The billionaire mogul also claimed that OpenAI was lying about its training methods, but interviewer Andrew Ross Sorkin may have flubbed the question.

Cryptocurrency Financial News

The billionaire mogul also claimed that OpenAI was lying about its training methods, but interviewer Andrew Ross Sorkin may have flubbed the question.

Tokens like GFY, TRUCK and GROK tied to Musk’s products and recent statements have popped up on Ethereum and other blockchains.

The billionaire X (Twitter) owner lashed out at advertisers who are ditching the platform due to his controversial posts.

Doge-1 is a cube satellite that will orbit the moon and broadcast a video feed.

The king of the memecoins, Dogecoin (DOGE), has been following the general sentiment in the crypto market as it breaks out from a critical level. The token experienced selling pressure on low timeframes but seems poised for further profits.

As of this writing, Dogecoin (DOGE) trades at $0.078 with a 1% loss in the last 24 hours. Over the previous seven days, the memecoin held 6% in profits, operating as a top performer in the top 10 by market capitalization.

As mentioned, the Dogecoin rally has found hurdles over today’s trading session, with the price returning below the critical level at $0.08. Crypto trader Rekt Capital claims that the recent price action confirmed a bullish trajectory for the token.

The chart below shows that Dogecoin completed a path from its yearly lows at $0.052 across October and November. As the bulls pushed upwards, the cryptocurrency broke its descending channel, setting a path towards the area above $0.11, last seen in 2022.

A separate report from another crypto trader looks at Dogecoin over high timeframes. The token is close to completing a bigger breakout over its Bitcoin (BTC) trading pair on this horizon.

The analyst cites a series of positive fundamentals for Dogecoin, including its scalability and “low energy consumption” transactions. On the chart above and pointing to the moving average convergence/divergence (MACD) indicator, the analyst stated:

In the $DOGE / $BTC trading pair, bullish patterns and indicators have been observed in the higher timeframes. Notably, a falling wedge pattern is evident in the 4-day timeframe, accompanied by a bullish crossover in the MACD indicator.

It remains to be seen if DOGE can return to its 2022 and 2021 high against its Bitcoin and USDT trading pairs. The bullish momentum in the crypto market is holding, albeit with an increase in selling pressure, possibly triggered by speculators taking profit at current levels.

Cover image from Unsplash, chart from Tradingview

Grok (GROK) token, inspired by Elon Musk’s artificial intelligence service through X (formerly Twitter), has recently come under scrutiny following explosive growth in market capitalization.

According to recent reports, Grok zoomed to a staggering $160 million market cap within just eight days of its release. However, reports of alleged scam involvement have overshadowed the token’s rapid ascent.

