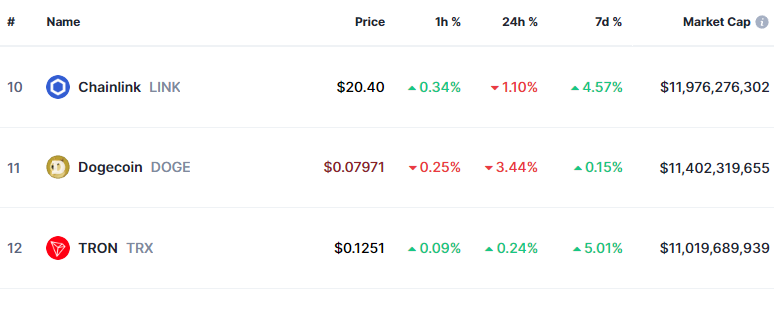

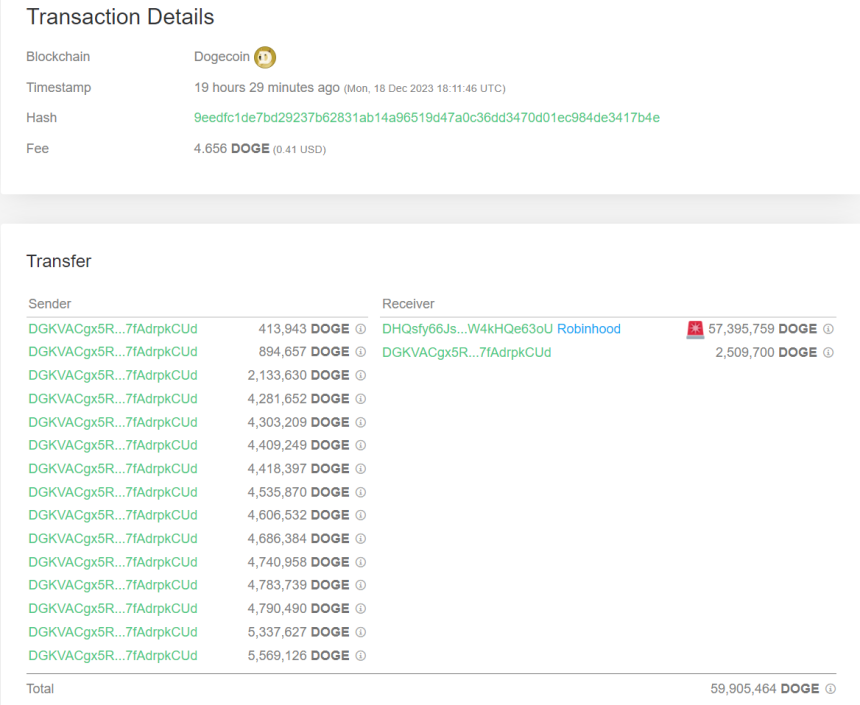

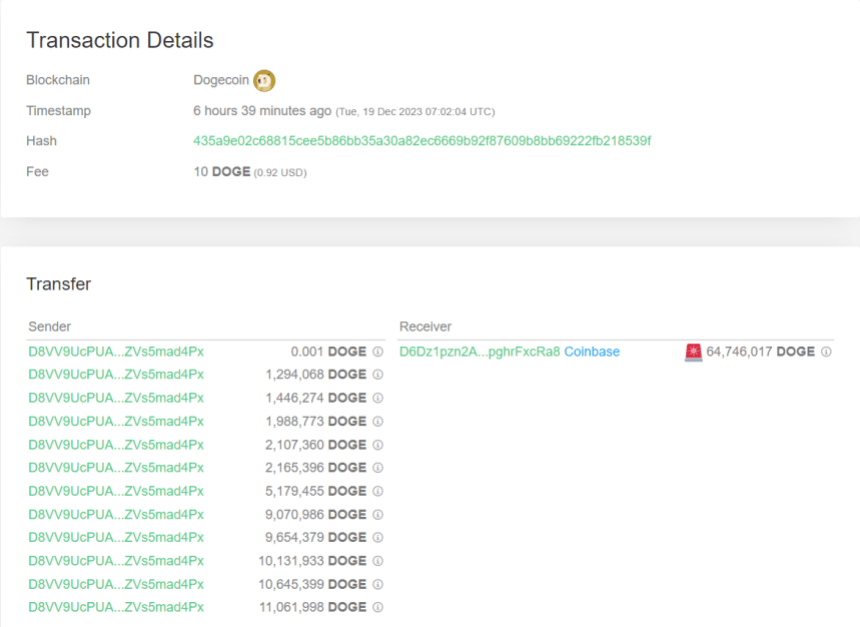

Dogecoin has seen a steady rise in activity in the past two days to reverse the period of stagnancy recorded earlier in the week. At the time of writing, DOGE is up by 7% in the past 24 hours, reversing some of the corrections it has experienced in the past week. Turns out some Dogecoin whales have been going on a massive buying spree, as indicated by on-chain data.

