Since its inception, Ethereum has continuously been compared to Bitcoin with the former being hailed as a better option to the latter in some cases. As the years have flown by, the competition has gotten even fiercer, especially with ETH growing rapidly. Eventually, Ethereum seems to be catching up with Bitcoin, especially in terms of active addresses.

Ethereum Active Addresses Surpass Bitcoin

On Thursday, September 14, on-chain data tracker Santiment revealed a surprising update on the fierce rivalry between Bitcoin and Ethereum. In the X post, the tracker revealed that the number of unique addresses that were transaction on the network had reached its second-highest daily figure of all time.

While this is significant on the part of the blockchain alone, it is also significant in terms of the competition between the two largest assets in the space. To put this in perspective, the 1,089,893 figure reported by Santiment puts Ethereum ahead of Bitcoin in terms of this metric alone.

The last time that the daily unique active addresses on the network hit its new all-time high was back in December 2022. So it has been almost a year since the metric was this high, suggesting a unique driving factor behind it.

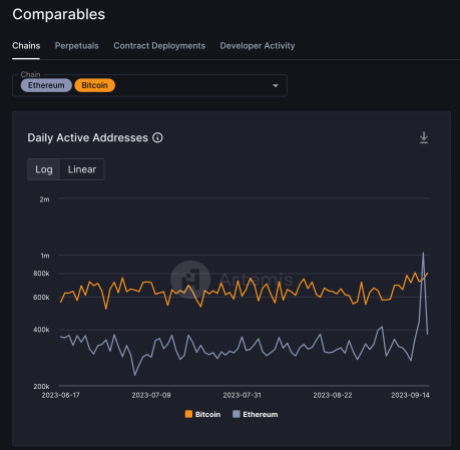

This report is also in line with the report from Artemis Terminal that shows that Ethereum was right in front of Bitcoin in terms of daily active addresses.

Artemis reports that on September 13, Ethereum saw a total of 1.03 million daily addresses compared to Bitcoin’s 743,800 addresses in the same time period. However, this figure has since retracted and Bitcoin has pulled in front of Ethereum once more as of September 14.

What Does This Mean?

While Ethereum’s surge on Wednesday was impressive, it does not mean much since the network has been unable to sustain the growth. Also, the surge could be easily explained by the rise in the popularity of the Friend.Tech decentralized finance social media platform based on the Ethereum blockchain.

Friend.Tech had seemingly come back from the death to reach a new all-time high in its number of daily users. Since an ETH address is required to participate in the platform, it is no surprise there was an uptick in the number of ETH addresses active on the network.

The spike in the number of daily active addresses also seems to have had little impact on the price of the cryptocurrency itself. ETH’s price is still struggling to hold above $1,600, with small gains of 0.35% in the last day and losses of 1.15% in the last week.