GameStop, the video game retailer that took Wall Street by storm in 2021, has once again become the talk of the town as its share price surges 100%.

Fueling this rally is the return of the influential social media figure Keith Gill’s “Roaring Kitty.” After a long hiatus, Roaring Kitty’s recent activity on social platforms, including an image and video, has ignited excitement among investors and triggered a renewed frenzy for GameStop’s meme stock and the emerging world of memecoins.

GameStop Memestock Frenzy

The meme-stock phenomenon gained widespread attention in 2021 when cash-rich investors pumped up the stock market and bet against short-selling hedge funds.

Keith Gill’s “TheRoaringKitty” account and the subreddit “WallStreetBets” played a pivotal role in the meme stock frenzy, driving stocks like GameStop and AMC Entertainment to surge over 1,000% by the end of the same year.

While some early investors reaped rich returns, hedge funds such as Gabe Plotkin’s Melvin Capital Management suffered significant losses, leading to closures.

According to Bloomberg, short sellers betting against GameStop initially enjoyed gains in the year’s first four months. Still, the volatile nature of meme stocks quickly erased those paper gains. Per the report, “skeptics” were up an estimated $400 million from January to April before slipping into the red by Monday morning.

The percentage of GameStop shares sold short relative to those available for trading has remained at approximately 24%, a relatively high level for a typical company but significantly lower than the 140% levels witnessed during the 2021 mania.

As GameStop’s shares gained momentum, the cost to bet against the company increased. Recent data from S3 indicates borrowing costs exceeding a 10% annual financing fee range.

Roaring Kitty’s Ripple Effect

Roaring Kitty’s influence extended beyond GameStop, as Wolverine-themed memecoins flooded various blockchains. In response to a social media post featuring a video of Marvel superhero Wolverine, more than 30 new tokens were launched on platforms like Ethereum and Solana, as data by Dextools shows.

Notably, the newly minted “Roaring Wolverine” token on the Ethereum blockchain experienced an astonishing 80% surge within hours of its release.

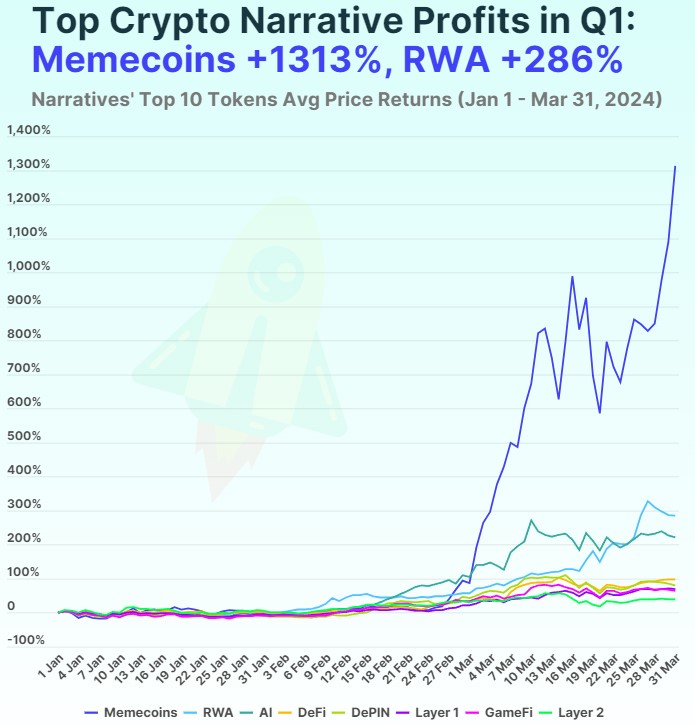

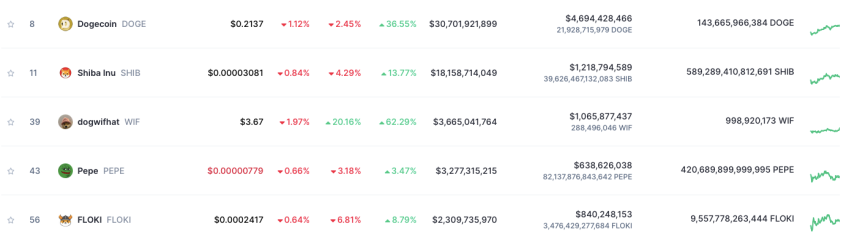

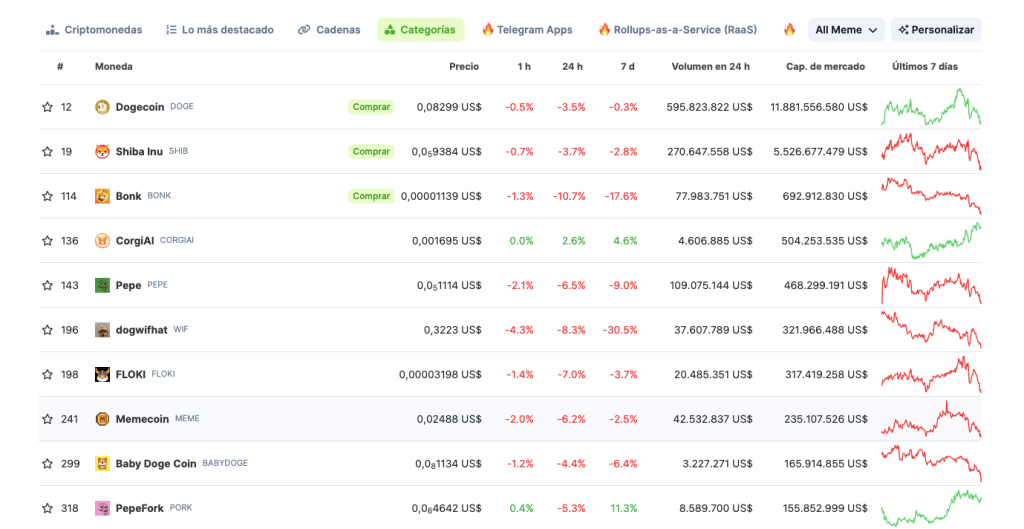

Furthermore, the memecoin market has witnessed a notable resurgence, with tokens such as Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), Floki Inu (FLOKI), and Bonk Inu (BONK) recording significant gains, according to CoinGecko data.

For instance, PEPE, the market leader, surged by 15% in the past 24 hours, complementing its 20% uptrend over the previous week. It reached a new high of $0.00001077 during early Monday trading.

Ultimately, GameStop’s meme stock resurgence, fueled by the return of Roaring Kitty, inflicted substantial losses on short sellers of the meme stock on Monday.

The impact of Roaring Kitty’s social media presence has extended to the memecoin market, with several Wolverine-themed tokens experiencing significant surges.

Featured image from Shutterstock, chart from TradingView.com

(@SolanaLegend)

(@SolanaLegend)