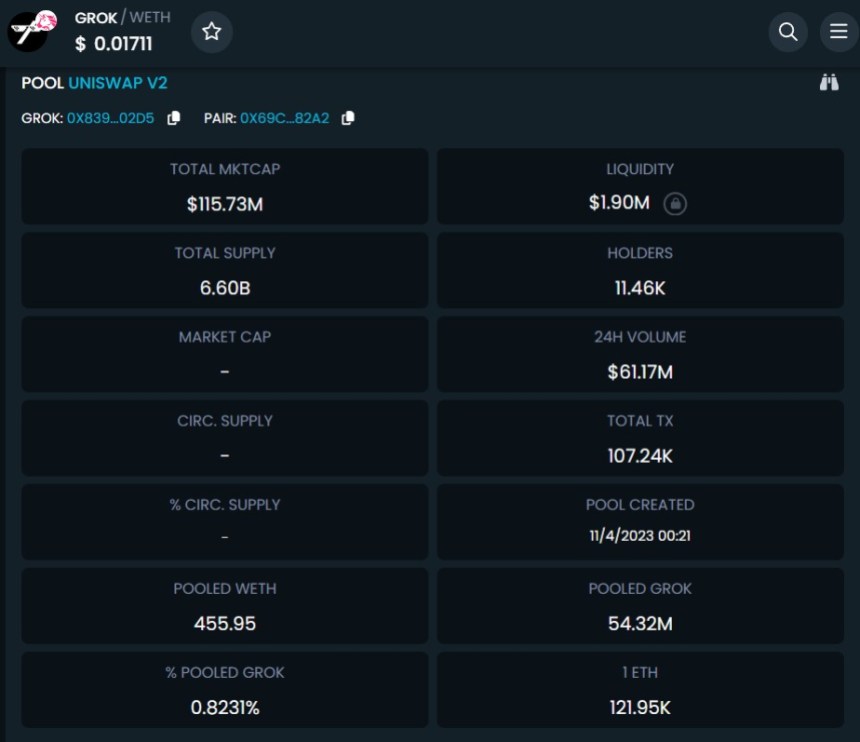

Grok token prices have soared, doubling within the past 24 hours alone, extending a week-long rally that has seen an astonishing 13,000% increase. The token boasts an impressive 11,000 holders and has witnessed a trading volume of over $60 million over the past 24 hours, according to data from DEXTools.

However, ZachXBT, a self-proclaimed crypto detective, has raised concerns about the legitimacy of Grok, stating that the token was created by a scammer. ZachXBT has stated that the same X/Twitter account associated with Grok has been linked to at least one other fraudulent scheme. ZachXBT stated:

Not that people in this space will care but GROKERC20 GROK was created by a scammer. Same exact X/Twitter account has been reused for at least one other scam. X/Twitter ID: 1690060301465714692

Satoshi Flipper, another prominent crypto trader on X, echoed this sentiment, labeling Grok as an “effing scam” and emphasizing that Elon Musk did not authorize the token’s launch. Satoshi Flipper said:

This is Grok. $1.9M liquidity and a $137M market cap? What an effing scam. Not only that, it’s completely fraudulent to trade this knowing Elon Musk, the owner of Grok, did not authorize these devs to launch a token. Imagine touching this toxic trash.

Experts from Arkham Intelligence also weighed in, reporting that an on-chain trader sold a significant amount of GROK at nearly 40% slippage, reinforcing the scam allegations made by ZachXBT.

The controversy surrounding Grok has raised concerns within the cryptocurrency community. Critics argue that the token’s market cap, coupled with the lack of authorization from Elon Musk, raises red flags.

The token’s market cap has undergone a retracement, now at $108 million, down from its previous value of $160 million. Additionally, the token exhibits a liquidity of $1.83 million.

Despite experiencing a substantial slippage of 48%, with its price dropping as low as $0.0056000, the token has remarkably recuperated and is now trading at $0.0108452.

It is yet to be determined whether further reports will surface to shed light on the individuals behind the token’s creation and their objectives, potentially exposing the risk of a rug pull within the cryptocurrency industry.

However, despite these allegations, the token has attracted significant attention and excitement from investors eager to participate in the potential surge of the next major meme coin, aiming to achieve substantial gains in their investments. As of the time of writing, the Grok official account on X has not made any statements regarding these allegations.

Featured image from Shutterstock, chart from TradingView.com

Sam Altman posted a meme on X accusing Grok of being a GPT designed to make grandpa jokes. Musk may have proved the OpenAI CEO’s point with his clap back.

Developers are trying to capture a piece of the global asset tokenization market as part of a new product in the Floki ecosystem.

A recent social media post by crypto pundit MartyParty has sparked renewed interest in the early investment patterns surrounding Solana. This interest centers around the revelation that Lyndon Rive, a cousin of Elon Musk, was among the first investors in Solana, a fact that has largely flown under the radar since Rive’s announcement on July 30, 2019.

“Why is Elon Musk’s cousin Lyndon Rive one of the first investors in Solana. Rive is a cousin of Elon Musk as their mothers are twin sisters,” Marty remarked.

Lyndon Rive, better known as the co-founder of SolarCity and cousin to tech mogul Elon Musk, has maintained a lower profile compared to his renowned relative. Despite their familial ties, Rive’s investment trajectory has diverged notably from Musk’s, especially after Rive left SolarCity following its acquisition by Tesla in 2016.

In July 2019, Rive invested in Solana Labs, the company behind the SOL blockchain. The project, launched in 2018, is distinguished by its use of a Proof of Stake consensus mechanism, which aligns with the growing interest in more energy-efficient blockchain technologies.

While Rive’s participation in the Series A funding of Solana was not singularly significant, it was part of a crucial $20 million funding round that helped kickstart the project. Subsequent investments by entities like CoinList and MXC Exchange bolstered Solana’s growth, cumulatively raising an additional $40 million.

