Tornado Cash developer Roman Storm pleaded “not guilty” to charges of conspiring to operate a money transmitter or facilitate money laundering and sanctions evasion in a court appearance Wednesday.

Bitcoin futures data hints at $22K as the next logical step

BTC derivatives flipped bearish after Bitcoin failed to establish bullish momentum despite the heightened spot ETF prospects.

No, Bitcoin withdrawals from exchanges are not inherently bullish for crypto

Traders say the record-low number of BTC held on exchanges is a bull signal, but data suggests otherwise.

FTX’s Sam Bankman-Fried prosecutors submit proposed jury instructions for trial

Ahead of FTX co-founder Sam Bankman-Fried’s October trial, government prosecutors have laid out their requests for how the jury should be directed.

DOJ Action Against Binance: A Hidden Blessing For Bitcoin And Crypto Markets?

The looming prospect of a U.S. Department of Justice (DOJ) action against Binance, the largest crypto exchange, may hold a silver lining for Bitcoin and the broader markets. Even if this sounds crazy at first, there are good arguments for it.

Rumors have been swirling for weeks about a potential DOJ action against Binance, a threat that has cast a long shadow over the markets, leading to increased volatility and uncertainty among investors. Yesterday’s report by Semafor has rekindled the rumor, but also gave it a new perspective, hinting that these developments may be a blessing in disguise for Bitcoin and crypto markets.

According to the Semafor report, the DOJ is contemplating fraud charges against Binance but is also weighing the potential repercussions to consumers and the crypto market at large. Citing sources familiar with the matter, the report suggests that federal prosecutors are concerned that an indictment could trigger a “bank run” similar to the calamitous fate that befell the now-bankrupt FTX platform.

This fear arises from the concern that a potential indictment could lead to a rapid withdrawal of funds, causing consumers to lose their money and potentially trigger a wider panic in the Bitcoin and crypto markets. To circumvent such a catastrophe, the prosecutors are exploring other options like levying fines or establishing deferred or non-prosecution agreements.

What Does This Mean For Bitcoin And Crypto Markets?

Interestingly, some crypto market analysts and commentators view this ongoing saga as a potential boon. Macro analyst Alex Kruger, in a recent Twitter post, speculated, “Too Big to Jail? Call me crazy but this seems bullish if true.” This statement captures the sentiment that if Binance is considered too important to be hit with crippling charges, the DOJ could explore less harmful alternatives.

A similar view is held by renowned analyst Pentoshi, who said, “It doesn’t mean they won’t drop the hammer either. I think calling it “bullish” is a bit extreme since they are considering dropping the hammer. And if not billions in fines and CZ likely gone. But I def don’t think it’d as bearish as headlines first said at all. Bullish would be no DoJ involvement.”

The prospect of the DOJ acting against Binance could also provide a much-needed clarity to the market. If Binance were indeed vulnerable to a bank run, it would quickly become apparent whether the exchange holds sufficient reserves.

However, so far, Binance has impressively weathered previous “stress tests”, as highlighted by CEO “CZ” in a Twitter post in mid-December last year after the Mazars audit rumors, stating, “We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us.”

