[toc]

The Ethereum network stands as a revolutionary innovation in the realm of blockchain technology. It serves as a robust platform for building and deploying decentralized applications (dApps), fueling the growth of decentralized finance (DeFi) and transforming the way we interact with financial services. However, with its widespread adoption and increasing popularity, Ethereum has faced challenges of scalability and high transaction fees, leading to the development of Layer 2 scaling solutions to enhance its capabilities.

The Ethereum blockchain hums with innovation, birthing a new breed of digital assets known as ERC-20 tokens. These versatile gems unlock a treasure trove of possibilities, from voting rights in decentralized communities to fueling innovative applications and even representing virtual currencies.

ERC-20 tokens are standardized building blocks on the Ethereum network. They adhere to a specific set of rules, ensuring seamless interaction and divisibility, making them perfect for trading and diverse applications. Think of them as digital coins, each with its unique identity and purpose, ready to be exchanged, used, and explored.

Whether you’re a seasoned crypto trader or a curious newcomer, navigating the thrilling world of ERC-20 trading can be challenging. This comprehensive guide will equip you with the knowledge and tools to confidently buy, sell, and trade these digital assets on the Ethereum network.

Some of the major and popular ERC-20 Tokens are Tether (USDT), Polygon (MATIC), Chainlink (LINK), Uniswap (UNI), Lido DAO (LIDO), Maker DAO (MKR), amongst many others.

Features of Ethereum Network

Ethereum’s innovative design sets it apart from other networks, paving the way for a decentralized future of finance, applications, and beyond. Distinguished by its unique features and capabilities, it stands as one of the pioneers of Blockchain Technologies with standout features like:

The Power of Smart Contracts

The Ethereum Virtual Machine (EVM) serves as the core engine that drives the execution of smart contracts on the Ethereum network. These smart contracts are self-executing code that automates various actions and agreements, forming the foundation of dApps and DeFi protocols. EVM compatibility is crucial for deploying and interacting with ERC-20 tokens, the most common token standard on Ethereum.

Unlike static databases, Ethereum boasts the groundbreaking ability to execute self-enforcing agreements through smart contracts. These programmable pieces of code automate a wide range of tasks, enabling trustless interactions and the creation of innovative applications in diverse sectors.

Layer 1 and Layer 2: Addressing Scalability

The Ethereum mainnet functions as a Layer 1 blockchain, the base layer where all transactions are ultimately settled. To address the scalability bottlenecks on this primary layer, Layer 2 solutions have emerged as a promising approach. These solutions aim to offload a significant portion of transaction processing off-chain, resulting in increased throughput, faster confirmation times, and significantly reduced transaction costs.

A Platform For Innovation

Ethereum isn’t just a cryptocurrency platform; it’s a fertile ground for developers to build revolutionary decentralized applications (dApps). From DeFi protocols automating financial transactions to NFTs unlocking new ownership models, the possibilities are endless.

Gas and Gas Fees: Fueling Transactions

Within the Ethereum network, gas refers to the computational power required to execute transactions and smart contracts. Users pay gas fees to compensate miners for processing their transactions. Gas fees are denominated in ETH, Ethereum’s native cryptocurrency.

Fueling Decentralized Finance (DeFi)

As a breeding ground for DeFi protocols, Ethereum empowers users to take control of their finances. Borrow, lend, invest, and trade without dependence on intermediaries, fostering a more open and inclusive financial system.

Ecosystem And Adoption

Unlike centralized projects, Ethereum thrives on a vibrant and passionate community. Developers, miners, and users participate in its governance and evolution, ensuring its development remains transparent and aligned with the community’s needs. This growing ecosystem includes decentralized exchanges (DEXs), gaming applications, and more.

Exploring Layer 2 Scaling Solutions

Layer 2 scaling solutions offer a promising pathway to address the scalability challenges faced by the Ethereum mainnet. They operate as secondary layers built on top of the main blockchain, providing alternative mechanisms for transaction processing and data storage.

Here are some common types of Layer 2 solutions:

- Sidechains: Independent blockchains that run in parallel with Ethereum, enabling faster and cheaper transactions.

- Plasma Chains: Blockchains that leverage Ethereum for security and finality, offering scalability benefits through data offloading.

- Optimistic Rollups: The technology employed by the Ethereum network for token transactions, which bundles multiple transactions off-chain and submits a summary to the mainnet for verification.

Beyond Features: What Truly Sets Ethereum Apart?

