Is your Bitcoin wallet shackled by the outdated chains of 2016 technology? Brace yourself, for trouble may be lurking in the shadows, ready to pounce on the unsuspecting.

In the fast-paced realm of cryptocurrency, your digital fortress could be nothing more than a relic of the past, leaving you vulnerable to the merciless winds of technological evolution.

Recently, cryptocurrency startup Unciphered revealed a potential security threat to Bitcoin wallets created prior to 2016.

Known as “Randstorm,” this software flaw encompasses a combination of bugs, architectural choices, and API (Application Programming Interface) modifications that heighten the vulnerability of Bitcoin wallets crafted between 2011 and 2015.

The genesis of this issue dates back to last year when Unciphered was assisting a customer who found themselves locked out of a Bitcoin wallet originally created on what is now recognized as Blockchain.com.

Unveiling The Risks: The Potential Perils Lurking In A 2016-era Bitcoin Wallet

During the investigation to recover the wallet, Unciphered stumbled upon a critical flaw in wallets generated by BitcoinJS between 2011 and 2015.

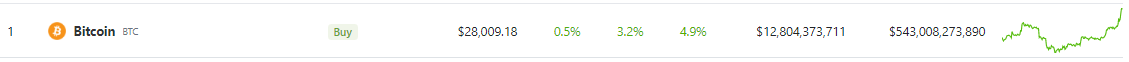

Unciphered, in its report on Tuesday, highlighted the significance of this flaw, suggesting that it may have impacted approximately 1.4 million Bitcoin.

This means, that if 3 to 5 percent of these wallets were affected, the potential value of the at-risk coins could range from $1.2 to $2.1 billion.

Eric Michaud, co-founder of Unciphered, stated that BitcoinJS was severely flawed until March 2014, and anyone using it directly faces a significantly high risk of being attacked.

Unciphered has dedicated several months to notifying a substantial number of individuals, over one million, on the vulnerability of their wallets.

The Dangers Of Holding Wallets On Obsolete Crypto Platforms

A significant number of individuals remain uninformed due to their possession of wallets constructed on defunct digital currency platforms.

Unciphered clarified that finding vulnerabilities doesn’t imply that Bitcoin or technology, in general, is fundamentally flawed. Instead, it reveals a chain of programming errors that occurred across various technologies from 2011 to 2015.

There are serious problems in a lot of the wallet code, Unciphered has discovered, and the companies who employed that technology may vanish.

Despite that, though, it serves as a stark reminder that open-source projects that little to no one oversees lie beneath software infrastructure of all types, even those specifically aimed at raising capital.

Michaud asserted that imperfections within every human-made technology stem from its creators.

“Every man-made technology contains flaws that originate within its creators,” he said.

The wallets’ software developer, Stefan Thomas, told The Washington Post that he created the wallets as a pastime. He said that without checking the program’s validity, he had stolen a significant portion of the code from a page belonging to a Stanford University student.

“Instead, I was obsessed about making sure that I didn’t make any mistakes in my own code […] I’m sorry to anyone affected by this bug,” he added.

In layman’s words, Unciphered called the vulnerability “Randstorm” since wallet software that produced cryptographic keys wasn’t sufficiently random was the source of it.

They produced electronic keys with a randomness factor that was easier to hack, only one in a specific number of thousands, as opposed to ones that were incredibly unique and hard for someone else to copy (like one in a trillion odds).

Navigating Cryptocurrency’s Hostile Landscape

Security expert Dan Guido said that the world of cryptocurrency is quite unfriendly. It’s filled with individuals attempting to undermine what you’re constructing, whether through hacking attempts, regulatory challenges, or others keen on causing harm to Bitcoin.

“Crypto is a pretty hostile place, to be honest, full of people attacking what you’re building,” he said.

As the curtains draw on the unsettling revelation of the “Randstorm” vulnerability, it’s a stark wake-up call for those still tethered to Bitcoin wallets from the pre-2016 era.

The ominous specter of technological evolution looms large, and the recent exposé by Unciphered sheds light on the potential peril faced by those oblivious to the vulnerabilities embedded in their outdated digital fortresses.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from WJHG