In an analysis shared via X, crypto analyst Ali Martinez elaborated on the ongoing price correction of Dogecoin (DOGE), positing that it is a consistent precursor to major bull runs, drawing on historical patterns to forecast future price movements.

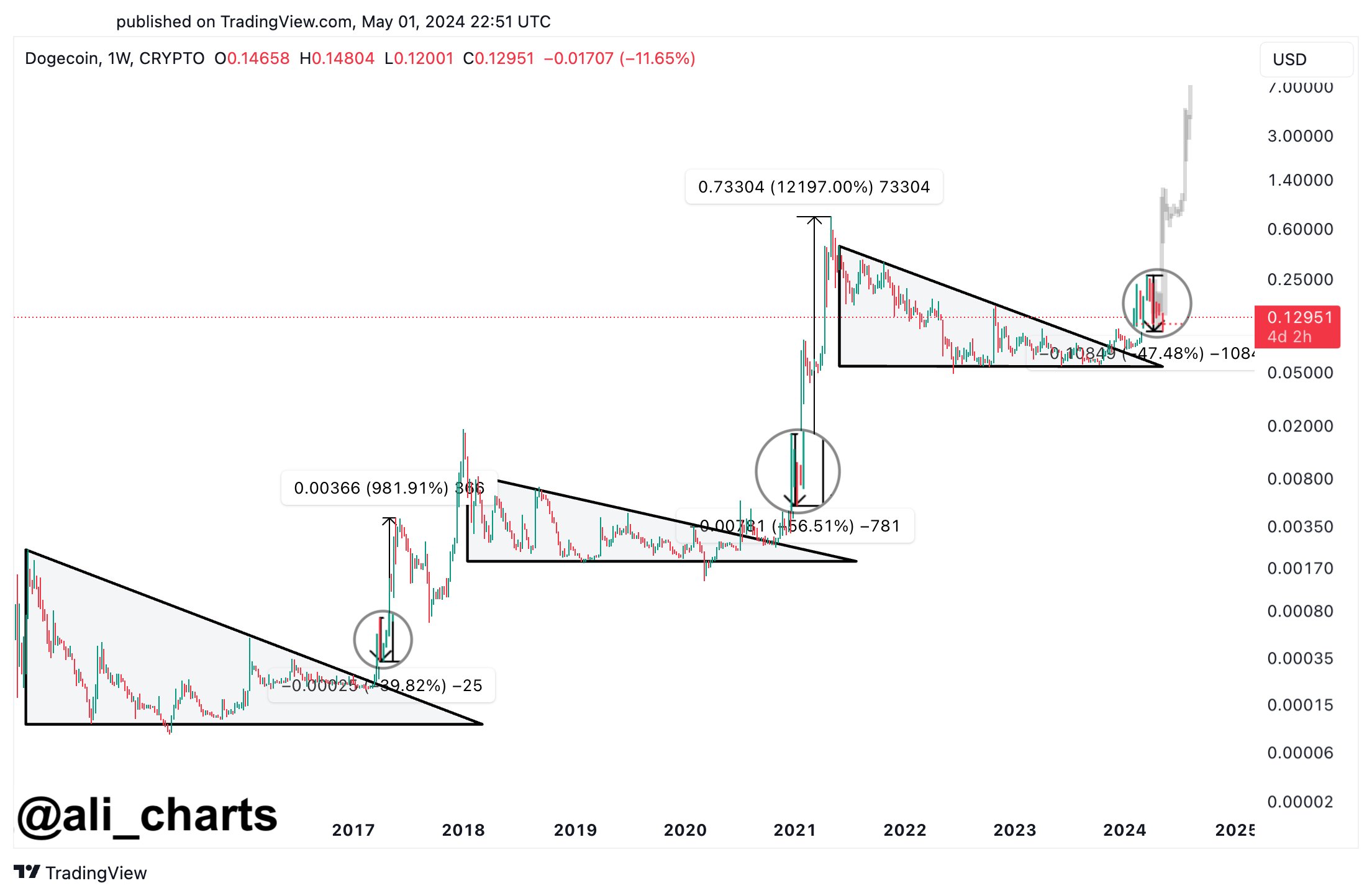

Martinez’s commentary centers on the chart pattern known as the “descending triangle.” This is a bearish formation that occurs when the price follows a downward trendline intersecting a flat support line. Typically, this pattern indicates a continuation of a downward trend, but in the context of Dogecoin, Martinez suggests it precedes significant bullish breakouts.

“The ongoing Dogecoin price correction is part of its usual behavior before massive bull runs! Let’s dive in,” Martinez shared. He explained the historical significance of this pattern in Dogecoin’s trading history: “In 2017, DOGE broke out of a descending triangle. Then, DOGE retraced by 40% before entering a 982% bull run!”

Martinez further analyzed more recent cycles to reinforce his observations, “In 2021, DOGE broke out of a descending triangle again. Then, DOGE retraced by 56% before skyrocketing by 12,197%!” According to Martinez, these retracements are not random but are characteristic of how Dogecoin has behaved in previous cycles, setting the stage for explosive gains.

The analyst drew parallels to the current market conditions: “Now, in 2024, DOGE has yet again broken out of a descending triangle! It is currently undergoing a 47% price correction, very similar to previous cycles, which could ignite the next DOGE bull run!” This assertion suggests that the current market downturn might be an opportune buying moment ahead of potential gains.

