Yao Qian, the first director of CBDC development at China’s central bank, is reportedly under investigation for suspected law violations.

Cryptocurrency Financial News

Yao Qian, the first director of CBDC development at China’s central bank, is reportedly under investigation for suspected law violations.

Litecoin (LTC) is proving its toughness in the wild world of crypto. Even with recent ups and downs in the market, Litecoin is holding steady, making investors hopeful about its future. While its price dipped a bit, experts and some charts are pointing towards a big comeback for LTC.

Litecoin’s recent performance stands in stark contrast to the broader market trend. While its price did experience a correction, dropping from a peak of $112 to its current value around $81.12, the decline has been relatively muted compared to other cryptocurrencies.

Financial experts are taking note of Litecoin’s recent performance. Matthew Dixon, CEO of Evai.io, has highlighted LTC’s resilience compared to Bitcoin during this period of market volatility.

He attributes this stability to the possibility that Litecoin may have already completed a corrective phase, a period of price adjustment often followed by an upward trajectory. This suggests that Litecoin could be poised for significant growth in the near future.

$Ltc#Ltc Gave Golden Chance For Those Who Missed Earlier Bouncing From Trendline Still Expecting Move Towards 250-300$ In Coming Months https://t.co/Uyv82IeTpp pic.twitter.com/bYo4cQ9ylx

— World Of Charts (@WorldOfCharts1) April 15, 2024

Adding to the optimistic outlook is respected crypto analyst World Of Charts. Their analysis suggests advantageous entry points for investors considering Litecoin. Additionally, they have identified a robust support level, which acts as a price floor and prevents excessive downward movement.

Based on these factors, World Of Charts forecasts a target range of $250 to $300 for LTC in the coming months, expressing strong confidence in its potential for substantial growth.

Litecoin Starts Q2 With A Dip, But Investors Eye Rebound

Litecoin (LTC) has gotten off to a rocky start in Q2, with its price falling 12% from $112 to $96. This decline can be attributed to two main factors. First, a broader market correction is impacting cryptocurrencies across the board. Second, some investors who bought in during Litecoin’s Q1 surge from $72 to $112 may be taking profits, further pressuring the price.

Related Reading: All Quiet On The Bitcoin ETF Front – Should You Be Paranoid?

Despite the recent slump, there are reasons for Litecoin investors to remain optimistic. Many investors still believe in the long-term potential of LTC, and some experts predict a price rise to $150 by June. The upcoming Bitcoin halving event, which some believe will drive up Bitcoin’s price, could also have a positive spillover effect on Litecoin.

Featured image from Pixabay, chart from TradingView

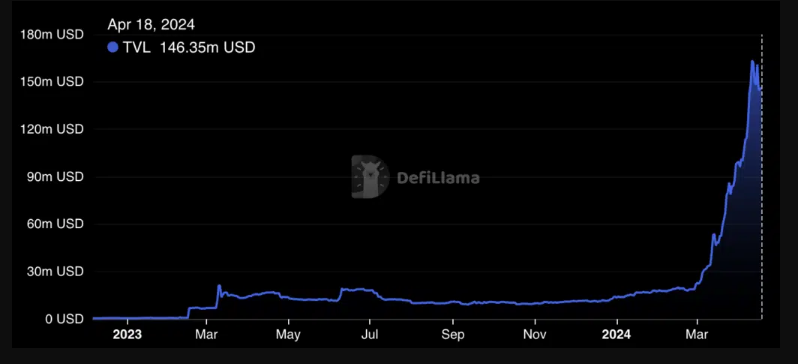

Toncoin, of the TON network, has captured the attention of the cryptocurrency community as its Total Value Locked (TVL) surpasses a staggering $148 million, marking a historic milestone. This meteoric rise, reported by DefiLlama, showcases an almost threefold increase in just one month and a jaw-dropping tenfold surge over the course of a year. As of the latest update, TON’s TVL stands firm at slightly over $146 million, underscoring its growing prominence in the decentralized finance (DeFi) landscape.

Within the TON ecosystem, standout performers in TVL include the Tonstakers liquid staking protocol and the STON.fi decentralized exchange. Together, these projects boast a combined total value of locked assets exceeding $283 million.

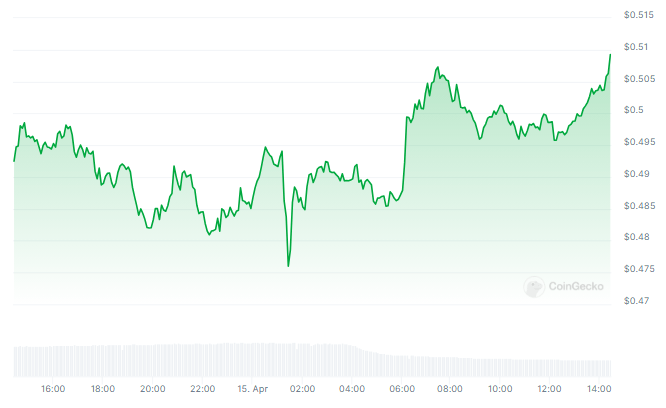

Amidst the flurry of activity, Toncoin emerges as the darling of the crypto market, experiencing a remarkable surge in value. Over the past month, Toncoin has skyrocketed by over 60%, propelling it to new all-time highs multiple times throughout April. Currently trading at around $6.25, Toncoin’s ascent shows no signs of slowing down.

Speculation And Partnership Buzz

Fueling Toncoin’s ascent are rumors swirling within the crypto community regarding a potential partnership between the TON Society developer community and HumanCode, an AI development firm. While details remain scarce, speculation abounds, with many anticipating a major announcement that could further propel Toncoin’s price up.

Gm

Who’s ready for the big announcement?! pic.twitter.com/1i3dBKVYkG

— TON

(@ton_blockchain) April 18, 2024

Toncoin Overtakes Cardano in Market Capitalization

Meanwhile, Toncoin has surpassed Cardano (ADA) in market capitalization, firmly establishing itself as a force to be reckoned with in the crypto market. With a market capitalization of over $22 billion, Toncoin now holds the coveted 8th position, relegating Cardano to the 11th spot.

