Developers’ aim with Pectra is to make some minor code changes while simultaneously working on a bigger code change, Verkle trees, for the following upgrade.

Changing Tides: Restaking Takes Center Stage In Ethereum (ETH) Staking Landscape

In recent months, the Ethereum staking landscape has witnessed significant transformations, prompting a shift in investor preferences and reshaping the sector’s dynamics.

According to on-chain data researcher and strategist at 21Shares, Tom Wan, key metrics indicate a notable change in the approach towards Ethereum staking, with restaking gaining prominence as a preferred method.

Ethereum Restaking Landscape

Wan’s observations, shared on the social media platform X (formerly Twitter), highlight a steady increase in ETH staking deposits from restaking, rising from 10% to 60% since 2024.

Restaking can be accomplished in two primary ways: through ETH natively restaked or by utilizing a liquid staking token (LST). By staking their ETH, users secure additional applications known as Actively Validated Services (AVS), which yield additional staking rewards.

A significant player in the staking landscape is EigenLayer, which has emerged as the second-largest decentralized finance (DeFi) protocol on the Ethereum network.

EigenLayer has achieved a significant milestone with the release of EigenDA, its data availability Actively Validated Service (AVS), on the mainnet.

According to a research report by Kairos, this launch marks the beginning of a new era in restaking, where liquid restaking tokens (LRTs) will become the dominant way for restakers to do business.

Currently, 73% of all deposits on EigenLayer are made through liquid restaking tokens. The report highlights that the growth rate of LRT deposits has been significant, increasing by over 13,800% in less than four months, from approximately $71.74 million on December 1, 2023, to $10 billion on April 9, 2024, demonstrating the growing confidence in EigenLayer’s approach to restaking and contributing to the shifting tides in Ethereum’s staking landscape.

According to Wan, the rise of liquid restaking protocols has also contributed to a decline in the dominance of Lido (LDO), a staking service solution for Solana (SOL), Ethereum, and Terra (LUNC).

On the other hand, Etherfi has emerged as the second-largest stETH withdrawer, with 108,000 stETH withdrawn through the first quarter of 2024. This trend exemplifies the increasing popularity of liquid restaking protocols, allowing stakers to withdraw and actively utilize their staked assets while still earning rewards.

Ether.fi Set To Surpass Binance In ETH Staking

Data provided by Wan also shows a decline in the dominance of centralized exchanges (CEXs) in ETH staking. Since 2024, CEXs have seen their share of staking decline from 29.7% to 25.8%, a significant drop of 3.7%.

As a result, the decentralized staking provider Kiln Finance has surpassed Binance and become the third-largest entity in terms of ETH staking. With Ether.fi poised to follow suit, it is expected to surpass Binance’s position shortly, according to the researcher.

In short, these developments signify a paradigm shift in the Ethereum staking landscape, with re-staking methodologies gaining traction and decentralized protocols like EigenLayer and Ether.fi challenging the dominance of established players.

As of this writing, ETH’s price stands at $3,500. It has been exhibiting a sideways trading pattern over the past 24 hours, remaining relatively stable compared to yesterday.

Featured image from Shutterstock, chart from TradingView.com

What the Ethereum Community’s Staking Argument Is Really About

The Ethereum community is debating the power and responsibilities of the Ethereum Foundation, which some think is playing central banker by suggesting changes to the ether issuance formula.

Coinbase Ranks As Second Largest ETH Staking Entity As Lido’s Dominance Raises Concerns

Prominent crypto exchange Coinbase has emerged as the second largest ETH staking entity based on a recent scoop by Chinese reporter Colin Wu. This development comes amidst growing concerns about network centralization in regard to Lido’s dominance in the ETH staking market.

Coinbase Accounts For 14.1% Of ETH Staking Activity – Report

According to Wu, a report from Dragonfly data scientist hildobby, using data from Dune analytics, reveals that Coinbase presently has 3.873 million staked ETH, representing 14.1% of all staked ETH.

Coinbase dominance in the ETH staking sphere is only superseded by that of the liquid staking platform, Lido DAO, which accounts for one-third of all staked ETH.

Other platforms with a significant staking percentage include the Binance and Kraken exchanges, with a 4.2% and 3.0% market share, respectively. Meanwhile, the Figment staking pool comes third with a 4.9% market dominance.