The connection between Rive’s investment in Solana and Musk’s stance on SOL remains unclear. Elon Musk is widely recognized for his enthusiasm for Dogecoin, often expressing support for the meme coin. Additionally, Tesla, under Musk’s leadership, has included Bitcoin as part of its corporate balance sheet.

However, Solana was never mentioned by Musk. Notably, after Tesla ceased accepting Bitcoin in May 2021 citing environmental concerns, the Solana Foundation reached out to Musk via Twitter, answering “dms are open”. Musk has never responded publicly, suggesting that there is no official connection between Musk and Solana despite his cousin’s investment.

The intrigue deepens with the parallel choices of Musk and Solana’s co-founder, Anatoly Yakovenko, in favoring the Rust programming language for their respective projects, xAI and SOL. xAI’s recent announcement lauds Rust for its robustness and reliability, essential for scalable and maintainable infrastructure. Crypto expert Joe McCann commented: “Elon Musk chooses Rust for xAI. Anatoly Yakovenko chose Rust for Solana.”

In conclusion, while Rive’s early investment in Solana is a notable piece of the platform’s history, the extent of his influence or any indirect connection to Musk remains speculative. Nevertheless, it is a story to keep in mind.

At press time, SOL was trading just below $40 and was undergoing a retest after the price broke out of the trading range post the FTX crash last week. A daily close above $38.76 could be crucial to establish a new range and possibly target the 1,618 Fibonacci extension level at $57.85.

While unrelated to the actual Grok service, the inspired tokens are quickly gaining a following among low-cap traders.

World renowned AI scientist Mustafa Suleyman appears to disagree with Elon Musk’s assessment of the threats and benefits A.I. technologies could pose in the future.

The second day of the UK AI summit featured a one-on-one talk between Prime Minister Rishi Sunak and Elon Musk that discussed the future of the job market, China and AI as a “magic genie.”

The U.K. AI Safety Summit concluded its first day with a common declaration, the U.S. announcing an AI safety institute, China willing to communicate on AI safety and comments from Elon Musk.

Elon Musk assured those attempting to “weaponize” the community notes feature will be immediately found out.

Elon Musk envisions X as an all-encompassing financial platform, embracing every aspect of users’ financial lives, from money and securities to eliminating the need for traditional bank accounts.

The two popular meme coins have mostly underperformed crypto majors in the past week.

The crypto community on X is on edge over cryptic posts by Ripple’s chief technology officer and X itself.

In the next three days, our team at Bitcoinist will cover xDay 2023, an event organized by MultiversX in the Palace of Parliament, Romania. Formerly known as Elrond, the project rebranded in 2022 to focus on the Metaverse, one of the hottest trends in crypto.

During the event, the head of product for MultiversX’s native “SuperApp” xPortal, Sergius Biris, unveiled new features to expand the ecosystem. The project aims to onboard new users to the network by providing social interactions, a bridge with other blockchains, and more to compete with Elon Muk.

Since last year, when Musk acquired Twitter (rebranded as “X”), the entrepreneur has progressively tried to turn it into something more. The social media app allows users to receive tips, subscribe to their favorite content, and interact with non-fungible tokens.

These features highlight the relevance for users to operate with a single hub. MultiversX and xPortal want to compete with Elon Musk by providing users access to these and other features announced during the conference, such as gamification, access to the metaverse, and NFTs to provide a “multifaceted digital experience.”

In contrast with X and Musk’s attempts, the team behind xPortal believes they have a critical advantage: their product is live and has over 1.5 million users already transecting and interacting with the MultiversX ecosystem.

Moreover, MultiversX has a vision to remove all friction from onboarding their ecosystem. Thus, xPortal announced a new fiat to crypto on and off-ramping capability and a feature enabling users to swap their tokens.

For European users, xPortal will enable peer-to-peer fiat payments with the traditional banking system, SEPA and SWIFT, earlier next year. During the conference, Biris stated:

The features launched today, most notably the debit cards, were a long time in the making. Today’s launch elevates xPortal from a crypto wallet to a financial super app. We thus created a bridge to an interconnected future where the lines between crypto, fiat, and emerging technologies like AI dissolve, bringing an unparalleled user experience.

The new features also included tools for developers and creators to leverage the MultiversX ecosystem. The xPortal app already allows them to launch their products for users to download quickly, similar to Apple’s Appstore and Google’s PlayStore.

