This week’s Crypto Biz examines X’s upcoming payment system, the NYSE’s potential 24/7 trading, Block’s expansion into Bitcoin mining, and more.

Cryptocurrency Financial News

This week’s Crypto Biz examines X’s upcoming payment system, the NYSE’s potential 24/7 trading, Block’s expansion into Bitcoin mining, and more.

The cryptocurrency market tends to thrive on a blend of innovation, utility, and sometimes, just a good meme. This week, the spotlight shone brightly on Dogecoin (DOGE), the Shiba Inu-themed meme coin, after a characteristically playful tweet from tech billionaire Elon Musk sent prices soaring.

While the tweet itself referenced a scene from Monty Python and didn’t directly mention Dogecoin, its timing, with DOGE hovering near the cusp of the top 10 cryptocurrencies by market cap, proved to be enough to ignite a firestorm of trading activity.

This latest episode serves as a stark reminder of the immense influence Musk wields over the meme coin market, and the hair-trigger reflexes of Dogecoin’s dedicated community.

— Elon Musk (@elonmusk) April 15, 2024

This isn’t the first time Musk has sent shockwaves through the Dogecoin world. In 2021, his enthusiastic endorsements, including a now-famous appearance on Saturday Night Live where he jokingly referred to himself as the “Dogefather,” propelled DOGE to its all-time high. However, the meme coin’s meteoric rise proved unsustainable, and prices eventually settled into a lower, but still respectable, position.

Currently, Dogecoin sits comfortably as the eighth-largest cryptocurrency, boasting a market cap of over $22 billion. However, there was a different narrative in the price department.

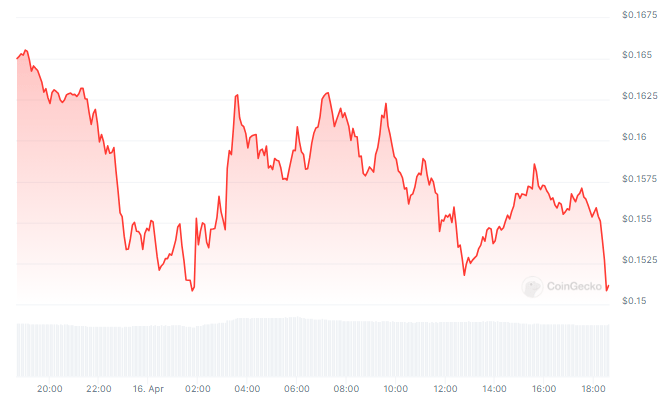

At the time of writing, DOGE was trading at $0.15, down 8.4% and 22.9% in the daily and weekly timeframes, data from Coingecko shows. Clearly, the Musk tweet magic didn’t work this time. Or, perhaps not yet?

A quick look at DOGE’s daily chart reveals a classic case of price resistance, where the coin struggles to break through specific price ceilings. This back-and-forth price action reflects the ongoing battle between enthusiastic buyers, emboldened by figures like Musk, and more cautious investors wary of the coin’s unpredictable nature.

No Price Boost This Time

Elon Musk’s tweets have long been synonymous with skyrocketing memecoin values, yet today’s unexpected downturn in Dogecoin following his latest post underscores the volatile and unpredictable terrain of cryptocurrency markets.

This stark deviation from the usual trajectory serves as a poignant reminder that even the most influential voices in the industry cannot fully control or anticipate the market’s whims and fluctuations. It highlights the inherent risks and complexities investors face as they navigate this ever-evolving landscape, where sentiments can shift swiftly, leaving even seasoned traders reeling from the abrupt changes.

Featured image from Pexels, chart from TradingView

Amid the recent momentum displayed by the meme-inspired cryptocurrency Dogecoin (DOGE), Rekt Capital, a crypto trader and analyst, has identified a new trend that could propel DOGE’s price to the $0.3 price mark in the short term.

Over the past few weeks, Dogecoin has been performing fairly well, triggering optimism and expectations for more price growth. Due to this, the top meme currency in the world in terms of overall market valuation has always generated discussion within the sector.

DOGE’s recent spike in price resulted in the conclusion of its Macro Downtrend, according to Rekt Capital. However, the breakout has triggered DOGE into a new Macro Uptrend on the upside.

Additionally, DOGE Monthly would recapture historical support if it closed above the red $0.20 price level. As a result, it would provide more momentum for a move towards the $0.30 range and even further.

The post read:

Dogecoin has ended its Macro Downtrend and begun a new Macro Uptrend. And if DOGE Monthly Closes above the red ~$0.20 level, it would reclaim historical support that could offer further fuel for a move towards the $0.30+ area.

It is worth noting that it took Dogecoin less than two weeks to break out from the macro downtrend after entering the area. Rekt Capital pointed out that the crypto asset successfully retested its support after breaking its macro downtrend two weeks ago.

During this period, the analyst underscored DOGE was still in the retest phase because the coin was still declining. Furthermore, the meme coin was moving sideways within a new macro range he dubbed black-red, around $0.12 and $0.20.

