U.S. argues that Binance’s former CEO should remain free until sentencing – but only in the U.S.

Binance Founder Changpeng ‘CZ’ Zhao Isn’t a Flight Risk, His Attorneys Say

Binance founder and former CEO Changpeng Zhao should be allowed to return to the UAE, where he is a citizen and lives, ahead of his February sentencing, his lawyers said, pushing back against a U.S. Department of Justice filing asking he not be allowed to leave the country.

Binance’s Settlement With U.S. Authorities Is Positive for Crypto as Well as the Exchange: JPMorgan

The settlement will significantly reduce the potential systemic risk emanating from a hypothetical collapse of the crypto exchange, the report said.

Binance’s Ex-CEO CZ ‘Poses a Serious Risk of Flight,’ Prosecutors Claim in Asking He Stay in U.S.

BNB Price Crash To $5 Unlikely Despite Binance Critic’s Dire Predictions

A Binance critic, “Whale Wire,” on X, who also claims to be a crypto whale, has issued a bold prediction that BNB, the native currency of the BNB Chain and which is used to incentivize trading activity on Binance, could plunge 95% to under $5 in the coming months.

Regarding Binance agreeing to pay $4 billion in fines related to legal settlements with U.S. regulators, Whale Wire argued that tighter oversight will supposedly “destroy Binance’s entire business model.” He further contended bankruptcy could be imminent as the effects of the BNB lead to a contagion.

Will The BNB Price Flash Crash?

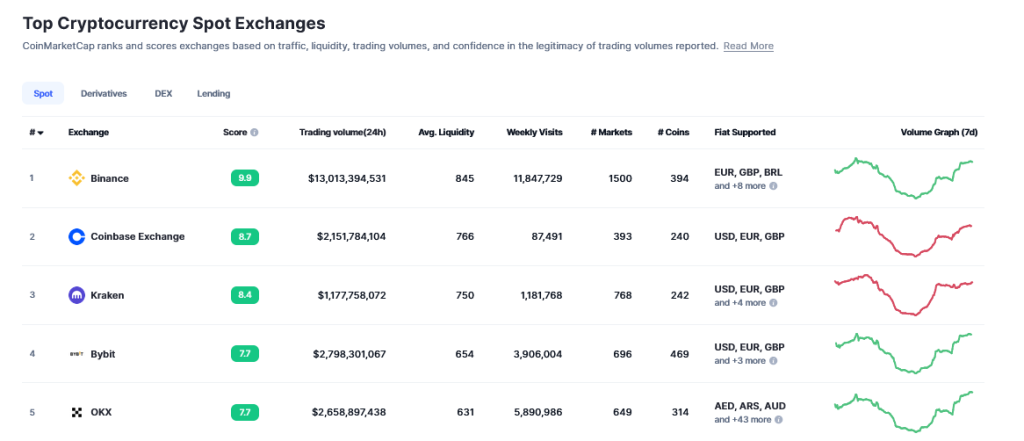

However, while increasing regulatory oversight, wind-downs, and decreased risk tolerance among traders have impacted volumes, Binance remains the world’s largest crypto exchange by client count and still facilitates the most trading globally by a wide margin as of writing on November 22.

For context and pulling data from CoinMarketCap (CMC), Binance continues to dominate spot crypto trading, generating over $14.7 billion in average trading volume, over 6X Coinbase, with $2.3 billion, and ahead by huge margins from Kraken, which draws 41.2 billion. The same trend can be observed in derivatives trading, where Binance leads ahead of OKX.

BNB also remains firmly among the top 5 cryptos in the market cap. Besides USDT, BNB is the third largest coin by market cap, leading other altcoins, including XRP, Solana (SOL), and Cardano (ADA).

Besides its dominance, Binance has been given over a year to pay assessed fines. Meanwhile, its new CEO, Richard Teng, said the exchange will continue to enact compliance overhauls. At the same time, it is assuring clients that funds remain safe.

Considering the exchange will continue operating both in the United States and globally, the transitional window offered by the DOJ could make its collapse, and that of BNB, unlikely.

Binance Under Pressure, Trading Volume Falling

Even so, factoring in dropping trading volume in 2023 and the impact of losing users, especially in areas Binance pulled out from, the resulting dip in revenue could, at the end of the day, apply downward pressures on BNB. Thus far, Binance sold its business in Russia while exiting Canada and the Netherlands.

