The London upgrade has been a success, and now eyes are on the even more eagerly awaited merge with Eth 2.0

Cryptocurrency Financial News

The London upgrade has been a success, and now eyes are on the even more eagerly awaited merge with Eth 2.0

Ethereum network continues to record increasing support as launch draws nearer with each passing day. The network has now successfully crossed 200,000 validators meaning there are now over 200,000 validator nodes running ahead of the ETH 2.0 launch and counting. The amount of staked ETH now stands at over 6.6 million coins staked, totally over $14 billion worth of ETH currently staked in the network.

Over 20,000 validators were added to the network in the span of a month, taking the validators number from 180,000 to over 200,000. With this has come an increasing number of ETH staked on the network. More and more investors continue to stake their coins in anticipation of the upgrade to ETH 2.0, which will come bearing rewards for the validators.

Related Reading | Ethereum EIP-3675 For ETH 2.0 Upgrade Launches On GitHub

At this point, the amount of staked ETH now totals over 5% of the entire circulating supply of ETH. With a current annual APY of 6.1% on staked ETH on the Ethereum network.

The move of the Ethereum network from proof of work to proof of stake has been a hot topic in the crypto space since the project was announced. Although the project continues to require more time to complete than was initially speculated by Ethereum CEO Vitalik Buterin. The move has had numerous delays, most of which are attributed to personnel working on the upgrade and not technical problems, according to the CEO.

ETH price tests $2,300 resistance point | Source: ETHUSD on TradingView.com

Ethereum still currently operates on a proof of work mechanism, but the move to proof of stake would see the network requiring less electricity to mine coins and making the hassle of mining much less than it currently is. The reduced electricity consumption will address the environmental pollution problem of mining, which has long been a bone of contention in the mining industry.

Recently, the EIP-3675 was formalized as an improvement proposal, which sets the stage for “The Merge.” This comes just before the scheduled London Hard Fork that is meant to take place about a week from now on August 4th. The hard fork will see gas fees being burned as the current system is switched out for a new and better one.

The price of Ethereum continues to see increasing improvement as ETH 2.0 breaks the 200,000 validator milestone. Over the weekend, the price of Ethereum grew over 10% as the market witnessed a tremendous run. Giving ETH a much-needed momentum push to break the $2,000 price level and continue an upwards movement.

Related Reading | Ethereum Price Could Go Up Over 860% To Break $10,000, Crypto Analyst

More validators are expected to hop onto the Ethereum network. And as the amount of ETH mined in each block is reduced due to the fee burn structure of the ETH 2.0 upgrade, the amount of forecasted circulating ETH will be less. Hence the new deflationary nature of the network will introduce scarcity, thereby increasing the value of the coins mined.

Ethereum is now comfortably trading above $2,000 and continues to see upward momentum as the price continues to test the $2,300 resistance point.

Featured image from Blockchain News, chart from TradingView.com

The Ethereum Improvement Proposal (EIP) 3675 has now launched on GitHub. EIP-3675 contains the ETH 2.0 proof of stake merge that is coming to the network. Although this does not mean that the move to proof of stake is happening anytime soon, it is bringing the Ethereum network one step closer to the move from proof of work to proof of stake.

Consensus researcher Mikhail Kalinin creating a pull request for the EIP-3675 on GitHub formalized the chain merge as an improvement proposal for the first time ever. The pull request was made on Thursday 22nd July 2021.

Related Reading | Ethereum Price Could Go Up Over 860% To Break $10,000, Crypto Analyst

Ethereum developers continue to work towards the merging of the Ethereum Mainnet with the already up and running Beacon Chain, which would mark the final step for the move to proof of stake.

The EIP-3675 is meant to set the stage for “The Merge,” which is slated to be discussed at a core developers’ meeting that will be held on Friday, July 23rd.

Ethereum co-founder Vitalik Buterin had confirmed that the move to ETH 2.0 had been delayed. But according to the CEO, a couple of factors had contributed to the delay of the project.

Firstly was that they had expected it to take a much shorter time than it would have. When the project was first proposed, the team had believed the move to proof of stake would only take a year. It turned out to be a project that would take at least six years to accomplish.

ETH price shows downwards movement post-recovery | Source: ETHUSD on TradingView.com

Another problem that the Ethereum upgrade had encountered had been team conflicts. It had been speculated that technical difficulties had been the reason for the continuous delays but in the end, Buterin confirmed that the problem was in fact not related to technical problems. One of the major causes for the delays had been with the people working on the project.