Turning Web3 And Crypto Into “Money”

The conference has been conducted under a key vision: users want to leverage the technology, so crypto projects need to focus on security, scaling, and making accessible products. Rather than “Web3” or “Web4,” xPortal is about turning crypto into “money” available for anyone.

Sergiu Biris, Head of Product at xPortal, spoke to us during the event in an exclusive interview and shared the project’s vision:

They have to be able to do anything, whether it’s crypto or fiat, they don’t have to think about Blockchain is this, blockchain is not money. We are trying to dissolve those barriers between crypto and fiat because in our vision, money, it’s just money. And that’s why we want to make it easier for anyone to do whatever they need in terms of financial needs through the app.

Cover image from MultiversX, chart from Tradingview

The context of the legal challenge centers around the SEC vs. Jarkesy case, in which George Jarkesy contends that his Seventh Amendment rights were violated.

In a pivotal moment backed by pro-XRP lawyer John E Deaton’s sentiments, high-profile entrepreneurs Elon Musk and Mark Cuban, along with a consortium of prominent investors, have raised objections against the US Securities and Exchange Commission (SEC). This challenge comes in the form of an amicus curiae brief addressing the SEC’s litigation procedures.

Musk, Cuban, and other amici such as Phillip Goldstein, Nelson Obus, Manouch Moshayedi, and the Investor Choice Advocates Network (ICAN) collectively argue against the SEC’s predominant use of administrative proceedings over jury trials. The brief highlights that this method raises questions about the constitutionality of the SEC’s practices.

The amicus brief was composed for the SEC v. Jarkesy case. Here, George Jarkesy, the complainant, alleges that his Seventh Amendment privileges were infringed upon. He argues that the SEC’s internal adjudication method, which lacks a jury and is overseen by a commission-designated administrative law judge, violates these privileges.

Drawing attention to the Seventh Amendment, which upholds a defendant’s right to a jury trial for cases mirroring “suits at common law,” the amici underline the SEC’s inconsistency. They cite the SEC v. Seghers case as an example, where the SEC opted for a jury trial, resulting in a liability verdict against Seghers for fraud.

The amici also address concerns of “forum shopping” by the SEC, suggesting that the agency might prosecute two identical defendants differently. This approach could result in one party benefiting from full constitutional rights, while the other might not, leading to a disparate legal outcome.

The document reads:

Forum shopping by itself may not be impermissible. But forum shopping by the federal government to pursue the same claims and penalties against similarly situated individuals, so that one individual has access to a jury and the other does not, violates the Equal Protection Clause of the Constitution.

The document further contends that such practices damage the SEC’s credibility at a time when public trust in such institutions is waning, intensified by revelations of the SEC’s “improper access to privileged memoranda.”

The amici conclude that the SEC’s practices deprive the public of critical information that might come to light during a jury trial, which contradicts the SEC’s core mission. This shared stance by Musk, Cuban, and their associates emphasizes the need for a reassessment of the SEC’s litigation approach, hinting at a potentially groundbreaking legal tussle on the horizon.

Renowned pro-XRP lawyer, John E Deaton, aired his views on X, expressing his support for Musk and Cuban’s stance. Deaton said, “I’m thrilled to see Mark & Elon take this path, even if they disagree on certain issues.” He reflected on past decisions, stating, “Three years ago I filed suit against the SEC, and encouraged companies in the crypto space to do the same.”

Deaton further challenges the narratives that discourage companies or executives from contesting the SEC or its chairmanship. “Just because they state something doesn’t make it true. Almost every court case involving the SEC is proving that very point,” he contends.

He highlights concerns about potential conflicts of interest within the SEC, suggesting that both parties, Republican and Democrat, are tainted. In a particularly revealing statement, he mentions, “These temporary bureaucrats are often conflicted, implementing agendas that favor their friends and the companies they go work for immediately following their tenure at the SEC.”

Detailing alleged past conflicts, the pro-XRP lawyer critically remarks, “Look at Jay Clayton. He helped Apollo Group after they gave Kushner a huge loan and Clayton becomes a top advisor and Board Member at Apollo… Speaking of Hinman, he’s made partner at A16z, and they, along with Joseph Lubin, Vitalik Buterin, asked Hinman to give ETH a free pass. Hell, a16z lawyers actually helped Hinman write his famous speech.”