Presently, $200 remains a critical support level for BNB. Whether this line will be retested in the months ahead remains to be seen. Changing hands at around $230, BNB is technically in an uptrend in the shorter time frame. It is up 15% from October 2023 lows. However, it is still down 65% from 2021 peaks when it soared to around $670.

Binance New CEO Affirms Strength In Company’s Fundamentals

The world’s leading cryptocurrency exchange Binance new Chief Executive Officer (CEO) and former global head of regional markets Richard Teng has recently expressed his confidence in the crypto company’s fundamentals.

Binance Fundamentals Shows Strength Amid Challenges, New CEO

Earlier today, the new Binance CEO confidently revealed the fundamental strength of the crypto company despite recent challenges. The CEO took to his official X (formerly Twitter) handle to share his belief in the company. According to Teng, the fundamentals of the company’s business are still solid.

Related Reading: Bitcoin Price Plunge Due to Binance’s Settlement Could Be ‘Buy Dips’ – Here’s Why

Furthermore, the CEO has asserted that the company will continue to operate as the biggest crypto exchange in the world. Teng pointed out several areas that will enable the company to hold on to its position in the crypto market. These include its debt-free capital structure, modest expenses, and robust revenues and profits.

Teng said:

Binance continues to operate the world’s largest crypto exchange by volume, our capital structure is debt-free, expenses are modest, and, despite the low fees we charge our users, we have robust revenues and profits.

Richard Teng’s X post responded to another X post by a user highlighting Binance’s revenue due to the DOJ’s $4 billion fine. According to the user, the company has no “problem paying the fine, as its total assets are valued at approximately $6.35 billion.”

In addition, the crypto company also holds about $3.19 billion worth of Stablecoins. Interestingly, the mentioned funds do not include off-chain cash balances or funds kept in wallets outside the Proof of Reserve (PoR). The post read:

I backed out Binance Corporate’s crypto holdings from their Proof of Reserves: $6.35B in total assets, and $3.19B in stablecoins. Doesn’t include off-chain cash balances or funds held in wallets, not in PoR. Most likely able to pay the full $4.3B DoJ fine with 0 crypto asset sales.

Changpeng CZ Zhao Pleads Guilty To Crime

This is so significant that despite the craze following former Binance’s CEO Changpeng CZ Zhao, the company remains strong, according to the new CEO. Changpeng was charged with US money laundering, of which he has recently pleaded guilty to the charge. Furthermore, the former CEO has agreed to pay about $50 million as part of his plea.

In addition to the penalty is Binance’s $4 billion fine as part of a settlement. The company’s fine is regarded as one of the largest corporate penalties in US history.

Did Binance’s CZ predict his own downfall?

An exclusive interview with Cointelegraph in 2018 highlighted growing scrutiny of Binance’s meteoric growth.

Spot Bitcoin ETF Odds ‘Might Have Increased To 100%’: Matrixport

Matrixport, a leading digital finance platform, today, November 22, released a comprehensive research note focusing on the significant implications of yesterday’s developments in the crypto industry, particularly regarding the prospects of a spot Bitcoin Exchange-Traded Fund (ETF) in the United States.

Following the guilty plea of Binance CEO Changpeng Zhao (CZ) and the substantial financial settlements involved, Matrixport suggests that the path for approving a spot Bitcoin ETF might have become significantly clearer. The note highlights the regulatory crackdowns and compliance upgrades in the crypto sector, indicating a shift towards greater regulatory alignment with traditional financial (TradFi) systems.

“Some would argue that the US agencies have cleaned up the industry this year by dismantling the US crypto-related banks, as two of them were running an internal ledger that crypto companies could use 24/7 to transfer fiat. Arguably, few (perceived) major actors are left, and with Bitcoin only declining -3.4% during the last 24 hours, the market is stomaching a major risk-off event,” Matrixport remarks.

Spot Bitcoin ETF Approval Odds At 100% Now?

The company points out that with stringent enforcement actions and enhanced compliance programs becoming the norm among crypto exchanges, the differentiation between regulated and non-regulated cryptocurrency exchanges may become a key metric in 2024. This shift is seen as instrumental in the potential approval of a spot Bitcoin ETF in the US, a development long anticipated by the industry.

“The result will likely be that more exchanges will enhance their compliance programs and become part of a surveillance-sharing agreement, which will be instrumental in approving a spot Bitcoin ETF in the US,” the firm stated, adding, “With this plea deal, the expectations for a spot Bitcoin ETF might have increased to 100% as the industry will be forced to follow the rules that TradFi firms must follow.”

