A 3% rebound in Ether’s price would wipe $345 million in short positions amid Grayscale withdrawing its Ether futures ETF application.

Cryptocurrency Financial News

A 3% rebound in Ether’s price would wipe $345 million in short positions amid Grayscale withdrawing its Ether futures ETF application.

On Wednesday, the Bitcoin price rallied toward $38,000 amid expectations of the United States Securities and Exchange Commission (SEC) finally approving the first Spot BTC ETF. The regulator would end up exercising its right to delay its decision further, something that has usually been bearish for the price. However, the Bitcoin price continued to show strength, suggesting that a Spot Bitcoin ETF approval might be priced into the market already.

The SEC announced on Wednesday that it had decided to further delay its decision on Spot Bitcoin ETF filings; in particular, the Hashdex Spot Bitcoin ETF filing which was due to a decision or a delay on November 15. The Commission had decided that it needed more time to contemplate and thoroughly investigate the filing before giving a final answer. This means that a decision for the Hashdex ETF filing is not expected until 2024.

Not only did the SEC decide to delay its decision on the Hashdex Spot ETF filing, but it also chose to do so on the Grayscale Ethereum Futures filing. This comes even after Grayscale had emerged victorious over the regulator in court, which demanded that the SEC review Grayscale’s Spot Bitcoin ETF filing.

Just like the Hashdex ETF, the SEC choosing to defer its decision on the Grayscale Ethereum Futures ETF pushes its deadline date into 2024, dashing hopes of the ETFs coming this year. However, both Bitcoin and Ethereum seemed to have shaken off this news with little to no reaction.

The approvals for a Spot Bitcoin ETF and an Ethereum Futures ETF have been anticipated by the crypto community for months now. And like any asset, investors may be becoming indifferent to whether the news affects their investment decisions or not.

Such a development would mean that the Bitcoin and Ethereum ETF approvals are being priced in already, and would not have much effect on the price when they are eventually approved. However, this does not seem to be entirely the case.

One example is when the price of XRP surged upon the rumors of BlackRock filing an XRP ETF, and then subsequently crashing once it was debunked. Then again, on Wednesday, as expectations around the SEC’s decision mounted, the prices of Bitcoin and Ethereum rallied to $38,000 and $2,080, respectively, suggesting that investors are still expecting approval to significantly move the market.

What seems to be happening is that news of delays from regulators is no longer having the bearish effects that they used to have. In this case, investors are simply not reacting to the news of a delay as they usually would seemingly because it is not widely understood that it is not the same thing as a rejection.

The Bitcoin price has since retraced since hitting $38,000 but it maintains a healthy $37,000 at the time of this writing. Ethereum has also followed suit, dropping to $2,046 from its Wednesday peak of $2,080.

Day one trading volume across all nine products stood at less than $2 million.

Asset management firm Valkyrie, one of the frontrunners for the first Ethereum ETF (exchange-traded fund) in the United States, has decided to pause its purchase of Ether futures contracts until the US Securities and Exchange Commission approves an Ether futures ETF. This comes barely a day after the asset manager reportedly secured approval to offer investors exposure to Ether futures under its existing strategy ETF (BTF).

On Friday, September 29, Valkyrie filed a 497 with the SEC, saying that it would halt the purchase of Ether futures contracts and unwind its existing positions.

A part of the filing read:

Effectively immediately, The Fund will not purchase ether futures contracts until the effectiveness of an amendment to the Fund’s registration statement contemplating the addition of ether futures contracts to the principal investment strategy of the Fund. Until such time, the Fund will unwind any existing positions in ether futures contracts.

As reported on Thursday, September 28, the SEC appears to be fast-tracking the approval of Ethereum futures ETF in anticipation of a potential US government shutdown next week.

Following this report, Valkyrie disclosed that it had begun purchasing Ether futures contracts for its combined strategy ETF ahead of a possible launch next week.

However, this latest action poses questions about the odds of Valkyrie becoming one of the first firms to introduce an Ethereum ETF in the United States.

Bloomberg analyst Eric Balchunas has put forward a possible reason for Valkyrie’s decision to halt and unwind its Ether futures purchases. “SEC must have threatened them to cut it out,” Balchunas speculated via a post on X (formerly Twitter).

The plot thickens, Valkyrie just put out 497 that they are in fact not going to buy Ether futures until they are live (prob Tue) and are going to sell the Eth futures they bought (in an effort to jump line a bit). SEC must have threatened them to cut it out. Damn. https://t.co/yDkggCw3d1 pic.twitter.com/cKaV7k7AJs

— Eric Balchunas (@EricBalchunas) September 29, 2023

Valkyrie filed its unique Ethereum ETF application with the SEC in August. The asset manager seeks to convert its existing Bitcoin Strategy ETF (BTF) to a combined Bitcoin and Ether futures ETF.