Market Analysis And Price Consolidation

Despite its meteoric rise, Toncoin is currently navigating a period of consolidation, with traders and analysts closely monitoring key price levels and volume dynamics. As the cryptocurrency hovers between $6.50 and $6.75, both bulls and bears are poised for potential shifts in market sentiment. Crypto trader Paxton emphasizes the importance of volume in determining Toncoin’s trajectory, urging caution amidst the market’s ebbs and flows.

Related Reading: Historical Data Sparks Excitement: VeChain Price Poised For A Bullish Breakout?

As the TON network continues to defy expectations and Toncoin reaches unprecedented heights, all eyes remain fixed on this thriving ecosystem. With its innovative projects, strategic partnerships, and surging value, TON is poised to reshape the future of decentralized finance and redefine the possibilities of the crypto market.

Featured image from Amazon, chart from TradingView

The cryptocurrency community is abuzz with speculation as the next Bitcoin halving event approaches. While all eyes are naturally on Bitcoin itself, XRP, Ripple’s native token, has emerged as a surprising source of intrigue. Historical price movements, recent legal developments, and a range of expert predictions are fueling a sense of cautious optimism for XRP’s future.

Historically, altcoins like XRP have often mirrored Bitcoin’s price movements. Following significant events in the Bitcoin market, particularly halving events that cut the mining reward in half, altcoins have frequently experienced surges in value. This has led some analysts to believe that it could be poised for a similar rise in the wake of the upcoming halving.

However, the narrative surrounding XRP has been complicated by the ongoing legal battle between Ripple Labs and the US Securities and Exchange Commission. The SEC alleges that the altcoin is an unregistered security, a classification that has cast a shadow over the token’s legitimacy and dampened investor enthusiasm.

A recent development in the lawsuit has injected a dose of optimism into the XRP market. In July 2023, a judge issued a ruling declaring XRP as a non-security. This long-awaited legal clarity has provided much-needed regulatory certainty for XRP, boosting confidence among investors who now view its potential with renewed faith.

Expert Opinions Offer A Range Of XRP Price Predictions

As the halving draws closer, prominent market analysts have weighed in on XRP’s potential price trajectory. Predictions vary considerably, reflecting the inherent volatility of the cryptocurrency market.

Leb, a respected analyst with a strong track record, believes XRP could reach its previous all-time high of $3.84 either before or immediately after the halving. This bullish prediction highlights the potential for significant gains.

Looking towards the longer term, analyst Jake Gagain presents a more conservative yet optimistic outlook. He predicts XRP could reach $5.85 by 2025. This aligns with the views of Dark Defender, another analyst who anticipates a steady upward trend for XRP in the coming years.

While some investors find these long-term projections overly ambitious, others believe they are achievable given the evolving regulatory landscape and XRP’s underlying utility as a cross-border payment solution.

Market Dynamics And XRP’s Position

Despite the recent short-term price fluctuations, XRP maintains its position as a top cryptocurrency by market capitalization, currently sitting at number seven with a total market cap of nearly $30 billion. Traders and investors are closely monitoring market trends and expert predictions as they prepare for the potential volatility and opportunities that the post-halving period may bring.

Featured image from Pixabay, chart from TradingView

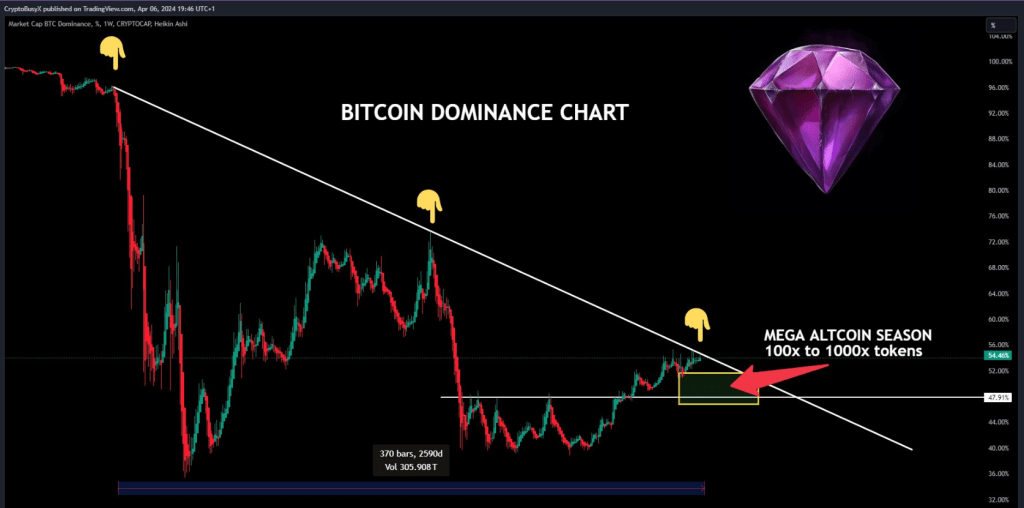

A renowned crypto trader and analyst has recently shared bold predictions regarding the future of the cryptocurrency market. In a comprehensive analysis, Crypto Busy has pointed towards a potential boom in alternative cryptocurrencies (altcoins), suggesting the possibility of significant gains in the near future.

According to him, altcoins could experience remarkable growth, with the potential for values to multiply by up to 1,000 times.

Crypto Busy’s analysis draws upon historical observations of the cryptocurrency market, particularly during previous bullish phases. Notably, fluctuations in Bitcoin’s dominance have often corresponded with increases in the value of altcoins.

This pattern suggests that as Bitcoin’s value surges, altcoins could witness substantial appreciation, providing astute investors with ample opportunities for diversification and profit.

The next wave of crypto gems will rise,

and another set of 100x to 1000x tokens

will born once the #Bitcoin price pumps

while the #BTC dominance remains low.During the last bull run, $BTC dominance ranged

from 38% to 48%, so altcoins went crazy!Hope you bagged a lot of… pic.twitter.com/N0QWEWGBsr

— CryptoBusy (@CryptoBusy) April 7, 2024

The market dynamics highlighted by Crypto Busy underscore the evolving nature of the cryptocurrency ecosystem. While Bitcoin remains the dominant force, its fluctuations can create openings for altcoins to emerge as significant players in driving market growth.