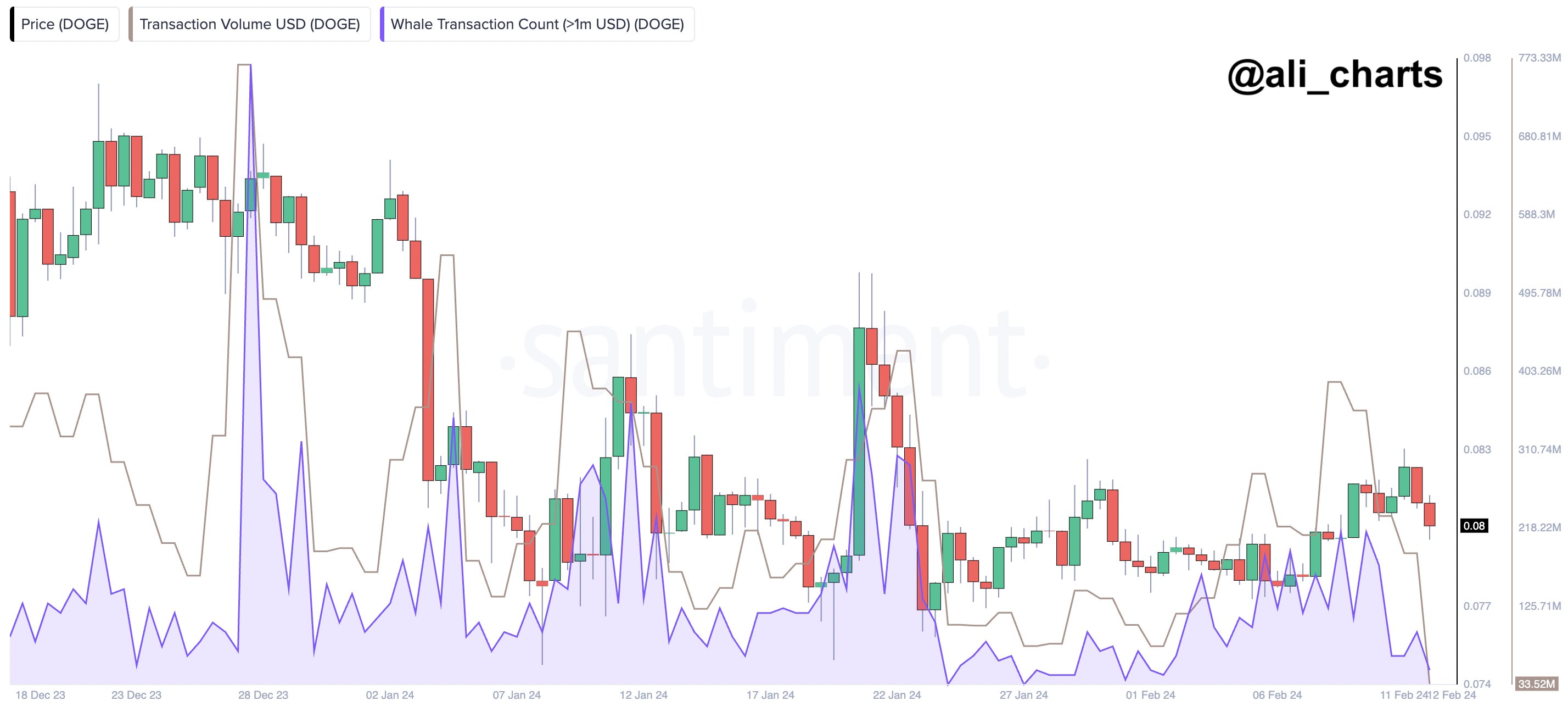

Popular crypto analyst Ali Martinez highlighted this accumulation trend by tweeting that DOGE whales have bought over 25 million DOGE worth around $3.75 million in the past three days.

Crypto Analyst Reveals Dogecoin Whale Accumulation

According to the Santiment chart shared by Ali Martinez on social media, wallets holding between 10 million to 100 million DOGE tokens have now pushed their total balance to 15.63 billion DOGE after adding 25 million DOGE in the past 24 hours.

Interestingly, the chart dynamics indicate this is a major change in sentiment from this cohort of traders, as their collective balance has been in a freefall since March 14th.

#Dogecoin whales have bought 25 million $DOGE in the past 72 hours, worth around $3.75 million! pic.twitter.com/y1RnRffWhv

— Ali (@ali_charts) March 21, 2024

Why Does This Matter?

Crypto whales typically move the market. Increased buying or selloff from a few large traders could change the sentiment of other investors, and they could further cascade a price surge or decline. Notably, the chart shared by Martinez shows that the total balance of DOGE’s whale addresses has largely corresponded with the price increase.

For example, the drop on March 14 in the total whale balance corresponded with a 33% drop in DOGE’s price from $0.1878 on March 14 to March 20. However, DOGE is now showing signs of recovery and is currently trading at $0.1629.