Related Reading | Ethereum Whales Go On Buying Spree, Top 10 Addresses Now Own 20% Of All ETH

One of the biggest problems I’ve found with our project is not the technical problems,” said Buterin. “It’s problems related to people. We have a lot of internal team conflicts in these five years.”

Continous disagreements and team conflicts seem to plague the project. The CEO is quoted saying, “if you are building a team, it is important to know who you are working with.”

Expectations for the network continue to remain high. Ethereum price itself has taken hits over the past months as the crypto market continues to be beaten down by bears. But despite the declining prices, holders continue to stake their coins ahead of the move to proof of stake.

Over 6.3 million ETH have been staked on the Ethereum network, accounting for over 5% of the current circulating supply of ETH.

Related Reading | As Ethereum Price Suffers, Investors Wonder If ETH Can Become Deflationary

Investors had hoped shard chains would be rollout this year but this is unlikely as the possible date of launch for the shard chains has now been moved to 2020.

Ethereum’s price continues to trade above $2,000 after the boost it received from Elon Musk. With a current market cap of $234.05B.

Sygnum, a Swiss-based bank, has recently revealed that it will begin offering customers access to Ethereum 2.0 staking through its banking platform. This would make the bank the first bank to offer ETH 2.0 staking to its clients. Sygnum Bank has said that its clients would be able to conveniently and security stake Ethereum through its institutional-grade banking platform. Furthermore, clients can generate up to 7% yield yearly on their staking activities.

This news follows a report from two JP Morgan analysts who forecasted that staking could be a $40 billion industry by the year 2025. They predicted this would come following the total implementation of ETH 2.0 which is expected to make the Ethereum network more secure and scalable.

Related Reading | Ethereum Tests $2,300 Range As Market Adds $70 Billion

The announcement was made on Sygnum’s website on July 6, 2021.

According to the announcement on Sygnum’s website, the digital asset bank believes that staking will always be a prime choice for investors in Ethereum. Given the benefits of ETH 2.0, the opportunities are endless for investors.

One of the reasons for this is the exponential growth of decentralized finance (DeFi). DeFi has gained significant popularity in the market these past months and the applications for DeFi are powered by the Ethereum network.

Sygnum is the world’s first digital asset bank. Keeping in line with being first at what they do, they have made the step to add Ethereum 2.0 staking to add to their portfolio of yield generating products.

Ethereum price breaks $2,300 as number of stake coins grows | Source: ETHUSD on TradingView.com

The feature for staking ETH 2.0 is completely integrated with the bank’s platform. Customers will be able to stake the Ethereum they have in their existing wallets on the network through the bank’s infrastructure.

Sygnum provides its clients institutional-grade custody and wallets are fully segregated. This means that clients’ stakes coins will be held in the clients’ individual accounts, with the highest security that the Sygnum platform provides.

This keeps true to Sygnum’s mission of bringing innovative digital assets products to regulated spaces. Signum continues to expand its offers of attractive and yield generating products. And staking is the latest addition to that portfolio.

ETH 2.0 consists of a series of upgrades that are currently being made to the Ethereum blockchain. The upgrades are meant to make the network safer, faster, efficient, and more scalable going forward.

The most prominent of the upgrades will be the move from proof-of-work currently being used by the network to proof-of-stake. Proof of work currently uses high computational power to confirm transactions via mining blocks. But proof-of-stake only requires validators, who are required to stake 32 ETH, to confirm transactions.

The validators for each transaction will be selected at random to confirm transactions. This completely eliminates the competition that is seen in the proof-of-work mechanisms and hence transactions will require less computational power to confirm because there is not a competition to mine blocks.

Ethereum 2.0 proof of stake mechanism is expected to use about 99% less energy than the current proof of work mechanism.

Related Reading | Ethereum Upgrades Could Jumpstart $40 Billion Staking Industry, JP Morgan

Staking has seen significant growth in the past year. It first became mainstream in the crypto space in 2020. Now, it has grown widely in popularity.

Investors are staking their coins as a way to get rewards for being validators. Staked coins could yield as high as 13% per annum for stakers. This is fast becoming a means of passive income for investors in the crypto community.