This interplay between Bitcoin and altcoins presents investors with a dynamic landscape to navigate, where strategic decisions can yield substantial returns.

In light of the market’s inherent volatility, the analyst emphasizes the importance of strategic investment approaches. By identifying undervalued altcoins during market downturns, investors may position themselves to capitalize on future rallies.

This strategy aligns with timeless investment principles, reinforcing the notion that buying assets when they are undervalued can lead to significant returns when market conditions improve.

Adapting To The Evolving Crypto Landscape

Beyond individual profit potential, Crypto Busy’s analysis sheds light on the evolving dynamics of the cryptocurrency ecosystem. As Bitcoin solidifies its position as the dominant digital asset, its impact on the broader market, including altcoins, becomes increasingly significant.

Crypto Busy’s analysis offers valuable insights into the potential for an altcoin boom in the cryptocurrency market. While the prospect of 1,000 times gains may seem ambitious, historical trends and market dynamics support the notion that altcoins could play a significant role in driving future market growth.

Featured image from Pixabay, chart from TradingView

XRP holders are facing mixed signals. While the digital asset boasts nearly 20% in gains over the past year, significantly outperforming traditional savings accounts, its recent performance pales in comparison to other cryptocurrencies.

After a substantial decline, the altcoin’s price has now entered a phase of sideways consolidation, making market players unsure of its future course. It appears like the cryptocurrency will likely stay stuck in a narrow range until there is a breakout in either way.

Despite the seemingly negative vibe, a recent report highlighted the coin’s resilience. Specifically, it underscored its advantage over stagnant savings accounts.

XRP hit a low of $0.42 in March 2023 and surged to $0.93 in July, fueled by optimism surrounding the Ripple vs. SEC lawsuit. The coin then saw a rise of 1.30% on Sunday. After losing 1.35% on Saturday, the altcoin gained 0.41% at the end of the week to close at $0.6299. Today, it sits at $0.61, reflecting a 20% year-over-year increase.

This dwarfs the returns offered by most savings accounts. A Business Insider report pegs the average Annual Percentage Yield (APY) for US savings accounts between 0.01% and 0.25%. Even high-yield online banks rarely surpass 5.30% APY.

XRP is up over 6% within a single year, it has outperformed every savings account of every bank in the world and yet you people are still crying about it. pic.twitter.com/GGxVPJfudU

— Mr. Huber

(@Leerzeit) March 29, 2024

“Mr. Huber,” a prominent crypto community investigator, emphasizes this point. To paraphrase his views, he said while XRP might not be setting the crypto world on fire right now, it’s definitely a better option than letting your money languish in a savings account.

However, discontent simmers within the community. Over the past three months, XRP has seen a meager 1% growth, while rivals like Bitcoin and Ethereum have skyrocketed by over 50%. This lackluster performance compared to its peers is causing frustration among holders.

The future trajectory of XRP hinges on multiple factors. The ongoing Ripple vs. SEC lawsuit, which centers around whether XRP is a security, is a significant cloud hanging over the coin’s price. A favorable outcome could reignite investor confidence and propel XRP upwards.

Another factor is the broader cryptocurrency market. If the current bull run continues and other top coins maintain their momentum, XRP might face additional pressure to catch up.

Analysts remain divided on XRP’s short-term prospects. Some believe the current stagnation is a buying opportunity before a potential price surge. Others urge caution, citing the ongoing lawsuit and the unpredictable nature of the cryptocurrency market.

The diverse perspectives surrounding XRP showcase the exciting array of options available to investors. With XRP presenting a compelling alternative to conventional savings methods, its unique features shine through.

Despite recent fluctuations in its performance compared to other digital assets, this opens up opportunities for thoughtful consideration and strategic investment. Ultimately, the choice to embrace XRP hinges on aligning with one’s personal risk appetite and long-term investment objectives, empowering individuals to make informed decisions tailored to their financial aspirations.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

XRP enthusiasts are in a frenzy after prominent community figure Chad Steingraber proposed a scenario where an XRP exchange-traded fund (ETF) could trade at a staggering 100x premium.

Steingraber, a seasoned game designer, laid out his thoughts in a recent post, igniting discussions about the potential trajectory of an XRP ETF, particularly in light of the ongoing push for institutional adoption of the altcoin.

Steingraber’s speculation centers around the price at which an XRP ETF’s shares might trade. His hypothesis hinges on the crypto reaching an unprecedented price of $5 per coin. In this scenario, he theorizes that the corresponding ETF could soar to equally unprecedented heights, potentially reaching a solid $500 per share.

The actual underlying asset price does NOT have to skyrocket. The fund can trade at MASSIVE Premiums.

Let’s say #XRP breaks ATH @ $5, its ETF fund could literally trade at 100x premium if the institutional demand kicks in.

Yes, that’s right, a $500 #XRP Institution Premium.

https://t.co/bwN6cGmmZd pic.twitter.com/tHyy4fkbeK

— Chad Steingraber (@ChadSteingraber) March 27, 2024

This hefty premium, according to Steingraber, would be fueled by a surge in institutional interest in the ETF. He cites the Grayscale Litecoin Trust (LTCN) as a prime example.

Similar to his proposed XRP ETF, LTCN trades at a significant premium over Litecoin’s current market price. Despite Litecoin hovering around $95, investors in LTCN are currently paying a premium of over $250 per Litecoin equivalent within the trust.

The prospect of such a high premium has sparked discussions about potential arbitrage opportunities. X user Zack, in response to Steingraber’s post, questioned whether individuals holding XRP could exploit this price disparity. Steingraber acknowledged the possibility, particularly if the issuing ETF allows for in-kind deposits, where investors can directly exchange their token for ETF shares.

However, he cautioned that in-kind deposits are still a rarity in the ETF market. While Steingraber expressed optimism about the future adoption of this practice, its absence presents a hurdle for immediate arbitrage opportunities.

The XRP community has long advocated for asset managers, especially industry giant BlackRock, to launch an XRP ETF. They believe such a product would significantly bolster the value of XRP by increasing its accessibility to institutional investors.

