The market intelligence platform IntoTheBlock has pointed out what may need to happen before Dogecoin can continue its uptrend and reach new highs.

Dogecoin Has Notable On-Chain Resistance Near $0.20

In a new post on X, IntoTheBlock has discussed the recent trend in the price of DOGE and what it would take for the memecoin to register a new high for the year.

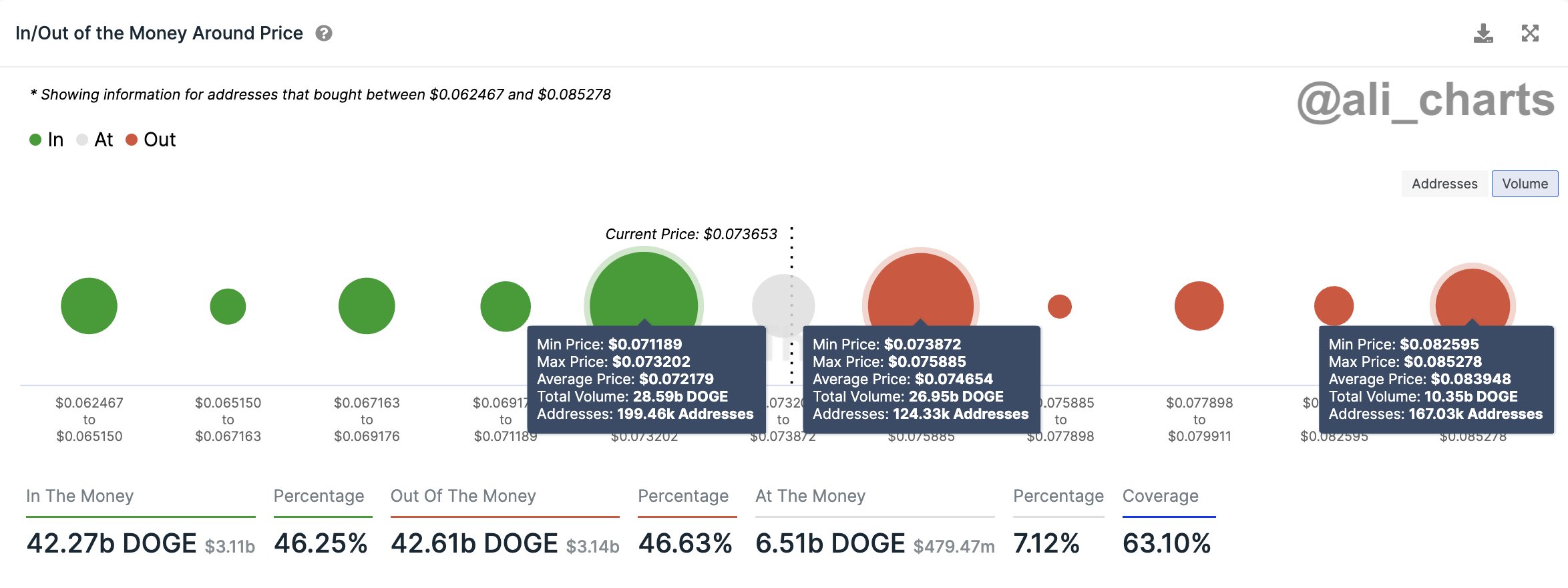

According to the analytics firm, Dogecoin must solidly break above the level where on-chain resistance is currently the strongest. In on-chain analysis, a level’s potential to act as resistance or support is based on the number of coins that were last bought at it.

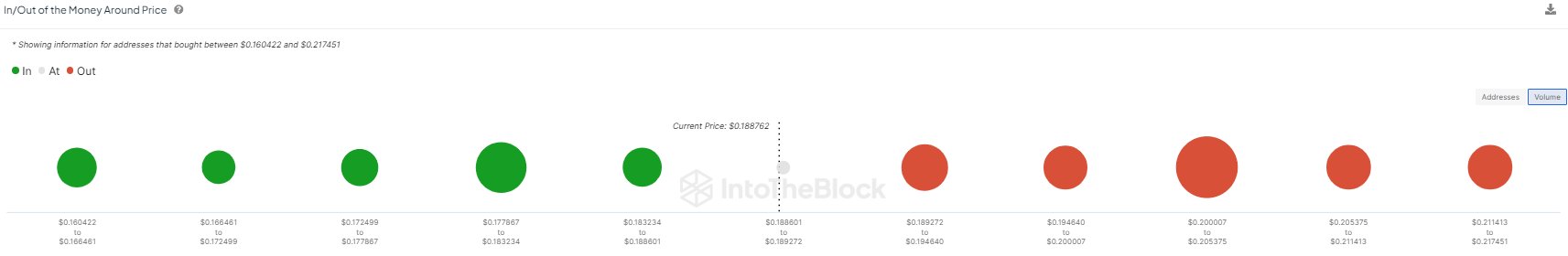

Below is a chart that shows this investor cost basis distribution for DOGE at price ranges near the cryptocurrency’s current spot value.

Here, the size of the dot represents the number of coins acquired within the corresponding price range. In terms of the levels ahead, the prices around $0.20 have held the cost basis of the most number of tokens out of the ranges listed.

To be more particular, about 32,000 addresses bought 3.78 billion DOGE around this mark. Since this price is above the current spot value of the asset, all of these investors would be holding at a loss.

Generally, the cost basis is a special level for investors, and as such, they are prone to reacting when the asset retests. Investors holding at a loss may tend to show a selling reaction when such a reaction happens.

This is because investors like these may fear that the cryptocurrency will dip again shortly, so exiting at the break-even mark might not sound like a bad idea, as they would at least be able to avoid any losses in the future.

Of course, if only a few investors are involved, any such reaction from the market wouldn’t be relevant to the Dogecoin price. However, if a large number of investors show this reaction, the asset may very well feel some visible fluctuations.

This is why the strength of an on-chain level’s ability to act as resistance or support lies in the number of coins acquired there. More coins mean a potentially larger reaction once the level is retested.

As the $0.20 level holds the cost basis of a notable number of investors, it’s possible that it could act as a source of major resistance when Dogecoin retests it next. IntoTheBlock says that, for DOGE to continue its recent rend, it would have to break past this barrier solidly.

DOGE Price

Dogecoin has experienced a drawdown over the last couple of days, which has taken its price to $0.188.