The firm believes that this “whitewashing” of the industry will not only enhance Bitcoin’s adoption by institutional players but also position it as a safe-haven asset in investment portfolios. “More importantly, this industry’s whitewashing will strengthen the Bitcoin adoption case for institutional players and will likely become a safe-haven asset in investors’ portfolios,” Matrixport predicts.

The note also touches on the anticipated sale of the FTX exchange and its potential relaunch under a US securities law-compliant management team by Q3 2024. Matrixport speculates that this could lead to significant inflows, estimated between $24-50 billion, into any US-listed Bitcoin ETF. They also note the increasing trend of crypto firms making markets on CME-listed crypto derivatives, indicating a shift from retail-focused, unregulated exchanges to those that are fully regulated and cater to institutional clients.

‘Dark Cloud Has Been Removed’ As ETF Makes Progress

Analysts and industry experts have echoed Matrixport’s sentiments. Will Clemente, a noted analyst, stated, “With resolution on Binance, just a matter of weeks until Bitcoin ETF approval now.” Tony “The Bull” Severino, head of research at NewsBTC, commented, “A dark cloud has just been removed from the crypto market.” Conversely, Scott Johnsson, a finance lawyer at Davis Polk, offered a more cautious view, suggesting that “It’s far more likely an ETF decision led the Binance resolution than the other way around imo. And I’m not convinced either is that likely.”

Remarkably, there has been some movement in the spot ETF approval process in the last few days. Ark Invest has kicked off the third round of amendments to the S-1 filings, Grayscale had a meeting with the US Securities and Exchange Commission yesterday regarding its “uplisting.”

At press time, BTC traded at $36,483.

Is Binance Big Enough to Survive a $4.3B Fine and Founder CZ’s Ousting?

Binance’s Busy Day, Kraken’s Second SEC Fight

Binance is paying one of the largest fines in corporate history to the U.S. Department of Justice, while its founder and CEO, Changpeng “CZ” Zhao, stepped down from his role running the platform as part of a settlement with multiple federal agencies. Meanwhile, Kraken is facing a lawsuit from the U.S. Securities and Exchange Commission that echoes the SEC’s previous wave of suits.

Binance Founder Changpeng ‘CZ’ Zhao Released on $175M Bond, Will Be Sentenced in February

Binance founder and former CEO Changpeng “CZ” Zhao has been released from custody on a $175 million personal recognizance bond.

Binance charges prove ‘following the rules’ was the right decision: Coinbase CEO

Brian Armstrong reflected on the announcement of criminal charges against Binance, stating that Coinbase’s decision to get licenses was correct.

Binance to Settle Charges With U.S. DOJ: Source

The DOJ will hold a press release later today to announce the settlement.

Tether Worth $9M Tied to ‘Pig Butchering’ Scams Is Seized by U.S. DOJ

The U.S. Department of Justice (DOJ) has seized $9 million worth of the USDT stablecoin linked to organizations that exploited victims through “pig butchering” scams.

Tether Freezes $225M Linked to Human Trafficking Syndicate Amid DOJ Investigation

Stablecoin issuer Tether has frozen $225 million worth of its stablecoin following an investigation by the U.S. Department of Justice (DOJ) into an international human trafficking syndicate in Southeast Asia.

‘Bruno Brock’, Founder of Oyster Pearl, Gets Four Year Jail Term for Tax Evasion

Elmaani pleaded guilty in April 2023, agreeing that he caused a tax loss of over $5.5 million.

Lawmakers Lummis and Hill Urge DOJ Decision on Charging Binance and Tether for Aiding Hamas

U.S. lawmakers Senator Cynthia Lummis (R-Wy.) and Rep. French Hill (R-Ark.) have urged the Department of Justice to “expeditiously conclude” investigations and reach a decision on charging Binance and Tether for aiding terrorism financing for Hamas.

Tornado Cash Developer Roman Storm Pleads Not Guilty to Money Laundering, Other Charges

Tornado Cash developer Roman Storm pleaded “not guilty” to charges of conspiring to operate a money transmitter or facilitate money laundering and sanctions evasion in a court appearance Wednesday.

Bitcoin futures data hints at $22K as the next logical step

BTC derivatives flipped bearish after Bitcoin failed to establish bullish momentum despite the heightened spot ETF prospects.

No, Bitcoin withdrawals from exchanges are not inherently bullish for crypto

Traders say the record-low number of BTC held on exchanges is a bull signal, but data suggests otherwise.