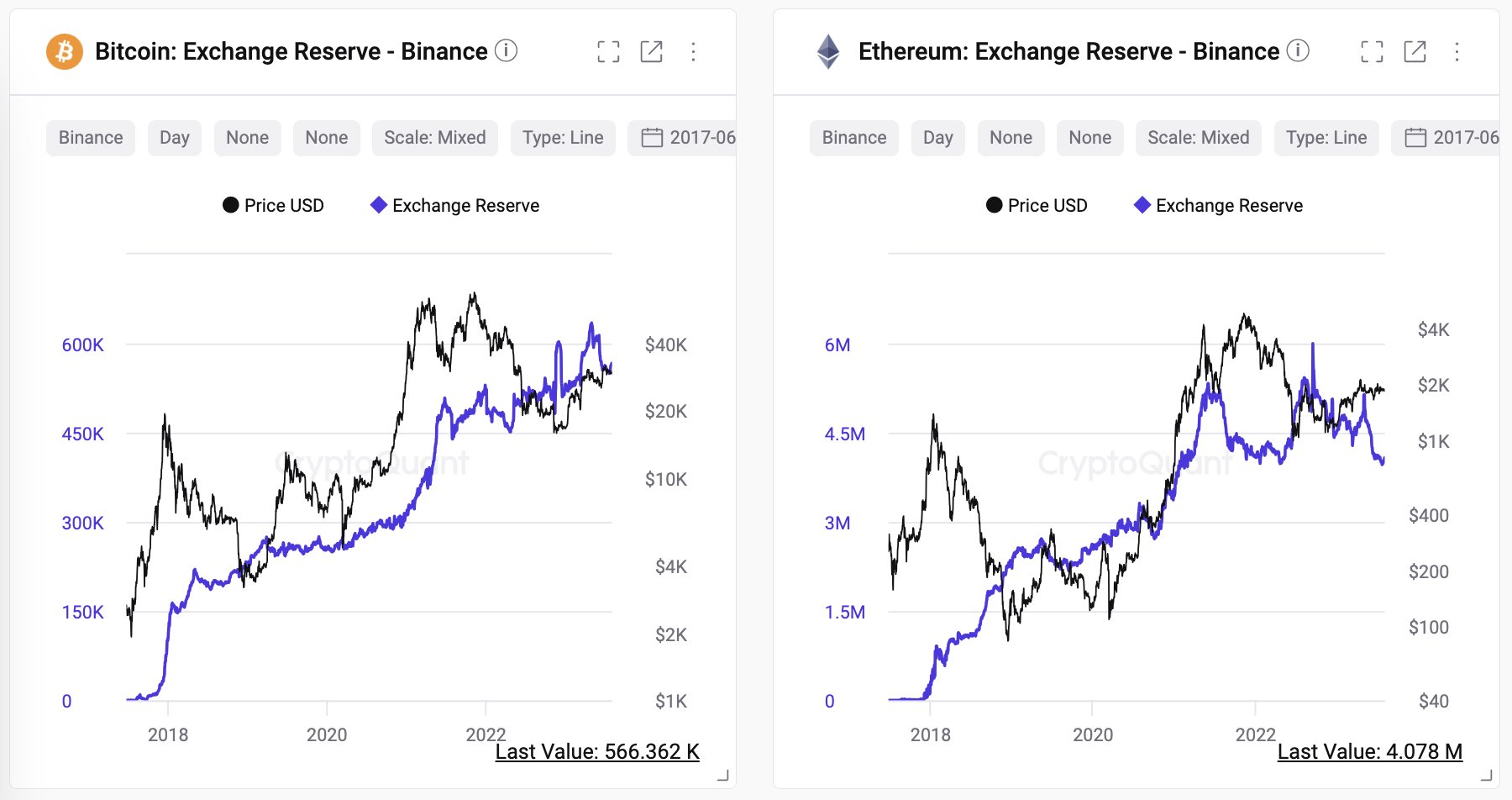

This sentiment is echoed by CryptoQuant CEO Ki Young-Ju who shared data supporting the strength of Binance’s user balances despite constant rumors of insolvency. He stated:

I’ve heard about the ‘bank run/insolvency risk on Binance’ a hundred times for years, but their user balances always tell a different story.