Martinez’s analysis underscores the cyclical nature of Dogecoin’s price movements, suggesting a pattern of sharp declines followed by dramatic recoveries. “Over the years, Dogecoin appears to mirror its previous bull cycles! All you need is a little bit of patience,” he concluded.

Short-Term Dogecoin Price Analysis

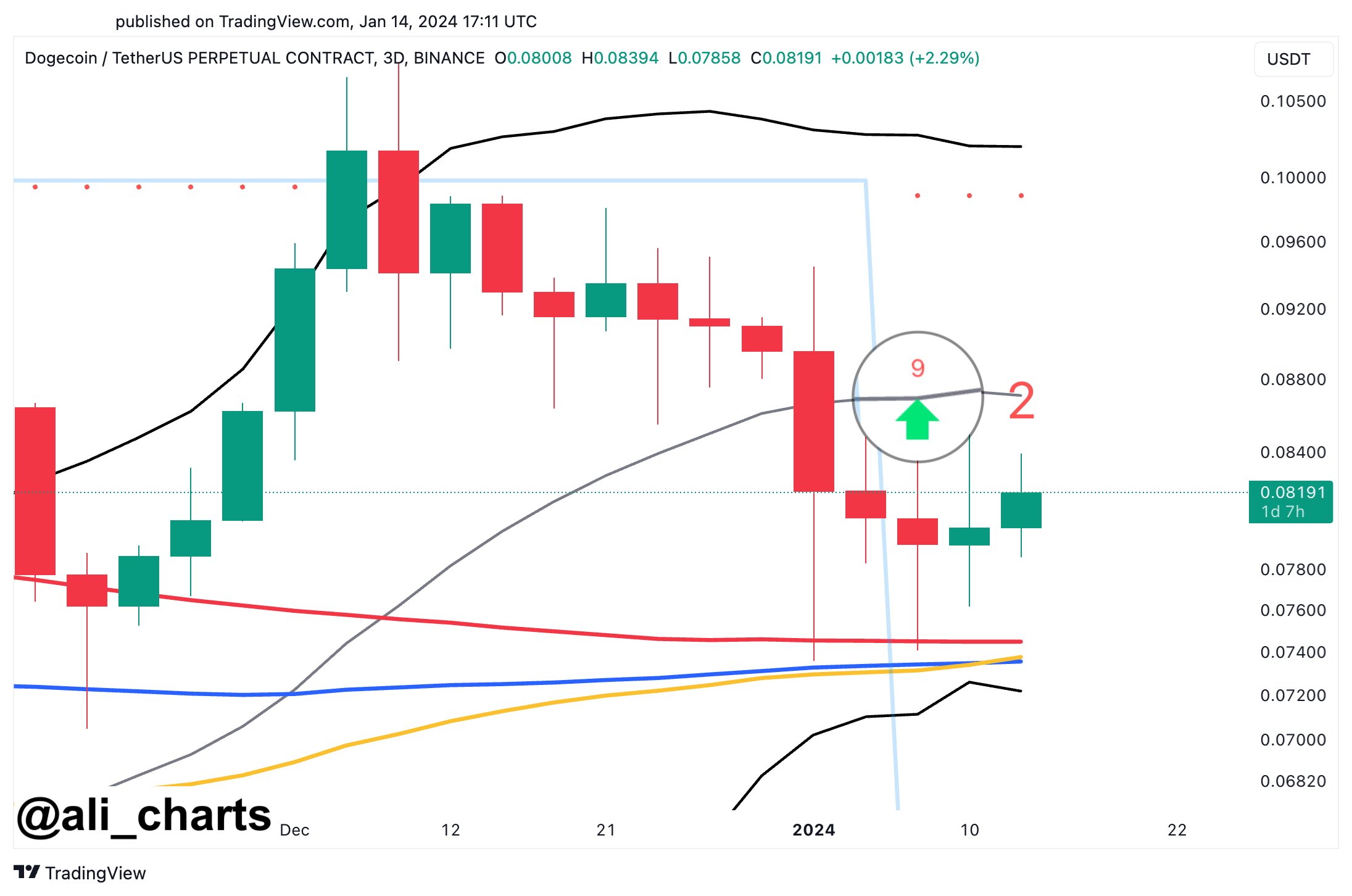

Amidst this optimistic prediction, the Dogecoin price is in a precarious scenario in the short-term. Since mid-April, DOGE has experienced significant technical resistance. Particularly, the DOGE price was consistently rejected at the 50-day EMA over multiple instances, indicating strong selling pressure at higher price levels.

Amid a broader market downturn, the trajectory was accentuated when Dogecoin’s price broke below the crucial 100-day EMA. This level, often watched by traders for signs of medium-term market direction, had previously offered support. The breach underscores a weakening market sentiment and could signal extended losses.

As of press time, Dogecoin’s price hovered near $0.1259 after narrowly holding above the 200-day EMA yesterday, a key psychological and technical barrier. This moving average is now a pivotal point for Dogecoin; its sustained breach on the daily chart could significantly alter the market structure, potentially triggering a slide towards the $0.1005 support level.

The Relative Strength Index (RSI) is at 31.63, edging close to the oversold territory but not conclusively signaling an imminent reversal. This indicates that while the market is nearing oversold conditions, the selling pressure has not fully abated. One last leg down might be necessary to get DOGE into “oversold” territory in order to mark a local bottom.