As the final date of the move to Ethereum 2.0 draws near, the number of coins staked has increased. There are currently over 6 million ETH staked today. This number accounts for 5% of the total circulating supply of Etherum.

Featured image from Genesis Block, chart from TradingView.com

We don’t know the identity of the whale that’s deposited a half billion into Ethereum, but a look at the chain tells us a whole lot about them.

Ethereum upgrades could jumpstart a $40 billion staking industry, according to a JP Morgan report. JP Morgan estimates that the staking industry is currently worth $9 billion and that this number could balloon to $40 billion by 2025.

The report speculates that the launch of ETH 2.0 would lead to more adoption of the coin and could increase staking payouts to $20 billion in the first years of the launch. While $40 billion is a number that could be reached by 2025.

Related Reading | Scaramucci’s Skybridge Capital Launches Ethereum Fund

The report was from two JP Morgan analysts who stated that the returns from staking are an attractive investment in this zero rate climate. Referring to the low-interest rates being given by banks on customer savings.

ETH 2.0 is an upgrade to the Ethereum network that will help to improve network security and provide more scalability. ETH 2.0 aims to improve the overall efficiency of the network by introducing sharding to the mix. Sharding is simply a process of splitting a database into smaller pieces so the network is better able to accommodate more load.

The ETH 2.0 upgrade will move the network from proof of work to proof of stake. Drastically reducing the amount of energy required to mine the coins and confirm transactions on the network.

Since proof of work requires machines to solve mathematical equations to confirm transactions on a network, the amount of energy it consumes is tremendous. Bitcoin and Ethereum mining still use proof of work mechanisms, leading to growing concerns about energy consumption in the crypto mining industry. Mining is purported to be the 33rd largest consumer of energy in the world.

Current total DeFi market cap | Source: Crypto Total DeFi Market Cap on TradingView.com

Proof of stake on the other hand achieves the same result of confirming transactions on the blockchain sans solving complex mathematical equations. Proof of stake allows holders of a coin to be validators of a transaction. The mechanism uses a pseudo-random selection process to select a node to be the validator for the next block.

According to the Ethereum website, this will happen in three stages. The first is the Beacon Chain. The Beacon Chain is already live and with it came staking. It will also lay the groundwork for future upgrades and coordinate the entire system.

Next is the Merge. This will be the merging of the Mainnet Ethereum with the Beacon Chain. The merge is estimated to go live in 2021.

Lastly will be the addition of the shard chains. Shard chains will increase the capacity of Ethereum to process transactions and store data. ETA for the addition of shard chains has been set at 2022.

The report went in-depth about why staking might be the new preferred way of investing. Staking provides up to 13% yield on crypto balances, and more in some cases. Compared to traditional banks and investments like bonds, this is a much more attractive investment opportunity for investors.

“Yield earned through staking can mitigate the opportunity cost of owning cryptocurrencies versus other investments in other asset classes such as U.S. dollars, U.S. treasures, or money market funds in which investments generate some positive nominal yield.” – JP Morgan analysts report on staking.

The report also pointed out that rewards from staking could be a way to mitigate against inflation. The rise of staking as a way of earning passive income will be on the rise.

Related Reading | How Ethereum Can Reach $2 Trillion In Market Cap, Matthew Sigel

Already, current market capitalizations of staking tokens have already exceeded $150 billion. And this number will only continue to grow as staking becomes more mainstream.

JP Morgan has been looking to give customers crypto options despite their CEO Jamie Dimon not being in support of crypto. Reports are that the company is preparing to offer customers a Bitcoin fund.

Featured image from CYBAVO, chart from TradingView.com

A $2,200 Ethereum price would give bulls a $28 million advantage in this week’s ETH options expiry, but traders are more focused on the impact of the London hard fork in mid-July.

Ethereum’s EIP-1559 upgrade is fast approaching, but derivatives data shows traders are less than optimistic about ETH’s short-term prospects.

A recent post on CryptoQuant by TemptingBeef has confirmed that the number of staked Ethereum on the ETH 2.0 deposit contract has now exceeded 100,000. This means that the number of staked ETH is now more than 5% of the amount of Ethereum that is currently in circulation.