Ethereum’s uniqueness extends beyond its specific features, encompassing its fundamental characteristics and impact on the blockchain landscape.

Network Effect and Ecosystem: Through its early adoption and widespread implementation, Ethereum has established a robust network effect. Developers, projects, and users gravitate towards it, creating a flourishing ecosystem that strengthens its overall value and resilience.

Security and Trust: Built on a Proof-of-Work (PoW) consensus mechanism, Ethereum offers a high level of security and protection against malicious attacks. Its distributed nature further bolsters trust and transparency, minimizing the risk of centralized control.

Flexibility and Adaptability: Ethereum’s design prioritizes flexibility and adaptability. Upgradeability mechanisms allow it to evolve and adopt new features to remain relevant and address emerging challenges in the blockchain space.

Global Impact and Pioneering Spirit: Ethereum has gone beyond being a mere technological advancement; it has ignited a global conversation about decentralization, ownership, and financial autonomy. Its pioneering spirit continues to inspire innovation and shape the future of our digital world.

How To Get Started on the Ethereum Network for ERC-20 Tokens.

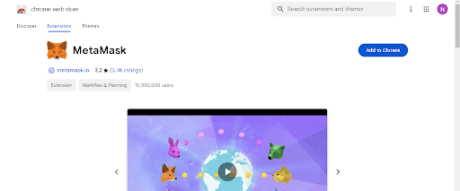

To buy/sell ERC-20 Tokens, you’ll need a crypto wallet. There are several crypto wallets to choose from within the Ethereum network and, popular options include software wallets like MetaMask, Trust Wallet, Coinbase Wallet, Binance WAllet, etc.

If you are using a desktop computer, you can download Google Chrome and install the MetaMask Wallet Chrome extension. If you prefer using your mobile phone, you can download MetaMask wallet via Google Play or the iOS App Store.

Just make sure that you are downloading the official Chrome extension and mobile app by visiting MetaMask Wallet’s website.

Once you’ve registered and set up your wallet via the Google Chrome Extension or via the mobile app you downloaded, MetaMask wallet allows users to manage their cryptocurrency wallets and interact with decentralized applications (DApps) to execute transactions on supported blockchain networks directly from their browsers. (Write down your seed phrase on a piece of paper and keep it in a safe place!).

Now, you’ll need to connect and add Ethereum to your MetaMask wallet. You may refer to MetaMask support page for reference on their website.

Trading ERC-20 Tokens on the Ethereum Network.

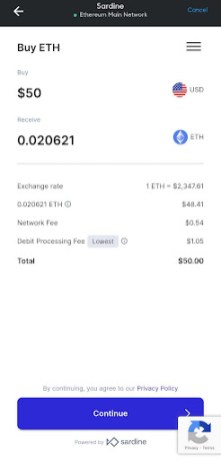

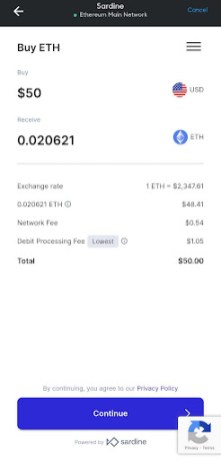

In order to ERC-20 token trades on the Ethereum network, you will need to buy ETH as your base currency. You can buy ETH on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the ETH from Binance to your Metamask wallet.

You can also purchase ETH directly within the Metamask wallet using traditional payment methods such as credit or debit cards, etc.

Just click on the “Buy/Sell” button within Metamask to open the interface. Here, you can put how much ETH (or any other token) you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your ETH to arrive in your wallet. Once the ETH arrives, you are all set to begin trading ERC-20 tokens on the Ethereum network. So, head over to UniSwap to get started on your trading journey.

How To Trade ERC-20 Tokens On The Ethereum Network Using UniSwap

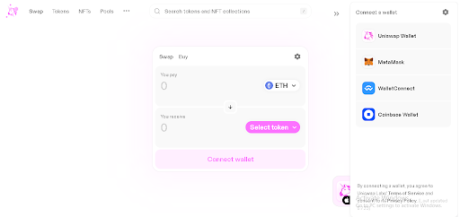

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly from their wallets without the need for intermediaries or traditional order books.

Uniswap offers users a simple and straightforward way to buy and sell a wide variety of tokens. Be sure you’re on the Uniswap website to protect your wallet.