Prior to the breakout, Rekt Capital stated that DOGE is taking all the appropriate steps to validate its new macro uptrend. Given that the token has broken through strong resistances, it could be headed for a new peak in this cycle.

Rekt Capital’s forecast came in light of DOGE witnessing a significant increase to $0.22, its highest level in the past 2 years. It is believed that the upswing was triggered by rumors that the asset could be incorporated into Elon Musk‘s X platform very soon.

Ever since the rumors developed, Dogecoin’s price has doubled in less than a month, suggesting interest growth from investors. Dogecoin is currently the eighth-largest crypto asset by market value, with a market cap of $31.087 billion, following its remarkable price explosion.

Presently, Dogecoin is trading at about $0.21, with a notable $5.157 billion trading volume in the past day. Despite the recent price development, DOGE is still more than 50% down from its all-time high of $0.74.

The resurgence of Dogecoin in the rapidly evolving cryptocurrency space is indicative of the dynamics of the market. This huge increase also reflects the general state of the market, showing investors’ ongoing interest in meme coins today.

A new report has revealed the total Bitcoin assets held by Elon Musk’s Tesla and SpaceX companies and how much profit they’re seeing so far.

On Thursday, March 7, Arkham Intelligence, an AI-based blockchain analytics platform, revealed the Bitcoin holdings of SpaceX and Tesla, two companies co-founded by X (formerly Twitter) owner, Elon Musk. The comprehensive report also outlined Tesla’s BTC transactions spanning from 2021 to 2024.

According to Arkham, Tesla had purchased about $1.5 billion worth of BTC in January 2021. Subsequently, the automotive company initiated multiple transfers, opting to sell off its Bitcoin holdings valued at $272 million in the first quarter of 2021 and about $936 million in the second quarter of 2022.

Arkham has claimed that the automotive company currently possesses a staggering 11,510 BTC, valued at $780 million. Furthermore, Tesla’s substantial Bitcoin holdings are reportedly spread across 68 wallet addresses.

On the other hand, SpaceX, a private space exploration and technology company, currently holds about $8,290 BTC worth approximately $560 million. These assets are reportedly distributed across a total of 28 wallet addresses.

The combined BTC holdings of these two companies place them in a league comparable to the BTC holdings of major financial institutions. Tesla has secured the third position among the largest Bitcoin holders, with MicroStrategy leading the list, possessing around 190,000 BTC worth over $8 billion.

Despite the considerable amount of BTC held by Musk’s companies, the CEO has seemingly had a love-hate relationship with Bitcoin. Earlier in 2023, Bitcoin crashed below $25,000 after Musk’s SpaceX sold all its Bitcoin holdings. However, it seems the space company is showing more interest in BTC, as seen by its massive Bitcoin portfolio.

A crypto community member, identified as “Definalist” on X, has shared insights, suggesting that Tesla might be increasing its involvement in Bitcoin. Referring to Arkham Intelligence’s report of Tesla’s BTC holdings, Definalist disclosed Tesla’s acquisition of an additional 1,790 BTC.

Definalist has revealed that in 2023, Tesla’s BTC balance sheet had held about 9,720 BTC. Fast forward to 2024, the automotive company’s portfolio has expanded to 11,510 BTC, revealing an unreported acquisition of an extra 1,790 BTC.

This significant Bitcoin purchase could be attributed to the growing enthusiasm for the cryptocurrency, driven by its recent bullish momentum and massive price increases. At the time of writing, Bitcoin is trading at a price of $67,279, according to CoinMarketCap. The cryptocurrency previously surged to an all-time high of $69,200 on March, 5, after which it retraced to its current price level.

WLD is considered a proxy bet on OpenAI, the Sam Altman-owned artificial intelligence company.

The cryptocurrency market was rattled as Dogecoin (DOGE) experienced a significant 5% decline in value, sending shockwaves through the industry. This decline, which caught many investors off guard, is attributed to a combination of factors that have created a cloud of uncertainty around the popular digital asset.

Firstly, the overall market sentiment towards cryptocurrencies has been bearish, with many investors becoming more cautious due to regulatory concerns and the ongoing legal troubles of influential figures in the industry.

Elon Musk, the enigmatic figure known for his support of Dogecoin, was called back to provide testimony in a regulatory investigation regarding his purchase of Twitter. This has cast a shadow over the future of Dogecoin, as the outcome of Musk’s legal battles could have far-reaching implications for the cryptocurrency.

ELON MUSK MUST TESTIFY AGAIN IN REGULATOR’S PROBE INTO TWITTER ACQUISITION — U.S. COURT RULING

— *Walter Bloomberg (@DeItaone) February 11, 2024

Technical indicators further compound the challenges facing Dogecoin, as they reveal that the coin’s bulls are struggling to gain momentum. The rejection at the 50-day Exponential Moving Average has created a strong resistance level, hindering any significant upward movement.

Additionally, Dogecoin is at a critical juncture due to declining trading volume, signaling a potential period of consolidation or a waning interest in the digital asset.

