin June 2024 Expiry Futures and Options in High Demand Due to Halving: Deribit

The Panama-based exchange will launch the June 2024 bitcoin futures and options contracts on Thursday at 08:00 UTC

Fed pauses interest rates, but Bitcoin options data still points to BTC price downside

Fed Chair Jerome Powell announced a pause in interest rates, but Bitcoin options data still warns that a BTC price drop to $25,000 is possible.

Why Bitcoin’s resistance to retesting the $25K support could be futile

Bitcoin’s price continues to explore the lower regions of its trading range, but a drop to $25,000 seems nearly inevitable, according to derivatives data.

Bitcoin rebound falters amid SEC crackdown on exchanges, raising chance of a BTC price capitulation

Regulatory concerns continue to impact the entire crypto market, and this week’s BTC options expiry could play a decisive role in pushing the Bitcoin price under $26,000.

Bitcoin price hangs in the balance — Friday’s $2.26B BTC options could result in more downside

Bitcoin bears benefit from the current macroeconomic uncertainty and are aiming for a $270 million profit if the BTC price falls below $25,000.

Bitcoin price capitulation below $26K increases as Friday’s BTC options expiry looms

This week’s BTC options expiry could play a decisive role in Bitcoin price potentially trading below the $26,000 level.