According to Eric Balchunas’ analysis, about nine Ethereum ETFs will potentially start trading on Monday, October 2. Notably, asset manager ProShares owns three of these funds, with two being combined Bitcoin and Ethereum ETFs.

VanEck is another frontrunner for the first Ether futures ETFs in the US. The investment manager recently announced its intention to donate 10% of profits from its Ethereum ETF (EFUT) to The Protocol Guild, a compensation plan for Ethereum core contributors.

VanEck wrote on X (formerly Twitter):

If TradFi stands to gain from the efforts of Ethereum’s core contributors, it makes sense that we also give back to their work. We urge other asset managers/ETF issuers to consider also giving back in the same way.

Big announcement!

We intend to donate 10% of our $EFUT ETF profits (https://t.co/gr652AkUvv) to @ProtocolGuild for at least 10 years.

Thank you, Ethereum contributors, for nearly a decade of relentless building & ongoing stewardship of this common infrastructure.

Details

— VanEck (@vaneck_us) September 29, 2023

It is worth mentioning that the ETH price has seen some reprieve since news of the potential Ethereum ETF launch started making rounds. As of this writing, Ether is valued at $1,676, reflecting a substantial 5% price jump in the past week.

After sinking roughly 30% from 2023 highs, Ethereum appears to be bouncing off from the pits of the crypto winter. Looking at candlestick arrangements in the daily and weekly charts, the coin has primary support at around $1,500 and is firm, bouncing off with decent trading volume.

At spot rates, ETH is up approximately 3% following positive developments sparked by the increasing adoption of its layer-2 scaling solution and the recent news that VanEck, a player managing billions of assets, is preparing to launch an Ethereum derivatives product.

Taking to X on September 28, Alex Masmej, the founder of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to such an extent that it no “longer makes sense to build on other platforms.”

The development and deployment of Ethereum layer-2 solutions took center stage following network congestion, which forced gas fees to spike to record highs in the last bull run.

Developers have responded to the network co-founder Vitalik Buterin’s urging. The expert believes they are quickly constructing and deploying safe, universal platforms that have gained widespread popularity.

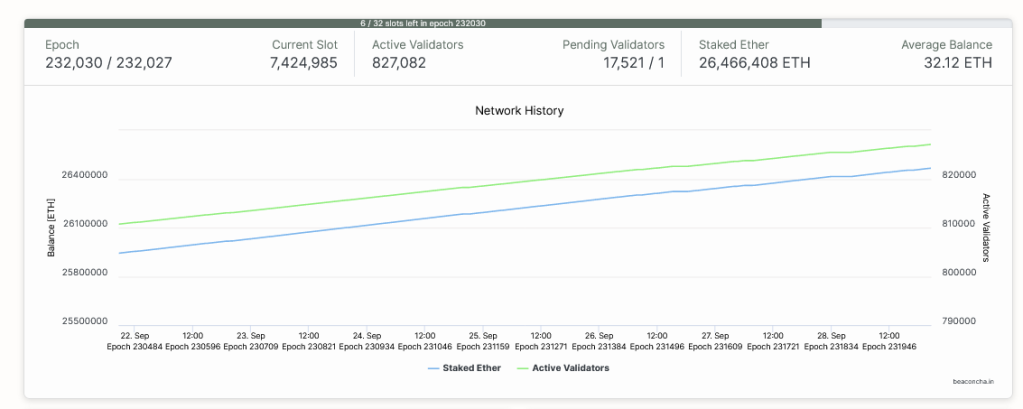

Layer-2 platforms bundle transactions off-chain before confirming them on-chain, allowing for faster and more cost-effective operations while benefiting from the security of Ethereum. As of September 28, there were over 827,000 validators whose job is to confirm transactions and ensure that the network is secure, thanks in part to their geographic distribution.

Most layer-2 solutions use optimistic rollups, including Arbitrum, Base, and OP Mainnet. However, Masmej also said that once ZK rollups, which utilize zero-knowledge proofs to validate transactions without revealing sensitive data, are available, it will end the scalability trilemma, further boosting the capabilities of layer-2 solutions.

In the founder’s assessment, high throughput options, including Solana, will be a hedge. At the same time, Cosmos, which drives blockchain interoperability, will act as a long-term source of inspiration. Meanwhile, Ethereum will continue to flourish as Layer-2 options gain traction.