Notably, Coinbase experienced a 44% increase in ETH staking activity over the last six months. Coincidentally, this development falls within the period during which the Ethereum Shanghai upgrade has been active.

Contrary to fears that the last Ethereum network update may induce a decline in staked ETH due to the ability to finally withdraw staked assets, the Shanghai upgrade has so far boosted stakers confidence, resulting in a net positive flow of 7.84 million ETH since its implementation in April.

At the time of writing, the total amount of staked ETH stands at 27.42 million ETH, representing 22.81 of ETH’s circulating supply.

Lido’s Growing Dominance Sparks Centralization Concerns

In other news, Wu stated there are community concerns about centralization in regard to Lido’s ETH staking dominance. Due to the Proof-of-Stake Consensus model, a higher amount of staked ETH translates to a higher voting power during governance processes.

Data from Dune Analytics shows that Lido accounts for 8.80 million staked ETH, representing 32.11% of the ETH staking market. Notably, the liquid staking platform experienced a 55% rise in staking activity over the last six months.

According to information from Ethereum’s official blog, concerns about centralization are quite valid, as any validator controlling a minimum of 33% of staked ETH can prevent the network from finalizing any block, even in the presence of a 66% majority.

Moreover, if a validator acquires 55% of the staked ETH, they could theoretically split the Ethereum chain into two forks. All these are speculations, as there is no evidence indicating that Lido DAO has any malicious intentions toward the Ethereum network.

At press time, ETH trades at $1,620.18, with a 1.36% decline in the last day, based on data from CoinMarketCap. In tandem, the token’s daily trading volume is down by 36.41% and valued at $2.86 billion.

Ethereum Liquid Staking Protocols Hit New Milestone Following Massive Inflows

Ethereum liquid staking platforms are making waves in the decentralized finance (DeFi) ecosystem. Recent on-chain reports have revealed that liquid staking protocols have recorded a new milestone in the number of Ether (ETH) staked, reaching a staggering 12 million ETH mark in just a few days.

Ethereum Liquid Staking Gains Momentum

With Ethereum 2.0 thriving, liquid staking protocols in the DeFi ecosystem have been growing rapidly despite recent market volatility.

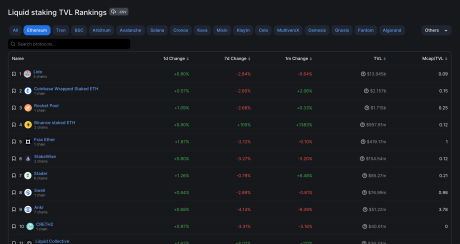

Research data from DeFi TVL aggregator, Defillama, revealed on Monday, September 25, the tremendous growth of Ethereum holdings in liquid staking platforms. According to the data, the ETH in liquid staking protocols has risen to approximately 12.31 million and may continue rising.

Reports uncovered that a staggering 370,000 ETH were staked in just five days, allowing liquid staking protocols to reach their current 12 million mark. Liquid staking platforms like Lido, Rocket Pool, Coinbase, and Binance are among the list of prominent protocols that led to the recent upsurge in Ether staking.

According to Defillama TVL rankings, Lido holds the top spot for the amount of Ethereum staked with a TVL of $13.997 billion in liquid staking. The protocol secured over 8 million Ether on September 20, and another 30,000 after that.

Coinbase is presently ranked second in Defillama’s TVL rankings, holding approximately $2.155 billion, a significant gap from Lido’s TVL.

Coinbase has about 1.3 million Ether presently in its reserve. Whereas, Rocket Pool holds the third position in TVL rankings and has increased its Ether holdings from 940,496 to 945,402.

Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driving force behind the recent spike in ether influx in liquid staking protocols in the DeFi ecosystem.

According to reports, Binance added a startling amount of ether to its already substantial ether reserves. The liquid staking platform which previously recorded 445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105 ETH. Research data have revealed that Binance amassed a considerable amount of ETH tokens to support its staking token, Wrapped Beacon ETH (WBETH).

In the last three months, the DeFi ecosystem recorded a liquid staking valuation above $20 billion evaluating various protocols in the DeFi ecosystem. Following this, Defillama’s September data revealed liquid staking protocols now hold $20.5 billion in assets, increasing by a staggering 293% from previous lows in June 2022.

