The DEX aggregator has been exploited across multiple blockchains with millions in wrapped Ether and other assets stolen.

Cryptocurrency Financial News

The DEX aggregator has been exploited across multiple blockchains with millions in wrapped Ether and other assets stolen.

The decentralized exchange launched a new feature that allows governance token holders to vote on which pools will receive the most rewards.

The DEX previously said traders lost a significant amount of ADA due to a “misunderstanding” about how the platform operates, but confirmed it would refund losses at the time.

SOL price has started to cool off as investors potentially question the reasons for the most recent double-digit rally.

The crypto exchange added a feature that allows users to deposit single assets into a vault, which are then automatically invested into diverse liquidity pools.

The funding round was led by Pantera Capital, and included participations from Susquehanna International Group and HashKey Capital.

Recently, Uniswap, a prominent decentralized exchange, made headlines by introducing a 0.15% swap fee on specific tokens. While generating buzz and curiosity, this decision has raised several questions regarding its impact on traders.

Decentralized exchanges (DEX) facilitate peer-to-peer trading without intermediaries. The absence of centralized entities has advantages but also presents challenges, especially regarding fee structures.

Uniswap’s latest update to alter its fee structure is a significant shift with potential implications for its large user base.

According to data shared by Colin Wu, a blockchain-focused reporter, the daily fees from this change on Uniswap V3 could range between $388,000 and $444,000.

Providing deeper insight into the platform’s operations, Wu mentions that approximately 35% to 40% of the entire transaction volume on Uniswap occurs on the front end.

These figures, while substantial, are just the tip of the iceberg. Specific tokens targeted for this new fee include popular tokens such as ETH, USDC, WETH, USDT, DAI, WBTC, agEUR, GUSD, LUSD, EUROC, and XSGD.

However, according to the Chinese reporter, this fee will only apply when these tokens are traded through Uniswap Labs interfaces on the mainnet and its supported Layer 2 networks.

Currently, about 35%-40% of the transaction volume in Uniswap is completed through front end, H/T @1kbeetlejuice. Ethereum Uniswap V3 in the past 24h is $810m, excluding major stablecoin pairs, which is $740m, the daily fees charged by V3 may be $388k-444k.… https://t.co/EAeV6xwQHX

— Wu Blockchain (@WuBlockchain) October 17, 2023

While the announcement sparked curiosity, it also led to some confusion concerning the fees. Uniswap’s help center, in response, clarified that these newly implemented fees stand apart from the Uniswap Protocol fee switch, which is determined through votes by Uniswap’s governance mechanism.

Despite the explanation by the DEX’s team, the genesis of this new fee introduction remains ambiguous to many within the community.

In response to Wu’s initial post, several individuals opposed the update, with a particular user questioning the rationale behind the 0.15% fee, the considerations leading to this specific percentage, and the selection of particular tokens for the fee imposition.

According to data from Coinmarketcap, Uniswap has reported a significant trading volume of $518.3 million in the past 24 hours, capturing 18.3% of the market share within the decentralized exchange sector.

Meanwhile, Uniswap native token UNI has witnessed a substantial decline. The asset has dipped by more than 10% over the past two weeks and showed a continuous drop of 5.5% in the last 24 hours. Currently, UNI is trading for $3.8.

Featured image from Bitcoin-Bude, Chart from TradingView

The entity behind popular DeFi exchange Uniswap will levy a small fee – the first in its history.

Grocery chain Trader Joe’s alleged the Trader Joe exchange chose a similar name to benefit from the former’s popularity.

THORSwap acknowledged the ongoing illicit use of the DEX and are acting to find a permanent block to the misuse.

The platform’s v2 allows sub-second optimistic trades and trading without a crypto wallet, the company said.

Pancakeswap now allows users to purchase crypto with debit card, Google Pay, Apple Pay, and other methods through Transak.

The DEX was developed in a direct response to the fallout from the collapse of crypto exchange FTX.

The investment happens at a time when crypto venture capital has mostly dried up and trading volumes plummeted.

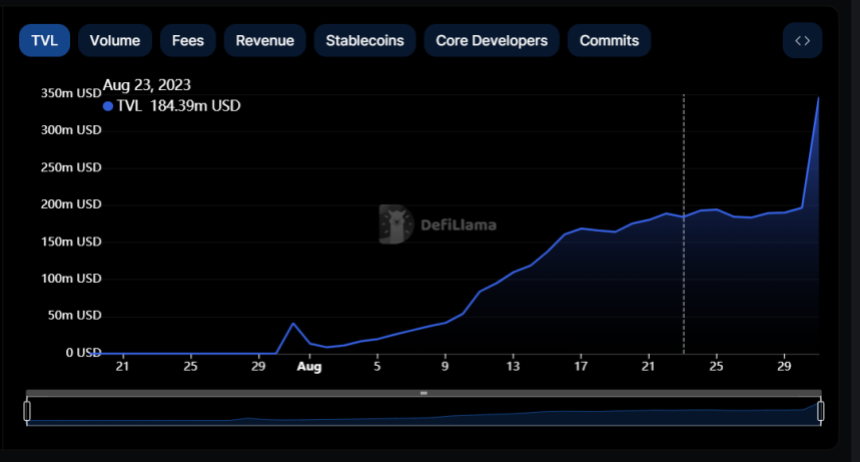

Base, an Ethereum layer 2 (L2) network developed by prominent cryptocurrency exchange Coinbase, has seen its total value locked (TVL) soar to new heights on Friday, August 31. This surge was triggered by the recent launch and growing hype around the decentralized exchange (DEX) platform Aerodrome.