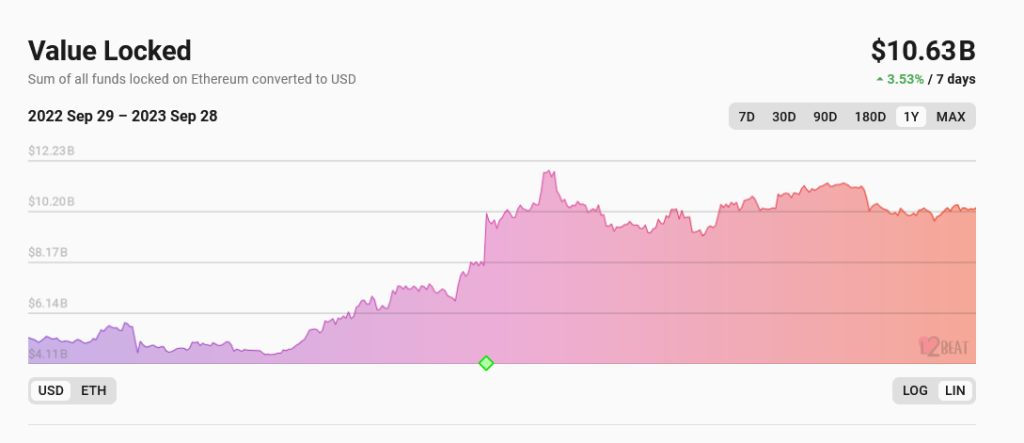

According to l2Beat data, popular solutions like Arbitrum and Base, which offer faster and cheaper processing environments while remaining coupled with Ethereum and enjoying the pioneer network’s fast-move advantage, have larger total value locked (TVL). As of September 28, layer-2 platforms have a TVL of over $10.6 billion, more than Solana’s market cap, which stood at $8 billion, according to CoinMarketCap.

Beyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a global asset manager, is preparing to introduce its Ethereum futures exchange-traded fund (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) will invest in ETH futures contracts provided by exchanges approved by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being offered, the Ethereum derivative product will allow institutions to gain exposure, boosting liquidity.

According to a recent FOX Business report, Valkyrie Investments has secured approval from the Securities and Exchange Commission (SEC) to launch the first exchange-traded fund (ETF) featuring Ethereum (ETH) futures.

This achievement positions Valkyrie as the frontrunner among nine issuers seeking to provide investors with an opportunity to speculate on the future price of the world’s second-largest digital asset through an ETF.

Ether, the native token of the Ethereum blockchain, currently holds a value of approximately $1,659 per token. Valkyrie aims to enhance retail participation in the crypto market by introducing an ETF that tracks Ether futures.

According to FOX, Valkyrie Investments plans to merge its existing Bitcoin (BTC) futures ETF with the newly introduced Ether futures ETF, creating a combined fund named “the Valkyrie Bitcoin and Ether Strategy ETF”.

Notably, the ETF’s Nasdaq ticker, BTF, will remain unchanged. The fund’s strategy includes opportunistically purchasing Ethereum futures, reflecting the growing interest in this digital asset over the past year.

Originally scheduled to commence trading on October 3, Valkyrie expedited its launch in response to the possibility of a government shutdown on Friday, a development that would limit SEC operations.

With nearly two million federal workers facing layoffs without a funding agreement, Gensler has urged companies planning to go public to expedite their offerings before the shutdown occurs.

The fate of the Ether futures applicants remains uncertain, as the SEC has requested that they update their filings with any additional information by Friday afternoon.

Lastly, Steven McClurg, Chief Investment Officer at Valkyrie, expressed enthusiasm about being at the forefront of offering Ethereum futures to investors, recognizing the exponential growth in interest surrounding this asset class.

Featured image from Shutterstock, chart from TradingView.com

On the back of its partial victory against the US Securities and Exchange Commission (SEC), Grayscale has applied to the Commission for another Ethereum Futures Exchange-Traded Fund (ETF).

According to a report by the Wall Street Journal (WSJ), Grayscale Investments filed this application on September 20. This development may come as a surprise to many, considering that the asset manager had filed an earlier application to offer this same investment vehicle. As such, this will represent its third application (Grayscale withdrew its first application due to SEC concerns before filing another one in July).

There is, however, a distinction between both applications, as WSJ noted. The latest application is filed under the Securities Act of 1933, a regulation under which spot Bitcoin ETFs like BlackRock’s filed. Meanwhile, the initial application was filed under the Investment Company Act of 1940, a regulation which securities-based ETFs are registered under.

While the exact reason for Grayscale’s action remains unknown, it may be a contingency plan in case the SEC denies its initial proposed Ethereum futures ETF, which is expected to launch in October, barring any denial.