Although the key protocols steering the surge are Lido, Binance, and Rocket Pool. Other upcoming liquid staking protocols like Davos and InQubeta are persisting, driven by the Ethereum 2.0 upgrade and investors desire to maximize their earnings through Ethereum staking.

Shanghai Upgrade Drives 25% Boost In ETH Staking Activity

The Shanghai upgrade was one of the most anticipated blockchain events of 2023, expected to introduce a higher level of speed and scalability to the Ethereum network.

However, the most important feature of the Shanghai upgrade was allowing validators and stakers to finally withdraw their staked ETH from the Ethereum Beacon Chain.

To explain, the Beacon Chain was created to aid the smooth transition of Ethereum from a Proof-of-Work consensus model to a Proof-of-Stake mechanism, i.e., ETH 2.0. Since its launch in 2020, many users have been staking their ETH tokens on the Beacon chain to facilitate network security and earn rewards. Albeit, those assets and the rewards they generate were inaccessible until after the Shanghai upgrade in 2023.

Prior to this network upgrade which occurred on April 12, 2023, the total number of staked ETH stood at 18.1 million, according to data by Dune Analytics.

Four months later, the token analytics website Token Unlocks has offered more insight into how the Shanghai Upgrade has impacted the ETH staking activity so far.

Shanghai Upgrade Sparks Confidence In ETH Staking

On August 10, Token Unlocks posted on social media platform X that the Ethereum Shanghai upgrade has yielded a positive result on ETH staking, with a significant rise in demand for LSD protocols – a liquid staking aggregator project designed to promote maximum yields for ETH stakers.

Wrapped Up for Shanghai Upgrade

The Shanghai Upgrade fueled sector growth, and the demand for the LSD protocol keeps rising.

Here’s what you can’t afford to miss:

22.99m $ETH staked, ~18.86% of circulation (Overall)

5.84m $ETH staked, ~4.8% of circulation (Since… pic.twitter.com/ZReOpNVTzD

— Token Unlocks (@Token_Unlocks) August 10, 2023

According to the report by Token Unlocks, there are currently 22.99 million staked ETH on the Ethereum network, accounting for about 18.86% of ETH’s circulating supply.

The report also highlights that 25% of this currently staked ETH was staked after the Shanghai upgrade in April. This means that about 5.84 million ETH, constituting about 4.8% of ETH circulating supply, has been staked in the last four months.

To emphasize the impact of the Shanghai upgrade on ETH staking, Token Unlocks noted that the net ETH staking ratio is up by 147%, with about 9.82 million ETH deposited and only 3.97 million ETH withdrawn post-upgrade.

It is worth stating that there were some speculations that the Shanghai upgrade would lead to a large-scale withdrawal of ETH, which could negatively affect the crypto market.

Interestingly, the report above paints a different reality, with many users now willing to stake ETH as they have the freedom to withdraw at will.

ETH Elites Strengthen Grip On Coin Supply

In other news, on-chain analytics firm Santiment reports a wealth accumulation trend in the ETH market. According to Santiment, the top 10 ETH addresses have significantly increased their ETH holdings in the last five years.

Within this period, the market intelligence firm notes that these wallets have acquired 27.86 million ETH, increasing their holdings from 11.2% to 34.6% of the token’s supply.

Related Reading: Ethereum Price Prints Bullish Technical Pattern, Why Close Above $1,880 Is Critical

At the time of writing, ETH is trading at $1,855.86, with a 0.68% decline in the last 24 hours based on data from CoinMarketCap. With a market cap of $222.18 billion, the Ethereum native token remains the 2nd largest cryptocurrency in the market.

Ether Staking Ratio Nears Key Milestone as Inflows Slow Amid Regulatory Pressures

Investors committed nearly 20% of all ETH tokens to lock up in staking contracts, according to blockchain data.

Coinbase Loses Market Share in Ether Staking as Regulatory Pressure Mounts

The exchange’s share in ETH staking dropped to 9.7%, the lowest since May 2021, as the SEC sued Coinbase for offering unregistered securities this month.

Ethereum Poised To Hit 35% Surge In Staking Demand – What It Means For Investors

In 2022, Ethereum formally adopted Proof of Stake (PoS) as a more secure and energy-efficient method to validate transactions and add new blocks to the blockchain.