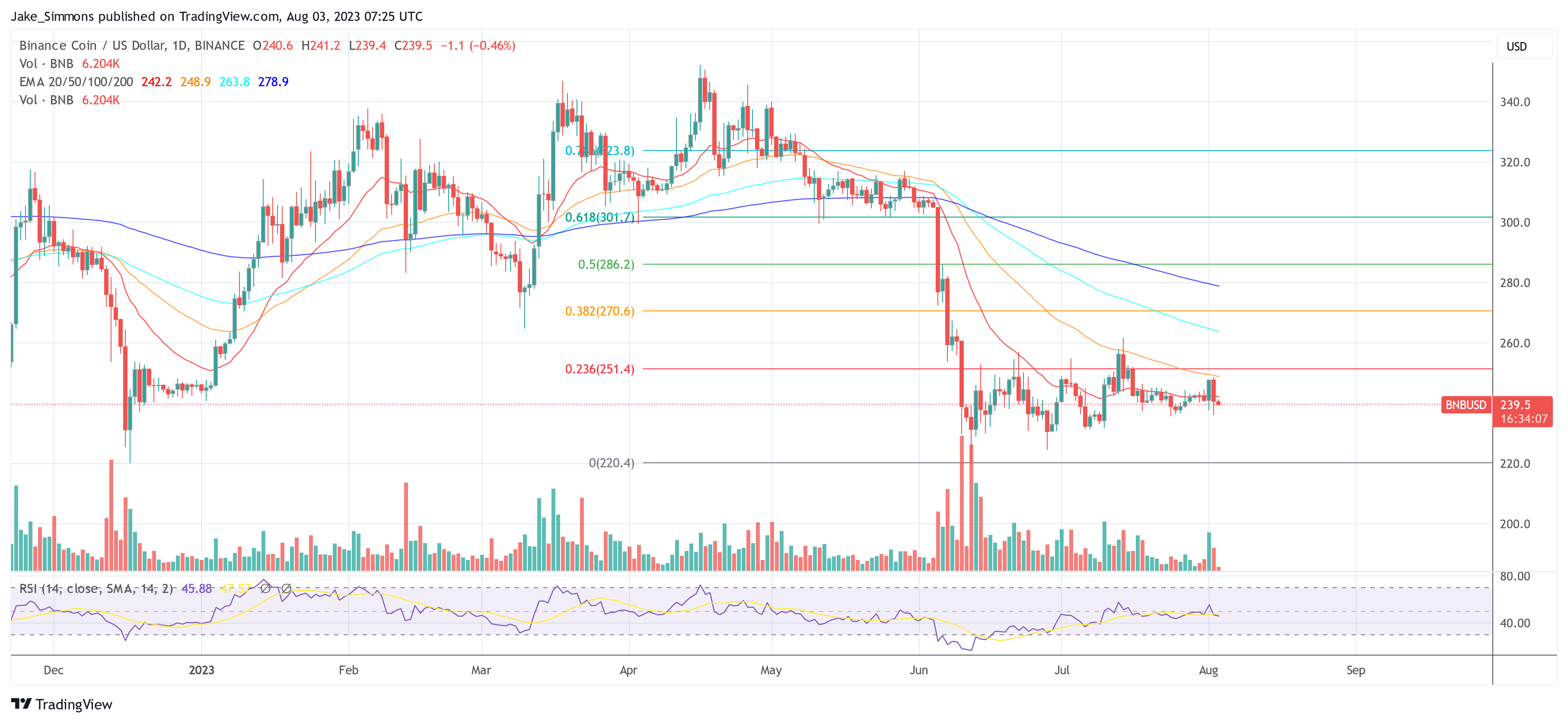

At press time, the BNB price stood at $239.5.

Binance Could Face U.S. Fraud Charges, but Prosecutors Worry About Risk of Bank Run: Semafor

Why Is Bitcoin Price Down Today?

Today, Bitcoin took another dive, this time to its lowest level since June 21. A check on Bitfinex reveals a BTC price slump to $28,641. Coinbase, America’s largest crypto exchange, reported an even more drastic drop to $28,478. Although the price bounced back slightly to hover just below $29,000 (-1.4% in the last 24 hours), the downward trend sparks questions.

Why Is The Bitcoin Price On The Decline?