Chart showing the amount of staked ETH over time | Source: TemptingBeef on CryptoQuant

ETH 2.0 has been in the pipeline for a number of years now. Hopes were that an Ethereum proof of stake would be unveiled in 2020. But developers want to make sure that the network was completely safe before they rolled it out. Users wait in anticipation for the announcement of release dates as it looks like the release will be delayed again due to it not being ready yet.

According to Ethereum’s founder Vitalik Buterin, the biggest problem causing the delays with ETH 2.0 has not been technical problems of any kind. But have been the people working on it.

The CEO pointed out that the project is ravaged by internal conflicts. Leading to delays in finishing up the project.

Related Reading | Cardano Founder: Ethereum Will Overtake Bitcoin

The ETH 2.0 is a response to the growing criticism of the power consumption of the proof of work systems used by coins like bitcoin, with the blockchain requiring miners’ computers to solve complex mathematical problems to approve transactions. This requires high computing power from computers. Which translates to high energy consumptions by the mining operations.

Ethereum 2.0 is going to reduce network fees and increase transaction speeds. This will be done by providing scalability to the Ethereum network. It is also expected to use 99.95% less energy than proof of work protocols like the bitcoin blockchain.

This is a staggering number when compared to the amount of energy that mining currently uses. It is estimated that bitcoin currently uses more energy annually than entire countries like the Netherlands and Argentina.

It is no surprise then that there is a rush to find more energy-efficient ways to mine cryptocurrencies. Mining activities are a big concern when it comes to the pollution created by fossil fuel-based energy consumption.

Ethereum trading below $2,000 as ETH 2.0 hits milestone | Source: ETHUSD on TradingView.com

The anticipated move from PoW to PoF with ETH 2.0 has been further delayed to 2022. Expectations were that the transition would be done this year. As was announced back in 2020. But it seems that investors will just have to wait another year for the move.

Ethereum 2.0 is going to eliminate the bottlenecks that are currently present in the network. Things like high gas fees during high traffic hours will be eliminated. Transactions will be faster regardless of how congested the network is. And faster transaction speeds means fewer network congestions.

It will also increase the security in the network. Providing more scalability and throughput.

But the primary advantages lie in the energy efficiency of the network.

The first part of the ETH 2.0 is the Beacon Chain, which is currently live now. This is what allows users to stake their coins for new ETH rewards.

Related Reading | Ethereum to $20,000? Factors Behind The Bold Call

The Merge will come after this. This is when the main net merges with the Beacon Chain. This is estimated to happen in 2021. But for now, there are no definite dates given for when this will happen.

Finally will come the shard chains. It will enable Ethereum to process more transactions. And it also increases the capacity of the network to store data.

Shard chains will gain more features as time goes on. These features will be rolled out in multiple stages.

As for holders of Ethereum, rest assured that their coins will be safe in the move from ETH 1.0 to ETH 2.0. All of the data history, transaction records, and asset ownership of ETH coins will remain. Just that new transactions will be carried out on the new network.

Featured image from Bitcoin Market Journal, charts from CryptoQuant, TradingView.com

Polygon’s cheaper transaction costs and faster block time have driven increased adoption by a number of major projects.

The second-largest digital asset doesn’t look to be stopping its meteoric rise anytime soon.

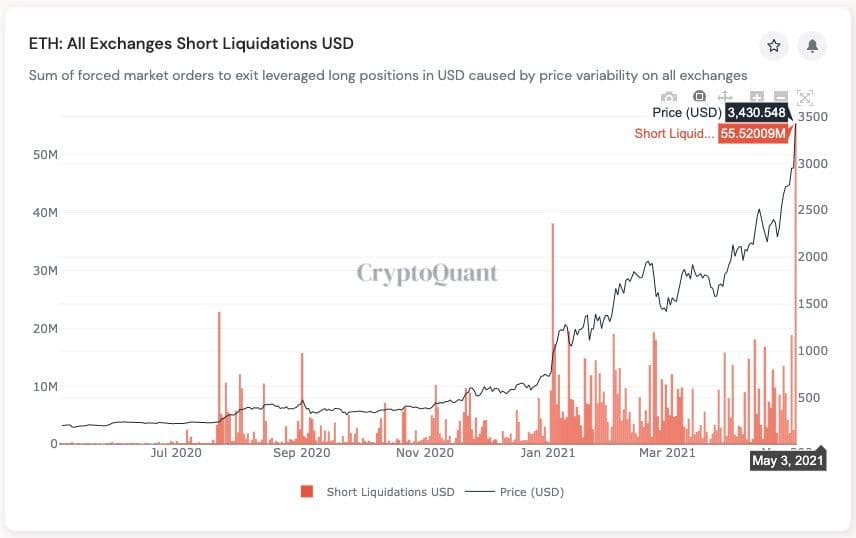

For the last few days, Ethereum has been adding incredible returns for investors. According to CoinMarketCap, on Monday, ETH added over 16% pushing the coin to a new record of slightly over $3,450. At the time of writing, the coin was trading at around $3,470, a gain of 9.43% over the last 24 hours.