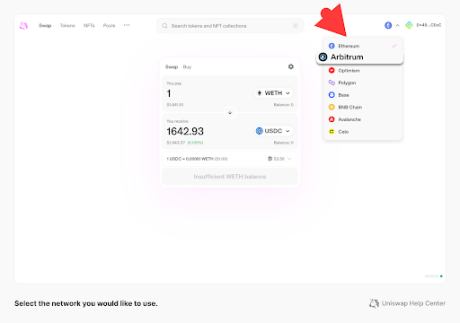

The first step is clicking on the “Launch App” button at the top right corner, as shown in the image below:

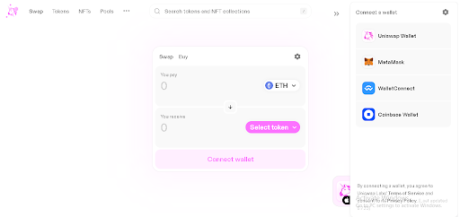

The next step is clicking on the connect wallet option on Uniswap at the top right corner, as shown in the image below:

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

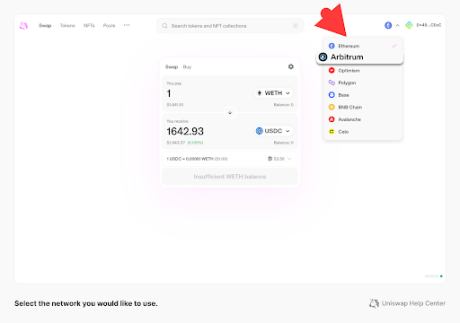

Once connected, switch Metamask to the Ethereum network. (If you’re already on the Ethereum network, you do not need to switch):

After connecting MetaMask to the Ethereum network, go to Uniswap, and then you can start your ERC-20 Tokens on the Ethereum network using UniSwap.

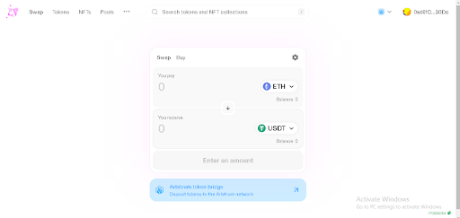

Trading Ethereum Tokens On Uniswap

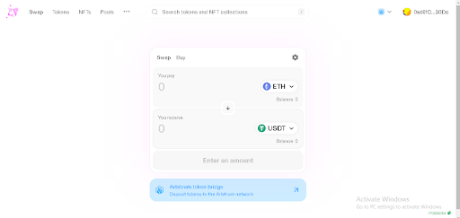

The next step is to select your preferred tokens on the UnsSwap interface and since Uniswap operates on a token to token trading model, click on the “select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using ETH, select ETH – USDT, enter the amount, then click on “swap” or “trade now” and confirm the transaction in your Metamask wallet. You can view the tokens in your wallet’s asset list.

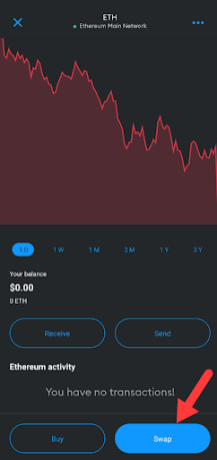

Buying and Selling ERC-20 Tokens with the Metamask Wallet

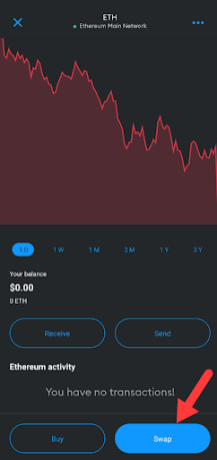

Ethereum Network users can also buy and sell tokens using the Metamask extension wallet already connected to the Ethereum network. To do this, make sure you’re connected to the Ethereum network and have ETH to swap and pay for gas fees. Then, navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on UniSwap. Input the amount of ETH you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking ERC-20 Token Prices on The Ethereum Network

