On-chain data shows that the Ethereum exchange netflow recently spiked significantly, a sign that could be bearish for the cryptocurrency’s price.

Ethereum Exchange Netflow Registered A Large Positive Spike Recently

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the latest trend that has been occurring in the exchange netflow metric for Ethereum.

The “exchange netflow” here refers to an on-chain indicator that tracks the net amount of any given cryptocurrency entering into or exiting the wallets associated with centralized exchanges.

When this metric’s value is positive, it means that investors are depositing a net number of tokens on these platforms right now. Generally, one of the main reasons holders may transfer to the exchanges is for selling-related purposes, so this trend can have bearish implications for the asset’s price.

On the other hand, the negative indicator implies the exchanges are currently bleeding supply as outflows are outpacing the inflows. Such a trend may be a sign that the investors are accumulating, which can naturally be bullish for the coin.

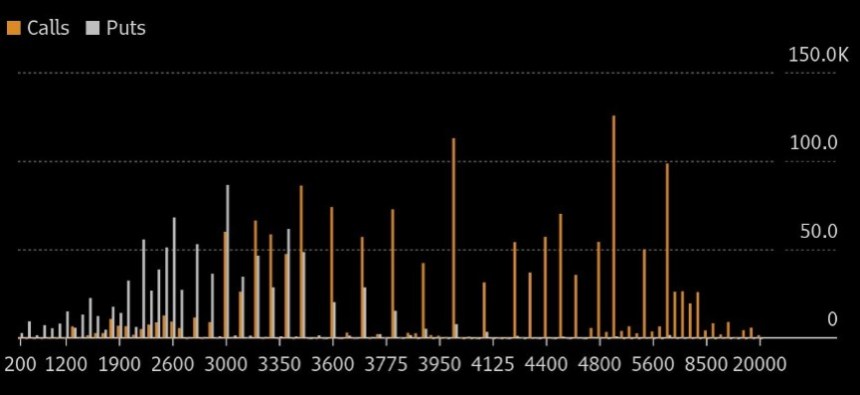

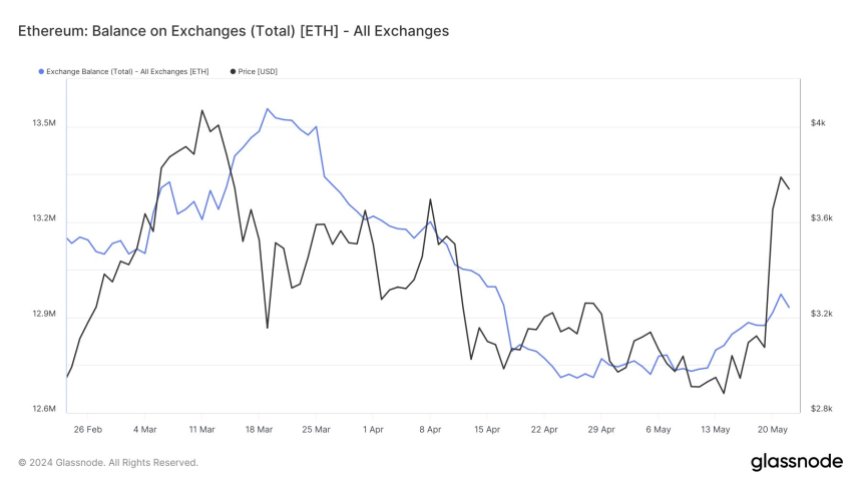

Now, here is a chart that shows the trend in the Ethereum exchange netflow since the start of the year 2024:

The graph shows that the Ethereum exchange netflow has registered a positive spike recently. At the height of this spike, the exchanges received 140,660 ETH in net deposits.

At the current price of the cryptocurrency, this amount is equivalent to almost $547 million. This is a huge amount and the largest net deposit spree these central entities have witnessed since January.

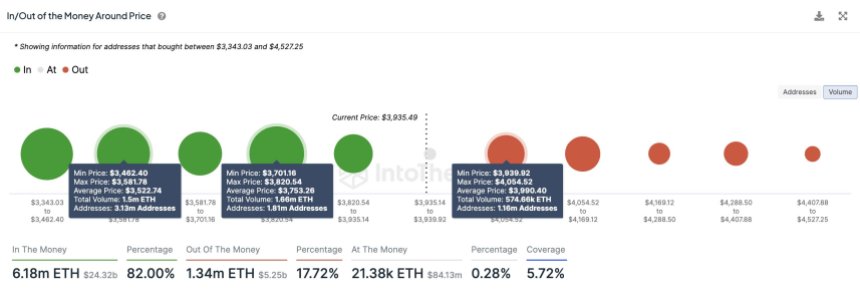

“High inflows to exchanges are typically a sign of selling behavior, as people either try to claim profits or succumb to FUD,” notes the analytics firm. Interestingly, though, since these deposits have come, the asset’s price has increased.

This could suggest that either the whales making the inflows haven’t pulled the trigger on selling these coins yet, or they never planned to sell to begin with. Of course, it’s also possible that the market demand has been able to absorb the selling if the whales have indeed sold.

In the scenario where the whales made the deposits with the intention of selling but haven’t made the trade yet, Ethereum could feel a bearish effect.

It now remains to be seen how the cryptocurrency’s price will develop in the coming days and if these large deposits will play any visible role at all.

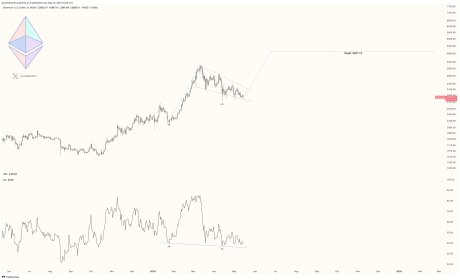

ETH Price

Ethereum had seen a pullback earlier, but the asset has managed to make a recovery, as its price is now once again floating above the $3,900 mark.