A short squeeze refers to when short-sell orders in the futures market are liquidated in a short period of time. When the shorts are liquidated, short-sellers will have to buy back their positions. This automatically causes buyer demand to increase in the market.

Hence, the number of shorts rapidly declines, and long contracts or buy orders begin to dominate the market.

In the case of Ethereum, the last 24 hours has seen all-time high short liquidations across all derivative exchanges. According to cryptoanalysis firm, CryptoQuant, the cryptocurrency liquidations reached about $55 million in exit leveraged long positions causing the price to surge to a new record high.

As a result of the increased volatility, Ethereum (ETH) saw its market capitalization spike to almost $400 billion. Notably, its daily average traded volume stood at approximately $72.7 billion according to metrics provided by CoinGecko.

According to the chart, higher support is required to keep the bears at bay and allow bulls to focus on price levels above $3,500 and $4,000, respectively. The Moving Average Convergence Divergence (MACD) suggests that Ethereum is firmly in the bulls’ hands.

Related article | $150 Million In Short Squeeze Liquidated As Bitcoin Scales Above $53,000

Ethereum, the second-largest digital asset by market capitalization, has earned a warm welcome from institutional investors, owing to its massive DeFi supremacy. Coincidentally, Ethereum began to eat away at Bitcoin’s market share, with the latter having about 44.6 percent against 16.7% for ETH. The average amount of ETH gas is 39 gwei.

After a two-week period of consolidation, the cryptocurrency bulls were re-energized by a surge in the price of Ethereum. The cryptocurrency market, however, is in a super-cycle. According to Dan Held, a prominent cryptocurrency analyst, and will continue to rise in the coming months.

“Money printers go Brrrr…Bitcoin was planted during the 2008 financial crisis as an antidote to bad central banking policy, but it has grown during a macro bull run (largely no recessions or depressions from 2008 – 2020),” Held noted.

He further added that:

“With Bitcoin’s current 4-year microcycles coinciding with the longer macro ~10-year cycles, that puts Bitcoin in a potential Supercycle. This is similar to Ray Dalio’s observation of short and long-term debt cycles but on an accelerated timeline.”

For most decentralized financial networks, the Ethereum ecosystem is considered a pioneer in the smart contract market. DeFi networks, such as Uniswap DEX, is based on the Ethereum ecosystem and manages the majority of daily cryptocurrency transactions.

“Thousands of developers are building applications that recreate traditional financial products in decentralized ways on top of Ethereum, and as more and more users pour in to interact with these apps, they require ETH (ether) to conduct any transaction,” said Sergey Nazarov, co-founder of smart contract company Chainlink.

“Second, there seems to be growing institutional interest in the public Ethereum blockchain, as stakeholders play around with ways to leverage the public network,” he added.

It’s also interesting to note that Ethereum’s co-founder, Vitalik Buterin, has made it the list of the world’s youngest cryptocurrency billionaires. The 27-year-old programmer’s crypto holding soared to higher levels as Ethereum price hit new record highs.

With a balance of over 333,520.81+ in his public Ether wallet, Buterin valued crossed the billion dollars when this cryptocurrency reached $3,000. Store at address 0xAb5801a7D398351b8bE11C439e05C5B3259aeC9B since September 8, 2015, Buterin’s lowest value in USD terms stood at $0,12 on November 19 of that year and stands at $1,044,090,315.14 today, according to Etherscan data.

Related article | Ethereum Rally Extends Above $3,400, Why Dips Remain Attractive

Featured image from Pixabay, Charts from Tradingview.com and CryptoQuant.