While Dogecoin whales and FOMO buyers may temporarily push DOGE higher, its long term success really depends on whether it can transform from a memecoin into a widely used cryptocurrency. Dogecoin recently scored a point in its bid to achieve mainstream adoption. Coinbase, America’s biggest crypto exchange, revealed plans to introduce Dogecoin along with Litecoin and Bitcoin Cash to its regulated futures contract offerings.

According to an earlier prediction by Ali Martinez, DOGE could reach the $1 mark in April. His prediction was based off of the crypto’s performance after similar breakouts in 2017 and 2021.

A large part of this prediction coming to manifestation is a bullish sentiment from whale addresses, especially if they continue on an accumulation pattern. A key price level to watch is $0.20. If DOGE breaks above this resistance level, it could continue surging higher on buying momentum. But if it fails to break $0.20 and starts dropping again, it may indicate the rally is running out of steam.

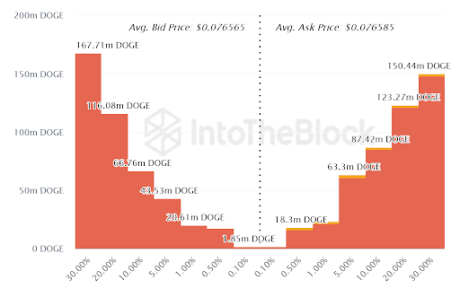

Source: IntoTheBlock

Source: IntoTheBlock Support Wall: Spanning $0.072-$0.073, with 200K addresses holding 28.6B

Support Wall: Spanning $0.072-$0.073, with 200K addresses holding 28.6B  Resistance Wall: Ranging from $0.074-$0.076, where 124K addresses hold 26.95B

Resistance Wall: Ranging from $0.074-$0.076, where 124K addresses hold 26.95B