A Speculative Outlook With Underlying Uncertainties

It’s crucial to remember that Steingraber’s vision is entirely speculative. As of today, no asset manager has taken concrete steps towards applying for an XRP ETF. Furthermore, the justification for such a high premium rests heavily on the assumption of substantial institutional demand, a factor that remains uncertain.

The applicability of the Grayscale Litecoin Trust comparison also requires further scrutiny. The specific structure and features of an XRP ETF would significantly influence whether a similar premium dynamic would emerge.

A Reality Check For Investors

While Steingraber’s prediction has certainly captured the community’s imagination, investors are advised to approach it with a healthy dose of caution. The approval timeline for an XRP ETF hinges on the US Securities and Exchange Commission’s stance on cryptocurrency ETFs.

Additionally, competition from other potential ETFs could play a role in determining the premium, if any.

Featured image from Freepik, chart from TradingView

Stablecoins have recently achieved a significant milestone, surpassing $150 billion in market capitalization, with daily trading volume reaching $122 billion. This achievement marks a notable resurgence and growth in the stablecoin sector, with implications for the broader cryptocurrency ecosystem.

Stablecoins are digital assets designed to maintain a stable value by pegging their price to a reserve asset, such as the US dollar or other fiat currencies. They serve as a crucial bridge between traditional finance and the crypto space, offering stability and liquidity for users and investors.

The recent surge in the stablecoin market can be attributed to several key factors. Firstly, the growing demand for stable assets in the volatile crypto market has driven increased adoption of stablecoins as a safe haven for traders and investors. Additionally, the rise of decentralized finance (DeFi) platforms has fueled the demand for stablecoins as a means of conducting transactions, providing liquidity, and earning yields.

Tether (USDT), one of the most widely used stablecoins, has played a significant role in driving the growth of the stablecoin market. With a market capitalization exceeding $100 billion, Tether’s dominance underscores its position as a key player in the crypto space.

Undoubtedly dominant in this sector, Tether commands a 70% market share. With a market capitalization of over $31 billion, USD Coin (USDC), the second largest stablecoin, grants Circle’s stablecoin a market share exceeding 20%. At the time of writing, DAI held a 3% market share and $4.7 billion, placing it in third position.

Tether’s market impact extends beyond its role as a stable asset, as it has faced scrutiny and regulatory challenges due to concerns about its reserve backing and transparency. Despite these challenges, Tether’s resilience and continued dominance highlight the strong demand for stablecoins and their utility in the digital economy.

Crypto Enthusiasts Celebrate Stablecoins’ Rising Market Cap

The crypto community is cheering the rising market cap of stablecoins, seeing it as a sign of coming prosperity.

Total Stablecoin Mcap:

Mar 21st. $147b.

Feb 21st. $138b.

Jan 21st. $133b.

Dec 21st. $130b.

Nov 21st. $127b.

Oct 21st. $124b.it is impossible and stupid to not be bullish on DeFi whilst this chart is just up and to the right for the last 6 months. pic.twitter.com/qkcERkIXi8

— ZeroToTom (@zerototom) March 21, 2024

A growing market cap suggests more money is flowing into crypto, providing much-needed liquidity for trading and potentially pushing prices up. Additionally, stablecoins offer a safe haven during market dips, potentially encouraging more investors to enter the broader crypto market. This increased comfort and investment could fuel the entire market’s growth.

The surpassing of $150 billion in stablecoin market capitalization signifies a maturing and expanding crypto ecosystem. Stablecoins have become essential infrastructure in the digital economy, enabling seamless transactions, cross-border payments, and financial services innovation.

Featured image from Xverse, chart from TradingView

Bitcoin transaction fees have experienced an unprecedented surge, doubling in just one week, as the market rallies towards the coveted $70,000 mark. This surge cannot be solely attributed to the upward trajectory of Bitcoin’s price but is significantly influenced by the sudden rise in Ordinals transactions.

Amidst the fervor of Bitcoin’s price rally, Ordinals transactions have emerged as a driving force behind the surge in transaction fees. Our in-depth analysis reveals that Ordinals, which started the week with approximately 48,000 daily inscriptions, witnessed an extraordinary surge, surpassing 93,000 by March 8th.

This surge in daily inscriptions has not only contributed to a substantial increase in fees, with the daily average fee standing at around eight BTC but has also added a staggering $3.8 million to the total network fees for the week.

Bitcoin’s fee trend for the week has been nothing short of dynamic. While the initial daily fees stood at around 46 BTC, the momentum gained pace around March 5th, surging to an impressive 103 BTC. Towards the end of the week, the daily fee decreased slightly to around 40.7 BTC.

Despite the decline, the overall trend indicates a significant increase in daily fees compared to the preceding week, showcasing the dynamism and resilience of the Bitcoin market.

Bitcoin’s Ascent Towards $70K And Its Ripple Effect

As Bitcoin teeters on the edge of the $70,000 price range, the cryptocurrency market is on the brink of a potential breakthrough. At the time of reporting, Bitcoin was trading at about $68,950, marking a 10% increase in the last seven days.

A Closer Look At Bitcoin’s Fee Surge

Examining data provided by IntoTheBlock, it becomes evident that Bitcoin’s recent fee surge is not merely a consequence of its price rise. The notable increase in transaction fees, doubling compared to the previous week, is closely tied to the upward movement in the price of BTC.

Bitcoin fees more than doubled this week, with Ordinals-related transactions hitting a monthly high. pic.twitter.com/YXh9oMMYSK

— IntoTheBlock (@intotheblock) March 9, 2024

This movement has propelled transaction volumes to their highest levels in months, with NewsBTC’s analysis revealing a staggering volume surpassing $100 billion on March 5th and 6th, a level not witnessed since November 2022.