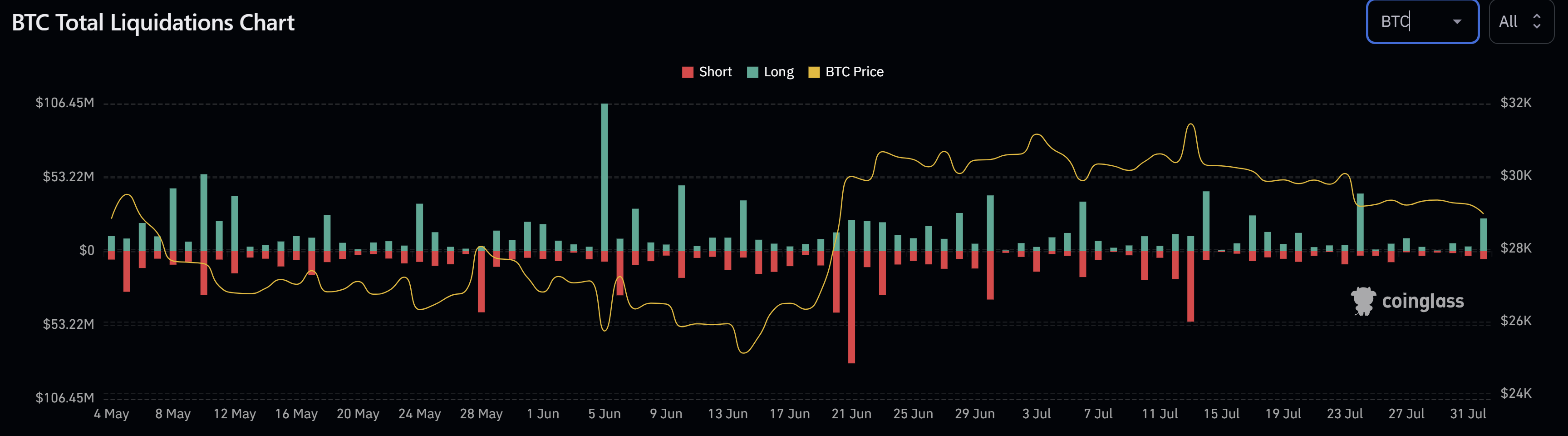

James V. Straten, a renowned on-chain analyst, recently tweeted: “Bitcoin drops below $29,000 as open interest spikes while funding rates go lower. As a result of the biggest long liquidation since 24th July.” As the analyst states, Bitcoin’s price trend can be majorly attributed to long liquidations. The liquidation data from Coinglass indicates that $23.6 million in BTC longs were liquidated, a relatively small amount but significant considering the market’s state.

In an illiquid market, smaller orders can significantly sway the market. According to data from Kaiko, BTC and ETH have seen a decline in 90-day realized volatility this year, with volatility levels currently hovering around two-year lows.

Moreover, Kaiko’s data also reveals that Bitcoin’s correlation with the S&P 500 continued to decline in July, falling to just 3%. The last time it was this low was back in August 2021. This suggests that the traditional financial market’s influence on Bitcoin’s price is waning, an impulse much needed at the moment.

Analyst @52Skew noted that BTC Spot CVDs & Delta Retrospective were hinting at the downtrend. “There were clear signs of spot supply & sellers, especially on Coinbase. Aggregate Spot CVD indicated heavy supply prior to sell off: Price grinding higher into limit supply & market spot selling.”

Meanwhile, renowned trader @exitpumpBTC pointed out on Twitter: “Someone sitting with 400 BTC buy wall at $28,900 on Binance spot orderbook. Fully closed my short.” This buy wall might provide some support for Bitcoin’s price at the current level.

Bitcoin Market Sentiment Weighs On Price

The Bitcoin Market Sentiment, as represented by the Fear & Greed Index, is presently at 50 – neutral. However, the sentiment on the Bitcoin and crypto market is lukewarm, despite BTC being up 76% year-to-date. The fading momentum seems to be due to the Bitcoin and crypto market’s current “summer slumber.” The bullish news seems already priced in, and volumes on exchanges are dwindling.

Interestingly, despite some major bullish developments for the broader crypto market, including Blackrock’s filing for a spot ETF and the victory for XRP and Ripple, the retail and institutional interest remains low. This is reflected in the low liquidity and volatility in the market.

Remarkably, the crypto space has been rocked by an array of events recently. From the rise of liquidity absorbing meme coins to scam tokens, the market has seemingly descended into chaos. In the midst of all these, impending events such as the Curve (CRV) hack as well as fears of a potential DOJ action against Binance and Tether, continue to add anxiety to the market. In this uncertain state, there are no new investors to catapult the market upward.

At press time, BTC traded at $28,990.

Aliens Exist. And They Use Cryptocurrency

Celsius Sold Lies to Sell CEL Tokens

New York prosecutor charges hacker over $9M exploit of Solana-based exchange

A skilled computer security engineer has been charged with wire fraud and money laundering related to an attack on a decentralized exchange.

U.S. Department of Justice Arrests Engineer Over $9M Crypto Theft

The U.S. Department of Justice arrested a security engineer on wire fraud charges, alleging he stole $9 million worth of crypto from an unnamed decentralized cryptocurrency exchange.