PoS and other consensus mechanisms are integral to the security of a network. This shift has significant implications for the Ethereum ecosystem, particularly in terms of staking – the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network.

Related Reading: Will Listing Of Floki Inu On Brazil’s Largest Exchange Boost Meme Coin’s Price?

While staking has been around for some time, several factors are now converging to potentially drive a significant increase in ETH staking. In fact, a leading staking service provider has predicted a surge in staking activity and has backed it up with compelling reasons.

So, what does this mean for Ethereum, and why is staking becoming such a critical part of its blockchain infrastructure?

Staked Q2 Report Predicts Significant ETH Staking Rate Increase

Staked, a research subsidiary of the Kraken exchange, has released its Q2 report, projecting that the ETH staking rate could see a significant increase of 20% to 35% over the next 12 to 18 months. This forecast was based on several factors, including the recent increase in average Ethereum staking yield from 5.2% to 5.8% on a year on year basis.

Moreover, the Staked Q2 report’s prediction of a significant increase in the ETH staking rate could also have broader implications for the cryptocurrency market as a whole. If more users begin staking their ETH, the circulating supply of the cryptocurrency will decrease, potentially leading to an increase in its price.

This, in turn, could have a ripple effect on the entire cryptocurrency market, making it a crucial trend to watch in the coming months.

What Increased ETH Staking Means For Investors

One of the most obvious benefits is that a higher staking yield means investors can earn more rewards for their staked ETH. This could be especially appealing to long-term investors who are looking to maximize their returns.

Additionally, the increase in staking could potentially lead to a decrease in the circulating supply of ETH, which could drive up its price. This means that investors who are holding ETH could see their holdings increase in value.

But the impact of increased ETH staking goes beyond just earning rewards and potential price increases. It also has a positive effect on the overall health and stability of the Ethereum network.

By staking their ETH, investors are essentially locking it up, making it more difficult for bad actors to attack the network. This makes the network more secure and trustworthy, which could attract more users and investors to the platform.

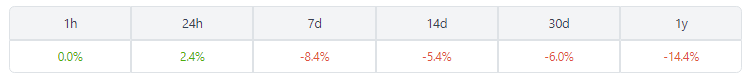

At the time of writing, the price of ETH stands at $1,798 according to CoinGecko, with a 2.4% rally in the past 24 hours. However, it’s worth noting that ETH has experienced a seven-day slump of 8.5%, highlighting the volatility that is characteristic of the cryptocurrency market.

-Featured image from Siam Blockchain

Liquid Staking Platform Lido Surpasses 6M Ether Deposits as Shanghai Upgrade Spurs Inflows

Ethereum’s Shanghai upgrade spurred deposit inflows to liquid staking protocols, including to the largest player Lido.

Validator service to use API for ETH staking process

The project is also targeting institutional investors by allowing the setting up of 1,000 validators for ETH staking within its platform.

Why Are Liquid Staking Cryptocurrencies Seeing Double-Digit Gains?

Over the last week, liquid staking cryptocurrencies have been seeing a significant upside. All of these tokens have successfully moved into the green territory, recording double-digit gains for their holders. Although these digital assets seem to be following the general crypto market uptrend, there is another factor pushing up their prices.

Why Are Liquid Staking Crypto On The Rise?

Liquid staking cryptocurrencies have been receiving more attention ever since the announcement that the Ethereum “Shanghai” upgrade is likely to take place in March 2023. This upgrade is important for the network because it will mean that staked ETH will finally be withdrawable.

Anticipation around this upgrade is already on the rise and liquid staking tokens are enjoying a good portion of this attention. Their popularity comes from the fact that they allow stakers to earn a yield on staked ETH even though they can’t withdraw their ETH. It also makes it possible for stakers to have tokens on hand which they can deploy on other protocols to further participate in the ecosystem.

Liquid staking protocols reward stakers with ETH-pegged tokens such as stETH and ankrETH and make it possible for ETH users to stake without having to become validators themselves. But instead of having to rely on centralized exchanges to do this, as was previously the case, these DeFi protocols are decentralized.

The higher earning potential of staking with liquid staking protocols has led to more demand for them. With the Shanghai upgrade coming, it is expected that more ETH will be moved to these protocols, leading to more demand for their native cryptocurrencies.