The total decentralized finance (DeFi) deposits on Base have hit a new all-time high following a nearly 76% spurt in the past 24 hours. According to data from DefiLlama, the network’s TVL currently stands at $346.39 million, jumping from $196.8 million a day ago.

This sharp rise has seen Base leap into the top ten blockchains with the largest TVL, sitting above Solana in ninth position. However, Ethereum remains the dominant network in the decentralized finance space, with a total value of roughly $22.1 billion.

BREAKING: Total Value Locked on @BuildOnBase has surpassed $300M and entered the top 10 blockchains with the largest TVL

pic.twitter.com/KC7tClvA1g

— Base Daily (@BaseDailyTK) August 31, 2023

Interestingly, this latest feat only underscores the overall progress of Base since opening its doors to the public on August 9, 2023. The Coinbase-incubated network’s TVL has swelled more than 733% since the public mainnet launch.

One of the notable catalysts of the Base’s growth was the short-lived hype of the social media platform Friend.tech. However, activity on the decentralized app has since hit a snag, with trading fees dipping by more than 94%.

As earlier mentioned, the latest resurgence in Base’s DeFi deposits was triggered by the growing interest in the Aerodrome protocol, which recently launched on the blockchain.

Aerodrome is a decentralized exchange developed by the team behind Velodrome, a popular DEX on the Optimism chain. The platform rewards users who provide liquidity and participate in protocol governance with its native token, AERO.

Thanks to the AERO emissions, which began on August 30, Aerodrome has attracted more than $170 million in value to the Base network. Meanwhile, this has reflected a significant 6,000% rise in the protocol’s TVL in the past 24 hours.

Despite the initial negative sentiment brewing around Base due to the BALD rug pull, and various DeFi protocol exploits, it appears that major cryptocurrency projects are continuing to expand to the layer 2 network.

PancakeSwap, the second-largest decentralized exchange, is one of the protocols to have recently joined the trend. The DeFi platform went live on the Base network on Thursday, 30th of August.

PancakeSwap v3 introduces advanced Swap and Liquidity Provision functionalities, enabling users to trade tokens seamlessly and maximize capital efficiency.

The grant is part of Avalanche’s Multiverse initiative, an incentive fund that aims to push the growth of new subnets.

The decentralized exchange has expanded to several networks this year in the search for new users and revenue streams.

MuesliSwap, a decentralized exchange (DEX) on the Cardano network, has announced its decision to reimburse its users that have been affected by high slippage over the past year. This is in response to the recent questions faced by the protocol on its slippage feature.

Slippage refers to the price difference between when a transaction order is submitted and when the transaction is executed by the market maker and confirmed on the blockchain.

In a post on X (formerly Twitter), the team behind MuesliSwap admitted that it failed to provide “adequate clarity” on the slippage feature within its decentralized exchange. Users have had to pay high slippage due to the manner in which the protocol’s matchmaker was designed.

Related Reading: Is Curve DAO (CRV) Price On Track To Reach Or Exceed $1 This Month?

The MuesliSwap team explained in the post:

Our decentralized matchmaker setup allowed each matchmaker to fill the limit order and choose whether to return the additional slippage amount or retain the difference at their discretion.

MuesliSwap claims this difference has served as an incentive for the matchmakers since the beginning. To further clarify, the protocol’s team said this “supplementary matchmaker incentive” pushes the decentralized matchmaker to prioritize users’ orders during periods of high market volatility. However, it acknowledged that pushing this under the unclear term “slippage” may have confused new users.

Clarifying Slippage on MuesliSwap: We want to address confusion about advanced matchmaker slippage on our platform. Quick heads-up: This impacts only a handful of users so please be careful about what others state on Twitter.

1⃣ Trades through the MuesliSwap DEX aggregator… pic.twitter.com/SBpBZUWxnb

— MuesliSwap Team

(@MuesliSwapTeam) August 8, 2023

In a bid to rectify the situation, the MuesliSwap team disclosed that it would be refunding users who were affected by the high slippage on the protocol’s pools in the last 12 months. The team claims that the funds for users’ reimbursement will come from the “project funds”.

Additionally, MuesliSwap said that a comprehensive analysis of all trades will be carried out to ensure fair refunds. “This process may take approximately 3 to 4 weeks as we gather and validate the necessary data, and implement the distribution code,” the team noted.

At the end of the post, MuesliSwap stated that swift action has been taken to fix the high slippage issue in the DEX order book.

Related Reading: Cardano (ADA) Price Prediction: 28% Upswing Or 23% Drop Coming Next?

The team also said:

Going forward, our DEX protocol will provide clear and accurate information on slippage when interacting with our pools.

MuesliSwap is the fifth-largest protocol on the Cardano network, with a total value locked (TVL) of $10.41 million, according to data from DefiLlama.

Users are said to have lost varying amounts of funds by setting slippage too high due to a “misunderstanding.”