DOJ Charges Moroccan Man With Stealing $450K in OpenSea Spoofing Scam

U.S. Senator Tuberville Asks DOJ, SEC to Investigate Crypto Broker Prometheum

U.S. Senator Thomas Tuberville (R-Ala.) wrote an open letter to Attorney General Merrick Garland and Securities and Exchange Commission (SEC) Chair Gary Gensler asking them to investigate Prometheum, a special-purpose broker that recently secured federal permissions to offer crypto trading services.

Double trouble: FTX founder Sam Bankman-Fried faces two criminal trials

A District Judge ordered a separate trial for the DOJ’s charges against Sam Bankman-Fried which were added following his extradition to the U.S.

Judge Punts on FTX Founder Sam Bankman-Fried’s Efforts to Dismiss Some Charges

U.S. Justice Department Agrees to Try Sam Bankman-Fried on Original Charges Only for Now

Prosecutors with the U.S. Department of Justice wrote late Wednesday night that they would agree to try FTX founder and former CEO Sam Bankman-Fried on only the original eight charges filed in January after a court in the Bahamas blocked the local government from agreeing to additional charges.

U.S. Senators Tell DOJ to Investigate Binance for Potentially Lying to Lawmakers: Bloomberg

Two senate democrats, including Sen. Elizabeth Warren, allege in a letter that the platform may have lied about Binance.US being an independent entity.

U.S. Prosecutors Drop Extortion Charges Against Early Adviser to Ethereum Network

Criminal extortion charges against Steven Nerayoff, an early adviser to the Ethereum network, were dismissed by a New York judge on May 5, ending a three-and-a-half year legal battle that included explosive allegations he made against U.S. investigators.

US DoJ Goes After Rogue Exchanges As Crypto Crimes Grow ‘Significantly’

Eun Young Choi, the first director of the National Cryptocurrency Enforcement Team (NCET), has told reporters that crypto-related crimes have risen significantly in recent years. Through her team, the United States Department of Justice (DoJ) now plans to go after rogue exchanges that knowingly allow criminals to launder money.

NCET Wants Exchanges To Be Compliant

The Financial Times reports that Choi is concerned about the spike in crypto-enabled crimes and is setting their eyes on cryptocurrency exchanges, mixers, and tumblers.

Open-source token mixers such as Tornado Cash, a protocol that United States authorities have already sanctioned, are widely used by criminals to launder stolen assets. Because they make it hard for authorities to trace transactions on public ledgers, hackers are actively exploiting these tools to obfuscate transactions and evade justice.

NCET and the DoJ will go after crypto companies that, though compliant with existing laws on paper, have allowed themselves to be used by criminals; a development that Choi says is “problematic”.

By targeting these rogue agents, the director said they would send a “deterrent message” and hope their involvement would have a multiplier effect.

Specifically, NCET seems to have a problem with cryptocurrency exchanges that skirt anti-money laundering rules and those which don’t comply with know-your-customer (KYC) laws. The enforcement team says going after them could make them invest more in risk-mitigation procedures and comply more with existing rules.

Binance, the world’s largest cryptocurrency exchange, is reportedly one of the exchanges on the radar of the DoJ. Unconfirmed reports suggest that the DoJ, among other agencies, including the United States Securities and Exchange Commission (SEC), is investigating the Changpeng Zhao-led exchange for violating established rules.

US Government’s Position On Crypto

President Joe Biden’s administration has taken a relatively tough stance on cryptocurrencies. Regulators in the United States have been in recent months going after companies they deem to be non-compliant, especially after the collapse of FTX, a cryptocurrency exchange.

The position adopted in the United States, especially on regulation and enforcement, could be one of the strictest in the world. Several officials and policymakers in the country strongly believe cryptocurrencies can pose a significant risk to the stability of their financial infrastructure, which could also impact national security.

In that regard, steps have been taken to increase oversight and, most importantly, double down on regulation of the cryptocurrency scene.

NCET, of which Choi is the first director, was created in October 2021. A department under the DoJ, the team goes after entities, including individuals that misuse digital assets, flout established anti-money laundering rules, or engage in ransomware attacks using cryptocurrencies.

U.S. DOJ’s Crypto Enforcement Director Promises Crackdown on Illicit Behavior on Crypto Exchanges: FT

Eun Young Choi said the DoJ is targeting crypto exchanges that allow “criminal actors to easily profit from their crimes and cash out,”