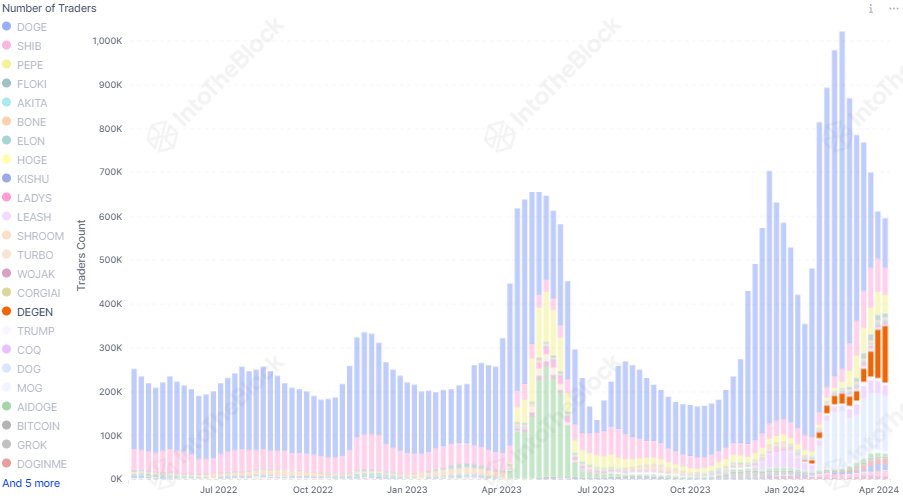

The Dogecoin price action seems to have turned bearish after a bearish close to April. Projections for the meme cryptocurrency are not bullish in the short term, especially considering the fact that it is now experiencing a 47% price correction from its highest point in the current market cycle. Despite its recent plunge, one analyst believes all is still well with Dogecoin, and the crypto asset is only gearing up for a bull run into new price territories.