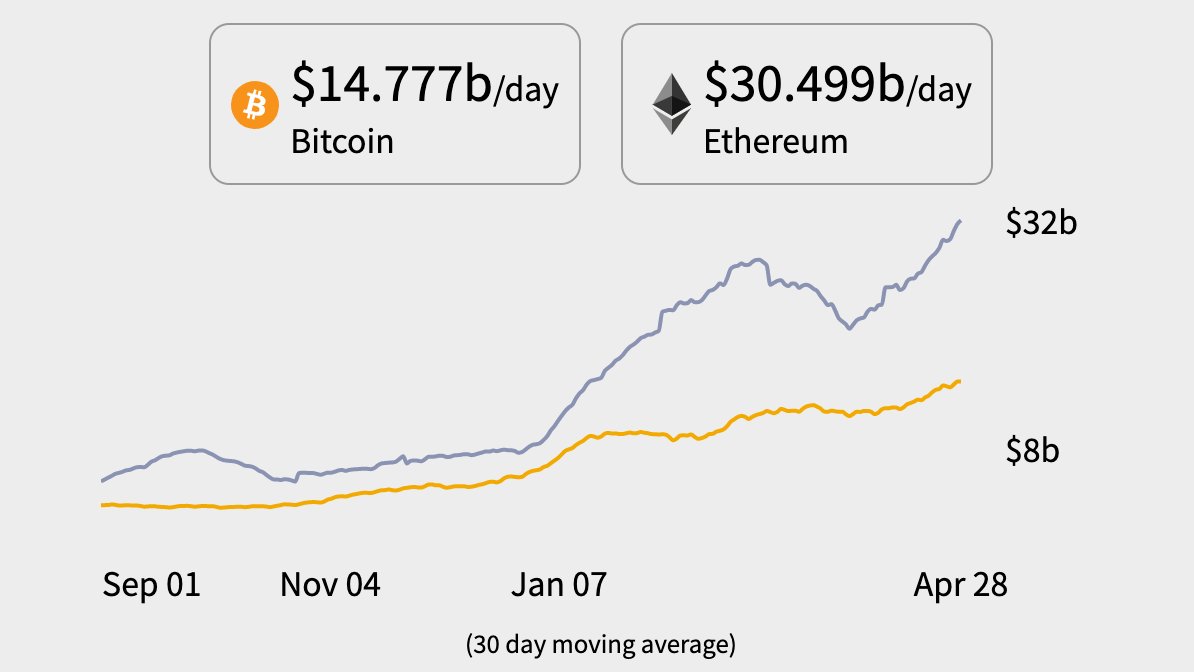

Ethereum has been steadily gaining 5% a day over the last week and is now reaching a new high of $2900. Ethereum is currently trading at a new all-time high of $2866, with a market capitalization of $331 billion.

For the first time in history, Ethereum was able to reach $2,850, and it is on its way to surpassing $3,000. This will help the virtual currency to break its all-time high price and get closer to Bitcoin’s market capitalization. While Bitcoin remains the most common virtual currency, its market share has fallen below 49%, and Ethereum’s market share is approaching 15%.

According to data analytics platform Skew, the recent ETH price rally coincides with an increase in spot trading volumes since mid-April.

Ether spot volumes have materially picked up since mid-April pic.twitter.com/3WqHlWdsl7

— skew (@skewdotcom) April 29, 2021

Analysts are optimistic about the ETH price surge, predicting that it will continue in the near future. A majority of market participants expect that the Ethereum price will rise to $10,000 or higher by the end of the year.

Bitcoin has crossed $58,000 in the last few hours and is now very close to $60,000, a high psychological level that will be critical to surpass in the coming days.

Bitcoin and Ethereum aren’t the only virtual currencies that are rising in value. Binance Coin (BNB), Dogecoin, and Litecoin are all up. Binance Coin has risen by over 2% in the last 24 hours, bringing it up to $627.

Dogecoin continues to draw buyers, and it is now trading at $0.36, up more than 17%. After surpassing $272, Litecoin, the digital asset generated by Charlie Lee, is up 3.14 percent from yesterday.

Related article | Ethereum Consolidates Above $2,700, Here Are Chances of Downward Move

Market analyst ‘Spencer Noon’ has provided the top-ten reasons why Ethereum holds the potential to hit $10,000 by the end of 2021.

The Ethereum community is now waiting for the ETH 2.0 update to be launched. As a result, ETH could grow to become one of the world’s largest blockchain networks. Several projects have moved from Ethereum to the Binance Smart Chain (BSC) in recent months, attracting a slew of new Decentralized Finance (DeFi) projects.