The Largest Liquid Staking Protocols

The largest liquid staking protocol in the space now is currently Lido Finance. It accounts for around 30% of the total 15 million staked ETH, making it an important contender in the space. Its native LDO token has a market cap of $1.6 billion and its price is up 57% in the last 7 days.

Next in line is Frax Share whose price is up 21% in the last week. The digital asset’s market cap is almost $403 million, rewarding users with frxETH for their staked ETH at an 8% APR. This is the highest APR of any liquid staking protocol.

Rocket Pool takes third place with a market cap above $260 million and is up 18% in the 7-day period. But in terms of ETH deposited, it is one of the highest, accounting for around 6.5% of the total market share.

Others include Ankr Protocol which is up 26% in 7 days, as well as Stafi, pStake Finance, and StakeWise, all of which are up 32%, 20%, and 10%, respectively, in the same time period.

Ethereum Marks Three Consecutive Red Weekly Closes, Will Uptober Change Its Trajectory?

Ethereum has been one of the cryptocurrencies that have received major support from the crypto community regardless of how the price performs in the market. Since the Ethereum Merge was completed, though, the digital asset has not performed as well as expected. ETH’s price has continuously bled out, which has led to its price relegating to the low $1,000s. As the new month begins, speculations abound on whether the cryptocurrency has what it takes to recover.

Three Red Weekly Closes

Along with the rest of the crypto market, Ethereum’s price has suffered bitterly at the hands of the bulls. Once again, the curse of September reared its ugly head, and digital assets across the space saw more red than green during this time period. Ethereum itself had closed out the month with three consecutive red weekly closes, which has greatly impacted its performance in the market.

Over the last few weeks, the resistance to the digital asset has been mounting, and the bears have made a solid stand just above the $1,400 level. This is evidenced by ETH’s inability to beat this point, even with some rise in momentum.

ETH sees three consecutive red weekly closes | Source: ETHUSD on TradingView.com

Interestingly, Ethereum’s chart looks eerily similar to the same trend that was recorded back in September of 2021. This had been in the middle of the bull market right before ETH had hit its all-time high above $4,900. The digital asset had recorded three consecutive red closes, followed by a green close. What followed would be two months of weekly green closes that saw the cryptocurrency surge by more than 48%.

If this trend holds and Ethereum is able to successfully break through the $1,400 resistance point this week, then ETH’s price could rally to $1,800 over the next two months before eventually losing steam.

Can Ethereum Hold Up?

The weakness of ETH following the Merge has done a number on not only the digital asset but on investor sentiment. The majority of investors still opt to hold their coins for the long term. However, the sell-offs continue to wax stronger at this time.

Mainly, all eyes are on the Ethereum staking contract, where more and more of the supply are being sent each day. The contract currently sits at more than 14.1 million ETH are already staked, accounting for about 12% of the total supply. And since there is presently no way to withdraw these ETH, they are temporarily taken out of circulation, causing a significant drop in supply.

Nevertheless, the majority of ETH investors are still in profit despite the current low prices. This 53% of investors who have mostly held their coins for longer than a year remains in the green. However, profit-taking continues with exchange inflows reaching $4.49 billion for the last 7 days compared to outflows of $4.44 billion.

Featured image from El Cronista, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Staked ETH Nears 14 Million As Ethereum Readies For Breakout

Since the completion of the Ethereum Merge, sentiment among the community has remained positive. There had been no withdrawal mechanisms coded into the hard fork, which meant that the feared dump of millions of ETH into the market did not happen. What had happened is that the amount of ETH that was being staked on the network had continued to grow, now getting close to another important milestone for the network.

Staked ETH Almost At 14 Million

By the time the Merge was to be implemented, there had been more than 13 million ETH already staked on the network. This represented more than 11% of the total circulating ETH supply being taken out of circulation temporarily.

Now, less than two weeks after the Merge was completed, the staked volume on the network is already ramping up. Since September 15th, there have been more than 200,000 ETH staked on the network. This has brought the total staked ETH to 13.979 million, leaving less than 27 ETH left for the network to reach the 14 million mark. This means that the addition of one more validator will push the staked amount above 14 million, meaning more than 11.5% of the total supply of ETH is now staked.