Dogecoin Repeating Behavior From Previous Bull Run

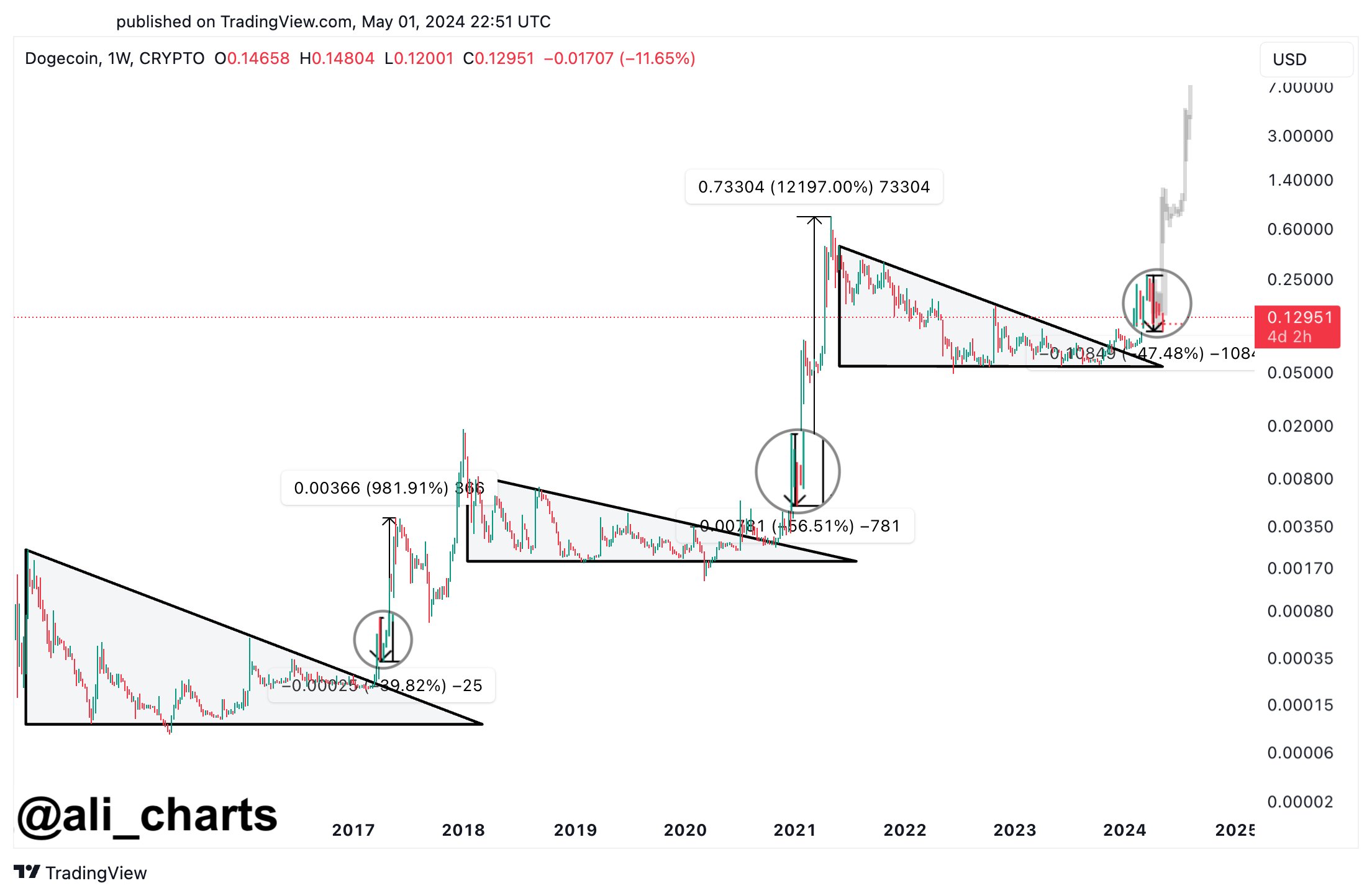

According to a recent analysis by popular crypto analyst Ali Martinez, Dogecoin’s current price action is setting up for a potential bull run, despite the cryptocurrency’s ongoing price correction. His analysis is based on interesting patterns on the Dogecoin price chart.

Although they are a very volatile asset class, patterns are an interesting way to predict the future movement of cryptocurrencies. Now, Dogecoin appears to be repeating some of the same patterns that led to its massive breakout in 2017 and 2021.

Specifically, Dogecoin broke out of a descending triangle pattern in the last quarter of 2023, a seemingly occurring trend and a first step for the cryptocurrency. As Martinez noted, the first time this breakout happened was in 2017. However, DOGE went on a 40% correction shortly after before resuming a 982% bull run. Again, a similar breakout of a descending triangle in 2021 saw the crypto retracing by 56% before skyrocketing by 12,197% to reach its current all-time high of $0.7316.

Now, in 2024, #DOGE has yet again broken out of a descending triangle!

It is currently undergoing a 47% price correction, very similar to previous cycles, which could ignite the next $DOGE bull run! pic.twitter.com/ZmuHmvIwei

— Ali (@ali_charts) May 1, 2024

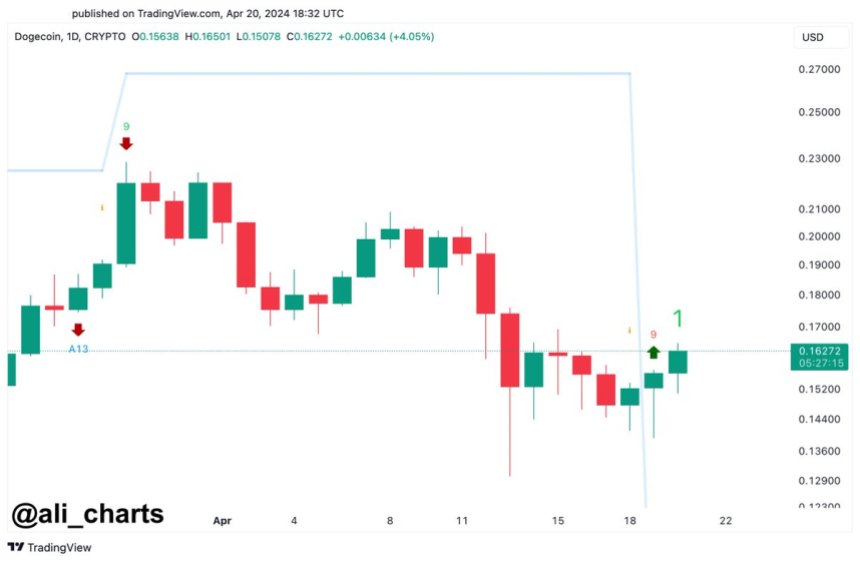

Now, the recent DOGE correction in the past month after breaking out of a descending triangle means the crypto could be gearing up for a similar bounce up. According to the DOGE price chart shared by Martinez, the first step is breaking above resistance at $0.224. If it can hurdle that level, it opens up a run back to the 2021 high and a push-up to a first target of around $1.2.

Looking further out, Martinez’s chart shows an ultimate price surge above $6 in this bull cycle. For this to happen, Dogecoin would need to regain momentum and rally over 4,700% from current levels over the coming months. While this price point looks overachieving, Dogecoin has pulled off epic rallies before, surging over 12,000% at one point in 2021 alone.

It has only been a few months into 2024 Dogecoin has already been on a wild ride this year along with the rest of the crypto market. At the time of writing, DOGE is trading at $0.125 and is down by 16.92% in the past seven days. Trading volume is up by 50% in the past 24 hours, which suggests a return of investor interest.

150,000,000

150,000,000