Dogecoin (DOGE), the popular meme-based cryptocurrency, has demonstrated its resilience in the market with a 2.5% price increase over the past 24 hours, reaching a trading price of $0.1607.

Analysts, including Altcoin Sherpa and Ali Martinez, have recently shared optimistic predictions for DOGE’s future, suggesting further gains and potential for outperformance compared to other tokens.

A Strong Future For Dogecoin In 2024?

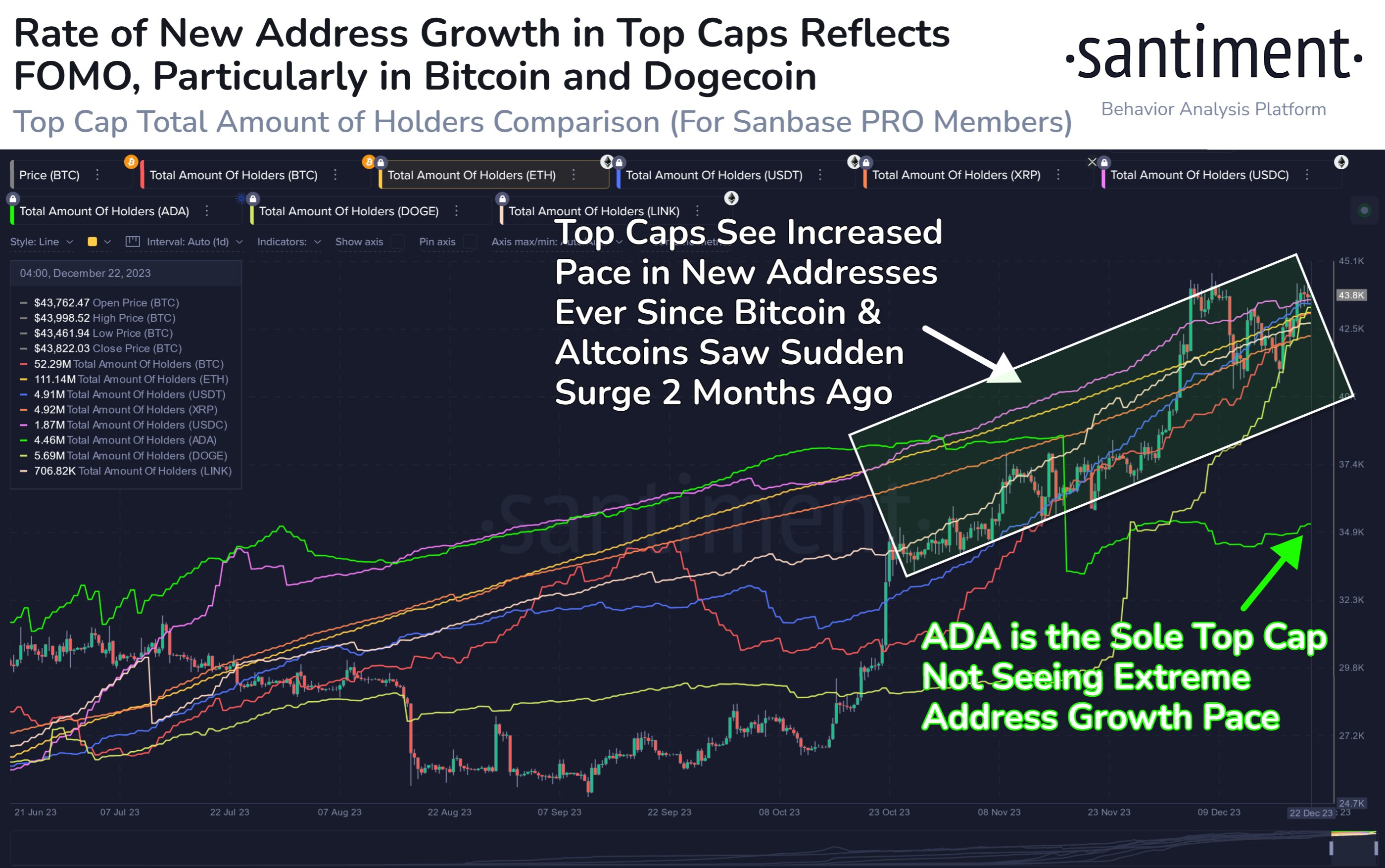

Over the past months, DOGE has closely followed Bitcoin’s price action, experiencing ups and downs in tandem with the market leader.