The accelerated rate of staking speaks volumes about the support that Ethereum is getting. Even though there are those who have lamented the network’s move to proof of stake, the improved capabilities of the network point to this being the right direction for it.

Ethereum Wants Another Breakout

The crypto market has been reeling from the crash, but it has seen some meaningful recovery in this time. One of the cryptocurrencies that continues to show great promise even through this bear run has been Ethereum, and this has everything to do with ETH staking.

Since more ETH is being staked on the network and there is no withdrawal mechanism in place, these ETH are being taken out of circulation and essentially reducing the supply. The ETH issuance since the Merge is also down 98%, meaning that the supply of ETH is declining by the day.

All of these point towards an incoming supply squeeze. When taking into account the fact that ETH continues to show accumulation trends and the support forming at $1,300, a breakout towards $1,500 is more likely at this point, as more investors move their coins out of centralized exchanges, as was seen in the last 7 days, the supply will get tighter, causing the value of the cryptocurrency to balloon.

Featured image from Business 2 Community, charts from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Ether price could ‘decouple’ from other crypto post Merge — Chainalysis

Chainalysis suggests ETH could decouple from other cryptocurrencies post Merge as its staking rewards could make it similar to bonds or commodities.

SEBA Bank to provide Ethereum staking services to institutions

SEBA Bank executive Mathias Schütz believes that institutions can also play a role in securing the Ethereum network by staking Ether.

Ethereum Breaks 200,000 Validators Milestone, Over $14 Billion Now Staked In ETH 2.0

Ethereum network continues to record increasing support as launch draws nearer with each passing day. The network has now successfully crossed 200,000 validators meaning there are now over 200,000 validator nodes running ahead of the ETH 2.0 launch and counting. The amount of staked ETH now stands at over 6.6 million coins staked, totally over $14 billion worth of ETH currently staked in the network.

Over 20,000 validators were added to the network in the span of a month, taking the validators number from 180,000 to over 200,000. With this has come an increasing number of ETH staked on the network. More and more investors continue to stake their coins in anticipation of the upgrade to ETH 2.0, which will come bearing rewards for the validators.

Related Reading | Ethereum EIP-3675 For ETH 2.0 Upgrade Launches On GitHub

At this point, the amount of staked ETH now totals over 5% of the entire circulating supply of ETH. With a current annual APY of 6.1% on staked ETH on the Ethereum network.

Move To Proof Of Stake

The move of the Ethereum network from proof of work to proof of stake has been a hot topic in the crypto space since the project was announced. Although the project continues to require more time to complete than was initially speculated by Ethereum CEO Vitalik Buterin. The move has had numerous delays, most of which are attributed to personnel working on the upgrade and not technical problems, according to the CEO.

ETH price tests $2,300 resistance point | Source: ETHUSD on TradingView.com

Ethereum still currently operates on a proof of work mechanism, but the move to proof of stake would see the network requiring less electricity to mine coins and making the hassle of mining much less than it currently is. The reduced electricity consumption will address the environmental pollution problem of mining, which has long been a bone of contention in the mining industry.

Recently, the EIP-3675 was formalized as an improvement proposal, which sets the stage for “The Merge.” This comes just before the scheduled London Hard Fork that is meant to take place about a week from now on August 4th. The hard fork will see gas fees being burned as the current system is switched out for a new and better one.

Ethereum Price Reactions

The price of Ethereum continues to see increasing improvement as ETH 2.0 breaks the 200,000 validator milestone. Over the weekend, the price of Ethereum grew over 10% as the market witnessed a tremendous run. Giving ETH a much-needed momentum push to break the $2,000 price level and continue an upwards movement.

Related Reading | Ethereum Price Could Go Up Over 860% To Break $10,000, Crypto Analyst

More validators are expected to hop onto the Ethereum network. And as the amount of ETH mined in each block is reduced due to the fee burn structure of the ETH 2.0 upgrade, the amount of forecasted circulating ETH will be less. Hence the new deflationary nature of the network will introduce scarcity, thereby increasing the value of the coins mined.

Ethereum is now comfortably trading above $2,000 and continues to see upward momentum as the price continues to test the $2,300 resistance point.

Featured image from Blockchain News, chart from TradingView.com