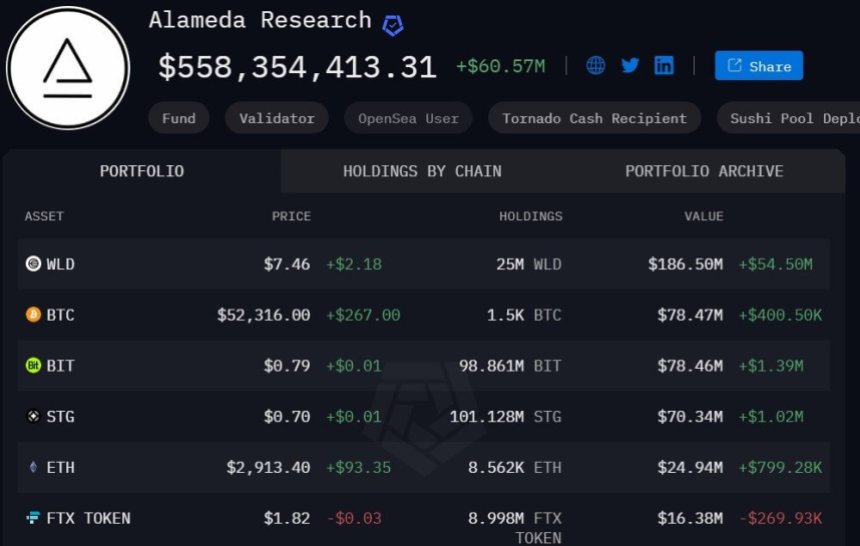

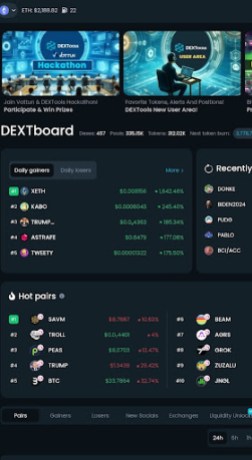

ERC-20 token holders and traders can take advantage of on-chain tools like DeFiLama to gain access to comprehensive market insights for specific tokens. These insights include price data and contract information, empowering users to make well-informed trading decisions based on reliable and up-to-date information.

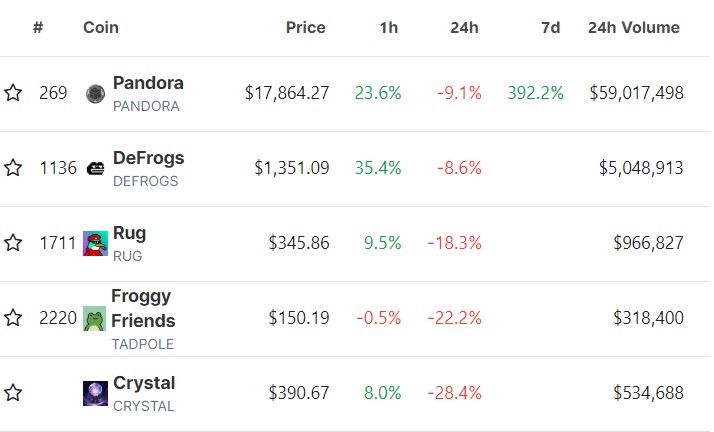

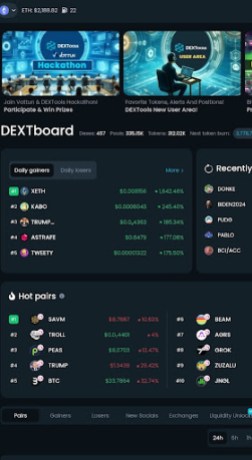

Dextools is a comprehensive analytic resource for managing digital assets traded on ERC-20 Decentralized Exchanges. It’s a vibrant analytical cryptocurrency resource that provides statistical information on all leading blockchains and crypto projects.

Among these features, an exceptional one is the charting functionality, which delivers both real-time and historical price data for a wide range of tokens.

By utilizing these charts, users gain valuable insights into price trends, trading volumes, and other pertinent metrics. This enables them to pinpoint potential entry or exit points for their trades with precision and confidence. For example, let’s assume you’re $ETH for $LIDO, your trading pair is ETH/LIDO.

Note, Trading pairs serve as bridges between currencies. For example, the ETH/LIDOpair allows you to acquire $LIDO tokens using Ethereum (ETH).

Choose the pair that fits your funding situation and trading strategy. Consider using ETH if you already hold it, or fiat currencies if you’re venturing in fresh.

Let’s track the $LIDO token on Dextools, here’s what we have:

Conclusion

Buying, selling, and trading ERC-20 tokens on the Ethereum network can be a thrilling adventure, opening doors to exciting investment opportunities and unlocking the potential of decentralized finance. However, it demands knowledge, caution, and a well-defined strategy.

This guide serves as your map and compass, but the ultimate treasure lies in your own learning and exploration. Navigate with confidence, trade responsibly, and remember that the most valuable asset in this journey is your knowledge.