Ethereum may be able to reclaim its supremacy in the DeFi market with ETH 2.0. With cheaper and faster transactions, the world’s second-largest blockchain network may once again become home to the most widely used and powerful dApps, attracting users from Binance Smart Chain who previously used Ethereum.

Related article | Ethereum Closing In on $2,800 As ETH 2.0 Deposit Contract Hit New ATH

Featured image from Pixabay, Charts from Tradingview.com

On Thursday, the world’s second largest cryptocurrency by market cap, Ethereum surged in an indomitable bull rally. At press time, the coin was trading at a new all-time high of $2,760, a 2.89% gain in the last 24 hours. ETH currently has a market cap of $320 billion.

The price surge comes after one of the world’s biggest asset managers WisdomTree listed its new Ethereum ETP on Deutsche Borse’s Xetra market in Frankfurt and the Swiss Stock Exchange in Zurich.

The WisdomTree Ethereum ETP (ETHW) is currently the cheapest available Ethereum-derivative product in Europe with an expense ratio of just 0.95%. The ETHW will allow investors to gain exposure to Ether without actually holding the cryptocurrency. Besides, WisdomTree will be working along with multiple custodian solution providers to hold the digital asset. Speaking of this new development, Jason Guthrie, head of capital markets and digital assets at WisdomTree, said:

“With this increase in popularity, institutional investors are doing their due diligence on the most liquid cryptocurrencies and we expect the pace of adoption across these to ramp up as the opportunity in digital assets becomes more compelling.”

Alexis Marinof, the European operations manager at WisdomTree, said that institutional demand for Ethereum has recently increased. In addition, its previous digital assets ETP products were well-received by institutional investors. He went on to say that the cryptocurrency asset class has helped institutions diversify their portfolios.

“By adding ETHW to our range, we now have the products and research capabilities to support institutional investors whether they are considering making their first allocations to digital assets or looking to diversify their exposures,” added Marinof.

Since the beginning of 2021, Ethereum has been on a big upswing. ETH has also gained nearly 300 percent year-to-date at its current price. CI Global Asset Management introduced the world’s first Ethereum mutual fund to the market earlier this week.

Related article | Ethereum Seems Unstoppable, Here’s How ETH Could Extend Rally

Ethereum 2.0 was billed as the most ambitious update to the Ethereum network to date, and the hype appears to be bearing fruit. According to a Tweet from Glassnode alerts, the world’s second-largest cryptocurrency has upgraded to a new all-time high of $10,935,392,247.93 for its deposit contracts.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of $10,935,392,247.93

View metric:https://t.co/1ezmu1GKcj pic.twitter.com/6uj4P0wwYD

— glassnode alerts (@glassnodealerts) April 28, 2021

The community has embraced the cryptocurrency, particularly since the launch of the Ethereum 2.0 update in November 2020.

The foundation’s success began right at the start, with the preparations for its launch. The team behind it had planned to launch it on December 1, 2020, if the deposit contract reached a stake of 524,288 Ethereum coins. It met its target in a matter of hours, collecting over 150,000 ETH deposits in less than 24 hours.

Ethereum has been plagued by high gas fees, and Ethereum 2.0 is being heralded as the solution. Danny Ryan, the Ethereum 2.0 coordinator, said before the launch that the update added a lot of intrinsic value to the system.

Related article | Ethereum Gains Momentum, Here’s Here Chances of a Run To $3K

Featured image from Pixabay, Charts from Tradingview.com

While Cardano and Polkadot are extending their staking dominance, Tezos has plummeted from the top ten by staked capitalization.

$250 million in Ethereum options are set to expire on April 23 and derivatives data shows bulls still have a slight advantage.

Scalability is a hot investment as VCs and retail pour into rollup and sidechain solutions

DeFi. NFTs. Stablecoins. Smart contracts. Ethereum is home to some of the biggest innovations in crypto. Community insider Danny Ryan joins us to discuss the network’s big future.

DeFi. NFTs. Stablecoins. Smart contracts. Ethereum is home to some of the biggest innovations in crypto. Community insider Danny Ryan joins us to discuss the network’s big future.

Ethereum developers met Tuesday to compare research on the eventual merge of Eth 1.x and Eth 2.0