Grayscale’s filing under the Securities Act of 1933 isn’t the first, as Brazilian investment firm Hashdex filed its Ethereum ETF application under that Act. Last week, Hashdex applied with the SEC to offer a fund that will hold both Ether futures contracts and a Spot Ethereum ETF (the first of its kind).

The firm justified this move by stating that a combination of both markets will help mitigate the risk of market manipulation.

Hashdex’s application has been singled out for how distinct it is from other applications. The investment firm has proposed to use the Chicago Mercantile Exchange (CME) to track the price of Ethereum and also plans to buy the Ether, which the fund will hold from the CME Market’s Exchange for Physical (EFP) transactions.

Several Ethereum futures ETFs are expected to hit the market in October, barring a denial by the SEC. Rule 485(a) of the SEC Rules allows these ETFs to launch 75 days from their respective filing dates if the SEC doesn’t deny them before then.

In line with this, the ETFs of fund managers like Volatility Shares, Bitwise, VanEck, ProShares, and Roundhill will be the first to launch if they receive approval from the SEC.

Volatility Shares was the first among them to apply to offer Ethereum futures ETF. As such, it will gain the first-mover advantage, carrying a possible October 12 launch date, with others coming after. However, this is subject to any decision by the SEC.

The SEC approving an Ethereum ETF will be a historical event that is expected to give the crypto market a much-needed boost as the bear market continues to linger. There are already forecasts that ETH’s price could rise above $2,000 when these funds launch.

Bloomberg ETF analyst James Seyffart expects more spot Ethereum ETFs to be filed in the coming days.

The co-filing comes just a week after reports emerged that the SEC is likely to greenlight Ethereum ETF applications.

The United States Securities and Exchange Commission isn’t likely to block the debut of Ethereum futures ETFs, according to sources.

The crypto space is on the verge of another potentially historic moment with the first Ethereum Futures ETF in the US. Volatility Shares, a pioneer in the ETF space, has announced its intention to launch the Ether Strategy ETF (Ticker: ETHU) on October 12, 2023. If all goes as planned, this could mark the first Ether based exchange traded fund (ETF) in the United States.

Volatility Shares has positioned the ETF around cash-settled Ethereum futures contracts trading on the CBOE. Notably, the ETF avoids direct investment in Ether itself. “The Fund is an exchange-traded fund that seeks to achieve its investment objective by investing its assets principally in cash-settled contracts referencing Ether… The Fund does not invest directly in Ether,” reads the SEC filing.

Stuart Barton, the CIO of Volatility Shares, voiced his optimism, saying, “Volatility Shares successfully launched the first 2x Bitcoin-linked ETF (BITX) in July and believes that ETHU is the next logical step before turning our forces to spot markets.”

Eric Balchunas, senior ETF Analyst for Bloomberg, weighed in on the audacity of Volatility Shares’ aggressive timeline: “VolatilityShares announcing they intend to list their Ether Futures ETF on Oct 12th (which would be a day or two ahead of the rest of pack (if the 75 days is adhered to).. they did same thing w $BITX”.

When prompted on the likelihood of SEC’s approval, he remarked, “Well, there’s been no withdrawals so SEC looks to be okay with them … he’s probably just pushing the envelope like he did w BITX”.

While Volatility Shares leads the pack, they’re not alone in this pursuit. A total of 13 heavyweight financial institutions, including names like Bitwise, VanEck, Vakyrie, Roubhill, ProShares, and Grayscale, have sought the US SEC’s blessings for their Ether Futures ETFs. However, as of now, the SEC hasn’t given its green signal to any.

Remarkably, the first Bitcoin futures ETF in the US was launched back on October 19, 2021. At that time, ProShares won the race for the first mover effect. And this has paid off. The total assets in Bitcoin futures ETFs accounts to $1.3 billion. Of that, nearly $1.1 billion is in the ProShares Bitcoin Strategy ETF (BITO). The second largest ETF is the ProShares Short Bitcoin Strategy ETF with $73 million. No other ETF has more than $50 million in assets under management.

When the first Bitcoin futures ETF was launched, BTC was in the midst of the 2021 bull run. In the run-up to the futures ETF launch, BTC put on a 60% rally from Oct. 1 to Oct. 19, rising 60% to $66,970. In the next seven subsequent days, BTC saw a correction of about 14% before Bitcoin continued its rally to the all-time high near $69,000.

Whether the ETH price will experience a similar euphoria as Bitcoin in 2021 remains to be seen. At least the environment is different. While BTC was in a full blown bull market, the crypto market is currently in a phase of stagnation, possibly before the start of a new bull market. However, without a doubt, the first Ethereum Futures ETF has the potential to be a catalyst for the ETH price.

At the time of writing, ETH was trading at $1,826, just above the key support of the 38.2% Fibonacci retracement level.