Market expert Miles Deutscher has identified several key trends and developments in the cryptocurrency market, particularly focusing on the Ethereum (ETH) rally and its implications for Layer-2 (L2) decentralized finance (DeFi) altcoins.

Deutscher highlights that ETH’s recent surge to a 22-month high of $3,130 has sparked increased interest in L2/DeFi altcoins, presenting potential opportunities for investors.

Ethereum Price Strength Continues

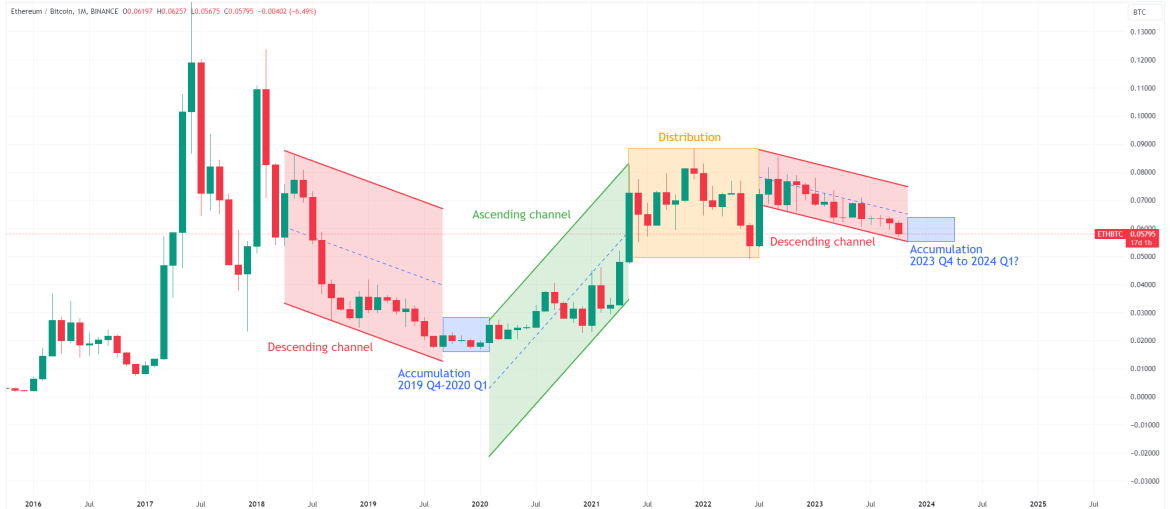

In a recent post on social media X (formerly Twitter), Deutscher notes that Ethereum continues to show strength, especially compared to Bitcoin (BTC), which remains in a key consolidation phase at $51,100. Holding above the significant psychological level of $3,000, ETH’s bullish momentum is further fueled by reports of Justin Sun, the founder of TRON, purchasing over $500 million worth of ETH in recent days.

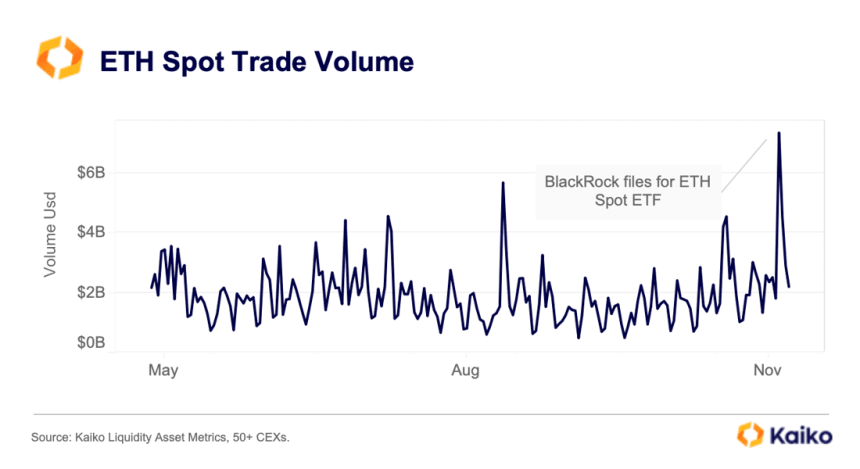

Deutscher remains optimistic about ETH and ETH-betas leading up to the proposed exchange-traded fund (ETF) dates in May and the upcoming Dencun upgrade in March. There are also potential indications of ETH/BTC breaking out, with investor Andrew Kang actively increasing his ETH long position.

First, on his altcoins watchlist, Deutscher highlights the fee switch proposal underway at Uniswap (UNI). This US-based decentralized crypto exchange has seen notable price gains of over 37% in the past week, which could have significant implications for the entire industry from a regulatory standpoint.

Notably, the analyst believes that this development could potentially trigger a broader rotation into other DeFi 1.0 tokens such as Curve DAO (CRV), Compound (COMP), Aave (AAVE), and Frax Share (FXS), THORchain (RUNE), GMX, as investors seek to capitalize on the DeFi landscape.

Moving on to another altcoin that could see a price spike, Deutscher suggests that this week’s anticipated launch of Blast L2, founded by the same individual behind BLUR, presents an opportunity for BLUR stakers to receive tokens from the airdrop and potentially be further integrated into the ecosystem.

Deutscher suggests that BLUR provides an alternative way to gain exposure to the Blast project, which has garnered bullish sentiment from numerous funds and thought leaders.

Following the positive news surrounding Uniswap, DYDX has been on the rise, with the token seeing a 7% increase in price over the last seven days. However, Deutscher cautions that a significant unlock is expected this week, which may tempt some recipients to sell, potentially causing a temporary dip in price.

Next in the spotlight, speculation surrounding the upcoming launch of Aevo (AEVO), which will allow developers to launch their protocols on its rollup and introduce an incentive program, is growing and generating interest in Ribbon Finance (RBN).

Given these developments, Deutscher notes that the prospect of pre-markets and IOU markets gaining “massive” attention and the recent record $4 million in fees positions RBN within an exciting narrative.

Deutscher’s Insights Point To Promising Trends

Following Deutscher’s mention of COTI last week, the coin has seen over 100% growth, breaking through key resistance levels. With the launch of their new privacy-enhancing L2 coinciding with the upcoming Ethereum Dencun upgrade, Deutscher notes that the protocol is in a favorable position for further price growth in the market.

On the other end of the spectrum, Deutscher acknowledges the rapid pace of market rotation and suggests keeping a close eye on Artificial Intelligence (AI) coins, which, as reported by NewsBTC, have seen significant gains with the hype surrounding AI projects such as Worldcoin (WLD).

Finally, with signs of life emerging over the weekend, according to the analyst, Rollbit Coin’s (RLB) burn mechanics position it as a leader in the “Rev Share/Real Yield” narrative. With the market potentially entering an “explosive bull run,” Deutscher believes the casino/gambling narrative could gain traction, benefiting projects like Rollbit, which has also seen gains of over 7% in the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com