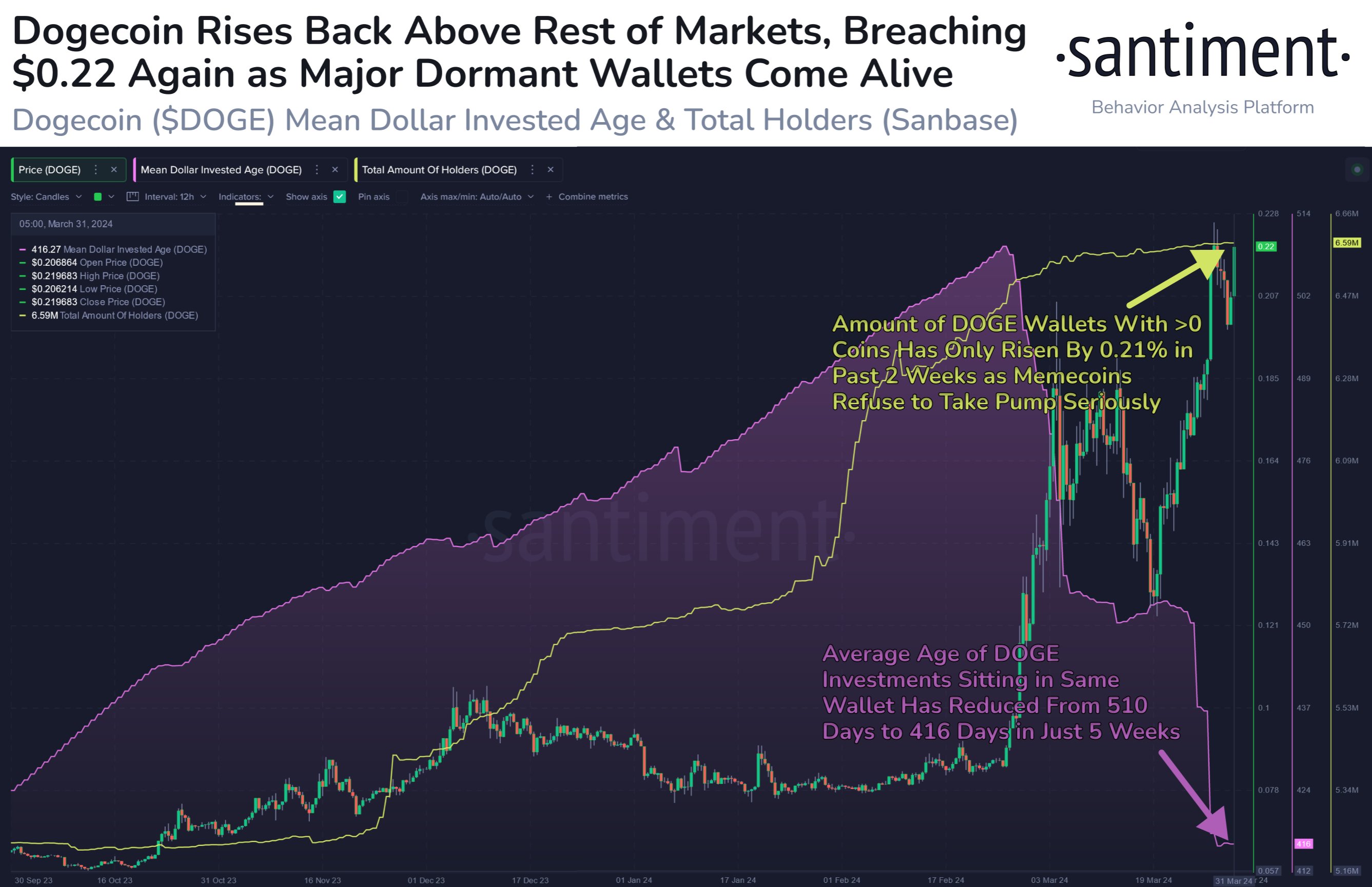

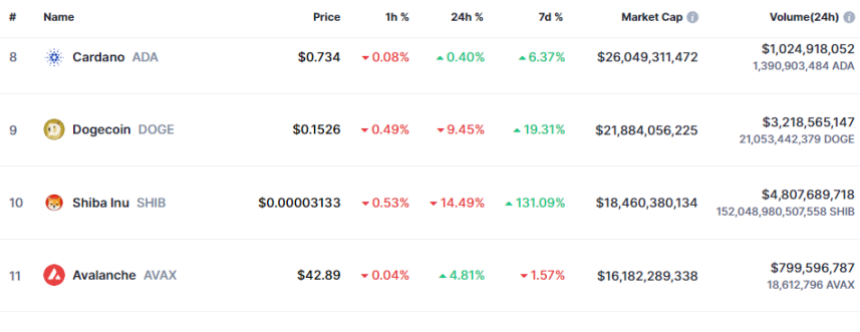

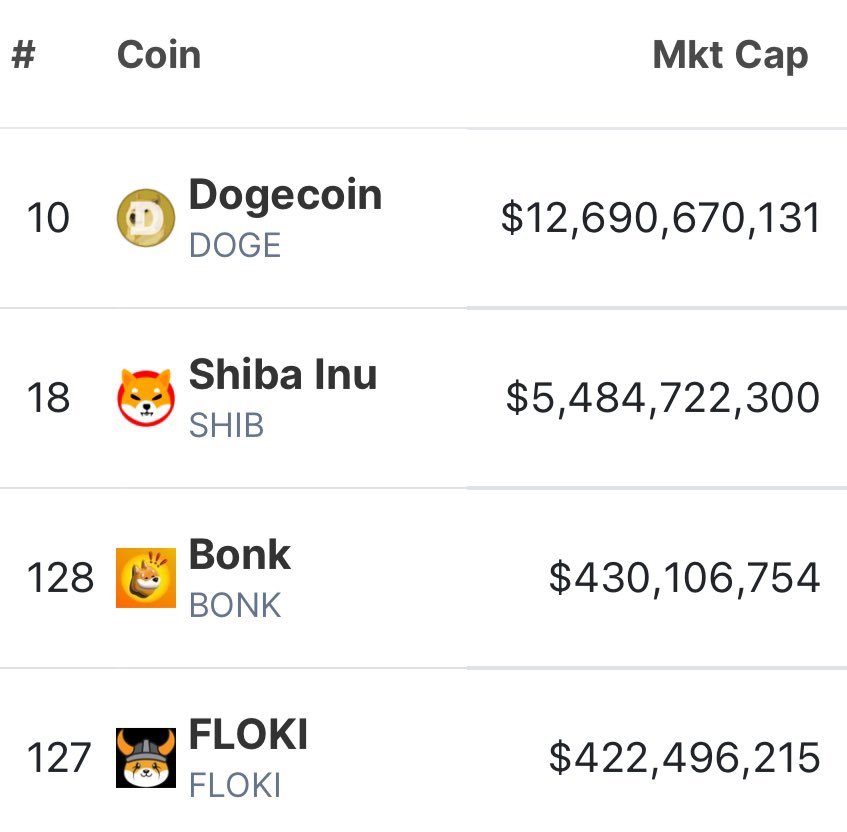

On March 28, DOGE reached its yearly high of $0.2292, solidifying its position as the 9th largest cryptocurrency with nearly 100% year-to-date growth. Despite the volatility, DOGE has demonstrated its ability to rebound and attract investor attention.

Market expert Altcoin Sherpa recently expressed optimism about DOGE’s future, stating that the coin is poised for strength in 2024.

Altcoin Sherpa recommended averaging between $0.12 and $0.14, emphasizing DOGE’s potential to outperform other tokens.

The analyst highlighted DOGE’s previous consolidation phase, lasting almost two years, and suggested that it is primed for a significant price surge in the future. Sherpa stated:

DOGE is looking good. I strongly feel like this is going to be a strong coin for 2024. I think averaging between $.12 and $.14 would be a solid play and this one should outperform many other tokens for a lot of reasons. It chopped for almost 2 years, it’s going to moon later.