#Dogecoin is experiencing a decrease in transaction volume and whale transaction count, which typically indicates lower trading activity. This could be a sign that fewer people are buying, selling, or transferring #DOGE, possibly due to reduced interest or confidence in it! pic.twitter.com/SiKNxx4FhN

— Ali (@ali_charts) February 12, 2024

The uncertainty surrounding Dogecoin is exacerbated by the possibility of it being classified as an investment akin to a stock, which could subject it to stringent regulations and negatively impact its value. If judges rule in this manner, it could deter potential buyers and erode the coin’s value, posing a significant threat to its future.

Despite these challenges, there is still a glimmer of hope for Dogecoin’s supporters. A potential recovery in the cryptocurrency is on the horizon if it can maintain its position above the 200-day moving average and overcome the negative sentiment stemming from Musk’s legal woes. However, a breach of this support level could lead to further declines and test lower support levels, potentially dropping to $0.065.

The decline in Dogecoin’s market capitalization and trading volume underscores the unpredictable nature of the cryptocurrency industry. As the market leader grapples with these challenges, it must adapt to the rise of other cryptocurrencies and find ways to distinguish itself.

Featured image from Pexels, chart from TradingView

The Elon Musk-led company holds over $387 million worth of bitcoin.

According to data from Coingecko, Dogecoin (DOGE) has soared by 10.5% in the last 24 hours, drawing much attention from market analysts and investors alike. Prior to this gain, the memecoin had shown little price movement, hovering around the $0.08 price region for most of the past week.

Dogecoin ranks as one of the top players in the crypto ecosystem, with a staggering market cap of $12.38 billion. The meme coin is particularly popular for its endorsements by famous figures such as Gene Simmons, Snoop Dogg, Mark Cuban and the world’s richest man Elon Musk.

Interestingly, the current rise in DOGE’s price appears to be related to recent developments on Elon Musk’s social media platform X. On January 20, X launched a dedicated account for its X Payments initiative, a peer-to-peer payment service designed to enhance “user utility” and introduce “new opportunities for commerce”.

The X Payments project was initially announced on January 9 as part of Elon Musk’s grand plan to position X as the “everything app”, providing a single interface which caters to user needs in terms of social media, advertising, content and video promotion, among others.

DOGE’s reaction to the creation of the X Payments account is driven mainly by the potential role many investors believe the token may play in this payment system upon launch. Such expectations are mostly based on Elon Musk’s vocal and consistent support of the meme coin since as far back as 2019. Tesla, one of Elon Musk’s more valuable companies, already accepts payment in Dogecoin, and there are speculations the crypto asset could adopt a similar role in the X Payments project.

The potential of such incorporation could spell massive gains for DOGE in terms of adoption. According to X, its payment initiative is now registered in 32 states of the United States, securing a money transmitter license in 10.

However, it is worth stating that there are no statements or hints from credible officials that X Payments will indeed adopt DOGE as a settlement option following its expected launch in mid-2024. Alongside the memecoin, other cryptocurrencies being propped to act as payment options in X’s e-commerce feature include XRP, and Stellar (XLM), among others.

At the time of writing, DOGE trades at $0.0861, reflecting a 7.4% gain in the last seven and fourteen days. On the monthly chart, DOGE is down by 7.5% and has barely shown any growth in the last year, with a Year-To-Date (YTD) gain of 0.6%. As earlier stated, Dogecoin boasts of a market cap of $12.38 billion, making it the 10th largest cryptocurrency. In addition, the memecoin’s daily trading volume is valued at around $1.17 billion.

X owner Elon Musk told advertisers to “go f— yourself” on Nov. 29 after many left the social media platform in response to antisemitic content and a report on hate speech.

The explosion of artificial intelligence this year hasn’t escaped the Vatican, with Pope Francis warning of its dangers in a hefty 3,400-word letter ahead of the World Day of Peace on Jan. 1.

The Google parent company Alphabet said it is slashing prices for its pro version of AI model Gemini and plans to make its tools more accessible to developers to create their own versions.

Tesla CEO Elon Musk has revealed a new prototype of its humanoid robot, Optimus Gen 2. It can dance and do squats.

DOGE surged Tuesday after an SEC filing showed xAI had already raised $134.7 million and might seek $1 billion.

BTC just hit $45,000 days after topping $40,000 for the first time since early last year – and crypto-skeptics are buying.

“Spicy” AI chatbot Grok hasn’t been seen by the public yet, but it’ll be worth plenty after this securities issue.

The filing lists the Tesla-billionaire-turned-social-media tycoon as a key backer.

The billionaire mogul also claimed that OpenAI was lying about its training methods, but interviewer Andrew Ross Sorkin may have flubbed the question.

Tokens like GFY, TRUCK and GROK tied to Musk’s products and recent statements have popped up on Ethereum and other blockchains.

The billionaire X (Twitter) owner lashed out at advertisers who are ditching the platform due to his controversial posts.

Doge-1 is a cube satellite that will orbit the moon and broadcast a video feed.