Bringing attention to the broader issue, Deaton’s concerns are not only with individual transgressions but with systemic flaws. “The SEC MUST be completely restructured. It’s a broken and failed agency,” he unequivocally asserts.

Deaton concludes with a strong call to action, emphasizing the urgent need for reform. “We need term limits in Congress and we need to pass legislation forbidding a regulator from immediately working for companies they were just regulating.”

In his final, resounding statement, he warns, “Now it’s no longer only a revolving problem. It’s gotten so out of hand, they blatantly violate conflict laws because they know no one will do anything about it. The next regulator simply takes the attitude: ‘Now it’s my turn.’”

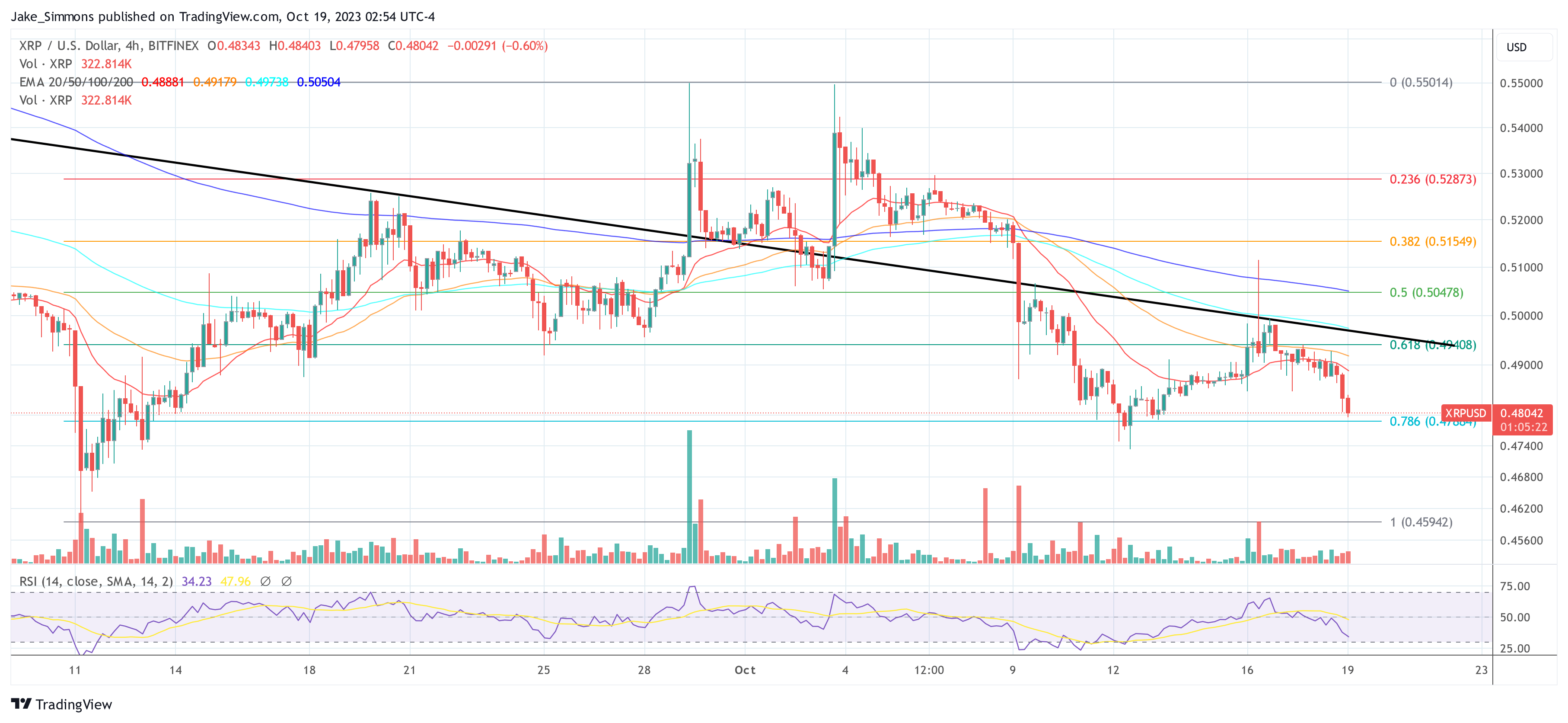

At press time, XRP traded at $0.4804.