700% Price Uptrend Toward $1

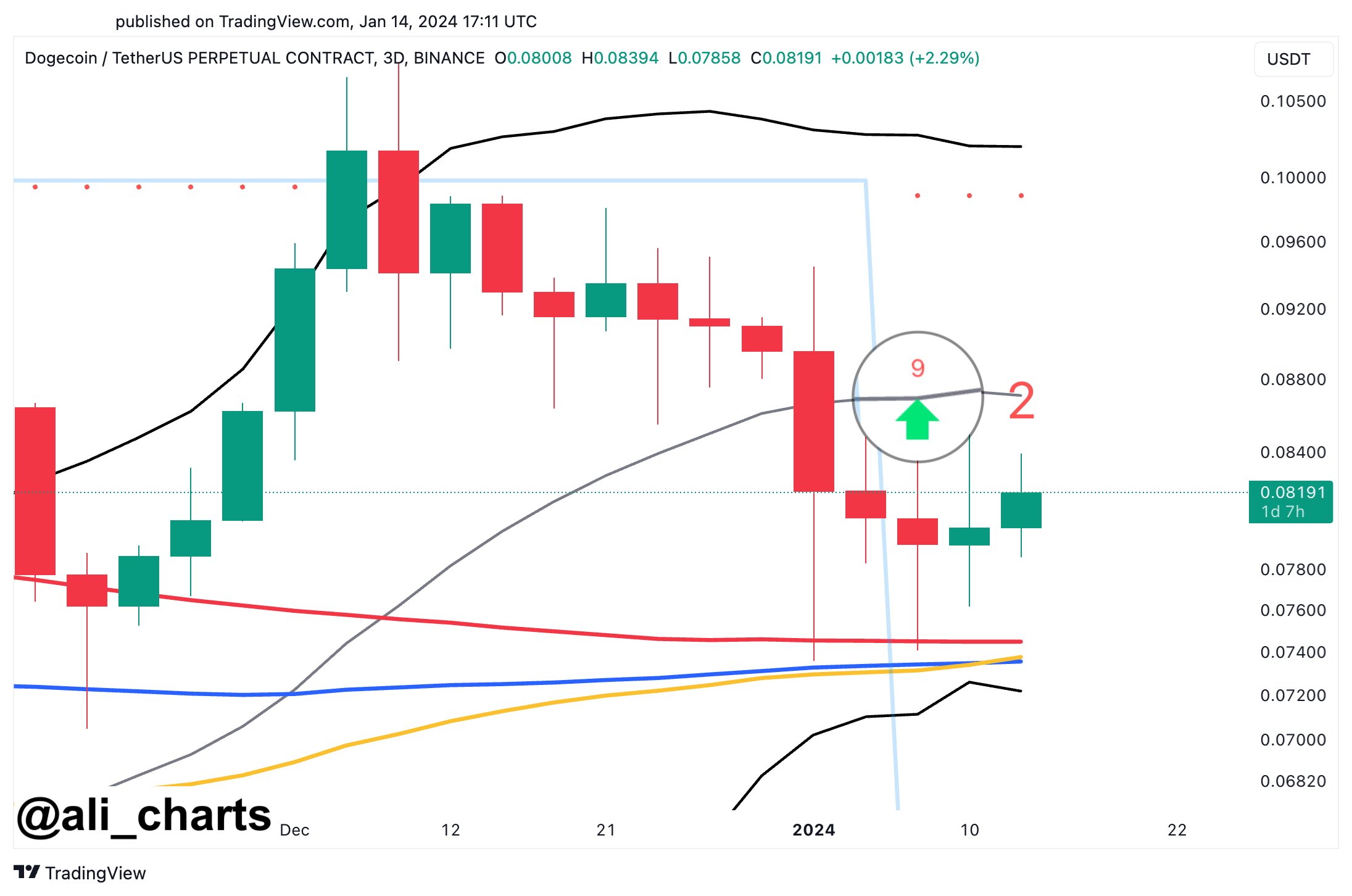

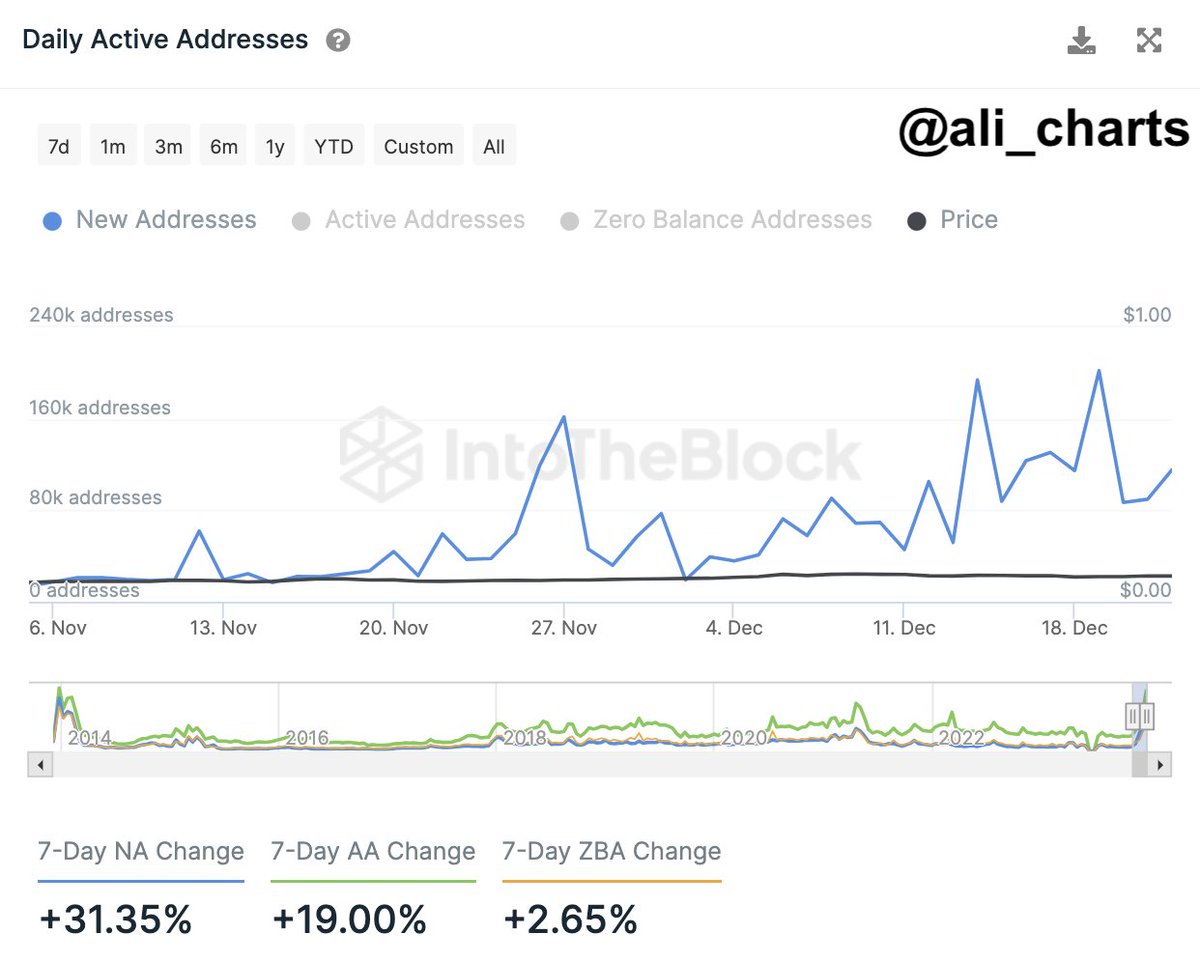

On the other hand, crypto analyst Ali Martinez has also shared a bullish prediction for DOGE, noting the coin’s recurring price patterns.

Martinez pointed out that DOGE consolidates after breaking out of a descending triangle formation. Based on historical trends, the analyst believes that DOGE has the potential to rally towards $1 in the coming weeks, which would represent a staggering 700% uptrend in price from current levels, surpassing the cryptocurrency’s current all-time high of $0.7316, reached in May 2021.

Despite Martinez’s optimistic outlook, Dogecoin faces several resistance levels that have impeded its recovery after a 21% price decline in the past two weeks.

The meme coin encounters a significant obstacle at the $0.1633 price level, as depicted in the DOGE/USD daily chart above. This level has acted as a barrier for the past 10 days, hindering further upward movement.

In its journey towards the $0.200 mark, DOGE may encounter additional hurdles at $0.1739, $0.1938, and $0.1998. These resistance levels must be overcome before the cryptocurrency can potentially retest its all-time high.

It is important to note that Bitcoin’s performance will likely influence Dogecoin’s price movement in the coming weeks. In addition, Dogecoin’s overall trajectory through the end of 2024 remains uncertain as it depends on the potential for a bullish breakout and various market factors.

Featured image from Shutterstock, chart from TradingView.com