Ordinals’ Remarkable Contribution To Bitcoin Fees

NewsBTC’s detailed evaluation of Ordinals transactions over the past week sheds light on the remarkable contribution of this sector to Bitcoin’s escalating fees. With daily inscriptions skyrocketing and daily fees averaging around eight BTC, Ordinals has made a significant impact on the cryptocurrency landscape, contributing over $430 million in fees to date.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

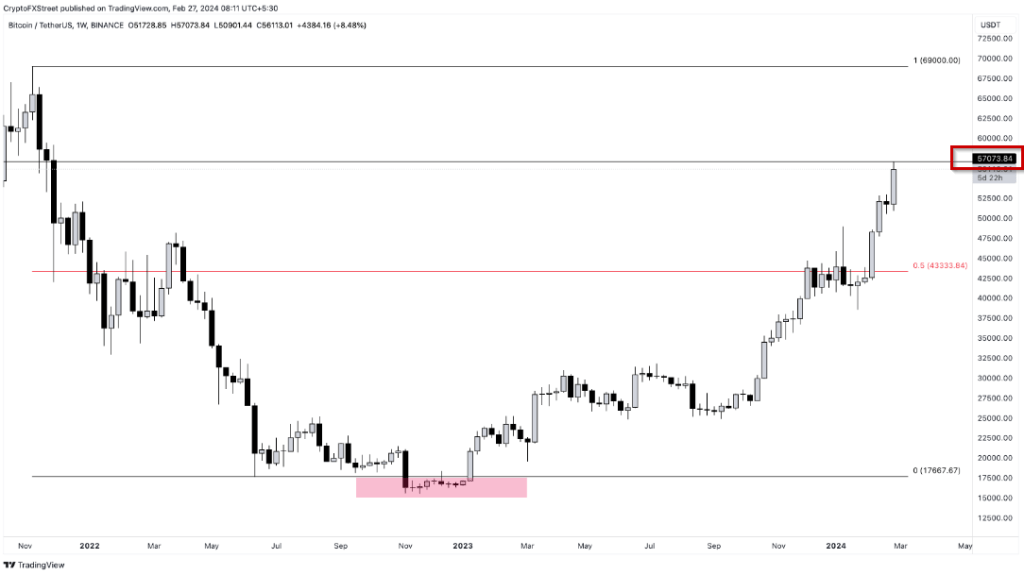

In a blazing start to March, the feverish activity of Bitcoin has set it up for its largest monthly increase in almost three years early Thursday. Money pouring into listed bitcoin funds is fueling a huge gain, and bitcoin is now just a stone’s throw away from a record high.

The primary cryptocurrency rose as much as 14% late Wednesday to momentarily reach $64,000 — its first move above $60,000 since November 2021 — before reversing part of the gains.

BTC was trading at $62,540 as of this writing, according to data from Coingecko.

Due to “fear of missing out” on potential price increases, investors are rushing to buy cryptocurrencies, which brings back memories of the crypto bull market that drove the main cryptocurrency asset to a record high of around $69,000 in November 2021.

Since the beginning of the year, the value of bitcoin has more than tripled, recovering from a 64% decline in 2022. That is an incredible recovery from a slew of scandals and bankruptcy that had cast doubt on the sustainability of digital assets.

Meanwhile, the sudden changes in price have been whipsawing both bulls and bears. According to CoinGlass, centralized exchanges had short liquidations of $176 million and long liquidations of $86.1 million over the previous day.

After prices crashed during the “crypto winter” of 2022, investors lost interest in spot bitcoin exchange-traded funds. However, this year’s approval and introduction of these funds to the US market has rekindled interest in cryptocurrencies.

According to LSEG statistics, the top 10 spot bitcoin ETFs saw inflows of $420 million on Wednesday alone, the highest amount in nearly two weeks. Voltages increased when the three most well-known, operated by Grayscale, Fidelity, and BlackRock (IBIT.O), ignited a whole new interest.

Ahead of April’s halving event, which occurs every four years and reduces the rate at which tokens are generated by half as well as the prizes paid to miners, more traders have now been flocking to bitcoin.

What The Experts Are Saying

“Bitcoin optimism is fueled by factors like spot BTC ETF inflows, the imminent halving reducing new issuance, and renewed confidence in the crypto asset class, according to Jonathon Miller, managing director at Kraken Australia.”

“When people see these kinds of increases in a short period of time . . . then it just draws in people and Fomo does kick in,” said Timo Lehes, co-founder of blockchain company Swarm.

“It’s just insane.”

“We could see the all-time high being broken any day now,” said Simon Peters, an analyst at trading firm eToro. “The driving force behind it is without a doubt the [bitcoin funds].”

A New ATH This March?

As Bitcoin experiences brief but notable fluctuations, reaching $64,000 before retracing to the $62,000 mark, the cryptocurrency market remains dynamic and full of anticipation. Investors and enthusiasts are closely monitoring the price movements, speculating on the possibility of a new all-time high (ATH) in March.

Featured image from Pexels , chart from TradingView

In a not-so unexpected turn of events, Bitcoin (BTC) has surged to new heights, breaking the $57,000 barrier during the early hours of Tuesday in the Asian market. This price level, not seen since November 2021, marks a significant resurgence for the leading cryptocurrency.

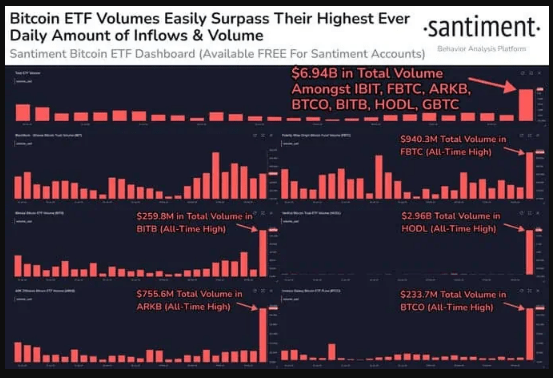

Remarkably, the surge in Bitcoin’s price has triggered substantial activity in US-based spot Bitcoin ETFs, excluding Grayscale’s GBTC. According to Bloomberg, these ETFs recorded a record-high $2.4 billion in trading volume on Monday. This surge in trading activity underscores the increasing interest and involvement of institutional investors in the cryptocurrency market.

As of the time of publication, bitcoin had slightly decreased to $56,437, but it was still up about 10% from the previous day. Since the beginning of the year, the price of bitcoin has risen by more than 30%, continuing a protracted surge that has also spurred interest in smaller currencies like Ether and Solana, among speculators.

The demand for Bitcoin is not confined to spot trading alone; a substantial influx of approximately $5.6 billion has poured into recently launched Bitcoin ETFs in the US, which began trading on January 11. This influx of investment signals a broadening interest in Bitcoin, extending beyond the traditional base of digital asset enthusiasts.

It’s official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Surprisingly, Bitcoin’s rally this year has outpaced traditional assets such as stocks and gold. The ratio comparing Bitcoin’s price to that of the precious metal has reached its highest level in over two years, indicating a shifting preference among investors towards digital assets.

The overall value of digital assets, including various cryptocurrencies, now stands at a staggering $2.2 trillion, a substantial increase from the lows experienced during the bear market of 2022 when the market value dipped to around $820 billion. This resurgence demonstrates the resilience and growing prominence of digital assets in the financial landscape.

Contrary Market Indicators Fail To Deter Crypto Momentum

In an intriguing development, despite a rise in US Treasury yields, which typically signals expectations for tighter monetary policy, the bullish momentum in the cryptocurrency market remains resilient. Digital tokens like Bitcoin are experiencing notable upward movements, defying conventional market indicators.

Fundstrat Global Advisors’ Head of Digital-Asset Strategy, Sean Farrell, noted in a recent statement that the “bullish momentum in crypto is unfolding despite an uptick in rates,” highlighting the unique dynamics influencing the cryptocurrency market.

MicroStrategy Boosts Corporate Bitcoin Holdings

In the midst of this ongoing rally, MicroStrategy, a notable enterprise software firm recognized for incorporating Bitcoin into its corporate strategy, has announced a significant addition to its cryptocurrency holdings.

The company revealed that it had purchased an additional 3,000 Bitcoin tokens this month, bringing its total Bitcoin holdings to approximately $10 billion. This strategic move by MicroStrategy highlights the growing acceptance of cryptocurrencies as a valuable asset by corporate entities.

Featured image from, chart from TradingView

The long-awaited arrival of spot Bitcoin ETFs has ignited a gold rush in the crypto world, attracting both newcomers and seasoned investors. While these new investment vehicles offer a convenient and accessible way to gain exposure to Bitcoin, their impact on the cryptocurrency’s core principles and long-term stability remains a complex question.

The data paints a fascinating picture. Following the SEC’s approval of 11 ETFs, the number of non-zero Bitcoin wallets initially soared, reaching a peak of nearly 53 million in January. This surge was likely fueled by the accessibility and security offered by ETFs, attracting individuals previously hesitant to directly engage with the intricacies of crypto wallets and exchanges.

However, according to data provided by Santiment, a concerning trend emerged 30 days later: nearly 730,000 fewer wallets held any Bitcoin, suggesting a potential shift towards holding through ETFs instead of directly owning the tokens. This raises questions about the long-term impact on Bitcoin’s decentralized nature and the potential for decreased on-chain activity.

There are 729.4K less #Bitcoin wallets holding greater than 0 $BTC, compared to one month ago. After the #SEC approved 11 Spot Bitcoin #ETF‘s, this amount of non-0 wallets peaked on January 20th at 52.95M. This is attributed to the increased interest in #hodlers

(Cont)

pic.twitter.com/FThtSDOmk0

— Santiment (@santimentfeed) February 21, 2024

While the ETF market is thriving, its impact on Bitcoin’s core principles is less clear. The recent record volume and inflows exceeding $7 billion across the top 7 ETFs highlight strong market interest and the potential for mainstream adoption.

However, it’s crucial to remember that these ETFs can hold both actual Bitcoin and futures contracts. This means investors gain exposure without directly impacting the underlying supply or demand of the cryptocurrency itself. This raises questions about whether ETFs are truly driving adoption or simply creating a derivative-based market with its own set of risks and dynamics.

Speculation Surges, Raising Red Flags

Perhaps the most concerning trend is the surge in speculative trading using derivatives. Open interest on centralized exchanges, particularly for Bitcoin, has reached unprecedented levels, exceeding $10 billion for the first time since July 2022.

This indicates investors are taking on more risk by leveraging derivatives, potentially fueled by the “crowd euphoria” surrounding Bitcoin and the allure of potentially quick gains. This echoes the speculative frenzy seen in 2017, raising concerns about potential market volatility and potential crashes. Ethereum, Solana, and Chainlink also exhibit significant open interest, suggesting broader market-wide trends beyond just Bitcoin.

The Verdict: A Double-Edged Sword

The arrival of spot Bitcoin ETFs has undoubtedly opened doors for new investors, but it’s important to acknowledge the potential downsides. While accessibility has increased, direct ownership might be decreasing, and the rise of speculative trading using derivatives raises concerns about future market stability.

Moving forward, it will be crucial to monitor how these trends evolve and their long-term impact on the overall health of the crypto ecosystem. Additionally, ongoing regulatory developments surrounding ETFs and derivatives could further shape the landscape.

Featured image from Nicola Barts/Pexels, chart from TradingView

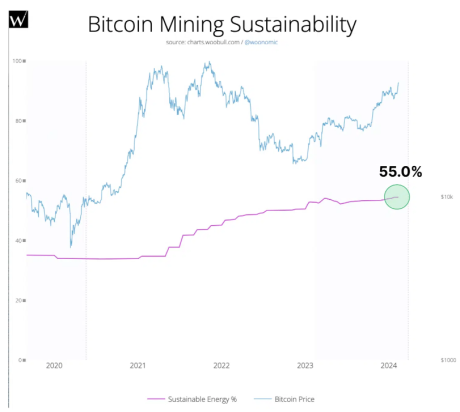

Bitcoin, the enigmatic cryptocurrency known for its volatile price swings and digital gold status, is making a surprising play for a new title: sustainability champion.

A recent analysis by Bitcoin environmental impact expert Daniel Batten reveals a remarkable surge in renewable energy use for mining, reaching a staggering 55%. This marks a significant shift from just four years ago, when the figure languished below 40%, and paints a picture of an industry undergoing a green metamorphosis.

Bitcoin’s mining process, essential for creating new coins, has historically been a lightning rod for environmental criticism. The sheer computing power required gulps up massive amounts of electricity, often sourced from fossil fuels. This led to accusations of Bitcoin being a climate villain, spewing greenhouse gases and contributing to global warming.

However, the narrative is evolving. Companies like Luxor Technology are harnessing Ethiopia’s hydroelectric bounty, while Argentina’s Unblock Global repurposes wasted natural gas from oil reserves.

Even domestic players like CleanSpark are upping their game with low-carbon solutions. These efforts, coupled with an overall decline in mining emissions intensity, suggest a genuine commitment to going green.

Despite the positive strides, the sustainability of Bitcoin is far from over. The ever-growing network demands more energy, and ensuring enough renewable sources to keep pace is critical.

Furthermore, the environmental impact extends beyond energy consumption. The mountains of discarded mining hardware raise concerns about e-waste, another hurdle on the path to true sustainability.

The Future: Doubling Down On Green

The success of Bitcoin’s green gamble hinges on several factors. Continued investment in renewable energy infrastructure is paramount, and regulatory frameworks that incentivize sustainable practices could play a vital role.

Ultimately, the industry needs to demonstrate a long-term commitment to environmental responsibility, moving beyond individual success stories to ensure widespread adoption of green solutions.

While the jury is still out on whether Bitcoin can truly shed its carbon-intensive past, the recent surge in renewable energy use is a promising sign. This green gamble, if played with transparency, scalability, and a holistic approach to sustainability, could pave the way for a future where Bitcoin and the environment coexist in harmony.

The question remains: will Bitcoin’s green hand win the game, or will it fold under the weight of its own growth and environmental concerns? Only time, and the industry’s commitment, will tell.

Featured image from Karolina Grabowska/Pexels, chart from TradingView

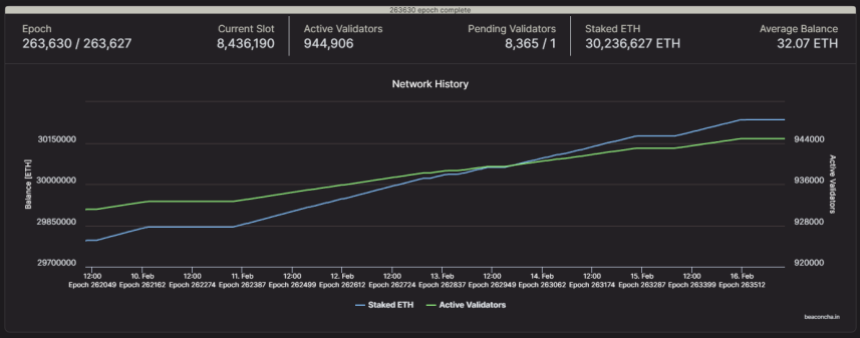

Ethereum (ETH), the global runner-up in the cryptocurrency ring, is making serious moves this week, stepping closer to the coveted $3,000 mark. Could this be the opening bell for a February knockout, sending it soaring towards a staggering $4,000 finish by month’s end?

Several factors are fueling this bullish sentiment, starting with the surging popularity of ETH staking. As Ethereum 2.0 gathers momentum, more investors are locking their ETH into staking contracts, earning passive income while reducing the readily available supply in the market. This “induced market scarcity,” as experts call it, creates upward pressure on the price.

The numbers are impressive: a whopping 25% of all circulating ETH, or 30.2 million coins, are now locked in staking contracts. This represents a significant surge of 600,000 ETH deposited between February 1st and 15th. And with an annualized reward rate of 4%, the incentive to join the staking party is only growing stronger.

But staking isn’t the only force propelling ETH forward. The potential approval of an Ethereum Exchange-Traded Fund (ETF) has also injected optimism into the market. Such a product would make it easier for institutional investors to enter the crypto space, potentially leading to significant inflows and price appreciation.

Furthermore, the recent Dencun upgrade on the Sepolia testnet, promising improved network performance and lower transaction costs, has been met with positive reactions from stakeholders. This could attract more developers and users to the Ethereum DeFi ecosystem, boosting its utility and ultimately driving demand for ETH.

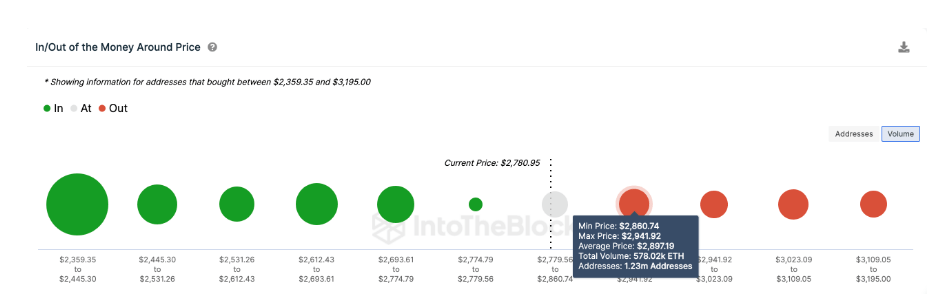

However, the path to $4,000 isn’t without its obstacles. A major resistance level looms at $2,850, where approximately 1.23 million addresses, holding a combined 578,000 ETH, bought in. These holders might be tempted to take profits as the price approaches their break-even point, creating a temporary hurdle.

Additionally, a price dip below $2,500 could trigger panic selling among investors who bought at higher prices. While some experts suggest that such a scenario might be mitigated by “frantic last-minute purchases” to avoid losses, it underscores the inherent volatility of the cryptocurrency market.

IntoTheBlock’s global in/out of the money (GIOM) data further emphasizes this point. This data groups all existing ETH holders based on their historical buy-in prices. According to GIOM, the cluster of holders at the $2,850 resistance level represents a potential selling pressure. However, if the bulls can overcome this hurdle, another leg-up towards $3,000 and beyond becomes more likely.

Ultimately, while the short-term outlook for ETH seems promising, caution remains key. Investors should carefully consider their own risk tolerance and conduct thorough research before making any investment decisions. As with any market, past performance is not necessarily indicative of future results.

The next few days or weeks will be crucial in determining whether ETH can break through the $2,850 resistance and continue its ascent towards $3,000 and beyond.

Featured image from Adobe Stock, chart from TradingView

The CBDC-like bakong provides digital payment services in riel and the U.S. dollar. It has been steadily extending its regional scope.

According to the report, these expectations can be addressed by applying existing rules or creating new ones, depending on the jurisdiction.

EU lawmakers are anticipating the arrival of the digital euro, though German politician Joana Cotar is pushing back against the currency and fighting in favor of Bitcoin.

Is your Bitcoin wallet shackled by the outdated chains of 2016 technology? Brace yourself, for trouble may be lurking in the shadows, ready to pounce on the unsuspecting.

In the fast-paced realm of cryptocurrency, your digital fortress could be nothing more than a relic of the past, leaving you vulnerable to the merciless winds of technological evolution.

Recently, cryptocurrency startup Unciphered revealed a potential security threat to Bitcoin wallets created prior to 2016.

Known as “Randstorm,” this software flaw encompasses a combination of bugs, architectural choices, and API (Application Programming Interface) modifications that heighten the vulnerability of Bitcoin wallets crafted between 2011 and 2015.

The genesis of this issue dates back to last year when Unciphered was assisting a customer who found themselves locked out of a Bitcoin wallet originally created on what is now recognized as Blockchain.com.

During the investigation to recover the wallet, Unciphered stumbled upon a critical flaw in wallets generated by BitcoinJS between 2011 and 2015.

Unciphered, in its report on Tuesday, highlighted the significance of this flaw, suggesting that it may have impacted approximately 1.4 million Bitcoin.

This means, that if 3 to 5 percent of these wallets were affected, the potential value of the at-risk coins could range from $1.2 to $2.1 billion.

Eric Michaud, co-founder of Unciphered, stated that BitcoinJS was severely flawed until March 2014, and anyone using it directly faces a significantly high risk of being attacked.

Unciphered has dedicated several months to notifying a substantial number of individuals, over one million, on the vulnerability of their wallets.

A significant number of individuals remain uninformed due to their possession of wallets constructed on defunct digital currency platforms.

Unciphered clarified that finding vulnerabilities doesn’t imply that Bitcoin or technology, in general, is fundamentally flawed. Instead, it reveals a chain of programming errors that occurred across various technologies from 2011 to 2015.

There are serious problems in a lot of the wallet code, Unciphered has discovered, and the companies who employed that technology may vanish.

Despite that, though, it serves as a stark reminder that open-source projects that little to no one oversees lie beneath software infrastructure of all types, even those specifically aimed at raising capital.

Michaud asserted that imperfections within every human-made technology stem from its creators.

“Every man-made technology contains flaws that originate within its creators,” he said.

The wallets’ software developer, Stefan Thomas, told The Washington Post that he created the wallets as a pastime. He said that without checking the program’s validity, he had stolen a significant portion of the code from a page belonging to a Stanford University student.

“Instead, I was obsessed about making sure that I didn’t make any mistakes in my own code […] I’m sorry to anyone affected by this bug,” he added.

In layman’s words, Unciphered called the vulnerability “Randstorm” since wallet software that produced cryptographic keys wasn’t sufficiently random was the source of it.

They produced electronic keys with a randomness factor that was easier to hack, only one in a specific number of thousands, as opposed to ones that were incredibly unique and hard for someone else to copy (like one in a trillion odds).

Navigating Cryptocurrency’s Hostile Landscape

Security expert Dan Guido said that the world of cryptocurrency is quite unfriendly. It’s filled with individuals attempting to undermine what you’re constructing, whether through hacking attempts, regulatory challenges, or others keen on causing harm to Bitcoin.

“Crypto is a pretty hostile place, to be honest, full of people attacking what you’re building,” he said.

As the curtains draw on the unsettling revelation of the “Randstorm” vulnerability, it’s a stark wake-up call for those still tethered to Bitcoin wallets from the pre-2016 era.

The ominous specter of technological evolution looms large, and the recent exposé by Unciphered sheds light on the potential peril faced by those oblivious to the vulnerabilities embedded in their outdated digital fortresses.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from WJHG

JPMorgan Chase & Co. anticipates that its digital currency, JPM Coin, will facilitate daily transactions amounting to $10 billion in the coming year.

Umar Farooq, the Global Head of Financial Institution Payments at the bank, revealed this projection during an interview with Bloomberg held at the Singapore FinTech Festival.

Farooq’s insights shed light on the ambitious expectations the financial institution has for the widespread adoption and utilization of JPM Coin as a means of conducting transactions in the digital financial landscape.

Takis Georgakopoulos, the Global Head of Payments at JPMorgan Chase & Co., recently disclosed that JPM Coin is actively managing a staggering $1 billion in daily transactions.

In a recent interview on Bloomberg Television, Georgakopoulos highlighted the predominant use of JPM Coin in daily transactions denominated in US dollars and underscored the bank’s dedicated efforts to broaden its utilization, signaling a robust commitment to the ongoing evolution of digital financial instruments.

Farooq expressed his aspiration for a substantial increase in transaction volume, aiming for a growth rate ranging from five to 10 times over the specified period.

“We really think it’s going to start taking off,” he said during an interview with Haslinda Amin of Bloomberg TV Wednesday, on the sidelines of the Singapore FinTech Festival.

Although the billion-dollar daily transaction volume achieved by JPM Coin is notable, it represents only a small fraction of the colossal $10 trillion in daily US dollar transactions managed by JPMorgan.

JPM Coin presents a secure and efficient avenue for wholesale clients to participate in dollar and euro-denominated payments within the confines of a private blockchain network.

Advocates for blockchain technology contend that it has the potential to facilitate instant payments at a reduced cost compared to prevailing technologies.

However, it’s crucial to note that digital ledgers, despite their touted advantages, have not undergone trials on the same expansive scale as established payment networks.

The claims surrounding the efficiency and cost-effectiveness of blockchains are still in the process of being substantiated through broader and more comprehensive real-world applications.

Programmable Payments For Institutional Clients

Meanwhile, JPMorgan has just implemented a programmable payment functionality specifically designed for institutional customers of their private blockchain network.

The programmable payments functionality has been made available to all institutional clients, enabling the execution of real-time, programmable treasury operations and the development of novel digital business models.

The first institutional client to utilize the programmable payments capability is Siemens AG, a German tech company that demonstrated its use as recently as November 6. Before the conclusion of 2023, FedEx and Cargill are anticipated to utilize the solution as well.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from AdWeek

The Turkish finance minister reportedly stated that crypto assets are the sole outstanding technical compliance matter.